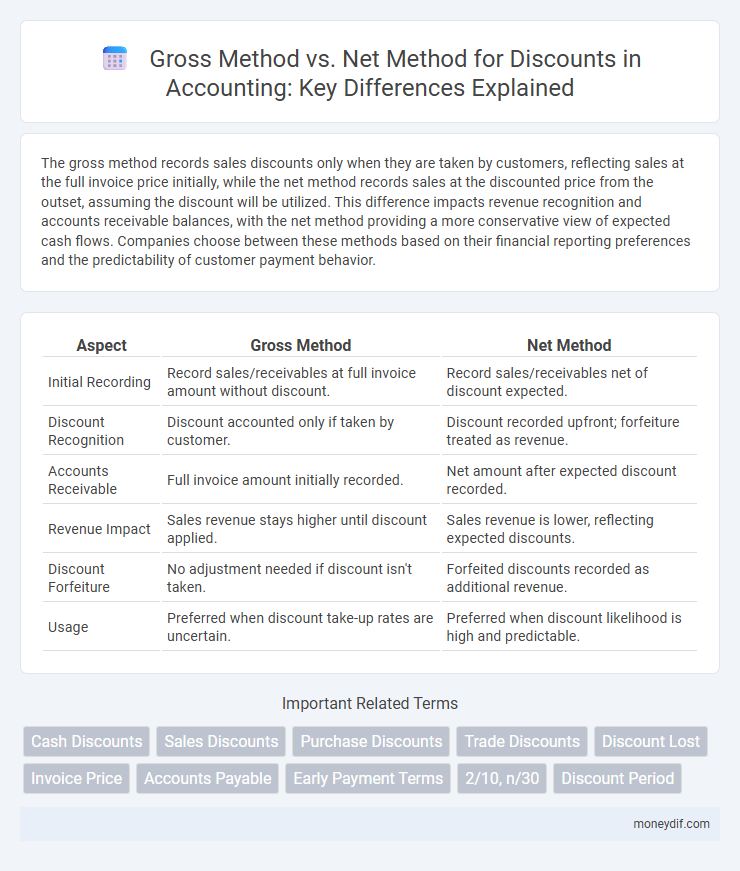

The gross method records sales discounts only when they are taken by customers, reflecting sales at the full invoice price initially, while the net method records sales at the discounted price from the outset, assuming the discount will be utilized. This difference impacts revenue recognition and accounts receivable balances, with the net method providing a more conservative view of expected cash flows. Companies choose between these methods based on their financial reporting preferences and the predictability of customer payment behavior.

Table of Comparison

| Aspect | Gross Method | Net Method |

|---|---|---|

| Initial Recording | Record sales/receivables at full invoice amount without discount. | Record sales/receivables net of discount expected. |

| Discount Recognition | Discount accounted only if taken by customer. | Discount recorded upfront; forfeiture treated as revenue. |

| Accounts Receivable | Full invoice amount initially recorded. | Net amount after expected discount recorded. |

| Revenue Impact | Sales revenue stays higher until discount applied. | Sales revenue is lower, reflecting expected discounts. |

| Discount Forfeiture | No adjustment needed if discount isn't taken. | Forfeited discounts recorded as additional revenue. |

| Usage | Preferred when discount take-up rates are uncertain. | Preferred when discount likelihood is high and predictable. |

Introduction to Gross Method and Net Method in Accounting

The gross method records purchases and sales at the full invoice amount without deducting cash discounts initially, reflecting the complete transaction value. The net method assumes discounts will be taken and records transactions at the discounted price, adjusting for any forfeited discounts if payment is late. These methods impact how companies report expenses and revenues, influencing financial statement accuracy and cash flow management.

Definition and Overview of Cash Discounts

Cash discounts are incentives offered by sellers to encourage early payment and improve cash flow management. The gross method records sales at full invoice price and recognizes discounts only when taken, while the net method records sales at the invoice amount less the discount, assuming discounts will be utilized. These methods impact revenue recognition and accounts receivable valuation in financial statements.

Gross Method: Key Characteristics and Process

The Gross Method records the full invoice amount as accounts receivable without immediately accounting for any potential early payment discounts, offering a straightforward and conservative approach to revenue recognition. Discounts are only recognized when the payment is made within the discount period, reducing the accounts receivable and increasing cash received. This method simplifies initial bookkeeping and provides a clearer picture of sales revenue before adjustments for discounts.

Net Method: Key Characteristics and Process

The Net Method records accounts receivable and sales revenue at the invoice amount less any potential cash discounts, assuming early payment will be made. This approach requires adjusting the revenue if the customer fails to take advantage of the discount, recognizing the forfeited discount as additional revenue. It enhances accuracy in financial reporting by directly reflecting the expected cash inflows and emphasizing efficient cash management practices.

Journal Entries: Gross Method vs Net Method

The gross method records sales and purchases at the full invoice amount, recognizing cash discounts only when taken, typically debiting Accounts Receivable and crediting Sales Revenue initially. The net method records transactions net of the discount, debiting Accounts Receivable and crediting Sales Revenue at the discounted amount, with any forfeited discounts later recognized as additional revenue. Journal entries under the gross method reflect the full amount followed by discount recognition, while the net method's entries streamline discount accounting by anticipating the discount upfront.

Impact on Financial Statements

The gross method records accounts receivable and sales at the full invoice amount, reflecting higher initial revenue and receivables, while the net method records them net of expected discounts, presenting more conservative asset and revenue figures. Using the gross method may overstate assets and revenues until discounts are taken, potentially misleading stakeholders about liquidity and profitability. The net method provides a more accurate reflection of expected cash flows and profit margins, enhancing the reliability of financial statements for decision-making.

