Capital leases transfer ownership risks and benefits to the lessee, requiring asset and liability recognition on the balance sheet. Operating leases, typically off-balance-sheet, are treated as rental expenses without asset capitalization. Understanding the differences impacts financial ratios, tax implications, and long-term asset management.

Table of Comparison

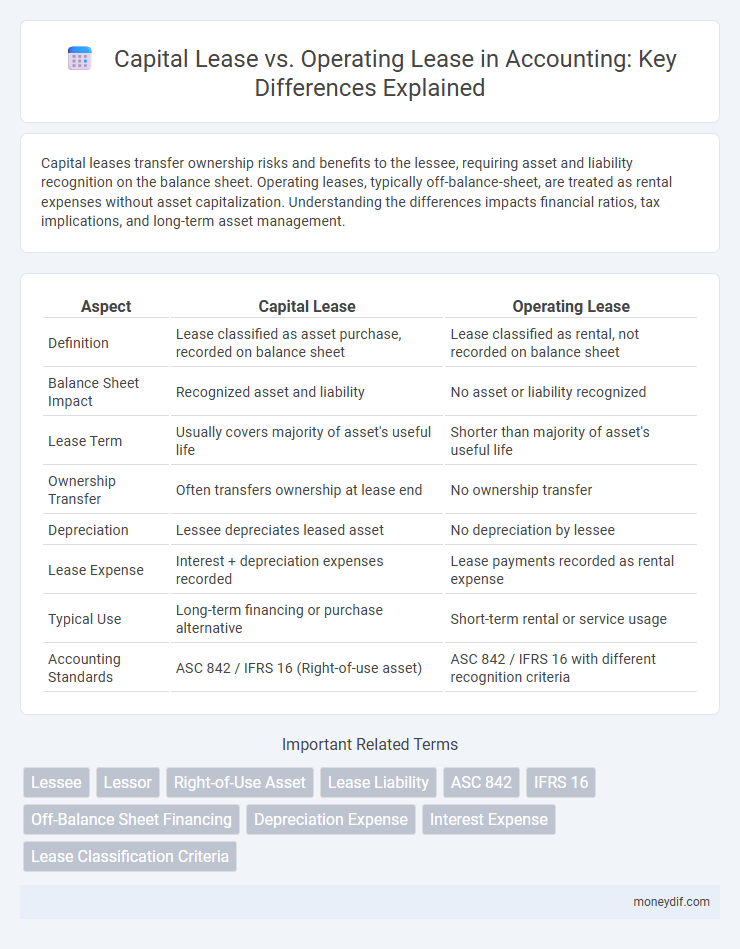

| Aspect | Capital Lease | Operating Lease |

|---|---|---|

| Definition | Lease classified as asset purchase, recorded on balance sheet | Lease classified as rental, not recorded on balance sheet |

| Balance Sheet Impact | Recognized asset and liability | No asset or liability recognized |

| Lease Term | Usually covers majority of asset's useful life | Shorter than majority of asset's useful life |

| Ownership Transfer | Often transfers ownership at lease end | No ownership transfer |

| Depreciation | Lessee depreciates leased asset | No depreciation by lessee |

| Lease Expense | Interest + depreciation expenses recorded | Lease payments recorded as rental expense |

| Typical Use | Long-term financing or purchase alternative | Short-term rental or service usage |

| Accounting Standards | ASC 842 / IFRS 16 (Right-of-use asset) | ASC 842 / IFRS 16 with different recognition criteria |

Introduction to Capital Lease and Operating Lease

Capital leases transfer substantial ownership risks and rewards of an asset to the lessee, often recognized on the balance sheet as both an asset and a liability. Operating leases, in contrast, are treated as rental agreements with lease payments recorded as expenses, and the asset remains off the lessee's balance sheet. Understanding the distinction hinges on criteria like lease term length, ownership transfer, and bargain purchase options governed by accounting standards such as ASC 842 or IFRS 16.

