Functional currency refers to the primary currency used by a business to record its financial transactions, reflecting the economic environment in which it operates. Presentation currency, on the other hand, is the currency in which the financial statements are presented to stakeholders, which may differ from the functional currency. Differences between these currencies require translation adjustments to accurately report financial performance and position.

Table of Comparison

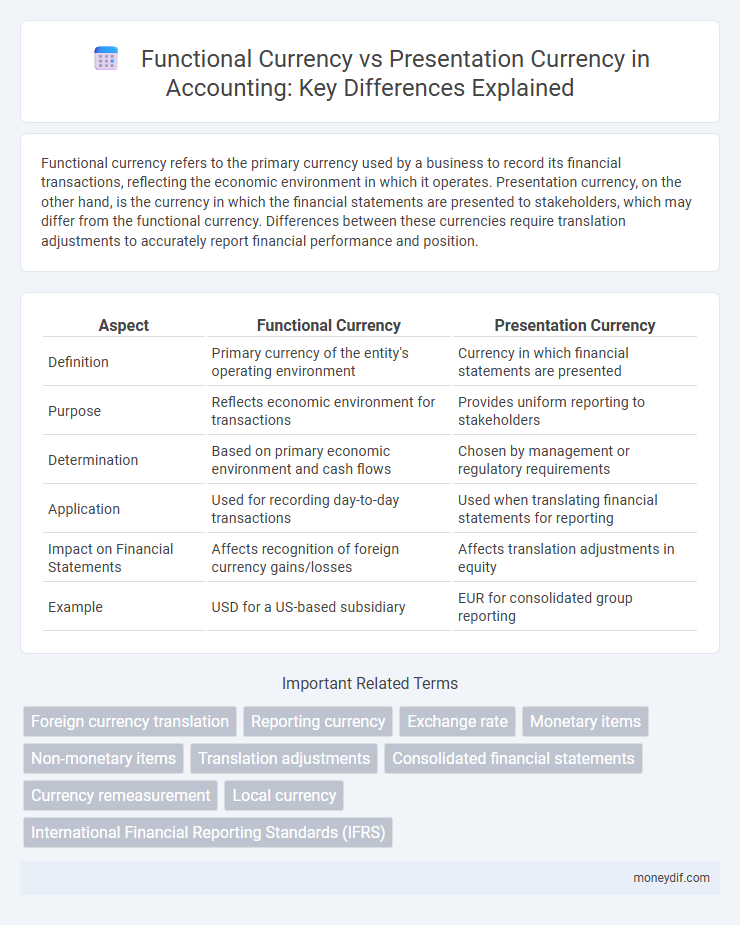

| Aspect | Functional Currency | Presentation Currency |

|---|---|---|

| Definition | Primary currency of the entity's operating environment | Currency in which financial statements are presented |

| Purpose | Reflects economic environment for transactions | Provides uniform reporting to stakeholders |

| Determination | Based on primary economic environment and cash flows | Chosen by management or regulatory requirements |

| Application | Used for recording day-to-day transactions | Used when translating financial statements for reporting |

| Impact on Financial Statements | Affects recognition of foreign currency gains/losses | Affects translation adjustments in equity |

| Example | USD for a US-based subsidiary | EUR for consolidated group reporting |

Introduction to Functional and Presentation Currency

Functional currency is the primary currency used by a business for its day-to-day operations and financial transactions, reflecting the economic environment in which it operates. Presentation currency is the currency in which the financial statements are reported, which may differ from the functional currency for reporting or consolidation purposes. Understanding the distinction between these currencies is essential for accurate financial reporting and compliance with accounting standards like IFRS and GAAP.

Defining Functional Currency in Accounting

Functional currency in accounting refers to the primary currency of the economic environment in which a business operates, reflecting the currency that mainly influences sales prices and costs. Determining the functional currency involves assessing factors such as the currency influencing sales, labor, and material costs, as well as financing activities. Accurate identification of the functional currency ensures proper financial reporting and compliance with International Financial Reporting Standards (IFRS) or Generally Accepted Accounting Principles (GAAP).

Understanding Presentation Currency

Presentation currency refers to the currency in which an entity's financial statements are presented to stakeholders, differing from the functional currency that reflects the primary economic environment of operations. It is crucial for multinational companies to consistently translate financial results from the functional currency to the presentation currency according to IFRS or GAAP standards. Accurate presentation currency reporting ensures comparability, transparency, and compliance in financial disclosures across international markets.

Criteria for Determining Functional Currency

The functional currency is determined based on the primary economic environment where the entity operates, typically the currency of the country whose competitive forces and regulations mainly influence sales prices. Key criteria include the currency that mainly influences costs of labor, materials, and other costs, as well as the currency in which funds from financing activities are generated. Management should also consider the currency in which receipts from operating activities are usually retained.

Presentation Currency Selection: Key Considerations

Presentation currency selection requires careful evaluation of an entity's operational environment, including the currency of the primary economic environment in which it operates. Companies must consider factors such as the currency influencing sales prices, labor and material costs, and financing activities to ensure the presentation currency reflects the underlying economic reality. Compliance with IFRS or GAAP standards mandates consistent application of presentation currency for financial statement comparability and transparency.

