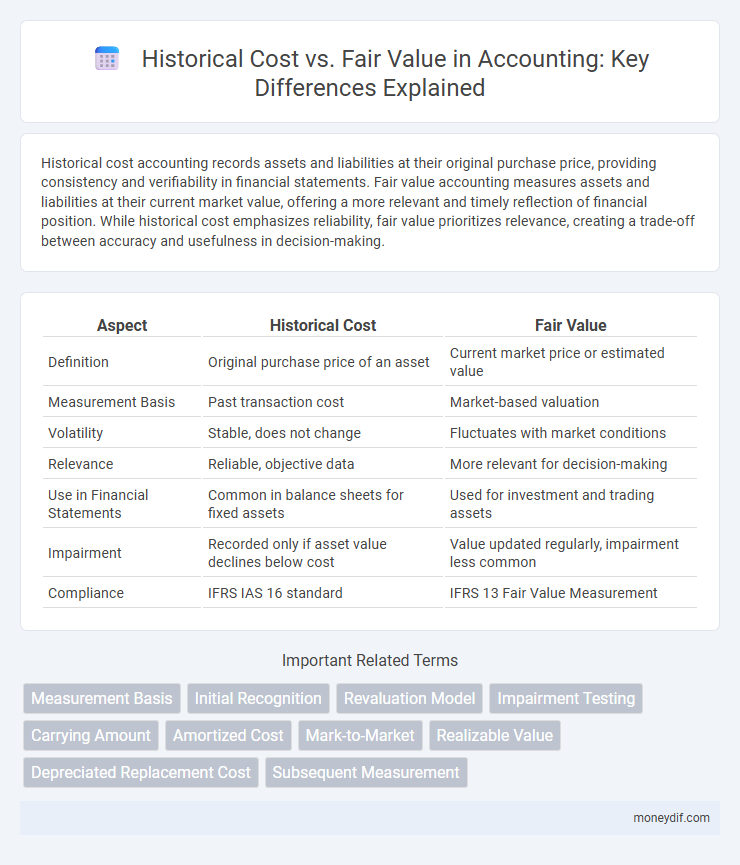

Historical cost accounting records assets and liabilities at their original purchase price, providing consistency and verifiability in financial statements. Fair value accounting measures assets and liabilities at their current market value, offering a more relevant and timely reflection of financial position. While historical cost emphasizes reliability, fair value prioritizes relevance, creating a trade-off between accuracy and usefulness in decision-making.

Table of Comparison

| Aspect | Historical Cost | Fair Value |

|---|---|---|

| Definition | Original purchase price of an asset | Current market price or estimated value |

| Measurement Basis | Past transaction cost | Market-based valuation |

| Volatility | Stable, does not change | Fluctuates with market conditions |

| Relevance | Reliable, objective data | More relevant for decision-making |

| Use in Financial Statements | Common in balance sheets for fixed assets | Used for investment and trading assets |

| Impairment | Recorded only if asset value declines below cost | Value updated regularly, impairment less common |

| Compliance | IFRS IAS 16 standard | IFRS 13 Fair Value Measurement |

Introduction to Historical Cost and Fair Value

Historical cost reflects the original transaction price of an asset or liability, providing reliability and verifiability in accounting records. Fair value represents the estimated market price at the measurement date, offering relevance and timely information for decision-making. Understanding the differences between historical cost and fair value is essential for accurate financial reporting and asset valuation.

Definition of Historical Cost

Historical cost refers to the original monetary value recorded for an asset at the time of its acquisition, reflecting the actual price paid including transaction costs. It provides a verifiable and objective basis for asset valuation, ensuring consistency and reliability in financial statements. Unlike fair value, historical cost does not fluctuate with market conditions, offering stability but potentially lacking in current relevance.

Definition of Fair Value

Fair value is defined as the estimated price at which an asset or liability could be exchanged between knowledgeable, willing parties in an arm's-length transaction. It reflects current market conditions rather than historical acquisition costs, providing a more relevant measure of value for financial reporting. Fair value measurement enhances comparability and timeliness in accounting by incorporating observable market data whenever available.

Key Differences Between Historical Cost and Fair Value

Historical cost records assets based on the original purchase price, offering reliability and verifiability in accounting records. Fair value measures assets and liabilities at their current market price, reflecting real-time economic conditions but with subjectivity in valuation. Key differences include stability and objectivity of historical cost versus the relevance and volatility of fair value in financial reporting.

Advantages of Historical Cost Accounting

Historical cost accounting provides reliable and verifiable financial data by recording assets at their original purchase price, minimizing subjectivity and estimation errors. It ensures consistency and comparability across reporting periods since transaction values do not fluctuate with market volatility. This method simplifies auditing procedures and supports regulatory compliance by adhering to established accounting standards such as GAAP and IFRS.

Advantages of Fair Value Accounting

Fair value accounting provides more timely and relevant information by reflecting current market conditions, enhancing decision-making for investors and stakeholders. It improves transparency by incorporating real-time asset and liability valuations, reducing the risk of outdated or inaccurate financial statements. This approach also facilitates better risk assessment and management through continuous measurement aligned with market fluctuations.

