Prepayments refer to payments made in advance for goods or services to be received in the future, recorded as assets until the expense is incurred. Accrued expenses represent obligations for goods or services already received but not yet paid, recorded as liabilities on the balance sheet. Proper differentiation between prepayments and accrued expenses ensures accurate financial reporting and effective cash flow management.

Table of Comparison

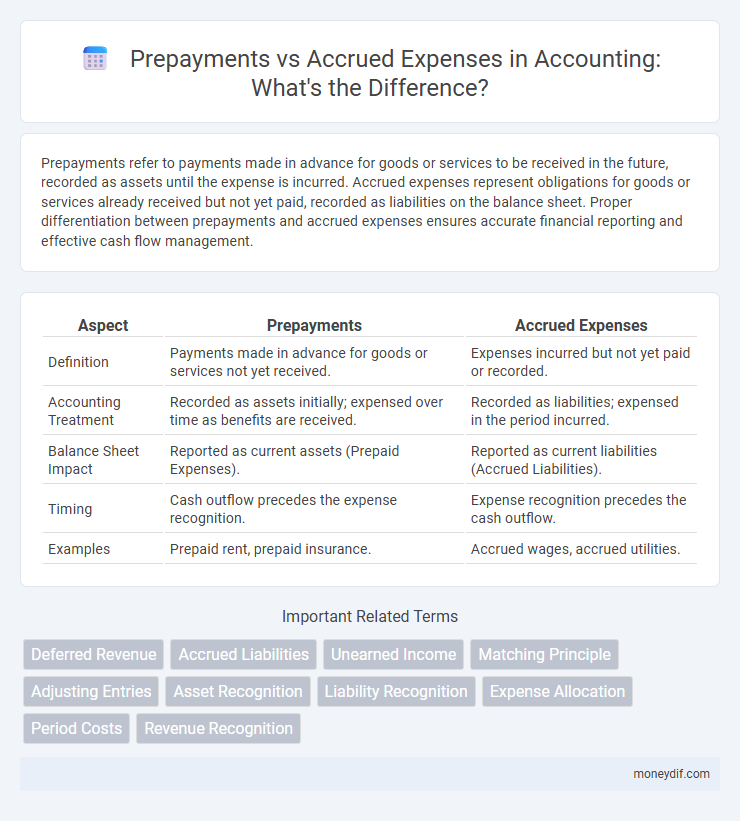

| Aspect | Prepayments | Accrued Expenses |

|---|---|---|

| Definition | Payments made in advance for goods or services not yet received. | Expenses incurred but not yet paid or recorded. |

| Accounting Treatment | Recorded as assets initially; expensed over time as benefits are received. | Recorded as liabilities; expensed in the period incurred. |

| Balance Sheet Impact | Reported as current assets (Prepaid Expenses). | Reported as current liabilities (Accrued Liabilities). |

| Timing | Cash outflow precedes the expense recognition. | Expense recognition precedes the cash outflow. |

| Examples | Prepaid rent, prepaid insurance. | Accrued wages, accrued utilities. |

Introduction to Prepayments and Accrued Expenses

Prepayments refer to payments made in advance for goods or services to be received in the future, recorded as assets until the benefits are realized. Accrued expenses represent liabilities for expenses incurred but not yet paid by the end of the accounting period, reflecting obligations to settle these costs. Understanding the distinction between prepayments and accrued expenses is essential for accurate financial statement presentation and ensuring compliance with accrual accounting principles.

Definition of Prepayments

Prepayments are payments made in advance for goods or services that will be received in a future accounting period, representing assets on the balance sheet until they are expensed. These prepaid expenses, such as rent, insurance, or subscriptions, are initially recorded as current assets and systematically allocated to expenses over time. Unlike accrued expenses, which are liabilities for costs incurred but not yet paid, prepayments reflect funds disbursed ahead of the financial obligation.

Definition of Accrued Expenses

Accrued expenses are liabilities recorded when expenses are incurred but not yet paid, reflecting obligations for goods or services already received. These expenses are recognized in the accounting period they relate to, adhering to the matching principle for accurate financial reporting. Typical examples include wages payable, utilities payable, and interest payable, which ensure expenses align with corresponding revenues.

Key Differences Between Prepayments and Accrued Expenses

Prepayments are payments made in advance for goods or services not yet received, recorded as assets until the service or product is delivered, whereas accrued expenses represent liabilities for goods or services already received but not yet paid. Prepayments decrease current assets as the service period progresses, while accrued expenses increase current liabilities on the balance sheet until settled. Understanding these distinctions is crucial for accurate financial reporting and compliance with accrual accounting principles.

Recognition and Recording in Financial Statements

Prepayments are recognized as assets on the balance sheet when payments are made in advance for goods or services to be received in the future, and these amounts are gradually expensed over the period they benefit. Accrued expenses are liabilities recorded on the balance sheet to reflect expenses incurred but not yet paid, ensuring expenses are matched to the correct accounting period. Proper recognition and recording of prepayments and accrued expenses ensure accurate financial statement presentation by adhering to the accrual basis of accounting and matching principle.