Differences Between Functional and Presentation Currency

Functional currency is the primary currency of the entity's operating environment, used for recording transactions and preparing financial statements. Presentation currency is the currency in which financial statements are reported and presented to stakeholders, which may differ from the functional currency. Differences between these currencies require translation adjustments in accordance with accounting standards like IFRS, affecting reported profits and equity.

Impact on Financial Statements and Reporting

Functional currency determines the primary economic environment in which an entity operates, influencing how transactions are recorded and assets and liabilities are measured. Presentation currency affects how financial statements are expressed and disclosed to stakeholders, often requiring translation adjustments that impact comprehensive income and equity. Differences between functional and presentation currencies necessitate compliance with IFRS or GAAP standards for consistent and transparent financial reporting.

Currency Translation Methods in Accounting

Currency translation methods in accounting primarily involve the temporal method and the current rate method, which address differences between functional currency and presentation currency. The temporal method translates monetary items at current exchange rates while non-monetary items use historical rates, typically applied when the functional currency differs from the reporting currency. Conversely, the current rate method translates all assets and liabilities at the closing rate, with income statement items at average rates, supporting consistent presentation currency financial reporting.

Common Challenges and Best Practices

Determining the functional currency often involves assessing the primary economic environment where the entity operates, which can lead to challenges in multinational firms with multiple transactional currencies. Presentation currency differs as it is the currency in which financial statements are reported, often necessitating consistent translation methods to maintain accuracy and comparability. Best practices include regularly reviewing currency exposure, applying consistent translation methods per IAS 21 guidelines, and clearly disclosing currency policies in financial statement notes.

Regulatory Guidance and IFRS/GAAP Requirements

Regulatory guidance under IFRS mandates that functional currency reflects the primary economic environment in which an entity operates, influencing transaction recognition and translation methods. Presentation currency, which may differ from functional currency, requires translation of financial statements using exchange rates at the reporting date and specific translation adjustments per IAS 21. U.S. GAAP similarly distinguishes these currencies, emphasizing consistent application of ASC 830 for foreign currency matters and ensuring compliance with SEC regulations for multinational entities.

Important Terms

Foreign currency translation

Foreign currency translation involves converting financial statements from an entity's functional currency, which reflects the primary economic environment in which it operates, into the presentation currency used for reporting purposes. This process requires applying exchange rates: typically, using the closing rate for balance sheet items and average rates for income statement items to ensure accurate representation of financial performance and position.

Reporting currency

Reporting currency refers to the currency in which a company's financial statements are presented, differing from the functional currency, which is the primary currency of the company's operating environment. While functional currency reflects the currency of the economic environment in which the entity primarily generates and expends cash, presentation currency is selected for reporting purposes and may require translation adjustments to accurately reflect foreign operations' financial results.

Exchange rate

Exchange rate fluctuations directly impact the translation of financial statements from a company's functional currency to its presentation currency, affecting reported revenues and expenses. Accurate application of the closing rate for assets and liabilities and the average rate for income statement items ensures compliance with accounting standards like IAS 21.

Monetary items

Monetary items denominated in a currency different from the functional currency are remeasured using the closing exchange rate at each reporting date, impacting the entity's financial position due to foreign exchange gains or losses. Presentation currency differs as financial statements are translated into it for reporting purposes, with assets and liabilities converted at the closing rate, while income and expenses use average rates, affecting the overall reported financial results.

Non-monetary items

Non-monetary items are assets and liabilities measured at historical cost or fair value and are not affected by exchange rate fluctuations between functional and presentation currencies. These items remain recorded at their original amounts in the functional currency and are translated using the exchange rates at the date of the transaction when presented in the presentation currency.

Translation adjustments

Translation adjustments arise from converting financial statements from a subsidiary's functional currency into the parent company's presentation currency, reflecting exchange rate fluctuations during consolidation. These adjustments are recorded in other comprehensive income to capture the effect of foreign currency translation without impacting net income.

Consolidated financial statements

Consolidated financial statements aggregate the financial data of a parent company and its subsidiaries, requiring translation of each subsidiary's functional currency--defined by the primary economic environment in which it operates--into the parent company's presentation currency. This currency translation process impacts reported figures by converting assets, liabilities, income, and expenses at exchange rates prevailing at the reporting date or transaction dates, ensuring comparability and compliance with accounting standards such as IFRS or US GAAP.

Currency remeasurement

Currency remeasurement involves converting financial statements from the functional currency, which reflects the primary economic environment of the entity, into the presentation currency used for reporting purposes. This process requires translating assets and liabilities at the closing rate while income statement items are remeasured using average or historical rates to accurately reflect exchange rate fluctuations.

Local currency

Local currency represents the currency of the primary economic environment in which an entity operates, often used interchangeably with functional currency, which is the currency of the primary business environment affecting revenues and expenses. Presentation currency is the currency in which financial statements are expressed, which may differ from the local or functional currency, requiring translation adjustments to align reporting with regulatory or stakeholder requirements.

International Financial Reporting Standards (IFRS)

The International Financial Reporting Standards (IFRS) define functional currency as the primary currency of the economic environment in which an entity operates, while presentation currency is the currency in which the financial statements are presented. IFRS requires entities to measure transactions in their functional currency and translate financial statements into the presentation currency using specific exchange rates, ensuring accurate representation of financial position and performance.

functional currency vs presentation currency Infographic

moneydif.com

moneydif.com