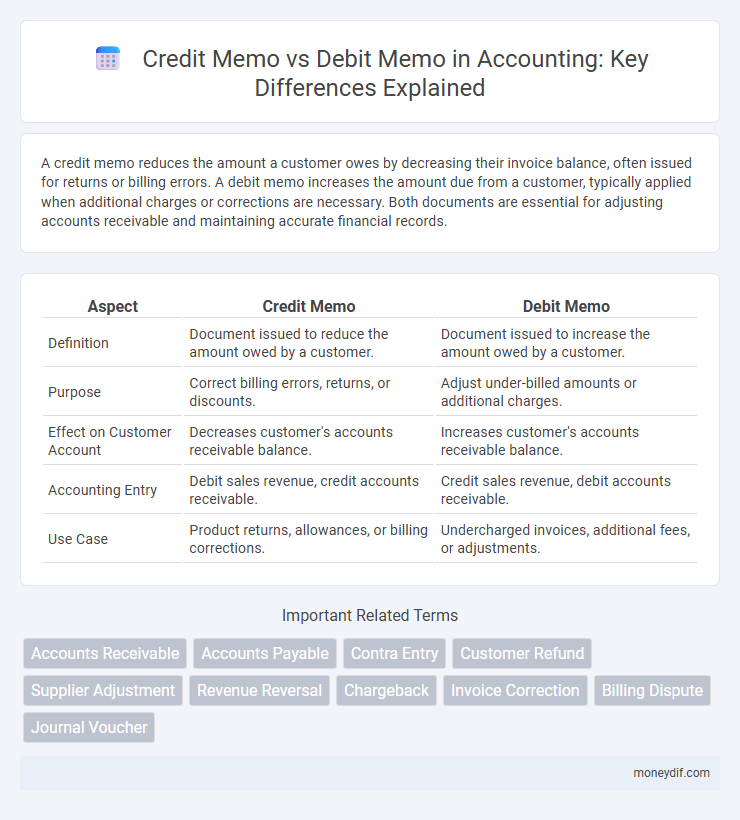

A credit memo reduces the amount a customer owes by decreasing their invoice balance, often issued for returns or billing errors. A debit memo increases the amount due from a customer, typically applied when additional charges or corrections are necessary. Both documents are essential for adjusting accounts receivable and maintaining accurate financial records.

Table of Comparison

| Aspect | Credit Memo | Debit Memo |

|---|---|---|

| Definition | Document issued to reduce the amount owed by a customer. | Document issued to increase the amount owed by a customer. |

| Purpose | Correct billing errors, returns, or discounts. | Adjust under-billed amounts or additional charges. |

| Effect on Customer Account | Decreases customer's accounts receivable balance. | Increases customer's accounts receivable balance. |

| Accounting Entry | Debit sales revenue, credit accounts receivable. | Credit sales revenue, debit accounts receivable. |

| Use Case | Product returns, allowances, or billing corrections. | Undercharged invoices, additional fees, or adjustments. |

Understanding Credit Memos in Accounting

Credit memos in accounting represent official documents issued by sellers to buyers, indicating a reduction in the amount owed due to returns, errors, or allowances. These memos adjust accounts receivable by decreasing the outstanding balance, effectively reversing part of a previous invoice. Understanding credit memos is essential for maintaining accurate financial records and ensuring proper reconciliation of customer accounts.

What Is a Debit Memo?

A debit memo is an accounting document issued by a seller to increase the amount a buyer owes for goods or services due to underbilling, errors, or additional charges. It adjusts the accounts receivable by reflecting the extra amount the buyer needs to pay, often used in cases of returned goods or pricing discrepancies. Debit memos ensure accurate financial records by correcting previous invoice amounts and maintaining proper audit trails.

Key Differences Between Credit and Debit Memos

Credit memos decrease a customer's accounts receivable balance by reducing the amount owed due to returns, allowances, or billing errors. Debit memos increase the accounts receivable balance when additional charges or underbillings are identified, reflecting a higher amount owed by the customer. The key difference lies in their impact on the ledger: credit memos reduce outstanding balances, while debit memos increase them, directly affecting revenue recognition and cash flow management.

Common Scenarios for Issuing Credit Memos

Credit memos are commonly issued when a customer returns goods due to defects or order errors, resulting in a reduction of the amount owed. Companies also issue credit memos to correct billing mistakes such as overcharges or duplicated invoices. These documents help maintain accurate accounts receivable balances by formally adjusting the customer's outstanding payment obligations.

