Gross profit represents the revenue remaining after deducting the cost of goods sold, highlighting the efficiency of core production activities. Operating profit further subtracts operating expenses such as salaries, rent, and utilities, providing insight into the company's operational efficiency and profitability. Understanding the distinction between gross profit and operating profit is essential for accurate financial analysis and decision-making.

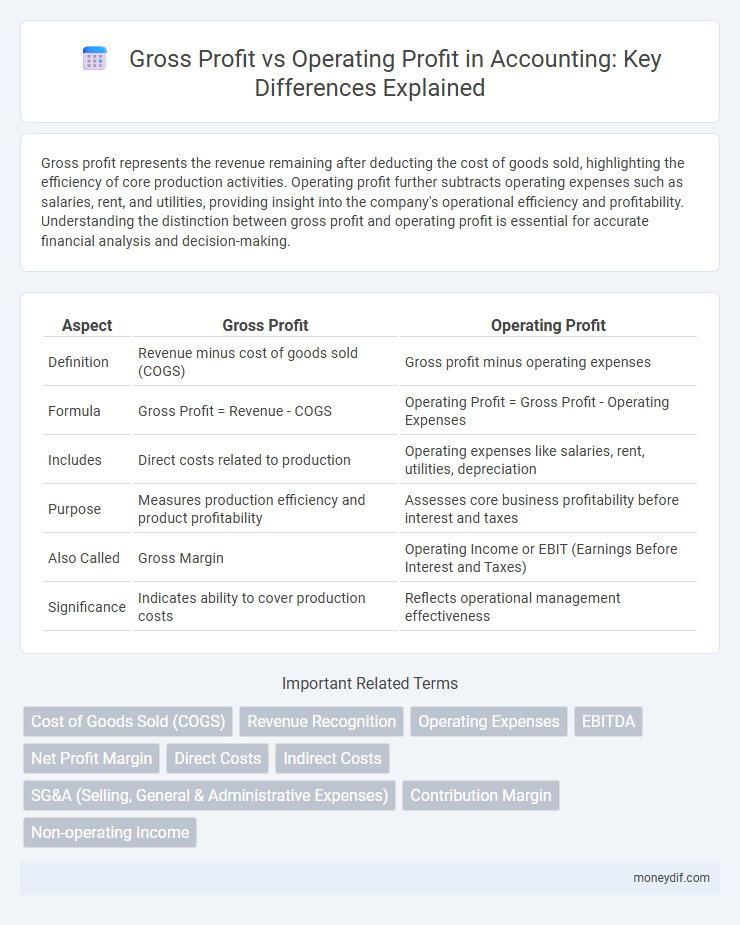

Table of Comparison

| Aspect | Gross Profit | Operating Profit |

|---|---|---|

| Definition | Revenue minus cost of goods sold (COGS) | Gross profit minus operating expenses |

| Formula | Gross Profit = Revenue - COGS | Operating Profit = Gross Profit - Operating Expenses |

| Includes | Direct costs related to production | Operating expenses like salaries, rent, utilities, depreciation |

| Purpose | Measures production efficiency and product profitability | Assesses core business profitability before interest and taxes |

| Also Called | Gross Margin | Operating Income or EBIT (Earnings Before Interest and Taxes) |

| Significance | Indicates ability to cover production costs | Reflects operational management effectiveness |

Introduction to Gross Profit and Operating Profit

Gross profit measures a company's revenue after deducting the cost of goods sold (COGS), reflecting the efficiency of core production activities. Operating profit, also known as operating income, deducts operating expenses such as wages, rent, and depreciation from gross profit, providing insight into overall operational efficiency. Understanding the distinction between gross profit and operating profit is essential for evaluating a business's profitability and managing financial performance.

Defining Gross Profit

Gross profit represents the revenue remaining after deducting the cost of goods sold (COGS) from total sales, reflecting the efficiency of production and pricing strategies. It excludes operating expenses such as salaries, rent, and utilities, which are accounted for in operating profit. Understanding gross profit is crucial for assessing a company's core profitability before administrative and other operating costs.

Defining Operating Profit

Operating profit, also known as operating income or operating earnings, represents the profit generated from a company's core business operations, excluding non-operating income and expenses such as interest and taxes. It is calculated by subtracting operating expenses--including cost of goods sold (COGS), wages, and depreciation--from gross profit. Operating profit provides a clear measure of a company's operational efficiency and profitability before the impact of financing and tax strategies.

Key Differences Between Gross Profit and Operating Profit

Gross profit represents the revenue remaining after deducting the cost of goods sold (COGS), highlighting the efficiency of production and inventory management. Operating profit, also known as operating income, is calculated by subtracting operating expenses such as wages, rent, and utilities from the gross profit, providing insight into a company's core business profitability. Key differences include gross profit's focus on direct costs, while operating profit accounts for both direct and indirect operating expenses, making it a more comprehensive measure of financial performance.

How to Calculate Gross Profit

Gross profit is calculated by subtracting the cost of goods sold (COGS) from total revenue, reflecting the core profitability of a company's products or services. This metric excludes operating expenses such as salaries, rent, and utilities, focusing solely on production efficiency and pricing strategy. Accurate gross profit calculation provides essential insight for assessing business health before considering operating profit adjustments.

