Matching principle ensures expenses are recorded in the same period as the revenues they help generate, providing accurate profit measurement. Consistency principle requires applying the same accounting methods and policies across periods to enable comparability of financial statements. Together, these principles enhance the reliability and relevance of financial reporting.

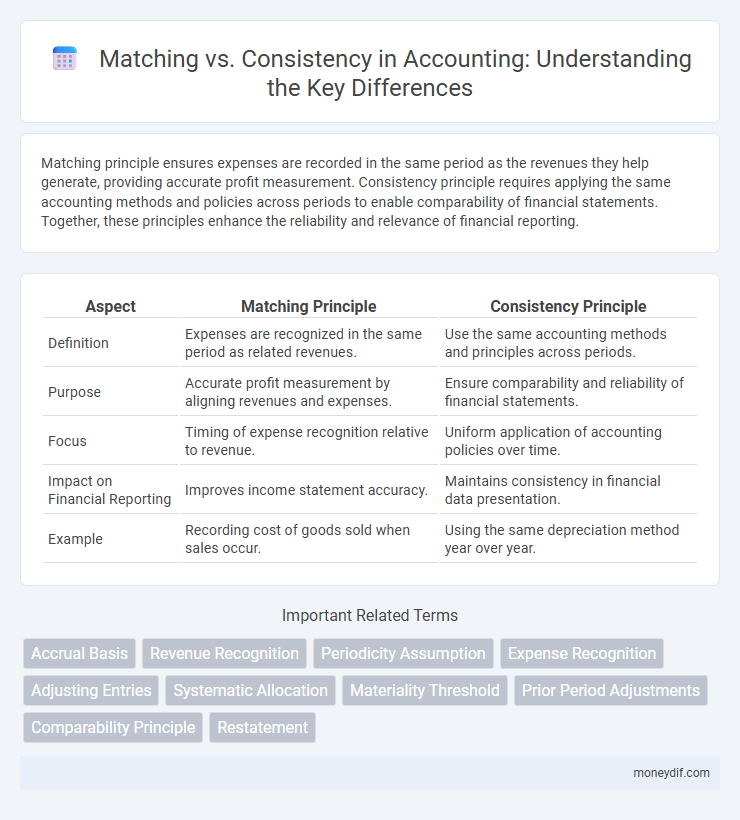

Table of Comparison

| Aspect | Matching Principle | Consistency Principle |

|---|---|---|

| Definition | Expenses are recognized in the same period as related revenues. | Use the same accounting methods and principles across periods. |

| Purpose | Accurate profit measurement by aligning revenues and expenses. | Ensure comparability and reliability of financial statements. |

| Focus | Timing of expense recognition relative to revenue. | Uniform application of accounting policies over time. |

| Impact on Financial Reporting | Improves income statement accuracy. | Maintains consistency in financial data presentation. |

| Example | Recording cost of goods sold when sales occur. | Using the same depreciation method year over year. |

Introduction to Matching and Consistency Principles

Matching principle requires expenses to be recorded in the same period as the revenues they help generate, ensuring accurate profit measurement. Consistency principle mandates the use of the same accounting methods and practices across periods to enable comparability of financial statements. Both principles are fundamental for reliable and transparent financial reporting in accounting.

Defining the Matching Principle in Accounting

The matching principle in accounting requires that expenses be recorded in the same period as the revenues they help generate, ensuring accurate profit measurement. This principle supports expense recognition by aligning costs directly with related income, rather than simply matching transactions chronologically. Consistency, by comparison, emphasizes applying the same accounting methods over time, whereas the matching principle specifically focuses on timing expenses to revenue recognition for precise financial reporting.

Understanding the Consistency Principle in Financial Reporting

The consistency principle in financial reporting requires companies to apply the same accounting methods and policies across periods to ensure comparability and reliability of financial statements. This principle supports the accurate matching of revenues and expenses by maintaining uniformity in how transactions are recorded, preventing arbitrary changes that could distort financial analysis. Adhering to the consistency principle enhances stakeholder confidence by providing a stable framework for evaluating a company's performance over time.

Key Differences Between Matching and Consistency

Matching principle ensures expenses are recorded in the same period as the revenues they generate, providing accurate profit measurement. Consistency principle mandates the use of the same accounting methods and policies across periods to enhance comparability. The key difference lies in matching focusing on timing of expense recognition, while consistency emphasizes uniformity in applying accounting techniques.

Importance of the Matching Principle for Accurate Reporting

The Matching Principle ensures revenues and expenses are recorded in the same accounting period, providing an accurate reflection of financial performance. By aligning costs with related revenues, this principle prevents misleading profit figures and supports reliable financial statements. Consistency in applying the Matching Principle enhances comparability across accounting periods, crucial for stakeholders' informed decision-making.

