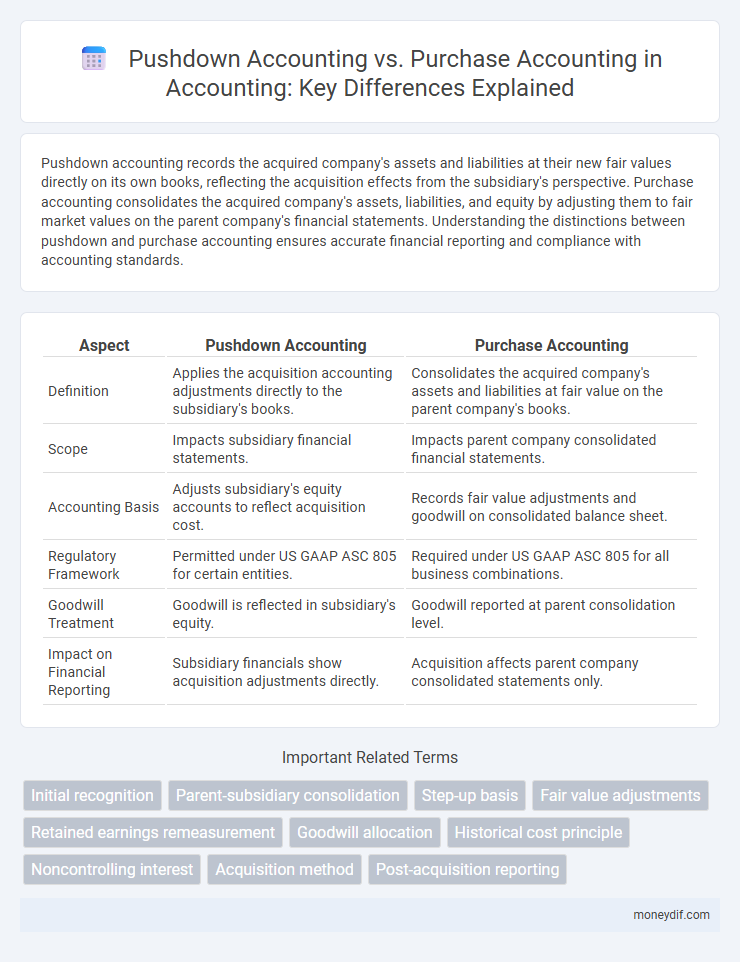

Pushdown accounting records the acquired company's assets and liabilities at their new fair values directly on its own books, reflecting the acquisition effects from the subsidiary's perspective. Purchase accounting consolidates the acquired company's assets, liabilities, and equity by adjusting them to fair market values on the parent company's financial statements. Understanding the distinctions between pushdown and purchase accounting ensures accurate financial reporting and compliance with accounting standards.

Table of Comparison

| Aspect | Pushdown Accounting | Purchase Accounting |

|---|---|---|

| Definition | Applies the acquisition accounting adjustments directly to the subsidiary's books. | Consolidates the acquired company's assets and liabilities at fair value on the parent company's books. |

| Scope | Impacts subsidiary financial statements. | Impacts parent company consolidated financial statements. |

| Accounting Basis | Adjusts subsidiary's equity accounts to reflect acquisition cost. | Records fair value adjustments and goodwill on consolidated balance sheet. |

| Regulatory Framework | Permitted under US GAAP ASC 805 for certain entities. | Required under US GAAP ASC 805 for all business combinations. |

| Goodwill Treatment | Goodwill is reflected in subsidiary's equity. | Goodwill reported at parent consolidation level. |

| Impact on Financial Reporting | Subsidiary financials show acquisition adjustments directly. | Acquisition affects parent company consolidated statements only. |

Introduction to Pushdown Accounting and Purchase Accounting

Pushdown accounting records the acquirer's purchase price directly in the target company's financial statements, aligning asset values with the acquisition cost at the subsidiary level. Purchase accounting consolidates the acquired company's assets and liabilities into the acquirer's books by adjusting fair values and recognizing goodwill or bargain purchase gains. This approach impacts financial reporting, tax basis, and post-acquisition performance measurement for both entities.

