Realisation refers to the process of converting assets into cash or cash equivalents, signaling the completion of a sale or transaction, while recognition involves recording revenues and expenses in the financial statements when they are earned or incurred, regardless of cash flow timing. The distinction ensures that financial reports accurately reflect the company's economic activities by matching income to the period it relates to, rather than when the cash is received or paid. Understanding the difference between realisation and recognition is crucial for accurate financial reporting and compliance with accounting standards.

Table of Comparison

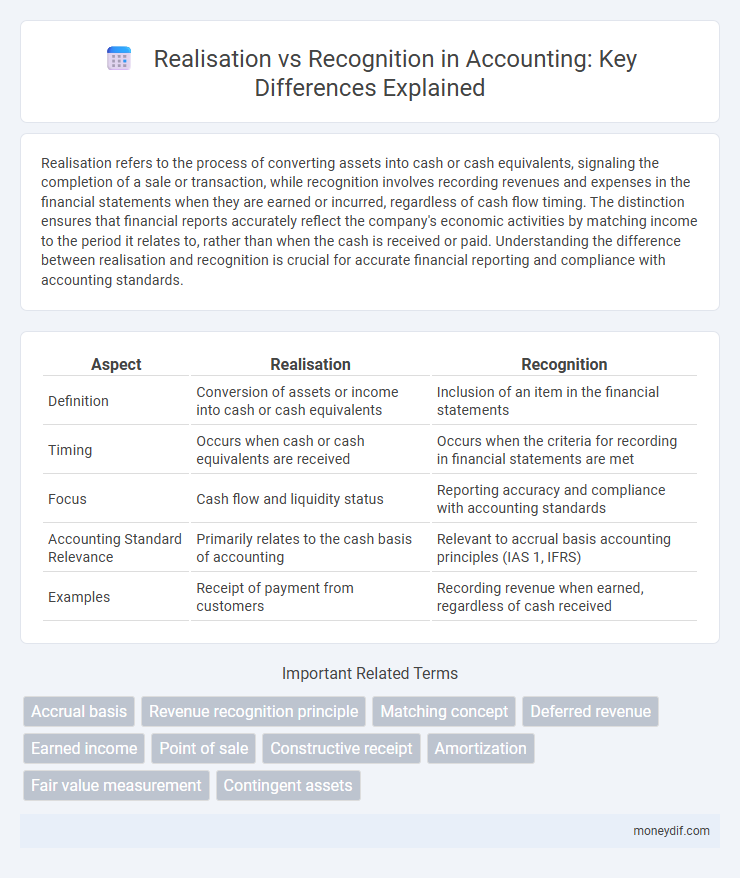

| Aspect | Realisation | Recognition |

|---|---|---|

| Definition | Conversion of assets or income into cash or cash equivalents | Inclusion of an item in the financial statements |

| Timing | Occurs when cash or cash equivalents are received | Occurs when the criteria for recording in financial statements are met |

| Focus | Cash flow and liquidity status | Reporting accuracy and compliance with accounting standards |

| Accounting Standard Relevance | Primarily relates to the cash basis of accounting | Relevant to accrual basis accounting principles (IAS 1, IFRS) |

| Examples | Receipt of payment from customers | Recording revenue when earned, regardless of cash received |

Introduction to Realisation and Recognition in Accounting

Realisation in accounting refers to the process of converting non-cash resources or assets into cash or cash equivalents, typically when revenue is earned by completing a transaction. Recognition involves formally recording the financial effects of transactions and events in the accounting records and financial statements when they meet specified criteria, such as measurability and relevance. Understanding the distinction between realisation and recognition is crucial for accurately reporting revenue and expenses according to accounting standards like IFRS and GAAP.

Defining Realisation: Meaning and Principles

Realisation in accounting refers to the process of converting non-cash assets into cash or claim to cash, signifying the completion of an earnings process. It is recognized when goods are sold or services rendered, and an entity has a valid claim to payment, regardless of when the cash is received. Key principles of realisation include the transfer of significant risks and rewards of ownership and the existence of a dependable measurement of the amount realizable.

Understanding Recognition: Key Concepts

Recognition in accounting involves formally recording an item in the financial statements once it meets specific criteria such as measurability and relevance. Realisation refers to the process of converting non-cash resources into cash or claims to cash, which is a prerequisite for recognition in revenue accounting. Accurate recognition ensures that financial reports reflect the true economic events, adhering to principles like matching and reliability for sound financial analysis.

Differences Between Realisation and Recognition

Realisation in accounting refers to the process of converting assets or income into cash or receivables, typically marked by the sale of goods or services. Recognition involves formally recording financial transactions or events in the accounting records once they meet specific criteria under frameworks like IFRS or GAAP. The key difference lies in timing; realisation emphasizes when economic benefits are obtained, while recognition focuses on when these benefits are reported in financial statements.

The Role of Realisation in Revenue Accounting

Realisation plays a critical role in revenue accounting by determining the moment when revenue is considered earned and can be recorded in the financial statements. It involves the actual receipt of cash or a claim to cash, signifying the completion of a sales transaction or service delivery. Accurate realisation ensures compliance with accounting standards like IFRS and GAAP, preventing premature or deferred revenue recognition that can distort financial performance.