How to Calculate Operating Profit

Operating profit is calculated by subtracting operating expenses, including selling, general and administrative costs, from gross profit, which itself is derived from total revenue minus cost of goods sold (COGS). This metric reflects the company's profit generated from core business operations before interest and tax deductions. Accurate calculation of operating profit aids in assessing operational efficiency and comparing profitability across periods or competitors.

Importance of Gross Profit in Financial Analysis

Gross profit represents the revenue remaining after deducting the cost of goods sold, serving as a key indicator of a company's core profitability and pricing strategy effectiveness. It provides crucial insight into production efficiency and inventory management, enabling analysts to assess the sustainability of business operations before considering operating expenses. Understanding gross profit margin trends is essential for identifying potential cost control issues and making informed financial decisions.

Significance of Operating Profit for Businesses

Operating profit reveals a company's core profitability by excluding non-operating income and expenses, providing a clearer measure of operational efficiency compared to gross profit. It reflects the effectiveness of cost management, including administrative and selling expenses, enabling businesses to assess true performance and sustainability. Investors and stakeholders rely on operating profit to gauge a company's ability to generate earnings from its primary activities, aiding strategic decision-making and financial planning.

Common Misconceptions About Gross and Operating Profit

Gross profit represents total revenue minus the cost of goods sold (COGS), often misunderstood as the sole indicator of a company's financial health, while operating profit accounts for gross profit minus operating expenses, reflecting the core business profitability. A common misconception is equating gross profit with net income, ignoring operating costs such as salaries, rent, and utilities that significantly impact operating profit. Accurate financial analysis requires distinguishing these profits to evaluate operational efficiency and overall business performance correctly.

Practical Examples: Gross Profit vs Operating Profit

Gross profit represents the revenue remaining after deducting the cost of goods sold, exemplified by a retail store selling products for $500,000 with $300,000 in inventory costs, resulting in a $200,000 gross profit. Operating profit accounts for additional expenses like salaries, rent, and utilities, so if the store incurs $50,000 in operating expenses, its operating profit becomes $150,000. These figures highlight the importance of distinguishing between gross profit, which focuses on production efficiency, and operating profit, which reflects overall business profitability before interest and taxes.

Important Terms

Cost of Goods Sold (COGS)

Cost of Goods Sold (COGS) directly impacts gross profit by representing the direct costs of producing goods sold, while operating profit accounts for gross profit minus operating expenses such as selling, general, and administrative costs. Understanding the relationship between COGS, gross profit, and operating profit is crucial for assessing a company's core profitability and operational efficiency.

Revenue Recognition

Revenue recognition determines the timing and amount of revenue recorded, directly influencing gross profit, which is calculated as sales revenue minus cost of goods sold. Operating profit further accounts for operating expenses, highlighting the impact of revenue recognition policies on both profitability metrics in financial analysis.

Operating Expenses

Operating expenses directly reduce gross profit to arrive at operating profit, highlighting the cost efficiency of business operations beyond production costs. Effective management of operating expenses such as selling, general, and administrative costs is crucial for maximizing operating profit margins.

EBITDA

EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) measures a company's operational profitability by excluding non-cash expenses and financial costs, sitting between gross profit and operating profit on the income statement. Unlike gross profit, which subtracts only the cost of goods sold, EBITDA provides a clearer view of core operational efficiency than operating profit by excluding depreciation and amortization expenses.

Net Profit Margin

Net profit margin measures the percentage of revenue remaining after all expenses, including cost of goods sold, operating expenses, interest, and taxes, have been deducted, providing a comprehensive view of overall profitability. While gross profit focuses solely on revenue minus cost of goods sold, and operating profit accounts for gross profit minus operating expenses, net profit margin encompasses all costs, reflecting the company's final profitability from total sales.

Direct Costs

Direct costs, including raw materials and labor directly tied to production, are subtracted from total revenue to calculate gross profit, reflecting the core profitability of goods sold. Operating profit further deducts operating expenses such as selling, general, and administrative costs, highlighting a company's efficiency in managing overall business operations beyond direct production costs.

Indirect Costs

Indirect costs, such as administrative expenses and depreciation, reduce operating profit but do not directly affect gross profit since gross profit only accounts for direct costs like cost of goods sold. Understanding the distinction between gross profit and operating profit highlights how indirect costs impact overall business profitability beyond production expenses.

SG&A (Selling, General & Administrative Expenses)

SG&A expenses encompass costs unrelated to production, such as marketing, administrative salaries, and office expenses, reducing gross profit to calculate operating profit. Operating profit reflects business efficiency by subtracting SG&A from gross profit, highlighting the impact of overhead on overall profitability.

Contribution Margin

Contribution margin represents the sales revenue remaining after variable costs are deducted, highlighting the profitability of individual products before fixed costs. Gross profit measures revenue minus cost of goods sold, while operating profit accounts for gross profit minus operating expenses, making contribution margin essential for understanding cost behavior and its impact on overall profitability.

Non-operating Income

Non-operating income includes earnings from investments, interest, and asset sales, distinct from gross profit which measures revenue minus cost of goods sold, and operating profit that reflects profitability after subtracting operating expenses from gross profit. This income category impacts net profit but is excluded from operating profit calculations, highlighting the core business performance versus ancillary financial activities.

gross profit vs operating profit Infographic

moneydif.com

moneydif.com