Challenges and Limitations of Historical Cost

Historical cost accounting presents challenges such as its inability to reflect current market conditions, leading to outdated asset valuations that may not represent true economic value. This method limits financial statement relevance during periods of inflation or significant market fluctuations, potentially misleading stakeholders. Additionally, historical cost lacks responsiveness to intangible assets and fair value changes, reducing the accuracy of financial performance and position assessments.

Challenges and Limitations of Fair Value

Fair value accounting presents challenges such as measurement uncertainty due to market volatility and lack of active markets for certain assets, leading to subjective valuation estimates. It also poses limitations in comparison to historical cost by increasing income statement volatility and potential manipulation through management discretion in fair value assessments. These factors complicate financial statement reliability and comparability across reporting periods and entities.

Impact on Financial Statements

Historical cost accounting records assets and liabilities at their original purchase price, providing consistency and reliability in financial statements but potentially understating current market values. Fair value accounting reflects the current market value of assets and liabilities, enhancing relevance and transparency but introducing volatility and subjectivity. The choice between these methods significantly affects balance sheets, income statements, and key financial ratios, influencing stakeholders' decision-making processes.

Regulatory Standards and Industry Practices

Regulatory standards such as IFRS and GAAP prescribe differing requirements for historical cost and fair value measurement, influencing financial reporting practices across industries. Historical cost provides reliability and verifiability, favored in regulatory frameworks for asset valuation, while fair value reflects current market conditions and is increasingly adopted in sectors like financial services for enhanced transparency. Industry practices often balance these methods, with fair value measurements prevalent in investment portfolios and historical cost maintained for long-term assets, aligning with regulatory mandates and stakeholder expectations.

Important Terms

Measurement Basis

Measurement basis determines how asset values are recorded and reported in financial statements, with historical cost reflecting the original purchase price and fair value representing the current market price. Historical cost provides reliability and verifiability, while fair value offers relevance by capturing real-time economic conditions.

Initial Recognition

Initial recognition of an asset or liability often requires measurement at historical cost, reflecting the transaction price, while fair value provides a current market-based measurement; the choice between these depends on the applicable accounting framework such as IFRS or GAAP. Historical cost offers reliability and verifiability, whereas fair value enhances relevance and reflects current market conditions in financial reporting.

Revaluation Model

The revaluation model adjusts asset values to fair value at each reporting date, contrasting with the historical cost model, which records assets at their original purchase price. This approach enhances financial statement relevance by reflecting current market conditions, but may introduce volatility compared to the stability of historical cost.

Impairment Testing

Impairment testing evaluates asset value by comparing the carrying amount under historical cost to its recoverable amount, often based on fair value less costs to sell or value in use. Historical cost reflects past purchase prices, while fair value provides a current market-based measurement, ensuring assets are not overstated on financial statements.

Carrying Amount

The carrying amount reflects an asset's value recorded on the balance sheet, typically based on its historical cost minus accumulated depreciation or impairment. Fair value measurement adjusts the carrying amount to represent the asset's current market value, providing a more accurate reflection of its economic worth.

Amortized Cost

Amortized cost measures an asset's value by adjusting its historical cost for repayment of principal and amortization of premiums or discounts over time, providing a consistent reflection of value based on initial transactions. Unlike fair value, which represents the current market price and fluctuates with market conditions, amortized cost maintains stability by accounting for the asset's cost basis and systematic allocation of related expenses.

Mark-to-Market

Mark-to-Market accounting records assets and liabilities at their current fair value, providing a more accurate reflection of market conditions compared to historical cost, which values items based on original purchase price. This approach enhances financial transparency by adjusting book values to real-time market data, though it may introduce volatility in financial statements.

Realizable Value

Realizable value represents the estimated amount an asset can be sold for in the market, often used to assess the net value recoverable upon sale, contrasting with the historical cost which records the original purchase price. Unlike fair value, which reflects current market conditions and potential future selling prices, realizable value focuses on the actual expected proceeds from a transaction, providing a more practical perspective for asset valuation and impairment analysis.

Depreciated Replacement Cost

Depreciated Replacement Cost (DRC) measures the current cost to replace an asset minus accumulated depreciation, bridging the gap between historical cost and fair value by reflecting up-to-date market conditions and wear. Unlike historical cost, which records asset value at original purchase price, and fair value, which assesses price in an active market, DRC provides a practical valuation method for specialized assets lacking active market prices.

Subsequent Measurement

Subsequent measurement involves adjusting asset values after initial recognition, primarily using historical cost or fair value bases; historical cost records assets at original purchase price, enhancing reliability but lacking current market relevance. Fair value measurement reflects market-based valuations, offering timely insights but increasing volatility and requiring frequent reappraisals to ensure accurate financial reporting.

historical cost vs fair value Infographic

moneydif.com

moneydif.com