Contra accounts are specific ledger accounts used to reduce the balance of a related account, such as accumulated depreciation reducing the asset's book value, while offset accounts generally refer to accounts used to balance transactions in double-entry bookkeeping. Contra accounts carry a normal balance opposite to their related accounts, helping in presenting net amounts on financial statements. Offset accounts facilitate the accurate matching of debits and credits for each transaction, ensuring precise financial records.

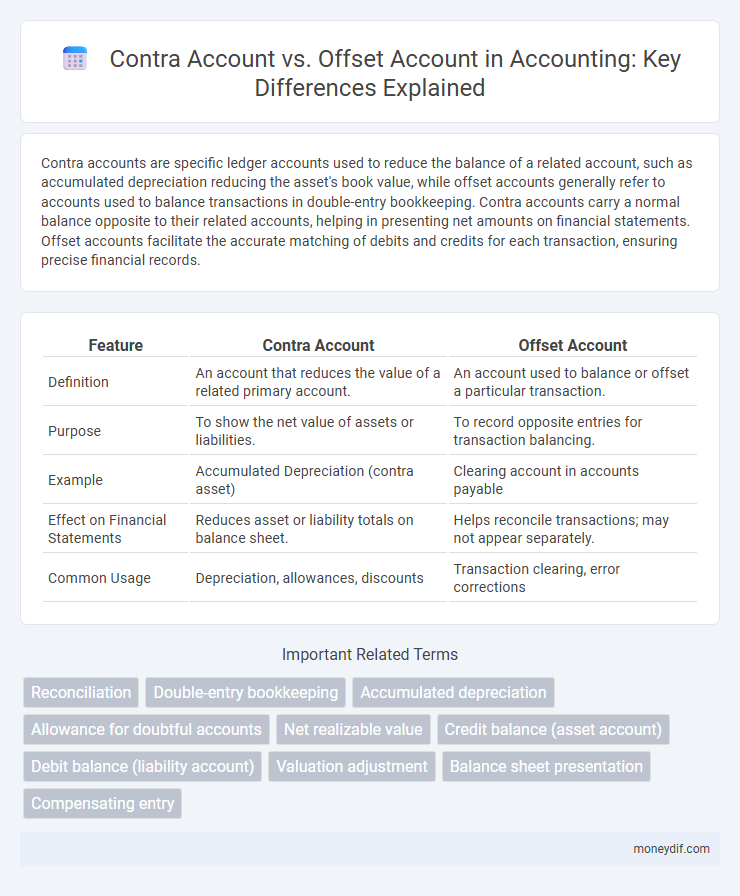

Table of Comparison

| Feature | Contra Account | Offset Account |

|---|---|---|

| Definition | An account that reduces the value of a related primary account. | An account used to balance or offset a particular transaction. |

| Purpose | To show the net value of assets or liabilities. | To record opposite entries for transaction balancing. |

| Example | Accumulated Depreciation (contra asset) | Clearing account in accounts payable |

| Effect on Financial Statements | Reduces asset or liability totals on balance sheet. | Helps reconcile transactions; may not appear separately. |

| Common Usage | Depreciation, allowances, discounts | Transaction clearing, error corrections |

Introduction to Contra and Offset Accounts

Contra accounts reduce the balance of a related account, such as accumulated depreciation lowering the book value of fixed assets. Offset accounts serve as counterpart accounts in double-entry bookkeeping, balancing transactions within the general ledger. Understanding the distinction between contra and offset accounts improves financial reporting accuracy and clarity in accounting records.

Definition of Contra Accounts

Contra accounts are specialized ledger accounts with balances opposite to their related accounts, used to reduce or offset the value of asset, liability, or equity accounts. Common examples include Accumulated Depreciation as a contra asset account, which decreases the book value of fixed assets, and Allowance for Doubtful Accounts, which offsets Accounts Receivable. Contra accounts provide clearer financial reporting by presenting net values, enhancing accuracy in balance sheets.

Definition of Offset Accounts

Offset accounts refer to specific ledger accounts used to balance or reduce the effect of another related account, often to reflect adjustments or corrections in financial statements. Unlike contra accounts, which typically have a normal balance opposite to the related account, offset accounts may carry a balance that directly counteracts the primary account to maintain accurate overall balances. In accounting software, offset accounts facilitate automatic adjustments during transactions, ensuring precise financial reporting and reconciliation.

Key Differences Between Contra and Offset Accounts

Contra accounts are used to record deductions from related asset, liability, or equity accounts, such as accumulated depreciation reducing the book value of fixed assets. Offset accounts, often found in double-entry bookkeeping, are specific accounts that balance or counterbalance entries in primary accounts, like accounts payable offsetting purchases. The key difference lies in their purpose: contra accounts directly reduce the balance of a related account, while offset accounts serve to balance transactions for accurate financial reporting.

Examples of Contra Accounts in Accounting

Examples of contra accounts in accounting include Accumulated Depreciation, which offsets the asset account for equipment or buildings, and Allowance for Doubtful Accounts, which reduces the accounts receivable balance. Another common contra account is Sales Returns and Allowances, used to decrease gross sales revenue. These contra accounts provide a clearer picture of net values on financial statements by directly adjusting related account balances.

Examples of Offset Accounts in Practice

Offset accounts in accounting commonly include allowance for doubtful accounts, which reduces accounts receivable to reflect expected uncollectible amounts, and accumulated depreciation, which offsets the value of fixed assets to show their net book value. Another practical example is the sales returns and allowances account, which reduces gross sales to provide a more accurate net sales figure. These offset accounts help present a clearer financial position by adjusting primary account balances.

