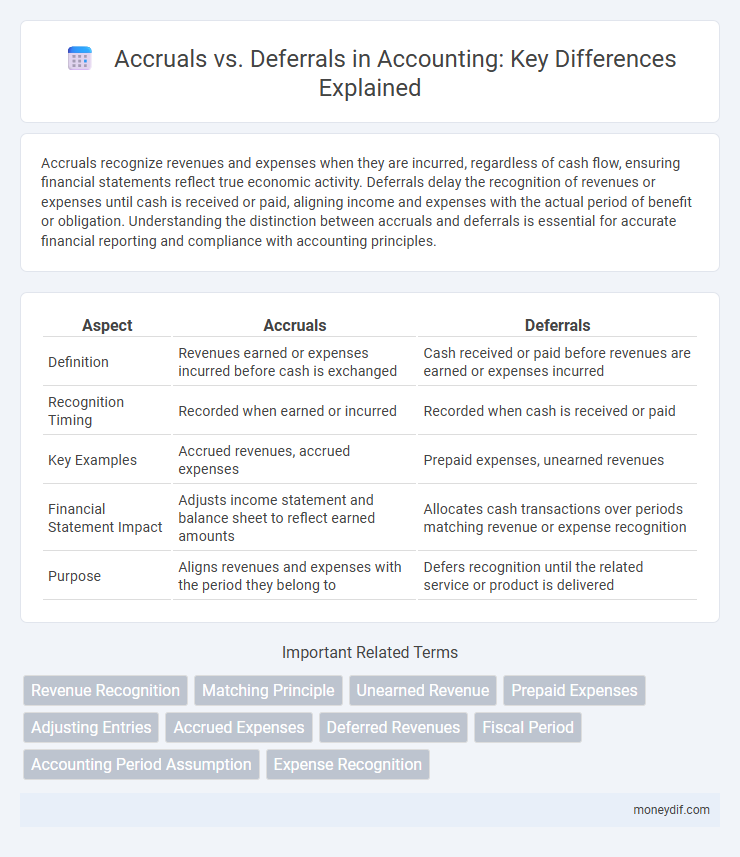

Accruals recognize revenues and expenses when they are incurred, regardless of cash flow, ensuring financial statements reflect true economic activity. Deferrals delay the recognition of revenues or expenses until cash is received or paid, aligning income and expenses with the actual period of benefit or obligation. Understanding the distinction between accruals and deferrals is essential for accurate financial reporting and compliance with accounting principles.

Table of Comparison

| Aspect | Accruals | Deferrals |

|---|---|---|

| Definition | Revenues earned or expenses incurred before cash is exchanged | Cash received or paid before revenues are earned or expenses incurred |

| Recognition Timing | Recorded when earned or incurred | Recorded when cash is received or paid |

| Key Examples | Accrued revenues, accrued expenses | Prepaid expenses, unearned revenues |

| Financial Statement Impact | Adjusts income statement and balance sheet to reflect earned amounts | Allocates cash transactions over periods matching revenue or expense recognition |

| Purpose | Aligns revenues and expenses with the period they belong to | Defers recognition until the related service or product is delivered |

Introduction to Accruals and Deferrals

Accruals recognize revenues and expenses when they are incurred, regardless of cash flow, ensuring accurate financial reporting across accounting periods. Deferrals postpone recognition of revenues and expenses until cash is received or paid, aligning income and expenses with the appropriate period. Understanding accruals and deferrals is essential for matching principle compliance and presenting a true financial position.

Understanding Accrual Accounting

Accrual accounting records revenues and expenses when they are earned or incurred, regardless of cash flow timing, ensuring financial statements reflect the true economic activity of a business. Accruals involve recognizing revenues earned but not yet received and expenses incurred but not yet paid, providing a more accurate financial position than cash accounting. This method aligns with Generally Accepted Accounting Principles (GAAP) and enhances decision-making through timely and relevant financial information.

Deferral Basics in Accounting

Deferrals in accounting refer to revenue and expenses that are recorded after cash is received or paid, aligning income and expenses with the appropriate accounting period. Deferred revenue represents money received before services are delivered or goods are provided, while deferred expenses involve payments made in advance for future benefits. Properly managing deferrals ensures accurate financial statements by matching revenues with the related expenses in the correct accounting period.

Key Differences Between Accruals and Deferrals

Accruals recognize revenues and expenses when they are incurred, regardless of cash flow timing, ensuring financial statements reflect economic events accurately. Deferrals postpone the recognition of revenues or expenses to future periods when cash transactions occur, aligning income and expenses with the period they affect. The key difference lies in timing: accruals anticipate revenues and expenses before cash changes hands, while deferrals delay recognition until cash is received or paid.

Impact on Financial Statements

Accruals directly affect the accuracy of financial statements by recognizing revenues and expenses when they are incurred, ensuring timely matching of income and costs within the reporting period. Deferrals delay the recognition of revenues and expenses, impacting the balance sheet through asset or liability accounts until the amounts are realized. Both accruals and deferrals enhance the precision of financial statements, supporting compliance with the matching principle and providing a clearer picture of a company's financial position.

