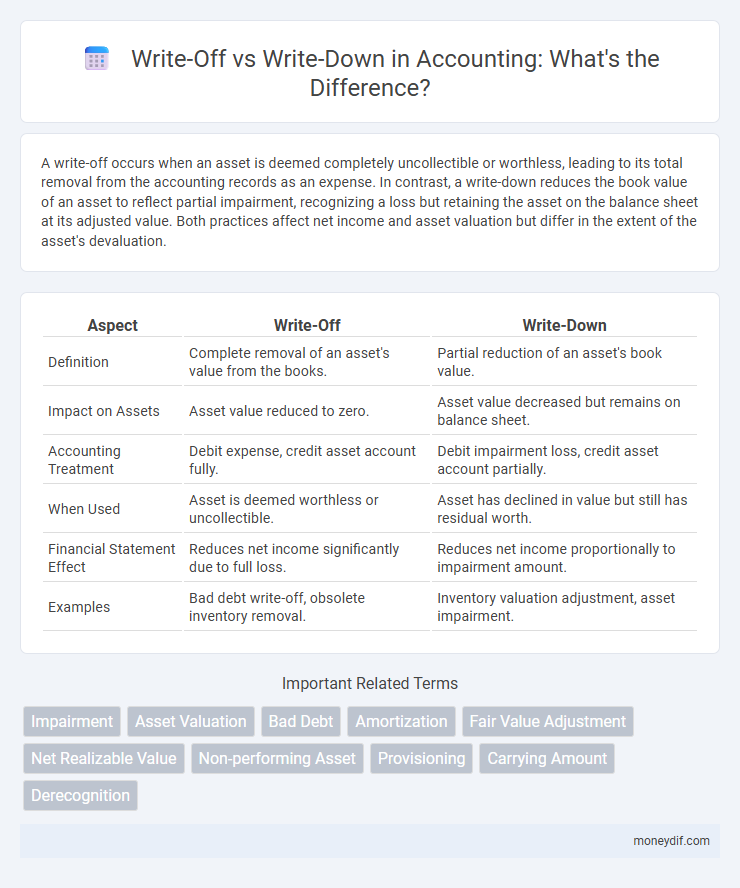

A write-off occurs when an asset is deemed completely uncollectible or worthless, leading to its total removal from the accounting records as an expense. In contrast, a write-down reduces the book value of an asset to reflect partial impairment, recognizing a loss but retaining the asset on the balance sheet at its adjusted value. Both practices affect net income and asset valuation but differ in the extent of the asset's devaluation.

Table of Comparison

| Aspect | Write-Off | Write-Down |

|---|---|---|

| Definition | Complete removal of an asset's value from the books. | Partial reduction of an asset's book value. |

| Impact on Assets | Asset value reduced to zero. | Asset value decreased but remains on balance sheet. |

| Accounting Treatment | Debit expense, credit asset account fully. | Debit impairment loss, credit asset account partially. |

| When Used | Asset is deemed worthless or uncollectible. | Asset has declined in value but still has residual worth. |

| Financial Statement Effect | Reduces net income significantly due to full loss. | Reduces net income proportionally to impairment amount. |

| Examples | Bad debt write-off, obsolete inventory removal. | Inventory valuation adjustment, asset impairment. |

Introduction to Write-Offs and Write-Downs

Write-offs and write-downs are accounting methods used to adjust the book value of assets to reflect their fair market value or recoverable amount. A write-off completely removes an asset from the financial statements when it is deemed uncollectible or obsolete, while a write-down reduces the asset's value without eliminating it entirely. These adjustments ensure accurate financial reporting and compliance with accounting standards such as GAAP and IFRS.

Definitions: Write-Off vs Write-Down

Write-off refers to the complete removal of an asset or receivable from the accounting records due to its total loss in value or uncollectibility. Write-down involves reducing the book value of an asset to reflect its decreased market value or impairment, without eliminating it entirely. Both accounting treatments adjust asset valuations to provide accurate financial statements but differ in the extent of value adjustment.

Key Differences Between Write-Off and Write-Down

Write-offs and write-downs both refer to reducing the book value of an asset but differ in extent and timing. A write-off eliminates the entire value of an asset deemed uncollectible or worthless, directly impacting net income by recognizing a full loss. In contrast, a write-down reduces the asset's carrying amount partially to reflect impairment or decreased market value, adjusting financial statements while maintaining some remaining asset value.

Common Scenarios for Write-Offs in Accounting

Write-offs in accounting commonly occur when receivables are deemed uncollectible due to customer bankruptcy, prolonged default periods, or disputes over invoice legitimacy. Businesses may also write off obsolete inventory that cannot be sold or used, reflecting a complete loss of asset value. These scenarios ensure accurate financial reporting by removing impaired assets from the balance sheet.

Typical Situations for Write-Downs

Write-downs typically occur when an asset's market value falls below its book value due to impairment, obsolescence, or damage, requiring a reduction in recorded value without removing the asset entirely from the balance sheet. Common situations include inventory becoming obsolete, receivables deemed partially uncollectible, or fixed assets suffering physical deterioration. These adjustments reflect a more accurate asset valuation and prevent overstated financial statements.

Impact on Financial Statements

Write-offs completely remove the asset's value from the balance sheet, resulting in an immediate expense that reduces net income and shareholders' equity. Write-downs reduce an asset's carrying amount to its fair market value, causing a partial loss recognized on the income statement and decreasing the asset's book value. Both actions affect financial ratios, but write-offs have a more severe impact on profitability and asset metrics than write-downs.

