Accounts payable represents short-term liabilities arising from credit purchases of goods and services, typically due within 30 to 90 days. Notes payable involves formal written promises to pay a specific amount on a future date, often carrying interest and having longer repayment terms. Understanding the distinction aids in accurate financial reporting and effective cash flow management.

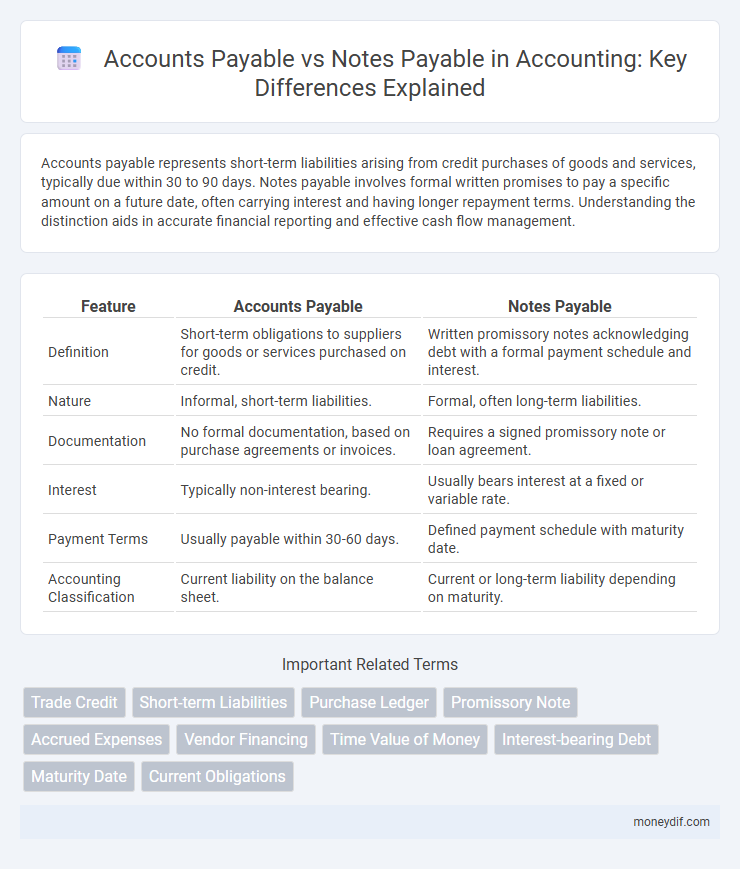

Table of Comparison

| Feature | Accounts Payable | Notes Payable |

|---|---|---|

| Definition | Short-term obligations to suppliers for goods or services purchased on credit. | Written promissory notes acknowledging debt with a formal payment schedule and interest. |

| Nature | Informal, short-term liabilities. | Formal, often long-term liabilities. |

| Documentation | No formal documentation, based on purchase agreements or invoices. | Requires a signed promissory note or loan agreement. |

| Interest | Typically non-interest bearing. | Usually bears interest at a fixed or variable rate. |

| Payment Terms | Usually payable within 30-60 days. | Defined payment schedule with maturity date. |

| Accounting Classification | Current liability on the balance sheet. | Current or long-term liability depending on maturity. |

Introduction to Accounts Payable and Notes Payable

Accounts payable represents short-term liabilities arising from credit purchases of goods or services, typically due within 30 to 90 days, and are recorded as current liabilities on the balance sheet. Notes payable refers to written promissory notes outlining formal debt obligations with specified interest rates and longer maturities, which can be classified as either current or long-term liabilities depending on the repayment schedule. Understanding the distinction between accounts payable and notes payable is crucial for accurate financial reporting and cash flow management in accounting.

Key Definitions: Accounts Payable vs Notes Payable

Accounts payable refers to short-term liabilities arising from regular trade credit extended by suppliers for goods or services received, typically due within 30 to 90 days. Notes payable are formal, written promissory notes indicating a borrower's legal promise to pay a specified amount along with interest by a future date, often involving longer repayment terms. Understanding the distinction between accounts payable and notes payable is crucial for accurate financial reporting and cash flow management in accounting.

Fundamental Differences Between Accounts Payable and Notes Payable

Accounts payable represents short-term obligations a company owes to suppliers for goods and services purchased on credit, typically due within 30 to 90 days and recorded as current liabilities. Notes payable involve formal written agreements outlining loan terms, interest rates, and maturity dates, often reflecting longer-term liabilities with legal enforceability. The fundamental distinction lies in the nature of the debt, where accounts payable arises from routine trade credit without interest, whereas notes payable are structured debts that may accrue interest and require scheduled repayments.

Recognition and Recording in Financial Statements

Accounts payable are short-term liabilities recognized when goods or services are received on credit, recorded under current liabilities on the balance sheet without interest. Notes payable represent formal written promises to pay a specific amount, often with interest, recorded as either current or long-term liabilities depending on maturity. The recognition of notes payable includes accrual of interest expense over time, impacting both liabilities and expenses in the financial statements.

