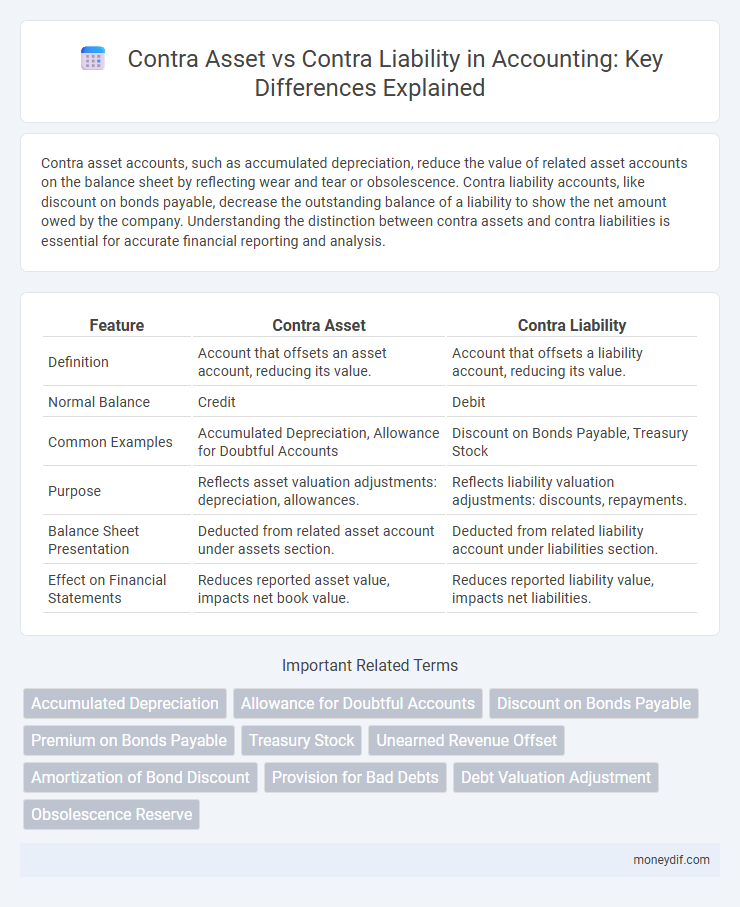

Contra asset accounts, such as accumulated depreciation, reduce the value of related asset accounts on the balance sheet by reflecting wear and tear or obsolescence. Contra liability accounts, like discount on bonds payable, decrease the outstanding balance of a liability to show the net amount owed by the company. Understanding the distinction between contra assets and contra liabilities is essential for accurate financial reporting and analysis.

Table of Comparison

| Feature | Contra Asset | Contra Liability |

|---|---|---|

| Definition | Account that offsets an asset account, reducing its value. | Account that offsets a liability account, reducing its value. |

| Normal Balance | Credit | Debit |

| Common Examples | Accumulated Depreciation, Allowance for Doubtful Accounts | Discount on Bonds Payable, Treasury Stock |

| Purpose | Reflects asset valuation adjustments: depreciation, allowances. | Reflects liability valuation adjustments: discounts, repayments. |

| Balance Sheet Presentation | Deducted from related asset account under assets section. | Deducted from related liability account under liabilities section. |

| Effect on Financial Statements | Reduces reported asset value, impacts net book value. | Reduces reported liability value, impacts net liabilities. |

Introduction to Contra Accounts in Accounting

Contra accounts in accounting are specialized ledger accounts used to reduce the balances of related asset or liability accounts, enhancing financial statement clarity. A contra asset account, such as Accumulated Depreciation, decreases the gross asset value to reflect net book value, while a contra liability account reduces the associated liability's carrying amount through entries like Discount on Bonds Payable. These accounts facilitate precise tracking of adjustments, ensuring accurate representation of a company's financial position.

What is a Contra Asset Account?

A contra asset account is an account that offsets the balance of a related asset account, reducing its net value on the balance sheet. Common examples include accumulated depreciation and allowance for doubtful accounts, both of which represent reductions in the book value of fixed assets and receivables, respectively. Contra asset accounts have a credit balance, contrasting with the typical debit balance of asset accounts, enabling more accurate financial reporting and asset valuation.

Common Examples of Contra Asset Accounts

Common examples of contra asset accounts include Accumulated Depreciation, Allowance for Doubtful Accounts, and Discount on Notes Receivable, which reduce the carrying amount of related asset accounts. Accumulated Depreciation offsets Property, Plant, and Equipment, reflecting wear and tear over time. The Allowance for Doubtful Accounts adjusts Accounts Receivable, accounting for estimated uncollectible amounts.