Impact on Income Statement and Balance Sheet

Prepayments appear as assets on the balance sheet and reduce expenses on the income statement until the prepaid service or benefit is consumed, at which point they are recognized as expenses. Accrued expenses are recorded as liabilities on the balance sheet and increase expenses on the income statement, reflecting costs incurred but not yet paid. Properly matching prepayments and accrued expenses ensures accurate financial reporting by aligning expenses with the period they relate to.

Examples of Prepayments in Accounting

Prepayments in accounting refer to payments made in advance for goods or services to be received in the future, such as prepaid rent, insurance premiums, or subscriptions. These expenses are recorded as assets on the balance sheet until the benefit is realized over time. Prepaid expenses help businesses match costs with the appropriate accounting periods to ensure accurate financial reporting.

Examples of Accrued Expenses in Accounting

Accrued expenses in accounting include wages payable, interest payable, and utilities expenses that have been incurred but not yet paid by the end of the accounting period. For example, a company may owe employees for work completed in December but will pay the salaries in January, creating an accrued expense. Recognizing these expenses ensures accurate matching of costs to the period in which they are incurred, aligning with the accrual accounting principle.

Common Challenges in Managing Prepayments and Accrued Expenses

Common challenges in managing prepayments and accrued expenses include accurately timing the recognition of expenses to comply with accrual accounting principles. Businesses often struggle with maintaining detailed records to differentiate between prepaid amounts and accrued liabilities, leading to potential misstatements in financial reports. Ensuring consistent tracking and reconciliation processes is essential to prevent errors in financial statements and improve overall financial transparency.

Best Practices for Accurate Accounting of Prepayments and Accrued Expenses

Accurate accounting of prepayments and accrued expenses requires the systematic recognition of these items in the correct accounting periods to ensure financial statements reflect true liabilities and assets. Best practices include maintaining detailed schedules for tracking prepaid amounts and accrued obligations, regularly reconciling balances with supporting documentation, and applying consistent recognition policies aligned with accounting standards such as GAAP or IFRS. Implementing automated accounting software can enhance accuracy and timeliness in recording transactions related to prepayments and accrued expenses.

Important Terms

Deferred Revenue

Deferred revenue represents payments received before goods or services are delivered, creating a liability until earned; it contrasts with accrued expenses, which are costs incurred but not yet paid and recorded as liabilities. Prepayments are cash outflows made in advance, reflected as assets until the service or benefit is received, differing from deferred revenue where cash inflows occur ahead of revenue recognition.

Accrued Liabilities

Accrued liabilities represent expenses incurred but not yet paid, differing from prepayments which are expenses paid in advance for future services or goods. Accrued expenses increase current liabilities without cash outflow, while prepayments create prepaid asset accounts until the expense is recognized.

Unearned Income

Unearned income represents cash received before services are rendered or goods delivered, categorized as a liability until earned, contrasting accrued expenses which are liabilities for expenses incurred but not yet paid. Prepayments refer to payments made in advance for expenses, recorded as assets, whereas unearned income reflects amounts received in advance by the business for future revenue recognition.

Matching Principle

The Matching Principle requires that expenses be recognized in the same period as the revenues they help generate, leading to the treatment of prepayments as assets until the related expense is incurred and accrued expenses as liabilities for costs incurred but not yet paid. This ensures accurate financial reporting by aligning prepaid expenses and accrued liabilities with the appropriate accounting periods to reflect true financial performance.

Adjusting Entries

Adjusting entries systematically update the ledger to reflect prepayments by allocating expenses to the periods benefited, ensuring prepaid assets decrease while expense accounts increase. For accrued expenses, adjusting entries record liabilities incurred but unpaid, recognizing expenses in the current period and increasing accounts payable accordingly.

Asset Recognition

Asset recognition involves recording prepaid expenses as assets on the balance sheet because they represent future economic benefits, whereas accrued expenses are liabilities reflecting incurred obligations not yet paid. Proper differentiation ensures accurate financial statements by matching expenses to the relevant reporting periods under accrual accounting principles.

Liability Recognition

Liability recognition requires distinguishing between prepayments, which are advance payments recorded as assets until services are received, and accrued expenses, which are obligations for goods or services already incurred but not yet paid, recorded as liabilities. Accurate classification ensures proper financial reporting by reflecting the timing of cash flows and matching expenses with the related accounting periods.

Expense Allocation

Expense allocation distinguishes prepayments, which are expenses paid in advance and allocated over future periods, from accrued expenses, which represent costs incurred but not yet paid and must be recorded in the current period to match revenues accurately. Effective management of prepayments and accrued expenses ensures precise financial reporting and compliance with the matching principle in accounting.

Period Costs

Period costs, including selling and administrative expenses, are expensed in the period they are incurred, regardless of prepayments or accruals, affecting income statement timing. Prepayments represent cash paid in advance for period costs, recorded as assets until incurred, while accrued expenses reflect costs incurred but unpaid, recognized as liabilities to match expenses with the correct accounting period.

Revenue Recognition

Revenue recognition requires matching revenue to the appropriate accounting period, distinguishing prepayments as cash received before goods or services are delivered, while accrued expenses represent costs incurred but not yet paid; this ensures accurate financial reporting by aligning recognized revenue with the timing of related expenses. Proper differentiation between prepayments and accrued expenses is essential for compliance with accounting standards such as ASC 606 and IAS 18, facilitating transparent reflection of a company's financial position.

prepayments vs accrued expenses Infographic

moneydif.com

moneydif.com