Capital expenditures refer to funds used by a company to acquire, upgrade, or maintain physical assets such as property, buildings, or equipment, providing long-term benefits. Revenue expenditures are costs incurred for the day-to-day functioning of the business, including expenses like rent, utilities, and repairs, which are fully deducted in the accounting period they occur. Proper differentiation between capital and revenue expenditures ensures accurate financial reporting and affects the calculation of taxable income.

Table of Comparison

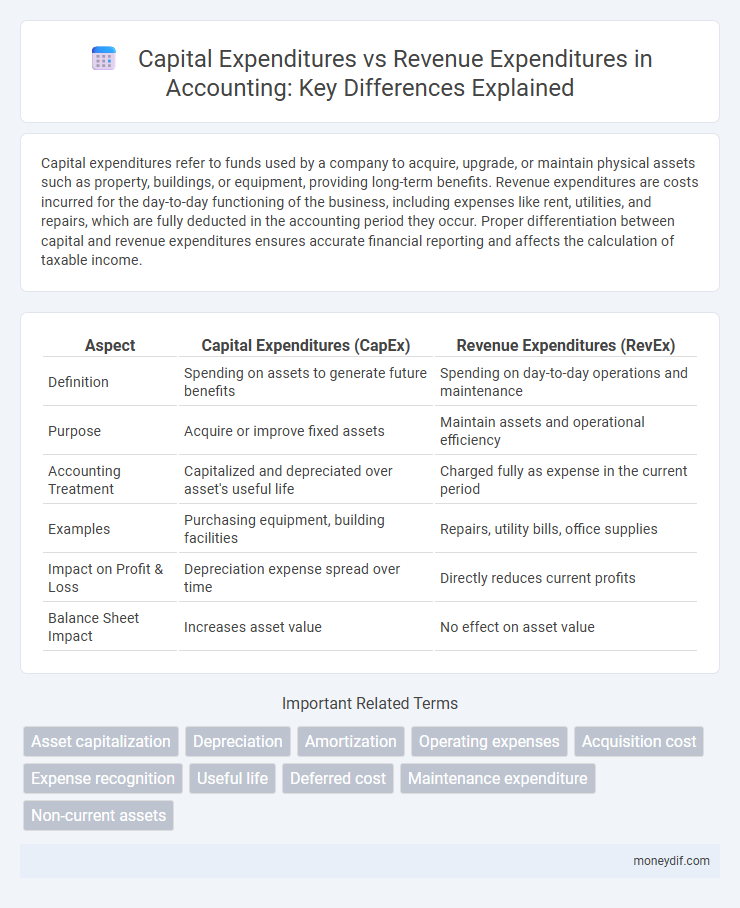

| Aspect | Capital Expenditures (CapEx) | Revenue Expenditures (RevEx) |

|---|---|---|

| Definition | Spending on assets to generate future benefits | Spending on day-to-day operations and maintenance |

| Purpose | Acquire or improve fixed assets | Maintain assets and operational efficiency |

| Accounting Treatment | Capitalized and depreciated over asset's useful life | Charged fully as expense in the current period |

| Examples | Purchasing equipment, building facilities | Repairs, utility bills, office supplies |

| Impact on Profit & Loss | Depreciation expense spread over time | Directly reduces current profits |

| Balance Sheet Impact | Increases asset value | No effect on asset value |

Introduction to Capital and Revenue Expenditures

Capital expenditures refer to funds used by a business to acquire, upgrade, or maintain physical assets such as property, equipment, or infrastructure, enhancing the company's long-term operational capacity. Revenue expenditures are costs incurred for the day-to-day functioning of the business, covering expenses like repairs, maintenance, and utilities that are charged to the income statement in the accounting period they occur. Distinguishing between capital and revenue expenditures is crucial for accurate financial reporting and compliance with accounting standards such as IFRS and GAAP.

Defining Capital Expenditures

Capital expenditures (CapEx) refer to funds used by a company to acquire, upgrade, or maintain physical assets such as property, buildings, or equipment, which provide benefits over multiple accounting periods. These expenses are capitalized on the balance sheet and depreciated over the asset's useful life, impacting long-term financial statements. Unlike revenue expenditures, which cover day-to-day operational costs, capital expenditures contribute to the growth and productivity of the business through asset enhancement.

Defining Revenue Expenditures

Revenue expenditures are costs incurred for the day-to-day functioning of a business, aimed at maintaining assets rather than acquiring or improving them. These expenses are fully charged against the income in the accounting period they occur, such as repairs, maintenance, and utility bills. Unlike capital expenditures, revenue expenditures do not result in the creation of long-term assets and thus do not appear on the balance sheet.

Key Differences Between Capital and Revenue Expenditures

Capital expenditures involve long-term investments in assets such as property, plant, and equipment, improving operational capacity or extending asset life, and are recorded as fixed assets on the balance sheet. Revenue expenditures cover day-to-day operational costs like repairs, maintenance, and utilities, which are expensed immediately on the income statement, impacting the profit and loss of the accounting period. The main difference lies in capitalization versus expensing treatment, affecting asset valuation and profitability metrics in financial reporting.

