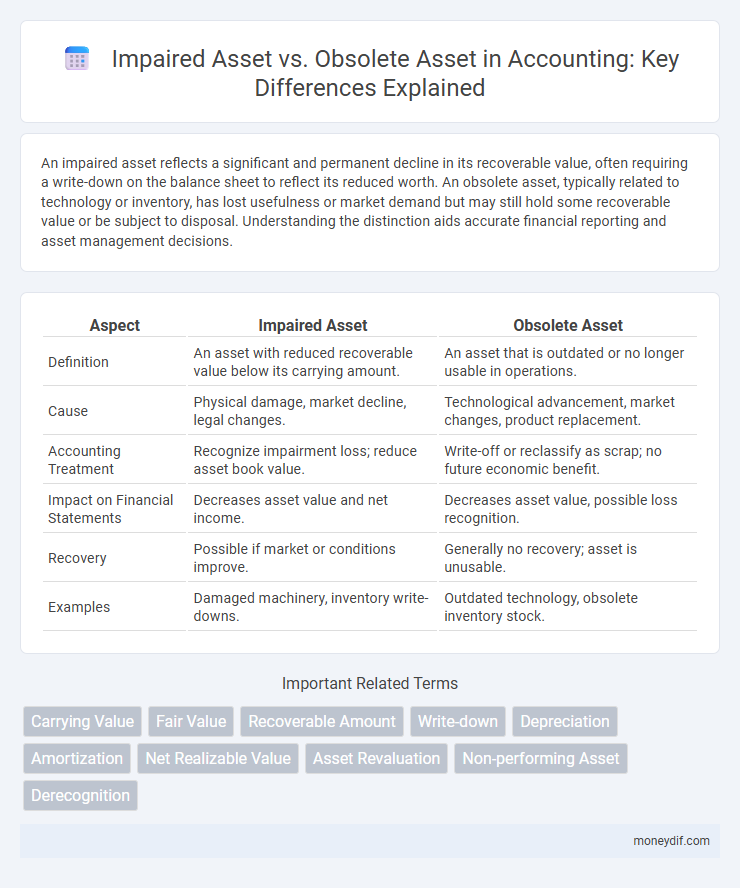

An impaired asset reflects a significant and permanent decline in its recoverable value, often requiring a write-down on the balance sheet to reflect its reduced worth. An obsolete asset, typically related to technology or inventory, has lost usefulness or market demand but may still hold some recoverable value or be subject to disposal. Understanding the distinction aids accurate financial reporting and asset management decisions.

Table of Comparison

| Aspect | Impaired Asset | Obsolete Asset |

|---|---|---|

| Definition | An asset with reduced recoverable value below its carrying amount. | An asset that is outdated or no longer usable in operations. |

| Cause | Physical damage, market decline, legal changes. | Technological advancement, market changes, product replacement. |

| Accounting Treatment | Recognize impairment loss; reduce asset book value. | Write-off or reclassify as scrap; no future economic benefit. |

| Impact on Financial Statements | Decreases asset value and net income. | Decreases asset value, possible loss recognition. |

| Recovery | Possible if market or conditions improve. | Generally no recovery; asset is unusable. |

| Examples | Damaged machinery, inventory write-downs. | Outdated technology, obsolete inventory stock. |

Definition of Impaired Asset

An impaired asset is an accounting term referring to a long-lived asset whose carrying amount exceeds its recoverable amount, indicating a measurable decline in value. This impairment occurs when events or changes in circumstances reduce the asset's expected future cash flows below its book value. Unlike obsolete assets, which are outdated or no longer usable, impaired assets specifically reflect financial losses recognized through impairment testing.

Definition of Obsolete Asset

An obsolete asset is a tangible or intangible resource that has lost its utility or value due to advancements in technology, changes in market demand, or regulatory shifts, making it unsuitable for its intended purpose. Unlike impaired assets, which suffer a measurable decline in value due to damage or wear, obsolete assets often become completely unusable or irrelevant in the current operational context. Accounting standards require companies to write down or write off obsolete assets to reflect their diminished worth accurately in financial statements.

Key Differences Between Impaired and Obsolete Assets

Impaired assets reflect a significant decline in the recoverable value compared to their carrying amount on the balance sheet, often due to damage, market changes, or obsolescence. Obsolete assets are outdated or no longer usable due to technological advancements or changes in market demand, frequently resulting in zero future economic benefit. Key differences include impairment requiring formal write-downs based on fair value less costs to sell or value in use, while obsolescence primarily impacts asset usefulness and replacement decisions without always triggering immediate impairment accounting adjustments.

Causes of Asset Impairment

Asset impairment occurs when the carrying value of an asset exceeds its recoverable amount due to factors such as physical damage, technological obsolescence, or adverse changes in market conditions. Impairment can also result from legal or regulatory changes that reduce the asset's utility or from significant declines in asset performance or cash flows. These causes differ from obsolescence, which specifically refers to assets becoming outdated or no longer useful due to innovation or market evolution, rather than a direct reduction in recoverable value.

Triggers for Asset Obsolescence

Triggers for asset obsolescence include technological advancements rendering assets outdated, changes in market demand reducing asset utility, and regulatory shifts imposing new compliance standards. Impaired assets differ as they reflect a significant decline in recoverable value due to physical damage or economic factors. Asset obsolescence specifically signals a loss in usefulness despite the asset being physically intact, impacting depreciation and write-down decisions in accounting.