Definition and Key Concepts of Pushdown Accounting

Pushdown accounting is a method where the acquirer's cost is directly recorded on the acquiree's financial statements, reflecting the purchase price allocation at the subsidiary level after an acquisition. It reallocates the purchase price to the acquiree's assets and liabilities, aligning book values with fair values and ensuring consistency in subsidiary reporting. This approach contrasts with purchase accounting, where adjustments remain solely at the parent company level without impacting the subsidiary's standalone financials.

Definition and Key Concepts of Purchase Accounting

Purchase accounting, also known as acquisition accounting, records the acquired company's assets and liabilities at their fair market value on the acquisition date. This method reflects the actual value paid for the acquired entity, impacting goodwill and future depreciation calculations. Pushdown accounting, by contrast, applies the purchase price adjustments directly to the acquired company's financials, aligning its book values with the acquisition price post-transaction.

Major Differences Between Pushdown and Purchase Accounting

Pushdown accounting records the acquired company's assets and liabilities directly on its books at the purchase price, reflecting new basis adjustments without consolidating into the parent company's financial statements. Purchase accounting, governed by ASC 805, requires the acquirer to consolidate the acquired entity and recognize assets and liabilities at fair value on the parent's financials, emphasizing goodwill and intangible asset recognition. Major differences lie in the reporting entity, consolidation approach, and how purchase price allocation impacts financial statements and subsequent earnings.

Recognition and Measurement of Assets and Liabilities

Pushdown accounting recognizes assets and liabilities at their fair values directly in the financial statements of the acquired company, reflecting the acquisition date values without altering the parent's books. Purchase accounting measures assets and liabilities at their acquisition-date fair values on the consolidated financial statements, requiring adjustments to the acquired company's records within the parent's accounts. The key distinction lies in pushdown accounting embedding these fair value changes at the subsidiary level, while purchase accounting consolidates such changes at the parent level.

Impact on Financial Statements and Reporting

Pushdown accounting directly adjusts the subsidiary's financial statements to reflect the acquisition price, impacting assets, liabilities, and equity on the balance sheet, and potentially enhancing transparency for consolidated reporting. Purchase accounting requires the parent company to incorporate acquisition adjustments at the consolidated level, affecting goodwill, deferred taxes, and amortization expenses on the income statement, influencing overall financial performance metrics. The choice between the two methods significantly alters disclosure requirements and comparability of financial statements across reporting periods.

Regulatory Guidance and Accounting Standards

Pushdown accounting aligns with regulatory guidance under ASC 805, allowing acquirers to reflect acquisition cost directly in the acquiree's financial statements, simplifying consolidation. Purchase accounting, governed by ASC 805 and IFRS 3, requires recognition of identifiable assets acquired and liabilities assumed at fair value, ensuring transparent and standardized financial reporting. Regulatory bodies emphasize adhering to these standards for consistent application, accurate goodwill measurement, and clear disclosure in business combinations.

Advantages and Disadvantages of Pushdown Accounting

Pushdown accounting streamlines financial reporting by directly reflecting the purchase price adjustment in the acquired company's books, enhancing transparency for stakeholders. It simplifies consolidation processes by aligning the subsidiary's carrying values with acquisition accounting but may reduce comparability with prior periods and obscure pre-acquisition performance. However, pushdown accounting's reliance on acquisition date fair values can introduce valuation complexities and impact deferred tax calculations.

Pros and Cons of Purchase Accounting

Purchase accounting provides a clear method for valuing acquired assets and liabilities at fair market value, ensuring accurate reflection of acquisition costs on financial statements. This approach can enhance transparency and comparability for investors but may lead to increased complexity and higher auditor fees due to detailed asset revaluation and potential goodwill impairment testing. Conversely, purchase accounting might result in larger depreciation expenses and tax implications, which could affect profitability in the short term.

Choosing the Right Method: Practical Considerations

Choosing the right accounting method between pushdown accounting and purchase accounting hinges on factors such as the size of the acquisition, regulatory requirements, and financial reporting objectives. Pushdown accounting integrates fair value adjustments directly into the subsidiary's financial statements, streamlining consolidation but potentially complicating comparability. Purchase accounting allocates the acquisition cost to identifiable assets and liabilities at fair value on the parent's books, offering detailed insight for investors and aligning with GAAP standards.