Understanding Contra Liability Accounts

Contra liability accounts reduce the total amount of liabilities reported on the balance sheet, providing a clearer picture of a company's obligations. Common examples include discount on bonds payable, which decreases the carrying value of bonds issued. Understanding these accounts helps in accurately assessing a company's net liabilities and financial health.

Key Examples of Contra Liability Accounts

Key examples of contra liability accounts include discount on bonds payable and treasury stock. Discount on bonds payable reduces the carrying amount of bonds issued, while treasury stock decreases total liabilities by accounting for repurchased shares. These accounts provide a more accurate representation of a company's obligations and financial position.

Main Differences: Contra Asset vs Contra Liability

Contra assets reduce the carrying amount of related asset accounts by recording accumulated depreciation or allowance for doubtful accounts, effectively showing the net asset value on the balance sheet. Contra liabilities offset liabilities by decreasing their balance, such as discount on bonds payable, reflecting the net liability amount owed. The main difference lies in their impact; contra assets decrease asset values, while contra liabilities reduce the gross liability balances to present net figures.

Impact on Financial Statements

Contra assets reduce the total value of related asset accounts on the balance sheet, directly decreasing reported asset totals and affecting equity through retained earnings. Contra liabilities decrease the gross amount of liabilities, lowering total liabilities and improving the company's debt ratio and financial leverage. Both contra accounts enhance the accuracy of financial statements by reflecting net asset and liability values, which is critical for investor and creditor decision-making.

Importance of Contra Accounts for Accurate Reporting

Contra accounts, including contra assets and contra liabilities, play a crucial role in accurate financial reporting by providing transparent adjustments that reflect the true value of related accounts. Contra asset accounts, such as accumulated depreciation, reduce asset balances to show net book value, while contra liability accounts, like discount on bonds payable, decrease liability balances to reflect the actual amount owed. Utilizing contra accounts ensures precise presentation of financial statements, enhancing stakeholders' ability to assess a company's financial position accurately.

Common Mistakes with Contra Asset and Liability Accounts

Common mistakes with contra asset and contra liability accounts include misclassifying contra assets like accumulated depreciation as liabilities, leading to inaccurate financial statements. Another frequent error is failing to properly offset contra liability accounts, such as discount on bonds payable, against their related liabilities, which distorts the true value of obligations. These errors can result in misstated asset or liability balances and affect key financial ratios used for decision-making.

Best Practices for Managing Contra Accounts

Best practices for managing contra accounts in accounting involve accurate classification and regular reconciliation to ensure the integrity of financial statements. Contra asset accounts, such as accumulated depreciation, should be updated consistently to reflect asset valuation adjustments, while contra liability accounts, like discount on bonds payable, require careful monitoring to track reductions in liabilities. Consistent documentation and adherence to accounting standards enhance transparency and support precise financial analysis.

Important Terms

Accumulated Depreciation

Accumulated depreciation is a contra asset account that reduces the book value of fixed assets, whereas contra liability accounts offset liabilities and are less commonly used.

Allowance for Doubtful Accounts

Allowance for Doubtful Accounts is a contra asset account that reduces Accounts Receivable to reflect estimated uncollectible amounts, whereas contra liability accounts offset liabilities but are not used for doubtful debts.

Discount on Bonds Payable

Discount on Bonds Payable is a contra-liability account that reduces the bond's carrying amount, unlike a contra-asset which decreases the value of an asset account.

Premium on Bonds Payable

Premium on Bonds Payable is classified as a contra liability account because it represents the amount received above the bond's face value, reducing the carrying amount of the bonds payable.

Treasury Stock

Treasury stock is classified as a contra equity account, reducing shareholders' equity rather than being a contra asset or contra liability.

Unearned Revenue Offset

Unearned Revenue Offset is a contra liability account that reduces total liabilities by recognizing advance payments for goods or services not yet delivered, unlike contra asset accounts that reduce asset balances.

Amortization of Bond Discount

Amortization of bond discount decreases the carrying amount of the contra liability account, bond discount, which is deducted from bonds payable on the balance sheet.

Provision for Bad Debts

Provision for bad debts is recorded as a contra asset account to accounts receivable, reducing its net value, whereas contra liabilities adjust related liability accounts by decreasing their reported balances.

Debt Valuation Adjustment

Debt Valuation Adjustment (DVA) reflects changes in a company's own credit risk affecting the fair value of its liabilities, typically recognized as a contra liability reducing the carrying amount of debt on the balance sheet. In contrast, contra assets decrease the value of specific asset accounts, whereas DVA functions as a contra liability adjusting the debt's value to account for credit risk fluctuations.

Obsolescence Reserve

Obsolescence reserve is a contra asset account used to offset inventory value, unlike a contra liability which reduces the balance of a related liability account.

contra asset vs contra liability Infographic

moneydif.com

moneydif.com