Prepaid expenses represent payments made in advance for goods or services to be received in the future, recorded as assets until they are incurred. Accrued expenses, on the other hand, are costs that have been incurred but not yet paid, recognized as liabilities on the balance sheet. Proper distinction between prepaid and accrued expenses ensures accurate financial reporting and matching of expenses to the correct accounting period.

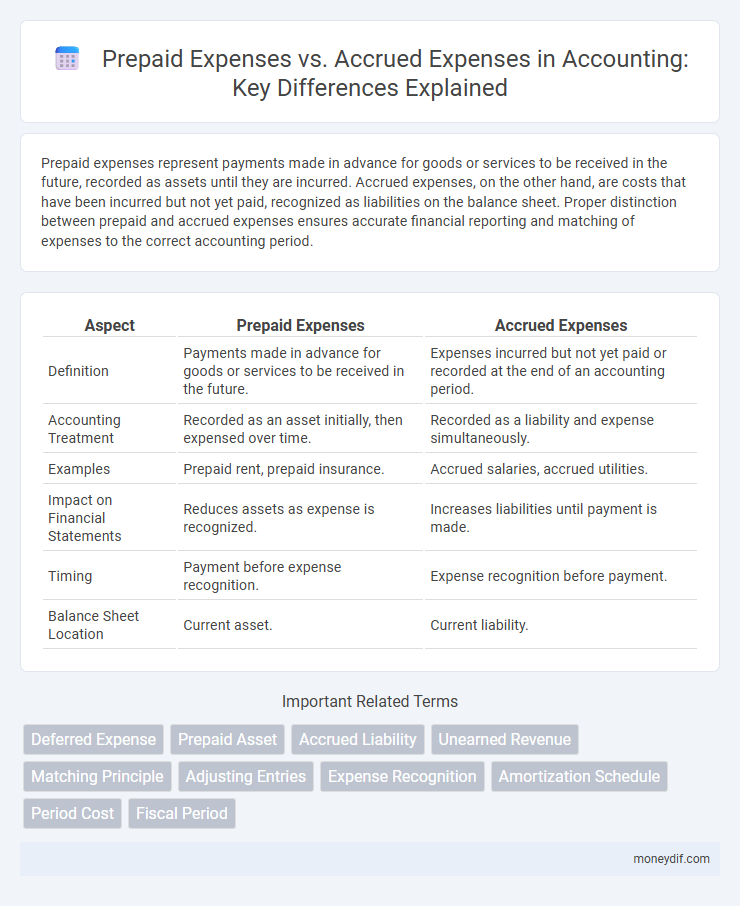

Table of Comparison

| Aspect | Prepaid Expenses | Accrued Expenses |

|---|---|---|

| Definition | Payments made in advance for goods or services to be received in the future. | Expenses incurred but not yet paid or recorded at the end of an accounting period. |

| Accounting Treatment | Recorded as an asset initially, then expensed over time. | Recorded as a liability and expense simultaneously. |

| Examples | Prepaid rent, prepaid insurance. | Accrued salaries, accrued utilities. |

| Impact on Financial Statements | Reduces assets as expense is recognized. | Increases liabilities until payment is made. |

| Timing | Payment before expense recognition. | Expense recognition before payment. |

| Balance Sheet Location | Current asset. | Current liability. |

Introduction to Prepaid and Accrued Expenses

Prepaid expenses represent payments made in advance for goods or services to be received in the future, recorded as assets until the benefit is realized. Accrued expenses, conversely, are costs incurred but not yet paid, recognized as liabilities to match expenses with the period they relate to. Proper accounting for prepaid and accrued expenses ensures accurate financial statements and compliance with the matching principle.

Definition of Prepaid Expenses

Prepaid expenses are payments made in advance for goods or services to be received in the future, categorized as current assets on the balance sheet until the benefit is realized. They differ from accrued expenses, which represent liabilities for expenses incurred but not yet paid. Common examples include prepaid insurance, rent, and subscription fees that are recognized as expenses over the period they cover.

Definition of Accrued Expenses

Accrued expenses are liabilities that represent costs a company has incurred but not yet paid or recorded by the end of the accounting period, such as wages, interest, or utilities. These expenses are recognized in the financial statements through adjusting entries to match the expense to the period in which it was incurred, following the accrual accounting principle. Unlike prepaid expenses, accrued expenses do not involve advance payments, reflecting obligations owed for services or goods already received.

Key Differences Between Prepaid and Accrued Expenses

Prepaid expenses represent payments made in advance for goods or services to be received in the future, recorded as assets until they are consumed. Accrued expenses are liabilities reflecting costs incurred but not yet paid or recorded, such as wages or utilities payable at period-end. The key difference lies in timing: prepaid expenses involve cash outflow before expense recognition, while accrued expenses recognize expenses before cash payment.

Accounting Treatment of Prepaid Expenses

Prepaid expenses are recorded as assets on the balance sheet when payment is made before the related expense is incurred, ensuring accurate matching of expenses to the period they benefit. During the accounting period, prepaid expenses are gradually expensed through systematic amortization or allocation, typically using journal entries to debit the expense account and credit the prepaid asset account. This treatment adheres to the accrual basis of accounting by reflecting the proper expense recognition in financial statements.