Key Differences Between Capital Lease and Operating Lease

Capital leases are recorded as assets and liabilities on the balance sheet, reflecting ownership with depreciation and interest expenses, whereas operating leases are treated as off-balance-sheet expenses with lease payments recorded as rent expense. Capital leases have lease terms that transfer ownership risks and rewards, often including bargain purchase options or lease terms covering the asset's useful life, while operating leases typically do not transfer ownership and have shorter terms. The accounting treatment under ASC 842 and IFRS 16 requires capitalization of most leases, but classification impacts expense recognition patterns and financial ratios.

Accounting Treatment of Capital Leases

Capital leases are recorded on the balance sheet as both an asset and a liability, reflecting the right to use the leased asset and the corresponding obligation to make lease payments. The leased asset is depreciated over its useful life, while the lease liability is amortized using the effective interest method. This accounting treatment aligns with ASC 842 and IFRS 16 lease accounting standards, ensuring transparency and accuracy in financial reporting.

Accounting Treatment of Operating Leases

Operating leases are recorded as rental expenses on the income statement, without recognizing the leased asset or liability on the balance sheet under traditional accounting standards. The lessee discloses lease payments in the footnotes, reflecting off-balance-sheet financing, which impacts financial ratios differently than capital leases. New lease accounting standards, such as IFRS 16 and ASC 842, require lessees to recognize right-of-use assets and lease liabilities for most operating leases, increasing transparency and asset recognition.

Recognition on Balance Sheet

Capital leases require the lessee to recognize both an asset and a liability on the balance sheet, reflecting the leased asset and the present value of lease payments. Operating leases are typically off-balance-sheet financing, with lease expenses recognized on the income statement without asset or liability recognition, except under new lease accounting standards like IFRS 16 or ASC 842. These standards mandate lessees to recognize right-of-use assets and lease liabilities for most operating leases, increasing transparency and comparability in financial reporting.

Impact on Financial Ratios

Capital leases increase both assets and liabilities on the balance sheet, resulting in higher debt-to-equity and asset turnover ratios compared to operating leases, which keep leases off the balance sheet. This capitalization impacts profitability ratios by increasing depreciation and interest expenses, thereby reducing net income under capital leases. Operating leases, treated as operating expenses, preserve return on assets (ROA) and debt ratios, offering a more favorable presentation of financial health.

Tax Implications of Lease Classification

Capital leases are treated as asset acquisitions for tax purposes, allowing lessees to claim depreciation and interest expense deductions, which can reduce taxable income. Operating leases are considered rental expenses, with lease payments fully deductible as business expenses, providing consistent tax benefits throughout the lease term. The choice between capital and operating lease classification significantly affects tax strategy and financial reporting outcomes.

Advantages and Disadvantages of Each Lease Type

Capital leases provide lessees with asset ownership benefits, enabling depreciation and interest expense deductions, which can improve long-term financial metrics; however, they increase liabilities on the balance sheet and reduce financial flexibility. Operating leases offer off-balance-sheet financing and preserve borrowing capacity, making them advantageous for managing short-term obligations, but they do not allow asset ownership or depreciation benefits and can result in higher overall costs if used for long-term asset use. Understanding the impact on cash flow, tax implications, and balance sheet presentation is essential for effective lease management and financial reporting compliance under ASC 842 or IFRS 16 standards.

Criteria for Lease Classification under IFRS and US GAAP

IFRS classifies leases as finance or operating leases based on transfer of ownership, option to purchase, lease term relative to asset's economic life, and present value of lease payments compared to asset's fair value. US GAAP uses similar criteria but specifies quantitative thresholds such as lease term being 75% or more of economic life and present value of lease payments being 90% or more of fair value for capital lease classification. Both standards require lessees to assess these criteria to determine lease classification, impacting balance sheet recognition and expense patterns.

Choosing the Right Lease for Your Business

Choosing the right lease for your business involves understanding the differences between capital leases and operating leases in accounting treatment and financial impact. Capital leases, recorded as both assets and liabilities on the balance sheet, affect depreciation and interest expenses, improving asset control and long-term investment visibility. Operating leases, often off-balance-sheet, provide flexibility with rental expenses recognized in profit and loss, beneficial for short-term use and managing cash flow without increasing debt ratios.