Common Examples of Accruals

Accruals in accounting commonly include accrued expenses such as wages payable, interest payable, and utilities payable, which are recognized before cash is exchanged. Accrued revenues often involve services performed or goods delivered but not yet billed, like unbilled consulting fees or earned rent revenue. These accruals ensure financial statements reflect the true financial position by matching revenues and expenses to the period in which they occur.

Common Examples of Deferrals

Common examples of deferrals in accounting include prepaid expenses such as insurance premiums and rent paid in advance, which are recorded as assets until the service is consumed. Deferred revenues, also known as unearned revenues, arise when payments are received before goods or services are delivered, requiring recognition as liabilities until earned. These deferrals ensure accurate matching of expenses and revenues within the appropriate accounting periods according to accrual accounting principles.

Importance for Accurate Financial Reporting

Accruals and deferrals are crucial for accurate financial reporting as they ensure revenues and expenses are recognized in the period they occur, aligning with the matching principle. Proper application prevents misstated financial statements, which can mislead stakeholders and affect decision-making. These adjustments enhance the reliability and comparability of financial data across reporting periods.

Challenges and Best Practices

Accruals and deferrals present challenges in accurate revenue and expense recognition, often complicating financial statement preparation and audit trails. Best practices include implementing robust accounting software for real-time tracking, maintaining thorough documentation, and ensuring continuous staff training on GAAP principles. Consistent review and reconciliation processes enhance accuracy and compliance in managing accruals and deferrals.

Conclusion: Choosing the Right Approach

Selecting between accruals and deferrals depends on the accurate matching of revenues and expenses to the appropriate accounting periods, ensuring financial statements reflect true economic activity. Accrual accounting provides a more comprehensive view by recognizing financial events when they occur, while deferrals adjust timing to align cash flow with reported income and expenses. Businesses must evaluate their transaction types and reporting goals to apply the method that enhances transparency and compliance with accounting standards.

Important Terms

Revenue Recognition

Revenue recognition principles dictate that revenue is recorded when earned, aligning with accrual accounting by matching revenues with related expenses in the same period. Accruals recognize revenue before cash is received, while deferrals postpone revenue recognition until cash is collected or services are completed, ensuring accurate financial reporting.

Matching Principle

The Matching Principle requires expenses to be recorded in the same period as the revenues they help generate, ensuring accurate financial statements by aligning accrued expenses and revenues with their corresponding periods. This principle distinguishes accruals, which recognize revenues and expenses before cash transactions, from deferrals, which delay recognition until cash is received or paid.

Unearned Revenue

Unearned revenue represents a liability on the balance sheet where cash is received before goods or services are delivered, categorized under deferrals in accrual accounting. Unlike accruals, which recognize expenses or revenues before cash transactions, unearned revenue deferrals postpone revenue recognition until the earning process is complete.

Prepaid Expenses

Prepaid expenses represent payments made in advance for goods or services to be received in the future, classified as assets until they are expensed over time, aligning with the deferral concept in accrual accounting. Unlike accruals, which recognize expenses before cash payment, prepaid expenses defer recognition of expenses until the related benefit is realized, ensuring accurate matching of expenses to the appropriate accounting period.

Adjusting Entries

Adjusting entries ensure accurate financial reporting by recording accrued revenues and expenses not yet received or paid, as well as deferrals that allocate prepaid expenses and unearned revenues to the appropriate accounting periods. These adjustments adhere to the accrual basis of accounting, matching revenues and expenses to the periods in which they are incurred, rather than when cash transactions occur.

Accrued Expenses

Accrued expenses represent liabilities for costs that have been incurred but not yet paid, embodying the accrual accounting principle of recognizing expenses when they are incurred regardless of cash flow. In contrast to deferrals, which postpone recognizing expenses or revenues until cash is exchanged, accrued expenses ensure expenses are recorded in the period they relate to, enhancing matching and accuracy in financial reporting.

Deferred Revenues

Deferred revenues represent payments received for goods or services not yet delivered, classified as a liability under accrual accounting until earned. Unlike accruals, which recognize expenses or revenues before cash exchange, deferrals postpone recognition to match accounting periods accurately, ensuring revenue is recorded when performance obligations are fulfilled.

Fiscal Period

Fiscal period classifications impact the timing of accruals and deferrals, ensuring revenues and expenses are recognized in the appropriate accounting period for accurate financial reporting. Accruals record earned revenues and incurred expenses before cash transactions occur, while deferrals delay recognition until cash is received or paid within the fiscal period.

Accounting Period Assumption

The Accounting Period Assumption divides financial reporting into specific intervals, enabling accurate matching of revenues and expenses within the same period through accruals and deferrals. Accruals recognize income and expenses when earned or incurred, while deferrals postpone recognition until cash transactions occur, ensuring precise financial statements.

Expense Recognition

Expense recognition follows the matching principle, ensuring expenses are recorded in the same period as the related revenues, which distinguishes accruals and deferrals. Accruals recognize expenses before cash payment, while deferrals postpone expense recognition until cash is paid, optimizing financial accuracy.

accruals vs deferrals Infographic

moneydif.com

moneydif.com