Criteria for Classification

Capital expenditures are classified based on their purpose to acquire or improve long-term assets, typically involving significant costs that extend the asset's useful life or increase its value. Revenue expenditures are identified by their nature of maintaining day-to-day operational efficiency, covering expenses like repairs and maintenance that do not enhance the asset's lifespan. The key criteria for classification include the benefit duration, cost magnitude, and whether the expenditure improves the asset beyond its original condition.

Impact on Financial Statements

Capital expenditures are recorded as assets on the balance sheet and depreciated over time, affecting both the asset value and future income statements through depreciation expense. Revenue expenditures are expensed immediately on the income statement, reducing net income in the current accounting period without impacting the asset base. The distinction influences cash flow statements by categorizing capital expenditures under investing activities and revenue expenditures under operating activities.

Examples of Capital Expenditures

Examples of capital expenditures include purchasing machinery, acquiring land or buildings, and upgrading office equipment to extend its useful life. These expenditures are capitalized on the balance sheet and depreciated over time, reflecting their long-term benefit to the business. Unlike revenue expenditures, capital expenditures improve the productive capacity or efficiency of an asset rather than covering day-to-day operational costs.

Examples of Revenue Expenditures

Examples of revenue expenditures include routine repairs, maintenance costs, and utility expenses that keep assets operational without enhancing their value or extending their lifespan. These expenses are recorded in the profit and loss account within the accounting period they occur. Unlike capital expenditures, revenue expenditures do not result in asset capitalization but directly affect net income.

Importance in Decision-Making and Budgeting

Capital expenditures represent long-term investments in assets that enhance a company's productive capacity, influencing strategic budgeting and financial planning decisions. Revenue expenditures cover day-to-day operational costs that maintain current business functions, impacting short-term cash flow management and expense forecasting. Understanding the distinction between these expenditures is crucial for accurate financial reporting and informed decision-making in resource allocation.

Common Mistakes in Expenditure Classification

Misclassifying capital expenditures as revenue expenditures can distort financial statements by understating asset value and overstating expenses, leading to inaccurate profit reporting. Common errors include treating routine maintenance costs as capital improvements or expensing large asset purchases instead of capitalizing them, which affects depreciation schedules. Accurate distinction between capital and revenue expenditures is essential for compliant financial reporting and effective asset management.

Important Terms

Asset capitalization

Asset capitalization involves recording capital expenditures (CapEx) that enhance the useful life or value of an asset on the balance sheet rather than expensing them immediately, in contrast to revenue expenditures which are routine costs expensed in the income statement due to their short-term benefit. Capital expenditures typically include purchases or improvements of fixed assets like machinery, buildings, or land, while revenue expenditures cover maintenance, repairs, and operational expenses that do not increase asset value.

Depreciation

Depreciation allocates the cost of capital expenditures, such as machinery or buildings, over their useful lives, reflecting long-term asset consumption on financial statements. Revenue expenditures, like repairs and maintenance, are expensed immediately, as they do not extend the asset's useful life or enhance its value.

Amortization

Amortization spreads the cost of intangible capital expenditures, such as patents or software development, over their useful life to match expenses with revenue generated. In contrast, revenue expenditures are expensed immediately since they relate to the day-to-day operational costs that do not provide long-term benefits.

Operating expenses

Operating expenses refer to the ongoing costs required to run a business's day-to-day activities, while capital expenditures involve investments in long-term assets like property or equipment. Revenue expenditures are short-term expenses tied to maintaining assets and generating revenue, contrasting with capital expenditures which enhance asset value and productivity over time.

Acquisition cost

Acquisition cost represents the total expense incurred to obtain an asset, including purchase price and any related fees, which is capitalized as part of capital expenditures (CapEx) to be depreciated over the asset's useful life. Revenue expenditures, in contrast, cover routine operational costs necessary for maintenance and repairs that do not extend the asset's life and are expensed immediately in the income statement.

Expense recognition

Expense recognition differentiates capital expenditures, which are capitalized and depreciated over time, from revenue expenditures that are immediately expensed in the period incurred. Correct classification affects financial statements by impacting asset valuation and net income, ensuring compliance with accounting standards such as GAAP or IFRS.

Useful life

Useful life determines the timeframe over which capital expenditures (CapEx) are depreciated or amortized, reflecting the long-term asset's value consumption. Revenue expenditures (OpEx) affect the income statement immediately, covering costs for maintaining assets without extending their useful life.

Deferred cost

Deferred cost refers to expenses recognized over multiple periods, commonly associated with capital expenditures that provide long-term benefits and are capitalized on the balance sheet. Revenue expenditures are fully expensed in the period incurred, representing short-term operational costs that do not create lasting assets.

Maintenance expenditure

Maintenance expenditure primarily falls under revenue expenditures as it covers routine costs for preserving asset functionality without increasing its value or lifespan. Capital expenditures involve significant investments to acquire or upgrade fixed assets, enhancing their capacity or extending useful life beyond the current period.

Non-current assets

Non-current assets represent long-term investments such as property, plant, and equipment, capitalized through capital expenditures that enhance asset value or extend its useful life. Revenue expenditures, in contrast, are recurring costs like repairs and maintenance that maintain operational efficiency without increasing the asset's capacity or value.

capital expenditures vs revenue expenditures Infographic

moneydif.com

moneydif.com