Typical Examples and Use Cases

Accounts payable typically includes short-term obligations such as invoices from suppliers for inventory or services received, reflecting routine operational expenses. Notes payable generally involve formal written promises to pay a specific amount on a future date, often used for financing arrangements like bank loans or purchasing equipment. Businesses rely on accounts payable for managing daily cash flow while notes payable serve to document and secure longer-term debt commitments.

Impact on Cash Flow and Working Capital

Accounts payable represents short-term obligations to suppliers that directly reduce cash flow when payments are made, often managed to optimize working capital by extending payment terms. Notes payable involve formal promissory notes with interest, impacting cash flow through scheduled principal and interest repayments, which can constrain working capital due to longer-term debt obligations. Efficient management of both accounts payable and notes payable is crucial for maintaining liquidity and ensuring healthy cash flow cycles within the accounting framework.

Importance in Financial Analysis and Reporting

Accounts payable and notes payable are crucial components in financial analysis and reporting, providing insights into a company's short-term and long-term obligations. Accounts payable represent current liabilities reflecting outstanding invoices from suppliers, essential for assessing liquidity and operational efficiency. Notes payable, often formalized through promissory notes with interest terms, indicate long-term debt commitments that impact leverage ratios and overall financial stability.

Role in Short-Term and Long-Term Liabilities

Accounts payable typically represents short-term liabilities arising from purchasing goods or services on credit, due within 30 to 90 days, reflecting immediate operational obligations. Notes payable can include both short-term and long-term liabilities, involving formal written promises to pay specified amounts with interest, often extending beyond one year. This distinction impacts a company's liquidity management and financial planning by categorizing obligations based on payment terms and legal formalities.

Implications for Business Credit and Risk Management

Accounts payable represent short-term obligations arising from trade credit, impacting business liquidity and vendor relationships, while notes payable involve formal debt instruments with specified terms affecting long-term creditworthiness and financial leverage. Efficient management of accounts payable supports operational cash flow optimization, whereas notes payable require rigorous risk assessment due to interest obligations and potential impact on credit ratings. Businesses must balance these liabilities to enhance credit standing and mitigate financial risk, ensuring sustainable growth and solvency.

Choosing the Right Payable Method for Your Business

Selecting the appropriate payable method requires analyzing your business's cash flow, credit terms, and transaction size to balance liquidity and financing costs. Accounts payable, typically short-term obligations to suppliers, offer flexibility and maintain supplier relationships without immediate interest expenses. Notes payable involve formal debt instruments with set terms and interest rates, suitable for larger, longer-term financing needs that require clear repayment schedules.

Important Terms

Trade Credit

Trade credit represents short-term financing extended by suppliers, classified under accounts payable, which typically does not involve formal interest charges or written debt instruments. Notes payable, in contrast, are formal written promises to pay a specified amount on a future date, often involving interest and recorded as liabilities separate from trade credit obligations.

Short-term Liabilities

Short-term liabilities include accounts payable, which are informal debts owed to suppliers for goods and services, and notes payable, formal written promises to pay specific amounts typically involving interest.

Purchase Ledger

Purchase Ledger tracks accounts payable, representing short-term supplier debts, whereas notes payable records formal written promises to pay specific amounts, often with interest, under defined terms.

Promissory Note

A Promissory Note represents a formal written promise to pay a specific amount of money at a future date, distinguishing it from accounts payable, which are short-term liabilities arising from regular credit purchases. Notes payable typically involve interest and longer repayment terms, reflecting a more structured debt obligation compared to the often informal nature of accounts payable.

Accrued Expenses

Accrued expenses represent liabilities for incurred costs not yet paid, typically recorded under accounts payable, whereas notes payable involve formal written promises to pay a specific amount by a future date with interest.

Vendor Financing

Vendor financing often appears as accounts payable, representing short-term obligations, while notes payable typically involve formal, interest-bearing agreements with defined repayment schedules.

Time Value of Money

Time value of money impacts accounts payable and notes payable by requiring businesses to account for interest costs on notes payable, unlike accounts payable which are typically short-term and interest-free.

Interest-bearing Debt

Interest-bearing debt includes notes payable, which accrue interest over time, unlike accounts payable that represent short-term, non-interest-bearing liabilities for operational expenses.

Maturity Date

The maturity date for notes payable specifies the exact deadline for repayment, unlike accounts payable which typically have shorter, less formal payment terms without a fixed maturity date.

Current Obligations

Current obligations include accounts payable, representing short-term vendor invoices payable within 30 to 90 days, and notes payable, which are formal written promises to pay specific amounts, often with interest, typically due within one year.

accounts payable vs notes payable Infographic

moneydif.com

moneydif.com