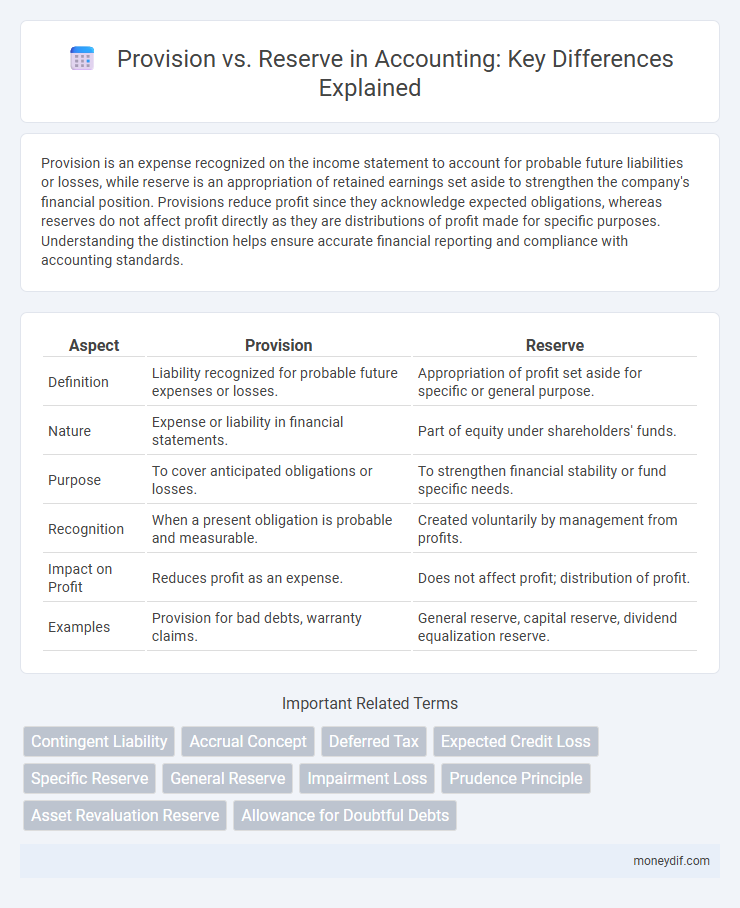

Provision is an expense recognized on the income statement to account for probable future liabilities or losses, while reserve is an appropriation of retained earnings set aside to strengthen the company's financial position. Provisions reduce profit since they acknowledge expected obligations, whereas reserves do not affect profit directly as they are distributions of profit made for specific purposes. Understanding the distinction helps ensure accurate financial reporting and compliance with accounting standards.

Table of Comparison

| Aspect | Provision | Reserve |

|---|---|---|

| Definition | Liability recognized for probable future expenses or losses. | Appropriation of profit set aside for specific or general purpose. |

| Nature | Expense or liability in financial statements. | Part of equity under shareholders' funds. |

| Purpose | To cover anticipated obligations or losses. | To strengthen financial stability or fund specific needs. |

| Recognition | When a present obligation is probable and measurable. | Created voluntarily by management from profits. |

| Impact on Profit | Reduces profit as an expense. | Does not affect profit; distribution of profit. |

| Examples | Provision for bad debts, warranty claims. | General reserve, capital reserve, dividend equalization reserve. |

Understanding Provisions and Reserves

Provisions are liabilities recognized for probable future expenses or losses with uncertain timing or amount, ensuring expenses are matched to the period they relate to under accrual accounting. Reserves represent appropriations of profits set aside voluntarily to strengthen the financial position or prepare for specific future contingencies without corresponding liabilities. Understanding the distinction between provisions and reserves is crucial for accurate financial reporting and maintaining compliance with accounting standards such as IFRS and GAAP.

Key Differences Between Provisions and Reserves

Provisions are liabilities recognized for probable future expenses or losses based on current obligations, reflecting estimated amounts deducted from profits to cover anticipated costs, whereas reserves are portions of retained earnings set aside to strengthen a company's financial position without any existing liability. Provisions reduce net profit and appear as expenses on the income statement, while reserves are allocated from profits after tax and are recorded in the equity section of the balance sheet. Provisions are mandatory under accounting standards like IAS 37, addressing specific uncertain liabilities, whereas reserves are discretionary and created for general financial prudence or future investments.

Definition and Purpose of Provisions

Provisions are recognized liabilities for uncertain obligations where the amount or timing is not precisely known, created to cover probable future expenses or losses. Their primary purpose is to adhere to the matching principle by aligning expenses with the related revenue period, ensuring accurate financial reporting. Unlike reserves, provisions directly address anticipated liabilities or contingencies, enhancing transparency and prudence in accounting.