When to Use a Debit Memo in Business Transactions

A debit memo is used in business transactions to notify a customer of an increase in the amount owed, often due to underbilling, returned goods, or additional services provided. It serves as an official document to adjust the customer's account balance by debiting their account. Businesses apply debit memos when correcting errors or adding charges post-invoice to maintain accurate financial records.

Impact on Accounts Receivable and Payable

A credit memo decreases the balance of accounts receivable by reducing the amount a customer owes due to returns or allowances, thereby improving cash flow management. Conversely, a debit memo increases accounts receivable or accounts payable by documenting additional charges or adjustments, reflecting amounts customers must pay or suppliers owe. Understanding the distinct impact of credit and debit memos is essential for accurate financial reporting and maintaining balanced ledgers.

How Credit Memos Affect Financial Statements

Credit memos reduce accounts receivable balances and directly decrease revenue on the income statement, improving the accuracy of reported earnings by reflecting returns or allowances. On the balance sheet, a credit memo lowers total assets as customer liabilities are adjusted downward. This adjustment also impacts cash flow projections by reducing expected cash inflows from outstanding invoices.

Recording Debit Memos in the General Ledger

Recording debit memos in the general ledger involves accurately debiting the accounts receivable or supplier accounts to reflect the reduction in owed amounts or increased liabilities. Debit memos typically indicate a decrease in customer balances due to returns, allowances, or billing errors and must be matched against original invoices to maintain accurate financial records. Proper documentation and timely entry of these memos ensure precise reconciliation and compliance with accounting standards.

Best Practices for Managing Memos in Accounting Software

Implement clear procedures for issuing credit memos and debit memos within accounting software to ensure accurate transaction records and seamless reconciliation. Use automated approval workflows and consistent coding to minimize errors and maintain compliance with financial reporting standards. Regularly audit memos for discrepancies and integrate real-time tracking features to enhance transparency and streamline accounts receivable and payable management.

Credit Memo vs Debit Memo: Frequently Asked Questions

Credit memos reduce the amount a customer owes by correcting overcharges or returns, while debit memos increase the amount owed due to additional charges or underbillings. These documents are essential for maintaining accurate account receivables and resolving billing discrepancies efficiently. Understanding the distinction ensures proper financial reporting and customer account management in accounting systems.

Important Terms

Accounts Receivable

Credit memos decrease accounts receivable balances by issuing customer credits, while debit memos increase accounts receivable by charging additional amounts.

Accounts Payable

Accounts Payable processes credit memos to reduce supplier balances and debit memos to increase liabilities, ensuring accurate financial reconciliation.

Contra Entry

A contra entry occurs when a transaction involves both a credit memo and a debit memo, effectively offsetting account balances within the same ledger to maintain accurate financial records.

Customer Refund

A customer refund is typically issued through a credit memo, which decreases the customer's account balance, while a debit memo increases the amount owed by the customer.

Supplier Adjustment

Supplier adjustments involve accounting entries that reconcile purchase discrepancies through credit memos and debit memos; credit memos reduce the amount payable to the supplier by acknowledging returns or overcharges, while debit memos increase payable amounts due to underbilling or additional charges from the supplier. Accurate management of these memos ensures precise supplier account balances and supports effective accounts payable reconciliation in financial systems.

Revenue Reversal

Revenue reversal occurs when a credit memo reduces previously recognized revenue, whereas a debit memo increases revenue by correcting underbillings or adding charges.

Chargeback

A chargeback reverses a credit card transaction, while a credit memo adjusts account balances by issuing credits and a debit memo records additional charges or corrections.

Invoice Correction

Invoice correction involves issuing a credit memo to reduce the billed amount or a debit memo to increase it, ensuring accurate financial records and customer account balances.

Billing Dispute

A billing dispute arises when discrepancies occur between a credit memo issued for customer refunds or adjustments and a debit memo used to increase the amount owed due to underbilling or additional charges.

Journal Voucher

A Journal Voucher is used to record adjustments in accounting, where credit memos decrease accounts receivable or payable, and debit memos increase them, ensuring accurate financial transaction documentation.

credit memo vs debit memo Infographic

moneydif.com

moneydif.com