Purposes of Using Contra Accounts

Contra accounts serve to directly reduce the balance of a related primary account, enhancing financial statement clarity by displaying deductions such as accumulated depreciation or allowance for doubtful accounts. These accounts provide a transparent method to record value adjustments without altering original transaction entries, maintaining the integrity of asset or liability valuations. By contrast, offset accounts enable balancing entries during bookkeeping processes but do not necessarily detail specific reductions linked to a primary account.

Purposes of Using Offset Accounts

Offset accounts serve to balance specific general ledger accounts, providing clear visibility of transactions without altering the primary account balance. Contra accounts reduce the value of related accounts, such as accumulated depreciation offsetting asset accounts. Using offset accounts enhances accuracy in financial reporting by distinctly tracking adjustments separately from the main account.

Impact on Financial Statements

Contra accounts reduce the balance of a related account on financial statements, such as accumulated depreciation lowering the book value of fixed assets. Offset accounts, while also linked to another account, typically represent transactions temporarily held to balance debits and credits without directly reducing the primary account's balance. The use of contra accounts directly affects asset valuation and net income presentation, whereas offset accounts mainly aid in transaction tracking and reconciliation within financial reporting.

Choosing Between Contra and Offset Accounts

Choosing between contra accounts and offset accounts depends on their specific purposes in accounting: contra accounts reduce the balance of a related account by showing deductions such as accumulated depreciation or allowance for doubtful accounts, while offset accounts are primarily used to record transactions that counterbalance or negate other entries, like clearing accounts. Contra accounts appear on the balance sheet directly linked to the associated asset or liability, providing transparency in net values, whereas offset accounts often function internally or temporarily to ensure accurate recording and reconciliation without affecting overall financial statements. Selecting the appropriate account type enhances financial clarity, audit trails, and compliance with accounting standards like GAAP or IFRS.

Important Terms

Reconciliation

Reconciliation involves matching transactions between a contra account, which records direct offsets to specific accounts like accumulated depreciation contra to equipment, and an offset account that balances entries without directly reducing the related account but ensuring overall ledger accuracy. Proper distinction between contra and offset accounts streamlines financial statement preparation by accurately reflecting asset values and corresponding adjustments during the reconciliation process.

Double-entry bookkeeping

Double-entry bookkeeping records financial transactions through paired entries, where contra accounts track reductions to related accounts, such as accumulated depreciation against assets, while offset accounts balance entries to maintain the accounting equation without directly reducing the primary account's balance. This distinction ensures accurate financial reporting by separately displaying adjustments and maintaining transparency in account balances.

Accumulated depreciation

Accumulated depreciation is recorded as a contra account on the balance sheet, reducing the book value of the related asset without directly offsetting its original cost account. Contra accounts maintain a clear record of depreciation separately, whereas offset accounts directly reduce asset balances, potentially obscuring detailed depreciation tracking.

Allowance for doubtful accounts

Allowance for doubtful accounts is a contra account that reduces accounts receivable on the balance sheet to reflect estimated uncollectible amounts, improving accuracy in financial reporting. Unlike offset accounts, which directly balance entries without affecting net balances, contra accounts like the allowance maintain original account totals while separately presenting potential credit losses.

Net realizable value

Net realizable value (NRV) represents the estimated selling price of an asset minus any costs required to complete and sell it, often adjusted through contra accounts such as allowance for doubtful accounts to reduce the asset's book value. Contra accounts directly reduce the related asset's carrying amount on the balance sheet, while offset accounts record transactions affecting different accounts without reducing the asset's value.

Credit balance (asset account)

A credit balance in an asset account typically indicates a contra asset account, which reduces the gross asset value, such as accumulated depreciation offsetting equipment cost. Offset accounts, in contrast, may involve related liabilities or equity accounts used for internal tracking, but do not directly reduce the asset balance on the financial statements.

Debit balance (liability account)

A debit balance in a liability account typically indicates an unusual condition, such as an overpayment or error, requiring adjustment; contra accounts related to liabilities, like discount on bonds payable, carry debit balances to reduce the liability's carrying amount without directly offsetting the account. Offset accounts differ as they are used to directly counterbalance a specific liability in the accounting equation, ensuring accurate financial statement presentation without altering the original liability's balance.

Valuation adjustment

Valuation adjustment refers to the process of adjusting the recorded value of an asset or liability to reflect its fair market value, often impacting financial statements through specific accounts. Contra accounts directly reduce the value of a related asset or liability, while offset accounts represent independent accounts used to balance transactions without directly diminishing the carrying amount of another account.

Balance sheet presentation

Balance sheet presentation distinguishes contra accounts, which reduce the value of a related account and appear as deductions directly beneath the related account's balance, from offset accounts that adjust balances by counterbalancing entries typically displayed separately. Contra accounts such as accumulated depreciation or allowance for doubtful accounts provide clearer asset valuation by explicitly presenting reductions, whereas offset accounts modify overall account totals without directly reducing individual line items.

Compensating entry

A compensating entry is an accounting adjustment that corrects errors by recording amounts in contra accounts, which reduce the value of related accounts, unlike offset accounts that balance entries by matching debits and credits. Contra accounts, such as accumulated depreciation or allowance for doubtful accounts, provide a detailed reduction to asset or revenue accounts, while offset accounts serve as counterbalancing entries in the ledger to maintain accurate financial records.

contra account vs offset account Infographic

moneydif.com

moneydif.com