Definition and Purpose of Reserves

Reserves in accounting refer to portions of a company's profits retained to strengthen financial stability and meet future liabilities or contingencies. Unlike provisions, which account for specific anticipated expenses or losses, reserves serve as a financial buffer without direct linkage to a particular liability. Establishing reserves enhances a firm's solvency and supports long-term business sustainability by ensuring available funds for unforeseen events or strategic investments.

Accounting Treatment of Provisions

Provisions are recognized as liabilities on the balance sheet when a present obligation arises from past events and a reliable estimate of the outflow of resources is probable. Accounting treatment of provisions requires measuring them at the best estimate of the expenditure needed to settle the obligation, often discounted to present value if the effect of the time value of money is material. Reserves, unlike provisions, are appropriations of profits and are not recognized as liabilities, reflecting retained earnings set aside for specific purposes or contingencies.

Accounting Treatment of Reserves

Reserves in accounting refer to appropriations of retained earnings, created to meet future uncertainties or specific contingencies without impacting profit and loss accounts. Unlike provisions, reserves do not correspond to any present liability or expense but are disclosed under shareholders' equity in the balance sheet. The accounting treatment of reserves involves transferring a portion of profits to reserve accounts, strengthening the company's financial stability and enhancing its creditworthiness.

Recognition Criteria for Provisions and Reserves

Provisions are recognized in accounting when there is a present obligation arising from past events, a probable outflow of resources to settle the obligation, and a reliable estimate can be made of the amount. Reserves, conversely, are appropriations of profits set aside by management without any present obligation or probable outflow, serving as internal safeguards for future uncertainties. The key difference lies in the recognition criteria: provisions reflect liabilities recognized on the balance sheet, whereas reserves represent equity adjustments recorded within shareholders' funds.

Impact on Financial Statements

Provisions reduce profit and increase liabilities on the balance sheet, reflecting probable future obligations with uncertain timing or amount. Reserves, created from retained earnings, strengthen the equity section and do not directly affect the income statement. Accurate distinction between provisions and reserves ensures transparent financial reporting and compliance with accounting standards such as IFRS and GAAP.

Regulatory Guidelines and Standards

Provisions and reserves are distinct accounting terms governed by regulatory guidelines such as IFRS and GAAP, where provisions represent liabilities of uncertain timing or amount recognized based on probable outflows. Regulatory standards mandate provisions to be created for anticipated losses, ensuring accurate financial representation and compliance with prudence principles. Reserves, in contrast, reflect appropriations of retained earnings for specific purposes or contingencies and are not recognized as liabilities under prevailing accounting standards.

Practical Examples of Provisions vs Reserves

Provisions in accounting are estimated liabilities recorded for probable future expenses, such as a company setting aside $50,000 for potential lawsuits based on past legal cases. Reserves represent appropriations of retained earnings for specific purposes, like a $100,000 general reserve created to strengthen the company's financial stability. While provisions impact profit and loss by recognizing anticipated obligations, reserves are shown in the equity section as internally allocated funds without immediate expense recognition.

Important Terms

Contingent Liability

Contingent liabilities require disclosure and potentially provisions under IFRS or GAAP when probable and estimable, whereas reserves are internal appropriations of retained earnings not recognized as liabilities.

Accrual Concept

The accrual concept mandates recognizing expenses and liabilities when incurred, making provisions essential for uncertain liabilities, whereas reserves are appropriations of profits without liability recognition.

Deferred Tax

Deferred tax arises from temporary differences between accounting provisions and reserves recognized in financial statements and their corresponding tax base values.

Expected Credit Loss

Expected Credit Loss (ECL) quantifies future credit risk and guides financial institutions to establish appropriate provisions rather than reserves, reflecting anticipated loan impairments under IFRS 9 standards.

Specific Reserve

Specific reserve represents funds set aside from profits to cover identified potential losses, differing from general provisions which address estimated or uncertain liabilities without precise identification.

General Reserve

General Reserve is an appropriation of profits set aside from retained earnings, unlike provisions which are recognized liabilities for specific future expenses or losses.

Impairment Loss

Impairment loss reflects the reduction in asset value recognized when carrying amount exceeds recoverable amount, distinguished from provisions, which address present obligations with uncertain timing or amount, and reserves, which are portions of equity set aside for specific purposes without liability recognition.

Prudence Principle

The Prudence Principle in accounting mandates recognizing provisions for probable liabilities while prohibiting the creation of reserves from profits to prevent overstating financial health.

Asset Revaluation Reserve

Asset Revaluation Reserve reflects increased asset values from revaluation, whereas provisions are liabilities recognized for probable future expenses, highlighting that reserves represent equity adjustments and provisions represent potential obligations.

Allowance for Doubtful Debts

Allowance for Doubtful Debts is a provision accounting estimate reflecting anticipated uncollectible receivables, whereas a reserve generally denotes retained earnings set aside for potential future losses without direct linkage to specific receivables.

provision vs reserve Infographic

moneydif.com

moneydif.com