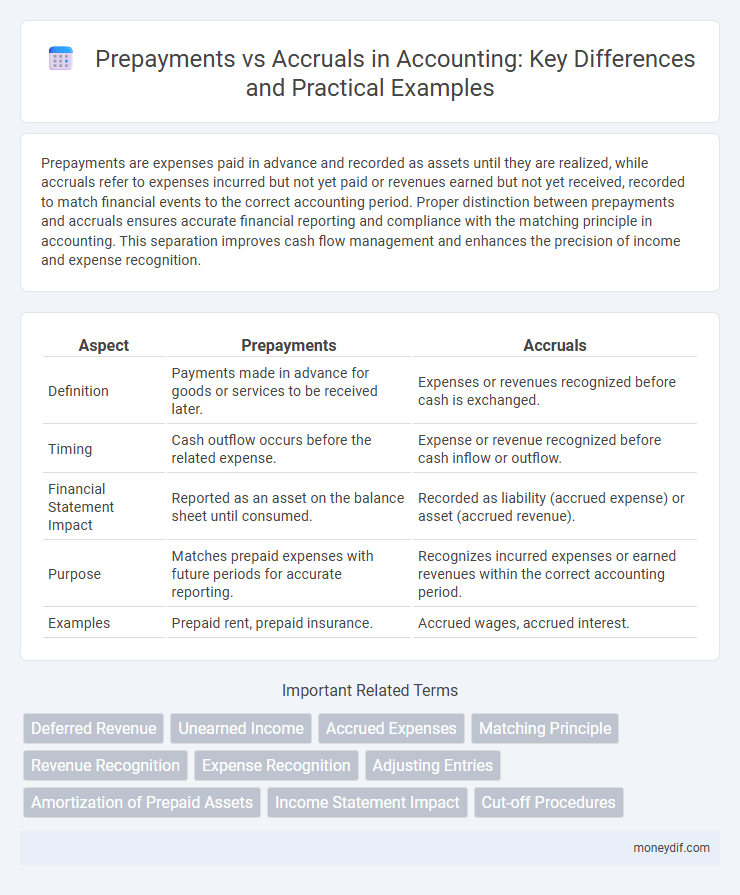

Prepayments are expenses paid in advance and recorded as assets until they are realized, while accruals refer to expenses incurred but not yet paid or revenues earned but not yet received, recorded to match financial events to the correct accounting period. Proper distinction between prepayments and accruals ensures accurate financial reporting and compliance with the matching principle in accounting. This separation improves cash flow management and enhances the precision of income and expense recognition.

Table of Comparison

| Aspect | Prepayments | Accruals |

|---|---|---|

| Definition | Payments made in advance for goods or services to be received later. | Expenses or revenues recognized before cash is exchanged. |

| Timing | Cash outflow occurs before the related expense. | Expense or revenue recognized before cash inflow or outflow. |

| Financial Statement Impact | Reported as an asset on the balance sheet until consumed. | Recorded as liability (accrued expense) or asset (accrued revenue). |

| Purpose | Matches prepaid expenses with future periods for accurate reporting. | Recognizes incurred expenses or earned revenues within the correct accounting period. |

| Examples | Prepaid rent, prepaid insurance. | Accrued wages, accrued interest. |

Understanding Prepayments and Accruals: Key Definitions

Prepayments represent payments made in advance for goods or services to be received in the future, recorded as assets until the related expense is incurred. Accruals, on the other hand, involve expenses or revenues recognized before the corresponding cash transaction occurs, reflecting liabilities or receivables on the balance sheet. Understanding these key definitions is essential for accurate financial reporting and adherence to the matching principle in accounting.

The Role of Prepayments in Accounting

Prepayments in accounting represent payments made in advance for goods or services to be received in the future, creating an asset on the balance sheet until the expense is recognized. They play a critical role in matching expenses to the correct accounting period, ensuring accurate financial reporting and compliance with the matching principle. Proper management of prepayments improves cash flow forecasting and prevents distortions in profit measurement by deferring expense recognition to periods when the associated benefits are realized.

Accruals: Recognizing Expenses and Revenues

Accruals involve recording expenses and revenues when they are incurred, regardless of when cash transactions occur, ensuring accurate financial reporting. This accounting principle aligns with the matching concept, recognizing revenue when earned and expenses when incurred, which improves the reliability of financial statements. Properly managed accruals enhance financial analysis by reflecting the true economic activities within an accounting period.

Key Differences Between Prepayments and Accruals

Prepayments are expenses paid in advance for goods or services to be received in the future, recorded as assets until the benefit is realized, whereas accruals represent expenses or revenues recognized when incurred or earned, regardless of cash flow. Key differences include timing and cash flow treatment: prepayments involve cash outflow prior to expense recognition, while accruals involve recognition before cash exchange occurs. Prepayments decrease assets over time as the benefit is used, while accruals create liabilities or receivables until settled.

The Impact of Prepayments on Financial Statements

Prepayments affect financial statements by increasing current assets on the balance sheet until the expense is recognized, improving liquidity ratios temporarily. Income statements reflect expenses only when the prepaid amount is amortized in the appropriate accounting period, which ensures accurate matching of costs with revenues. This treatment prevents distortion of net income and provides clearer insights into a company's financial performance and position.