Role of Consistency in Enhancing Financial Comparability

Consistency in accounting ensures that financial statements are prepared using the same accounting principles and methods across periods, which enhances the comparability of financial data. This consistent application allows stakeholders to accurately assess trends and performance without distortion from changes in accounting policies. By maintaining uniformity in reporting, consistency supports reliable analysis and informed decision-making among investors, regulators, and management.

Practical Examples: Matching vs Consistency in Accounting

Matching in accounting requires expenses to be recorded in the same period as the related revenues, exemplified by recognizing depreciation for equipment used during revenue generation. Consistency ensures that a company applies the same accounting methods, such as choosing straight-line depreciation across periods to allow reliable financial comparison. A practical example is a business using the matching principle to align advertising expenses with sales income in one period, while maintaining consistency by continuing the chosen expense recognition method in subsequent periods for comparability.

Common Challenges in Applying Matching and Consistency

Common challenges in applying matching and consistency in accounting include accurately aligning revenue with related expenses within the same period and maintaining uniform accounting policies across reporting periods to ensure comparability. Complexity arises from timing differences in recognizing transactions and changes in accounting standards or estimates that impact financial statements. Misapplication can lead to distorted financial results, affecting stakeholder decisions and undermining financial statement reliability.

Implications for Auditors and Financial Statement Users

Auditors must evaluate matching to ensure expenses are recorded in the period they generate related revenues, providing an accurate portrayal of financial performance, while consistency requires the uniform application of accounting methods across periods, enhancing comparability. Financial statement users rely on matching to assess profitability accurately and on consistency to identify trends and make informed decisions over time. Deviations in either principle may signal potential financial misstatements or shifts in accounting policies, warranting careful scrutiny.

Best Practices for Balancing Matching and Consistency

Balancing matching and consistency in accounting requires aligning expenses with related revenues while maintaining uniform application of accounting methods across periods to ensure comparability. Best practices include documenting and regularly reviewing accounting policies, implementing robust internal controls, and using accrual-based accounting to accurately reflect financial performance. Leveraging automated accounting systems can enhance precision in matching transactions and uphold consistency without sacrificing compliance or transparency.

Important Terms

Accrual Basis

Accrual basis accounting recognizes revenues and expenses when they are earned or incurred, ensuring the matching principle aligns income with related expenses within the same period. This approach enhances consistency by providing a systematic framework for recording financial transactions, promoting accurate financial reporting over time.

Revenue Recognition

Revenue recognition principles emphasize matching revenues with the related expenses in the same accounting period to accurately reflect financial performance, ensuring that income is recorded when earned and expenses are recognized when incurred. Consistency in applying these accounting methods over time enhances comparability and reliability of financial statements, supporting sound decision-making and compliance with standards like GAAP or IFRS.

Periodicity Assumption

The periodicity assumption in data analysis posits that patterns repeat at regular intervals, enhancing matching accuracy by aligning recurring elements. This assumption supports consistency by ensuring that repeated patterns generate reliable and predictable outcomes across datasets.

Expense Recognition

Expense recognition requires applying the matching principle to align expenses with related revenues in the same period, ensuring accurate financial reporting. Consistency in applying this principle across accounting periods enhances comparability and reliability of financial statements.

Adjusting Entries

Adjusting entries ensure expenses and revenues are recorded in the period they occur, supporting the matching principle by aligning income with related costs. Consistency is maintained by applying the same accounting methods for adjustments across periods, allowing comparable and reliable financial statements.

Systematic Allocation

Systematic allocation achieves a balance between matching and consistency by distributing resources or tasks in a fixed, cyclical order that minimizes variance and ensures fair treatment across all entities. This method enhances predictability and reduces allocation bias, improving overall system performance in environments requiring consistent yet proportionate matching.

Materiality Threshold

Materiality threshold determines the significance level at which discrepancies in financial reporting affect decision-making, influencing whether matching principles prioritize accurate period expense recognition or consistency ensures uniform application across periods. Balancing materiality ensures that matching aligns expenses with revenues without compromising the consistent application of accounting policies over time.

Prior Period Adjustments

Prior Period Adjustments ensure accurate financial reporting by correcting errors from previous accounting periods, aligning with the consistency principle by maintaining uniform accounting policies over time. These adjustments enhance the matching principle by properly associating revenues and expenses in the periods they actually belong to, improving the reliability of financial statements.

Comparability Principle

The Comparability Principle in accounting emphasizes the need for financial statements to be consistent over time and comparable across entities, enabling reliable analysis and decision-making. Matching focuses on aligning expenses with related revenues within the same period, supporting accurate profit measurement, while consistency ensures that the same accounting methods are applied across periods to maintain comparability.

Restatement

The Restatement principle emphasizes matching and consistency in contract interpretation, ensuring terms are aligned with the parties' original intentions and applied uniformly throughout the agreement. This approach minimizes ambiguity by prioritizing consistent usage of language and context, fostering clear and predictable legal outcomes.

matching vs consistency Infographic

moneydif.com

moneydif.com