Nominal accounts record expenses, losses, incomes, and gains, closing at the end of each accounting period to calculate net profit or loss. Real accounts pertain to assets and liabilities, remaining open across accounting periods to reflect ongoing financial positions. Understanding the distinction between nominal and real accounts is essential for accurate financial reporting and effective bookkeeping.

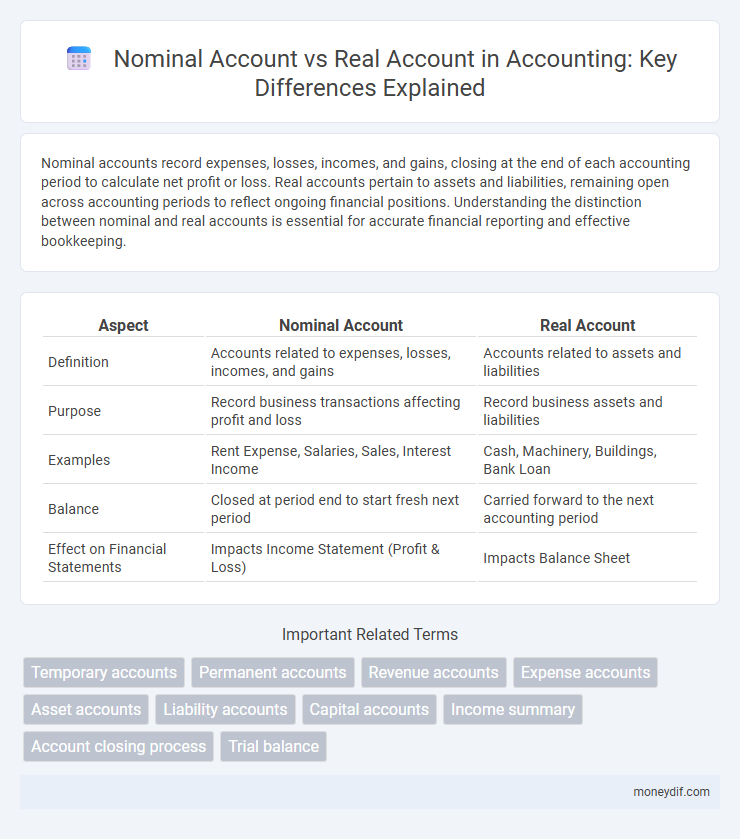

Table of Comparison

| Aspect | Nominal Account | Real Account |

|---|---|---|

| Definition | Accounts related to expenses, losses, incomes, and gains | Accounts related to assets and liabilities |

| Purpose | Record business transactions affecting profit and loss | Record business assets and liabilities |

| Examples | Rent Expense, Salaries, Sales, Interest Income | Cash, Machinery, Buildings, Bank Loan |

| Balance | Closed at period end to start fresh next period | Carried forward to the next accounting period |

| Effect on Financial Statements | Impacts Income Statement (Profit & Loss) | Impacts Balance Sheet |

Introduction to Nominal and Real Accounts

Nominal accounts record expenses, losses, incomes, and gains within an accounting period, closing at period-end to prepare financial statements. Real accounts represent assets and liabilities, maintaining ongoing balances that carry forward into future periods. Understanding the distinction between nominal accounts, which track temporary financial activities, and real accounts, which reflect enduring financial positions, is crucial for accurate bookkeeping and financial analysis.

Definition of Nominal Account

Nominal accounts represent expenses, losses, incomes, and gains, reflecting transactions within a specific accounting period. These accounts are closed at the end of the fiscal year to determine the net profit or loss. Unlike real accounts, nominal accounts do not carry balances forward into the next accounting period.

Definition of Real Account

Real accounts refer to balance sheet accounts that represent tangible and intangible assets owned by the business, including cash, buildings, machinery, and patents. These accounts carry their balances forward into future accounting periods and are not closed at the end of the financial year. Unlike nominal accounts, real accounts reflect the permanent financial position of a company.

Key Differences Between Nominal and Real Accounts

Nominal accounts record all income, expenses, losses, and gains, resetting to zero at the end of each accounting period to measure financial performance. Real accounts track assets, liabilities, and equity, carrying their balances forward from one period to the next to reflect ongoing financial position. The primary distinction lies in nominal accounts being temporary with periodic closure, while real accounts are permanent and continuously updated.

Examples of Nominal Accounts

Examples of nominal accounts include revenue accounts such as Sales and Service Income, expense accounts like Rent Expense and Salaries Expense, and loss accounts such as Bad Debts and Discount Allowed. These accounts track financial transactions related to the company's operational performance within an accounting period. Unlike real accounts, nominal accounts are closed at the end of the period to determine net profit or loss.

Examples of Real Accounts

Real accounts include tangible and intangible assets such as land, buildings, machinery, cash, and patents, representing resources owned by a business. These accounts maintain their balances over time and appear on the balance sheet, reflecting the company's financial position. Examples encompass fixed assets like equipment and vehicles, current assets like inventory and accounts receivable, and intangible assets like goodwill.