Accounting Treatment for Impaired Assets

Accounting treatment for impaired assets requires recognizing an impairment loss when the carrying amount exceeds the recoverable amount, determined by the higher of fair value less costs to sell or value in use. The impairment loss is recorded in the income statement, reducing the asset's carrying amount on the balance sheet. Reversal of impairment losses is allowed under IAS 36 if the recoverable amount increases, except for goodwill.

Accounting Process for Obsolete Assets

The accounting process for obsolete assets involves identifying assets that no longer have economic value due to technological advances or market changes. These assets are typically written down or written off through an impairment loss to reflect their reduced recoverable amount on the balance sheet accurately. Accurate documentation and periodic review ensure compliance with accounting standards such as IFRS or GAAP and maintain the integrity of financial statements.

Impact on Financial Statements

Impaired assets result in an immediate write-down on the balance sheet, reducing the asset's carrying value to its recoverable amount and impacting net income through impairment losses reported on the income statement. Obsolete assets may not always be immediately written down but often require inventory write-offs or increased depreciation expenses, affecting the cost of goods sold and reducing reported earnings. Both conditions decrease asset values and equity, altering key financial ratios such as return on assets and liquidity metrics.

Disclosure Requirements under IFRS and GAAP

Impaired assets require disclosure of the nature and carrying amount of the asset, the method of measuring impairment loss, and the reversal of previous impairment losses under both IFRS (IAS 36) and GAAP (ASC 360). Obsolete assets, often included within inventory or fixed asset categories, require disclosure of write-downs to net realizable value or fair value less costs to sell, as mandated by IFRS (IAS 2, IAS 36) and GAAP (ASC 330, ASC 360). Both frameworks emphasize transparency in impairment indicators, measurement methods, and the financial impact on the entity's statements.

Strategies for Managing Impaired and Obsolete Assets

Effective strategies for managing impaired and obsolete assets include regular asset impairment testing and implementing robust inventory management systems to identify slow-moving or obsolete items. Companies optimize asset recovery by timely disposal or revaluation of impaired assets, ensuring compliance with accounting standards such as IFRS 36 for impairment and ASC 360 for property, plant, and equipment. Leveraging data analytics improves forecasting accuracy, enabling proactive decisions that minimize financial losses and maintain asset utility.

Important Terms

Carrying Value

Carrying value represents the asset's book value after accounting for depreciation and impairment losses, reflecting its current worth on the balance sheet. Impaired assets have a carrying value reduced due to a decline in recoverable amount, while obsolete assets incur write-downs as they no longer provide economic benefits or are outdated.

Fair Value

Fair value for impaired assets reflects the recoverable amount based on current market conditions, often lower than the asset's carrying amount. Obsolete assets, determined by outdated technology or diminished utility, typically have a fair value approaching zero or scrap value due to lack of market demand.

Recoverable Amount

Recoverable amount refers to the higher value between an impaired asset's fair value less costs of disposal and its value in use, ensuring accurate impairment assessment under accounting standards like IAS 36. Obsolete assets typically have recoverable amounts close to their net realizable values due to diminished utility and market demand.

Write-down

A write-down reduces the carrying value of an impaired asset to reflect its diminished recoverable amount, while an obsolete asset is typically written off entirely as it no longer provides economic benefit. Impaired assets undergo valuation adjustments based on impairment tests, whereas obsolete assets are removed from the balance sheet due to irrelevance in operations or market demand.

Depreciation

Depreciation for impaired assets is adjusted based on a revised carrying amount reflecting reduced future economic benefits, whereas obsolete assets may be fully written off due to the inability to recover value through use or sale. Impairment triggers a revaluation process under accounting standards like IAS 36, while obsolescence primarily affects asset usability and may lead to accelerated depreciation or immediate recognition of loss.

Amortization

Amortization spreads the cost of an intangible asset over its useful life, but impaired assets require immediate recognition of a loss when their recoverable amount falls below carrying value, while obsolete assets, typically tangible, are written down or disposed of due to lack of utility. Impairment affects the amortization schedule by reducing the asset's book value, whereas obsolescence leads to accelerated write-offs or disposal without altering amortization methods for intangible assets.

Net Realizable Value

Net Realizable Value (NRV) represents the estimated selling price of an asset minus any costs associated with its sale, serving as a key metric in assessing both impaired and obsolete assets. Impaired assets reflect a decline in value due to damage or reduced utility, while obsolete assets lose value because they are outdated or no longer usable, both requiring NRV evaluation to determine appropriate write-downs in financial reporting.

Asset Revaluation

Asset revaluation involves adjusting the carrying value of assets to reflect their current market value, which differs from impairment accounting where assets are written down due to a decline in recoverable amount. Impaired assets show a significant drop in value impacting financial statements, while obsolete assets become outdated or unusable, often necessitating removal or replacement without necessarily reflecting a market value adjustment.

Non-performing Asset

Non-performing Assets (NPAs) are loans or advances on which the borrower has stopped making interest or principal repayments for a specified period, indicating impaired financial performance. While impaired assets show a decline in recoverable value due to credit issues, obsolete assets refer to outdated or unusable assets that have lost their economic value, primarily in physical or inventory contexts rather than financial lending.

Derecognition

Derecognition of impaired assets occurs when the carrying amount exceeds recoverable value and is adjusted to reflect impairment losses, while obsolete assets are derecognized when they no longer provide economic benefits due to technological advancements or market changes. Both impaired and obsolete assets require careful evaluation to ensure accurate financial reporting and compliance with accounting standards like IAS 36 for impairment and IAS 2 for inventory obsolescence.

impaired asset vs obsolete asset Infographic

moneydif.com

moneydif.com