Tax Implications of Write-Offs and Write-Downs

Write-offs reduce taxable income by removing uncollectible accounts or obsolete assets entirely, leading to immediate tax benefits. Write-downs decrease an asset's book value, spreading the tax benefit over multiple periods through depreciation or amortization adjustments. Understanding the distinction is crucial for optimizing tax strategies and ensuring compliance with IRS regulations.

Accounting Standards and Compliance

Write-offs and write-downs are distinct accounting treatments governed by standards such as IFRS and GAAP to ensure accurate financial reporting and compliance. A write-off removes an asset's entire value from the books when it is deemed unrecoverable, typically complying with IAS 36 Impairment of Assets or ASC Topic 360. Write-downs reduce an asset's carrying amount to reflect impairment or decreased market value, requiring regular impairment testing under standards like IFRS 9 and ASC 310 to maintain compliance.

Best Practices for Managing Asset Value

Implementing best practices for managing asset value involves accurately distinguishing between write-offs and write-downs to reflect true asset conditions. Write-offs completely remove impaired assets from the books, while write-downs adjust asset values to reflect partial impairment, preserving transparency and compliance with accounting standards such as GAAP or IFRS. Regular asset reviews, detailed impairment testing, and thorough documentation support precise valuation adjustments and optimize financial reporting integrity.

Case Studies: Write-Off and Write-Down Examples

Case studies highlight that a write-off completely removes an uncollectible receivable or obsolete asset from the balance sheet, as seen in companies dealing with bankrupt customers or irrecoverable inventory. Write-down examples often involve reducing asset values to reflect impairment or market decline, such as inventory devaluation due to spoilage or technology firms adjusting intangible assets after competitive disruption. These real-world scenarios demonstrate the strategic financial adjustments businesses use to maintain accurate and compliant accounting records.

Important Terms

Impairment

Impairment reflects a decline in an asset's recoverable value below its carrying amount, leading to either a write-down, which partially reduces the asset's book value, or a write-off, which fully eliminates the asset from the balance sheet. Write-downs are used when the asset retains some value, whereas write-offs occur when the asset is deemed worthless, directly impacting financial statements and tax calculations.

Asset Valuation

Asset valuation involves assessing the fair market value of assets, where a write-down reduces an asset's book value to reflect impairment or decreased worth without eliminating it, while a write-off completely removes the asset's value from the balance sheet due to its total loss or obsolescence. Accurate differentiation between write-offs and write-downs ensures precise financial reporting and compliance with accounting standards like GAAP or IFRS.

Bad Debt

Bad debt occurs when a debtor fails to pay the owed amount, leading businesses to either write off the full balance as uncollectible or write down a portion to reflect partial loss. Write-offs remove the entire bad debt from accounts receivable, impacting net income immediately, while write-downs adjust the asset's value, allowing for partial recovery and more accurate financial reporting.

Amortization

Amortization systematically reduces the book value of intangible assets over their useful life, while a write-down directly decreases an asset's value due to impairment without full elimination. Unlike a write-off that removes an asset entirely from the books, amortization allocates the cost gradually, and write-downs address partial losses in asset value.

Fair Value Adjustment

Fair value adjustment reflects the recalibration of an asset's carrying amount to its current market value, impacting financial statements during impairment events. A write-off eliminates the asset entirely when its value is deemed unrecoverable, whereas a write-down reduces the asset's book value to reflect partial impairment, both requiring precise fair value assessments to ensure accurate financial reporting.

Net Realizable Value

Net Realizable Value (NRV) represents the estimated selling price of an asset minus any costs associated with its sale, serving as a critical benchmark in inventory valuation. Write-downs reduce the book value to NRV when assets are impaired but still hold some value, whereas write-offs completely eliminate the asset's value from the balance sheet when it is deemed unrecoverable.

Non-performing Asset

Non-performing Assets (NPAs) represent loans or advances on which the borrower has stopped making interest or principal repayments for a specified period, leading banks to either write-down or write-off these amounts based on recoverability assessments. Write-downs partially reduce the asset's value to reflect its impaired status while maintaining it on the balance sheet; write-offs completely remove the asset, signaling the acknowledgment of unrecoverable losses in the financial statements.

Provisioning

Provisioning involves setting aside funds to cover potential losses, with write-offs representing the complete removal of an asset's value when recovery is deemed impossible, while write-downs reflect a partial reduction in asset value due to diminished recoverability. Effective provisioning ensures accurate financial reporting by anticipating write-downs to adjust asset valuations and authorizing write-offs to eliminate irrecoverable assets from the balance sheet.

Carrying Amount

The carrying amount represents the book value of an asset, which is adjusted through write-downs to reflect impairment losses without removing the asset from the balance sheet, whereas a write-off eliminates the carrying amount entirely by fully derecognizing the asset due to total loss of value. Write-downs decrease the carrying amount partially to match fair value or recoverable amount, impacting depreciation and future earnings, while write-offs result in immediate expense recognition and removal of the asset from financial statements.

Derecognition

Derecognition involves removing an asset or liability from the balance sheet when control is lost or obligations are settled, with write-off representing complete removal of the asset's carrying amount due to irrecoverability, while write-down refers to a partial reduction in asset value reflecting impairment or decreased recoverable amount. Financial reporting standards require that write-offs eliminate the asset entirely, whereas write-downs adjust the asset's book value to its fair value, ensuring accurate representation of company financial position.

write-off vs write-down Infographic

moneydif.com

moneydif.com