Rules of Debit and Credit for Nominal and Real Accounts

Nominal accounts, which track incomes and expenses, are debited with expenses and losses and credited with incomes and gains, following the rule "Debit all expenses and losses, credit all incomes and gains." Real accounts, representing assets and liabilities, are debited when assets are acquired or expenses increase and credited when assets are disposed of or liabilities increase, adhering to the rule "Debit what comes in, credit what goes out." Understanding these distinct debit and credit rules is essential to accurately recording transactions in accounting systems and maintaining balanced financial statements.

Closing Process: Nominal vs Real Accounts

Nominal accounts, including revenue and expense accounts, are closed at the end of an accounting period to transfer their balances to the income statement, reflecting the company's performance. Real accounts, such as asset, liability, and equity accounts, are not closed, as their balances carry forward to the next accounting period, representing the ongoing financial position. The closing process for nominal accounts ensures that temporary transactions are reset, while real accounts maintain continuity in the balance sheet.

Importance in Financial Statements

Nominal accounts record income, expenses, gains, and losses crucial for preparing the profit and loss statement, directly impacting reported net profit or loss. Real accounts represent assets, liabilities, and equity, forming the balance sheet and reflecting a company's financial position at a specific point in time. Distinguishing between nominal and real accounts ensures accurate financial statements, aiding stakeholders in evaluating performance and solvency.

Practical Tips for Classification

Nominal accounts record expenses, losses, incomes, and gains related to a specific accounting period, while real accounts track assets and liabilities that carry over across periods. Practical classification involves recognizing nominal accounts by their temporary nature, such as rent or salary accounts, which are closed at period-end, contrasted with real accounts like cash or machinery that represent tangible or intangible assets. Applying the golden rules--debit all expenses and losses (nominal accounts), and debit what comes in and credit what goes out (real accounts)--ensures accurate categorization and efficient bookkeeping.

Important Terms

Temporary accounts

Temporary accounts, also known as nominal accounts, record revenues, expenses, and dividends, closing at the end of each accounting period to transfer balances to permanent accounts. Real accounts, or permanent accounts, maintain asset, liability, and equity balances that persist across accounting periods and are not closed.

Permanent accounts

Permanent accounts, also known as real accounts, track assets, liabilities, and equity balances that carry forward across accounting periods, reflecting the financial position of a business. Nominal accounts, in contrast, record expenses, revenues, gains, and losses, which reset to zero at the end of each accounting cycle to determine net profit or loss.

Revenue accounts

Revenue accounts, classified as nominal accounts, record income from business operations and are closed at the end of each accounting period to calculate net profit or loss. In contrast, real accounts represent assets and liabilities, carry balances forward to subsequent periods, and are not closed during the accounting cycle.

Expense accounts

Expense accounts are classified as nominal accounts because they track costs and losses over a specific accounting period and are closed to the income statement at period-end. Unlike real accounts, which represent permanent asset, liability, or equity balances carried forward, expense accounts reset to zero after each financial cycle.

Asset accounts

Asset accounts represent resources owned by a business and are classified as real accounts, reflecting tangible or intangible items retained across accounting periods. Unlike nominal accounts, which record temporary income and expenses closed at period end, asset accounts maintain ongoing balances crucial for evaluating a company's financial position.

Liability accounts

Liability accounts represent obligations owed by a business and are classified as real accounts, reflecting permanent financial position components on the balance sheet. Nominal accounts, in contrast, record expenses and incomes that affect the profit and loss statement and reset each accounting period, unlike liability accounts which carry forward their balances.

Capital accounts

Capital accounts represent the owner's equity in a business and are classified as real accounts because they reflect permanent balances that carry over to future accounting periods. Unlike nominal accounts, which record temporary income and expenses closed at period-end, capital accounts maintain ongoing financial position and investment details.

Income summary

Income summary is a temporary nominal account used to close revenue and expense accounts at the end of an accounting period, transferring net income or loss to the retained earnings, a real account. Nominal accounts accumulate financial transactions for a specific period and are reset to zero after closing, while real accounts maintain ongoing balances essential for financial reporting.

Account closing process

The account closing process involves transferring nominal account balances, such as revenues and expenses, to the income summary to determine net profit or loss, after which these accounts are reset to zero for the new accounting period. Real accounts, representing assets, liabilities, and equity, remain open with their balances carried forward, reflecting the company's ongoing financial position.

Trial balance

A trial balance lists all nominal and real accounts with their debit or credit balances to verify ledger accuracy before financial statement preparation. Nominal accounts, representing expenses and income, reset each accounting period, while real accounts, including assets and liabilities, carry balances forward to subsequent periods.

nominal account vs real account Infographic

moneydif.com

moneydif.com