Accruals and Their Effect on Period-End Reporting

Accruals recognize expenses and revenues when they are incurred, not when cash is exchanged, ensuring financial statements reflect the true economic activity of the period. This matching principle enhances period-end reporting accuracy by aligning revenues with related expenses, improving the reliability of net income calculations. Proper accrual accounting supports compliance with GAAP or IFRS, facilitating transparent and consistent financial reporting.

Examples of Prepayments in Practice

Prepayments in accounting often include insurance premiums paid annually in advance, rent paid at the beginning of the lease term, and subscriptions for services like software licenses paid before usage. These prepayments are recorded as current assets on the balance sheet and expensed over the corresponding accounting periods to match revenue recognition principles. Proper tracking of prepayments ensures accurate financial reporting and compliance with accrual accounting standards.

Common Accrual Accounting Scenarios

Common accrual accounting scenarios include recognizing expenses before cash payment and recording revenues prior to cash receipt, ensuring accurate financial statements. Prepayments involve paying expenses in advance and recording them as assets until the service or benefit is received, while accruals capture incurred expenses or earned revenues yet to be paid or collected. Properly managing accruals like accrued salaries, utilities, and unbilled services is essential for matching revenues and expenses within the correct accounting period.

Benefits of Accurate Prepayment and Accrual Recording

Accurate recording of prepayments and accruals ensures precise matching of expenses and revenues within accounting periods, enhancing financial statement reliability and compliance. This accuracy improves cash flow management by forecasting liabilities and asset utilization, reducing the risk of budget overruns. Consistent application of prepayment and accrual principles supports audit readiness and strengthens internal controls in financial reporting.

Best Practices for Managing Prepayments and Accruals

Effective management of prepayments and accruals relies on precise documentation and timely adjustments in accounting records. Implementing automated tracking systems ensures accurate recognition of expenses and revenues in the correct periods, enhancing financial statement reliability. Regular reconciliation and review processes minimize errors and support compliance with accounting standards such as IFRS and GAAP.

Important Terms

Deferred Revenue

Deferred revenue represents payments received in advance for goods or services not yet delivered, distinguishing it from accruals, which record expenses or revenues incurred but not yet paid or received. Prepayments create deferred revenue as liabilities on the balance sheet until the earned service or product fulfills the obligation.

Unearned Income

Unearned income represents revenue received before services are rendered or goods delivered, classified as a liability on the balance sheet until earned, contrasting with accruals where revenue is recognized when earned regardless of cash receipt. Prepayments involve payments made in advance for expenses, recorded as assets initially, then expensed over time, highlighting the timing differences in revenue and expense recognition under accrual accounting.

Accrued Expenses

Accrued expenses represent liabilities for goods or services received but not yet paid, contrasting with prepayments where payments are made in advance for future expenses. Accrual accounting recognizes accrued expenses to match costs with incurred periods, while prepayments are recorded as assets until the expense is realized.

Matching Principle

The Matching Principle requires expenses to be recorded in the same period as the revenues they help generate, ensuring accurate financial reporting. Prepayments involve cash paid in advance and recognized as expenses over time, while accruals record expenses incurred but not yet paid, both aligning costs with associated revenues.

Revenue Recognition

Revenue recognition principles dictate that prepayments are recorded as liabilities until the related revenue is earned, ensuring compliance with the matching principle, while accruals recognize revenue when earned regardless of cash flow timing, enhancing financial statement accuracy. Proper differentiation between prepayments and accruals aligns revenue reporting with accounting standards such as IFRS 15 and ASC 606, facilitating transparent and consistent financial performance measurement.

Expense Recognition

Expense recognition differentiates prepayments, which record expenses when cash is paid in advance but benefits extend over multiple periods, from accruals that match expenses to the period they are incurred regardless of cash flow. Accurate accounting for prepayments involves deferring expenses as assets and systematically expensing them over time, while accruals recognize liabilities and expenses immediately to comply with the matching principle.

Adjusting Entries

Adjusting entries ensure accurate financial reporting by recognizing prepayments as expenses or assets over time and recording accruals for revenues or expenses incurred but not yet documented. These adjustments align income and expenses with the correct accounting periods, enhancing the matching principle and financial statement accuracy.

Amortization of Prepaid Assets

Amortization of prepaid assets systematically allocates the cost of prepaid expenses over their useful periods, reflecting their consumption in financial statements. Unlike accruals that recognize expenses or revenues when incurred regardless of cash flow, prepayments involve upfront payments recorded as assets and expensed gradually through amortization, ensuring accurate matching of costs to periods benefited.

Income Statement Impact

Prepayments reduce current expenses by deferring costs to future periods, improving short-term income statement profitability, while accruals increase expenses by recognizing incurred costs before payment, providing a more accurate matching of revenues and expenses within the reporting period. Properly managing prepayments and accruals ensures compliance with the matching principle, enhancing the accuracy of financial performance analysis and decision-making.

Cut-off Procedures

Cut-off procedures ensure accurate financial reporting by correctly classifying transactions within the appropriate accounting period, distinguishing prepayments as assets for future expenses and accruals as liabilities for incurred but unpaid expenses. Proper implementation of these procedures prevents misstated revenues or expenses, maintaining compliance with GAAP or IFRS standards and enhancing the reliability of financial statements.

prepayments vs accruals Infographic

moneydif.com

moneydif.com