Important Terms

Initial recognition

Initial recognition under pushdown accounting records assets and liabilities at their historical carrying amounts adjusted to the acquirer's basis, reflecting the pushdown of purchase price adjustments to the subsidiary's financial statements. Purchase accounting requires the acquiring company to recognize identifiable assets and liabilities at their fair values on the acquisition date, resulting in the recognition of goodwill or gain from a bargain purchase on the consolidated balance sheet.

Parent-subsidiary consolidation

Parent-subsidiary consolidation involves combining financial statements of the parent company and its subsidiaries to present them as a single economic entity, with purchase accounting recognizing the acquisition at fair value and pushdown accounting adjusting the subsidiary's books to reflect the new basis of accounting from the acquisition date. Purchase accounting focuses on the parent's consolidation process, while pushdown accounting directly modifies the subsidiary's financials, often leading to differences in asset valuation and goodwill recognition.

Step-up basis

Step-up basis refers to the adjustment of the tax basis of an acquired asset to its fair market value at the acquisition date, impacting depreciation and gain calculation. In pushdown accounting, the step-up basis is reflected directly in the acquired company's financials, while purchase accounting records the step-up basis in the parent company's books, affecting consolidation and tax reporting differently.

Fair value adjustments

Fair value adjustments in pushdown accounting directly reflect the acquirer's fair value basis on the acquiree's financial statements, resulting in a realignment of assets and liabilities to current market values at the acquisition date. In contrast, purchase accounting records these adjustments only at the consolidated level, preserving the acquiree's historical book values on its separate financials while recognizing fair value changes during consolidation.

Retained earnings remeasurement

Retained earnings remeasurement in pushdown accounting involves adjusting the subsidiary's equity to reflect the new basis of accounting post-acquisition, aligning book values with the purchase price allocated to identifiable assets and liabilities. In contrast, purchase accounting consolidates the subsidiary's retained earnings into goodwill without remeasuring retained earnings separately, focusing on fair value adjustments at the acquisition date.

Goodwill allocation

Goodwill allocation under pushdown accounting assigns the acquired goodwill directly to the acquiree's equity, reflecting the fair value adjustments on its standalone financial statements, whereas purchase accounting consolidates goodwill into the parent company's balance sheet by allocating the purchase price to identifiable assets and liabilities. Both methods impact depreciation, amortization, and impairment testing but differ in the recognition and reporting of goodwill within financial statements.

Historical cost principle

The historical cost principle requires assets to be recorded at their original purchase price, which contrasts with pushdown accounting where assets are revalued to fair market values upon a change in ownership. Purchase accounting aligns with this by recognizing assets and liabilities at their fair values acquired, differing from the historical cost approach by adjusting book values to reflect current market conditions post-acquisition.

Noncontrolling interest

Noncontrolling interest represents the equity in a subsidiary not attributable to the parent company, impacting consolidation metrics differently under purchase accounting, where it is separately reported in equity. Under pushdown accounting, noncontrolling interest adjustments reflect changes in the subsidiary's base financials post-acquisition, aligning subsidiary book values with the purchase price without altering consolidated equity presentation.

Acquisition method

Acquisition method in accounting involves recognizing assets and liabilities at fair value on the acquisition date, closely aligning with purchase accounting principles that consolidate financial statements and record goodwill. Pushdown accounting, however, applies the acquirer's fair value adjustments directly to the acquired company's standalone financial statements, reflecting the new basis of accounting after a change in control.

Post-acquisition reporting

Post-acquisition reporting under pushdown accounting reflects the acquired company's financial statements restated to the purchase price, aligning assets and liabilities with the acquirer's fair value basis. In contrast, purchase accounting consolidates the acquired entity's assets and liabilities at fair value on the parent company's books without altering the subsidiary's standalone financials.

pushdown accounting vs purchase accounting Infographic

moneydif.com

moneydif.com