Advantages and Disadvantages of Gross Method

The gross method records purchases and sales at the full invoice amount, simplifying initial bookkeeping and providing clear visibility of all transactions before discounts. This approach can overstate expenses and revenues if discounts are frequently taken, potentially distorting financial analysis. It delays the recognition of discount benefits until payment, which may impact cash flow management and profitability assessments.

Advantages and Disadvantages of Net Method

The net method records purchases and sales net of discounts, enhancing accuracy in reflecting expected cash flows and improving financial statement reliability by recognizing discounts only when earned. This method encourages prompt payment and better cash management but can result in more complex accounting procedures due to the need for adjustments if discounts are not taken. However, it may overstate receivables and payables initially, potentially complicating short-term liquidity analysis.

Industry Practices and Regulatory Considerations

Industry practices show the gross method is widely favored for its simplicity in recording sales and discounts, while the net method is preferred for more accurate revenue recognition reflecting expected discount take-up. Regulatory considerations, such as GAAP and IFRS standards, emphasize consistent application of either method but often lean towards the net method to better match revenues and expenses in the accounting period. Companies in industries with high discount rates or frequent early payments tend to adopt the net method to comply with revenue recognition principles and provide clearer financial statements.

Choosing the Appropriate Discount Accounting Method

Choosing the appropriate discount accounting method depends on the likelihood of customers taking early payment discounts; the gross method records the full invoice amount initially, recognizing discounts only when taken, while the net method assumes discounts will be utilized, recording the invoice net of discounts upfront. Businesses with historically high discount redemption rates benefit from the net method for more accurate revenue reporting, whereas the gross method suits companies with uncertain or low discount usage. Assessing cash flow patterns and customer payment behavior is critical for selecting the method that best aligns with an entity's financial reporting and management objectives.

Important Terms

Cash Discounts

Cash discounts under the gross method record sales at the full invoice amount and recognize discounts only when payment is made within the discount period, while the net method initially records sales at the discounted amount, treating any failure to pay promptly as a loss. The gross method simplifies accounting but may overstate revenues temporarily, whereas the net method provides a more accurate reflection of expected cash flows and discount utilization.

Sales Discounts

Sales discounts under the gross method record revenue at the full invoice amount with discounts recognized only if taken, while the net method initially accounts for revenue net of expected discounts and adjusts for discounts not taken. The gross method often results in higher reported revenue initially, whereas the net method provides a more conservative, realistic revenue estimate by anticipating discount usage.

Purchase Discounts

Purchase discounts under the gross method record the purchase at full invoice price with the discount recognized only if payment is made within the discount period, while the net method initially records the purchase net of the discount, adjusting if the discount is not taken. The choice between these methods impacts reported expenses and accounts payable, influencing financial statements and cash flow management.

Trade Discounts

Trade discounts reduce the invoice price before recording the transaction, while the gross method records purchases at full price and recognizes discounts only if payment is made within the discount period; the net method records purchases net of discounts and adjusts if discounts are forfeited. The gross method emphasizes full amount recognition with potential discount adjustments, whereas the net method focuses on anticipated discount realization from the transaction's outset.

Discount Lost

Discount lost refers to the failure to take advantage of cash discounts offered by suppliers, impacting accounts payable and overall cost management; under the gross method, purchase discounts are recorded only if payment is made within the discount period, whereas the net method initially records purchases net of discounts and recognizes discount losses if payment is late, providing a clearer representation of discount utilization and expense. The net method typically results in more accurate financial reporting on discount lost, enhancing analysis of payment behaviors and supplier relationship efficiency.

Invoice Price

Invoice price using the gross method records the full invoice amount before applying any cash discounts, reflecting the initial payable value, whereas the net method recognizes the invoice price net of expected discounts, promoting more accurate expense reporting by anticipating cash discounts on early payments. Understanding these distinctions impacts financial statements, as the gross method can overstate liabilities and expenses initially, while the net method better matches actual outflows by factoring in discount assumptions upfront.

Accounts Payable

The gross method records accounts payable at the full invoice amount, recognizing purchase discounts only when payment is made within the discount period, while the net method initially records the payable at the discounted amount, treating any failure to pay within the discount period as an expense. Businesses use the gross method to reflect full liabilities and the net method to encourage early payments and better cash flow management.

Early Payment Terms

Early payment terms influence accounting through the gross method, which records purchases at full invoice price and recognizes discounts only when paid early, versus the net method, which initially records purchases net of potential discounts and adjusts for lost discounts if not paid promptly. Companies apply the gross method for conservative expense recognition, while the net method emphasizes cost accuracy and incentivizes early payment.

2/10, n/30

The 2/10, n/30 payment term offers a 2% discount if the invoice is paid within 10 days, otherwise the net amount is due in 30 days, impacting Accounts Receivable valuation. Under the gross method, discounts are recorded only when taken, inflating initial receivables, whereas the net method anticipates discounts upfront, presenting a more conservative and accurate receivable balance.

Discount Period

The discount period in the gross method records sales at full invoice price, recognizing discounts only if payment occurs within the discount period, while the net method initially records sales net of the discount and adjusts for forfeited discounts if payment is late. Understanding the impact of the discount period on cash flow and revenue recognition is crucial for accurate financial reporting under both gross and net methods.

gross method vs net method (for discounts) Infographic

moneydif.com

moneydif.com