Criteria for Recognition of Assets and Liabilities

Assets and liabilities are recognized in financial statements only when it is probable that future economic benefits will flow to or from the entity and their cost or value can be measured reliably. The recognition criteria ensure that assets are recorded when control of the resource exists, and liabilities when present obligations result from past events. Reliable measurement and probable inflows or outflows create a foundation for faithful representation in accordance with accounting standards.

Examples Illustrating Realisation vs Recognition

Revenue is recognized when earned, such as a company recording a sale at the point of delivery, while realization occurs when cash is actually received, like when the customer pays the invoice. For example, a software firm may recognize revenue upon licensing the software to a client, yet realization happens only when the payment is deposited into the bank. This distinction affects financial statements, as recognition follows the accrual basis of accounting, whereas realization is tied to cash flow events.

Impact on Financial Statements and Reporting

Realisation affects the timing of cash flow recording, indicating when cash or its equivalent is received, and directly impacts the cash flow statement but not necessarily the income statement. Recognition determines when revenue or expenses are recorded in the financial statements, influencing the accuracy of profit or loss and affecting the balance sheet through accrued assets or liabilities. Misalignment between realisation and recognition can lead to misstated financial positions and misinformed stakeholders due to discrepancies in reported earnings and cash flows.

Realisation and Recognition in IFRS and GAAP

Realisation in accounting refers to the process of converting non-cash assets into cash or cash equivalents, which typically triggers revenue recognition. Recognition, as defined by IFRS and GAAP, involves recording revenues and expenses in the financial statements when they meet specific criteria for measurability and probability of economic benefit. IFRS emphasizes a principles-based approach focusing on the transfer of control for revenue recognition, while GAAP follows detailed rules often centered on the delivery and acceptance of goods or services.

Common Challenges and Best Practices

Common challenges in realization versus recognition include timing discrepancies and revenue misclassification, which can lead to misstated financial statements and compliance issues under GAAP or IFRS standards. Best practices involve aligning revenue recognition policies with contractual terms, maintaining detailed documentation, and implementing robust internal controls to ensure accurate matching of income and expenses. Regular training on updated accounting standards and continuous monitoring of transactions help mitigate risks associated with premature or delayed revenue recognition.

Important Terms

Accrual basis

Accrual basis accounting records revenues and expenses when they are earned or incurred, aligning with the realization principle which emphasizes recognizing revenue upon delivery of goods or services. This method ensures financial statements reflect economic activity accurately by matching income and related expenses within the same accounting period, enhancing the relevance and reliability of financial reporting.

Revenue recognition principle

Revenue recognition principle dictates that revenue is recorded when it is both earned and realizable, emphasizing the importance of matching the timing of revenue recognition with the actual transfer of goods or services to the customer. Realization refers to the conversion of non-cash resources into cash or claims to cash, while recognition involves officially recording the revenue in the financial statements once the earnings process is substantially complete and collectibility is reasonably assured.

Matching concept

Matching concept in accounting requires expenses to be recognized in the same period as the revenues they help generate, ensuring accurate financial performance measurement. This principle contrasts with realization, where revenue is recognized only when earned, emphasizing timing differences in revenue and expense recording.

Deferred revenue

Deferred revenue represents payments received for goods or services not yet delivered, where revenue recognition occurs only once the related performance obligations are fulfilled. Realization involves the actual receipt of cash or claims to payment, but revenue recognition aligns with the transfer of control or earning process, adhering to accrual accounting principles.

Earned income

Earned income is recognized in financial statements when it is both realized and realizable, meaning the entity has completed the earnings process and there is reasonable assurance of payment. Realization occurs when goods or services are delivered, while recognition happens when the income is recorded, adhering to accounting principles that match earned revenue with the appropriate accounting period.

Point of sale

Point of Sale (POS) systems play a crucial role in the timing of revenue recognition by capturing transaction data at the moment of sale realization, which directly influences when income is recorded in accounting records. Accurate POS integration ensures compliance with revenue recognition standards like IFRS 15 or ASC 606, aligning realized sales events with proper financial reporting and enhancing audit traceability.

Constructive receipt

Constructive receipt occurs when income is made available to a taxpayer without restrictions, triggering realization even if not physically received, thus impacting the timing of income recognition for tax purposes. The distinction between realization and recognition hinges on realization being the event when income is earned or made available, while recognition is the actual inclusion of that income on tax returns, potentially deferred or accelerated based on constructive receipt rules.

Amortization

Amortization impacts the recognition of intangible assets by systematically allocating their cost over useful life in financial statements, while realization refers to the actual inflow of economic benefits when the asset contributes to revenue generation. Correct matching of amortization expenses with revenue ensures accurate recognition, reflecting the asset's diminishing value despite the timing of cash realization.

Fair value measurement

Fair value measurement requires assets and liabilities to be recorded at prices reflecting current market conditions, emphasizing realization through observable transactions rather than mere recognition based on historical cost. This approach aligns financial reporting with real-time economic value, enhancing transparency and comparability in financial statements.

Contingent assets

Contingent assets are potential economic benefits that may arise from past events, recognized only when their realization becomes virtually certain. Realisation refers to the occurrence of a future event that confirms the asset, while recognition requires reliable measurement and high probability of inflow, ensuring contingent assets are disclosed but not recorded until those criteria are met.

realisation vs recognition Infographic

moneydif.com

moneydif.com