Important Terms

Lessee

Lessees classify leases as capital or operating based on criteria like lease term length and present value of lease payments, impacting balance sheet recognition and expense reporting. Capital leases are recorded as assets and liabilities, reflecting ownership risks and rewards, while operating leases are treated as rentals, with lease payments expensed on the income statement.

Lessor

A lessor in a capital lease transfers substantially all ownership risks and rewards to the lessee, recognizing the lease as a financed sale, while in an operating lease, the lessor retains ownership risks and rewards, treating lease payments as rental income. Capital leases meet criteria such as transfer of ownership, bargain purchase option, lease term covering major asset life, or present value of lease payments equaling asset value, impacting lessor accounting and financial reporting significantly.

Right-of-Use Asset

Right-of-use assets represent the lessee's right to use an underlying asset during the lease term, recognized on the balance sheet under ASC 842 and IFRS 16 for both capital (finance) leases and operating leases. Capital leases require recognizing both a right-of-use asset and a lease liability reflecting the present value of lease payments, while operating leases also involve a right-of-use asset but typically result in a single lease expense without asset depreciation.

Lease Liability

Lease liability represents the present value of lease payments a lessee is obligated to make under a capital lease, recognized as both an asset and a liability on the balance sheet, while operating lease liabilities are typically disclosed in footnotes and not recorded as assets or liabilities under previous accounting standards. Under ASC 842 and IFRS 16, operating leases also require recognition of lease liabilities and corresponding right-of-use assets, aligning lease accounting more closely with capital leases by capturing future payment obligations on the balance sheet.

ASC 842

ASC 842 distinguishes capital leases, now referred to as finance leases, from operating leases by recognizing finance leases on the balance sheet as both a right-of-use asset and a lease liability, reflecting the transfer of ownership or economic benefits to the lessee. Operating leases under ASC 842 also require balance sheet recognition of the right-of-use asset and lease liability, but do not transfer ownership and are expensed over the lease term on a straight-line basis.

IFRS 16

IFRS 16 requires lessees to recognize nearly all leases on the balance sheet by recording a right-of-use asset and a lease liability, effectively eliminating the distinction between capital leases and operating leases for lessees. This standard enhances transparency by aligning lease accounting with the economic reality of asset usage and financial obligations, impacting financial ratios and key performance metrics.

Off-Balance Sheet Financing

Off-Balance Sheet Financing often involves classifying leases as operating leases rather than capital leases to keep liabilities off the balance sheet, enhancing financial ratios and debt capacity. Under current accounting standards, however, most leases must be recognized on the balance sheet, diminishing the off-balance sheet treatment advantage previously afforded to operating leases.

Depreciation Expense

Depreciation expense on capital leases is recorded on the leased asset over its useful life, reflecting ownership and affecting both the balance sheet and income statement, whereas operating leases do not result in asset depreciation because the lessee only records lease expense, typically on a straight-line basis, without recognizing the leased asset. This distinction impacts financial ratios, with capital leases increasing asset base and liabilities, while operating leases keep liabilities off the balance sheet under previous accounting standards but require right-of-use asset recognition under ASC 842 and IFRS 16.

Interest Expense

Interest expense for capital leases is recognized on the lease liability and reflects the cost of borrowing inherent in the lease agreement, increasing total lease costs over time, while operating leases typically record lease payments as rent expense without separately identifying interest. Capital leases affect the balance sheet through asset capitalization and liability recognition, impacting interest expense calculations, whereas operating leases remain off-balance-sheet under older standards but require lease cost recognition on the income statement.

Lease Classification Criteria

Lease classification criteria focus on evaluating lease term, present value of lease payments, ownership transfer, and purchase options to distinguish between capital lease and operating lease; a lease is classified as a capital lease if it meets any of the four criteria outlined in accounting standards such as ASC 842 or IAS 17. Capital leases are recognized on the balance sheet with assets and liabilities, whereas operating leases are treated as off-balance-sheet expenses, impacting financial ratios and lease accounting disclosures.

capital lease vs operating lease Infographic

moneydif.com

moneydif.com