Accounting Treatment of Accrued Expenses

Accrued expenses represent liabilities for goods or services received but not yet paid, requiring recognition in the accounting period incurred to comply with the matching principle. The accounting treatment involves recording an accrued expense journal entry by debiting the appropriate expense account and crediting accrued liabilities or accounts payable. This ensures financial statements accurately reflect all obligations, improving the accuracy of expense reporting and providing a true snapshot of company liabilities at period-end.

Impact on Financial Statements

Prepaid expenses, recorded as assets on the balance sheet, reduce current assets as they are expensed over time, directly impacting the income statement through gradual expense recognition. Accrued expenses, recognized as liabilities, increase current liabilities on the balance sheet while simultaneously recording expenses on the income statement before cash payment, affecting net income and financial ratios. Understanding the timing differences in recognizing prepaid and accrued expenses is crucial for accurate financial reporting and cash flow analysis.

Examples of Prepaid and Accrued Expenses

Prepaid expenses include payments made in advance for services or goods such as insurance premiums, rent, and subscriptions that are recognized as assets until they are incurred. Accrued expenses refer to liabilities for expenses that have been incurred but not yet paid or recorded, commonly including unpaid wages, utilities, and interest expenses. Recognizing these examples accurately ensures proper matching of expenses with revenues within accounting periods.

Common Mistakes in Recording Expenses

Common mistakes in recording prepaid and accrued expenses often involve misclassifying timing, leading to inaccuracies in financial statements. Prepaid expenses are sometimes expensed immediately instead of being amortized over the relevant period, while accrued expenses may be omitted or recorded in the wrong accounting period, distorting expense recognition. Accurate matching of expenses to the correct period requires careful adjustment entries to avoid misstated liabilities and assets.

Importance of Proper Expense Recognition

Proper expense recognition ensures accurate financial statements by matching expenses to the period they relate to, preventing misstated earnings. Prepaid expenses represent payments made in advance for future benefits, requiring allocation over time, while accrued expenses record obligations incurred but unpaid, reflecting current liabilities. Correctly distinguishing between these ensures compliance with accounting standards such as GAAP or IFRS and supports effective financial analysis and decision-making.

Important Terms

Deferred Expense

Deferred expenses represent payments made in advance for goods or services to be received in the future, classified as prepaid expenses on the balance sheet. Unlike accrued expenses, which reflect incurred costs not yet paid, deferred expenses are recorded as assets until the benefit is realized and then expensed accordingly.

Prepaid Asset

Prepaid assets represent payments made in advance for goods or services to be received in the future, classified as prepaid expenses on the balance sheet until recognized as expenses over time. In contrast, accrued expenses refer to costs incurred but not yet paid or recorded, requiring accrual adjustments to reflect liabilities and expenses in the current accounting period.

Accrued Liability

Accrued liability represents expenses incurred but not yet paid, differing from prepaid expenses where payment is made in advance for future costs; accrued expenses increase liabilities on the balance sheet, while prepaid expenses are recorded as assets. Understanding the timing and recognition of these accounts ensures accurate financial reporting and compliance with the matching principle.

Unearned Revenue

Unearned revenue represents payments received before goods or services are delivered, contrasting with prepaid expenses which entail payments made in advance for future benefits, both recorded as liabilities and assets respectively on the balance sheet. Unlike accrued expenses that reflect obligations for services or goods already received but not yet paid, unearned revenue captures cash inflows pending revenue recognition under accrual accounting principles.

Matching Principle

The Matching Principle requires expenses to be recorded in the same period as the revenues they help generate, ensuring accurate financial reporting. Prepaid expenses are allocated over time as they are incurred, while accrued expenses recognize obligations before cash payment, aligning expenses with related revenues.

Adjusting Entries

Adjusting entries for prepaid expenses involve debiting expense accounts and crediting prepaid asset accounts to recognize the portion of the prepaid amount used during the period. For accrued expenses, adjusting entries require debiting the relevant expense account and crediting a liability account to record expenses incurred but not yet paid.

Expense Recognition

Expense recognition requires matching expenses to the period in which they are incurred; prepaid expenses represent payments made in advance and are initially recorded as assets, while accrued expenses reflect obligations for costs incurred but not yet paid, recorded as liabilities. Proper accounting treatment ensures accurate financial statements by recognizing prepaid expenses as expenses over time and accrued expenses when the related goods or services are consumed.

Amortization Schedule

An amortization schedule details the systematic allocation of prepaid expenses over time, ensuring accurate matching of expenses with revenue periods. In contrast, accrued expenses represent liabilities recorded for incurred costs not yet paid, requiring adjustment entries without a formal amortization schedule.

Period Cost

Period costs related to prepaid expenses represent payments made in advance for goods or services that will be expensed in future periods, whereas accrued expenses are costs incurred but not yet paid, requiring adjustment entries to recognize liabilities and matching expenses to the current period. Effective management of prepaid and accrued expenses ensures accurate financial reporting and proper matching of costs to revenues within the correct accounting periods.

Fiscal Period

Fiscal periods define the time frame for recognizing prepaid expenses as assets that are expensed over the period they benefit, while accrued expenses represent liabilities for costs incurred but not yet paid within the same fiscal period. Accurate matching of these expenses to the fiscal period ensures compliance with the accrual accounting principle and provides a clear financial picture.

prepaid expenses vs accrued expenses Infographic

moneydif.com

moneydif.com