Hedge accounting aligns the accounting treatment of hedging instruments with the underlying exposures, reducing volatility in reported earnings by matching gains and losses on derivatives with the hedged items. In contrast, fair value accounting requires assets and liabilities to be recorded at their current market values, which can introduce fluctuations in financial statements due to market price changes. Choosing between hedge accounting and fair value accounting depends on the company's risk management strategy and the desire for earnings stability versus market value reflection.

Table of Comparison

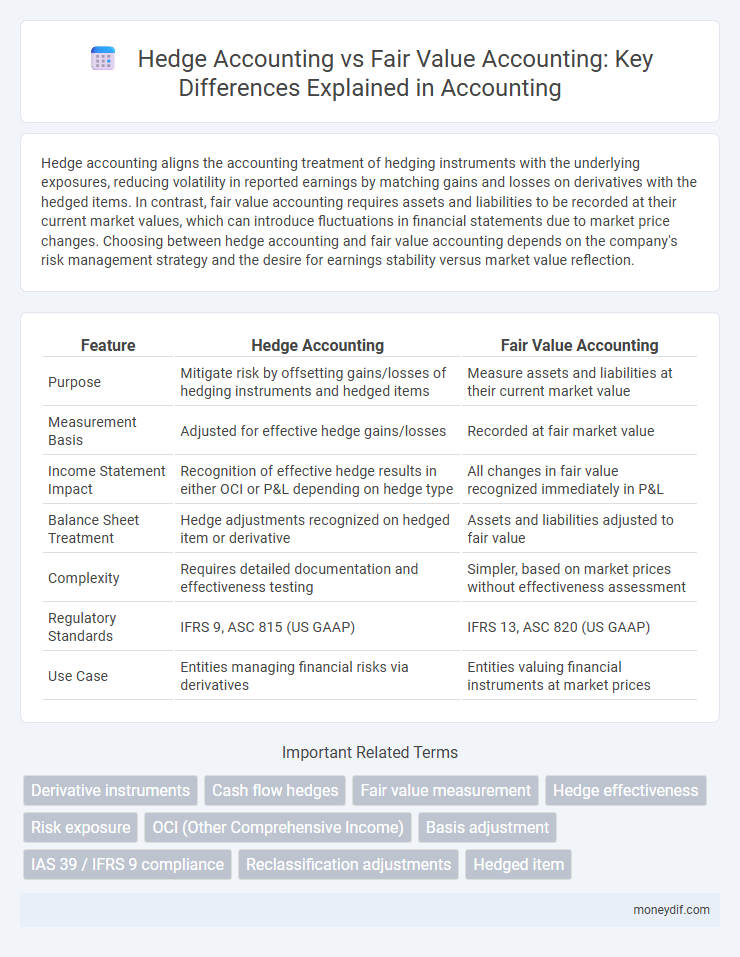

| Feature | Hedge Accounting | Fair Value Accounting |

|---|---|---|

| Purpose | Mitigate risk by offsetting gains/losses of hedging instruments and hedged items | Measure assets and liabilities at their current market value |

| Measurement Basis | Adjusted for effective hedge gains/losses | Recorded at fair market value |

| Income Statement Impact | Recognition of effective hedge results in either OCI or P&L depending on hedge type | All changes in fair value recognized immediately in P&L |

| Balance Sheet Treatment | Hedge adjustments recognized on hedged item or derivative | Assets and liabilities adjusted to fair value |

| Complexity | Requires detailed documentation and effectiveness testing | Simpler, based on market prices without effectiveness assessment |

| Regulatory Standards | IFRS 9, ASC 815 (US GAAP) | IFRS 13, ASC 820 (US GAAP) |

| Use Case | Entities managing financial risks via derivatives | Entities valuing financial instruments at market prices |

Introduction to Hedge Accounting and Fair Value Accounting

Hedge accounting aligns the accounting treatment of hedging instruments and the related hedged items to reduce volatility in financial statements caused by fluctuating fair values. Fair value accounting measures assets and liabilities at their current market value, reflecting real-time economic conditions but often introducing earnings volatility. Understanding the differences enables companies to implement effective risk management strategies and present more accurate financial information.

Key Concepts and Definitions

Hedge accounting aligns the timing of gains and losses on hedging instruments with the underlying exposure, stabilizing reported earnings by offsetting changes in fair value or cash flows related to risk management activities. Fair value accounting measures and reports assets and liabilities at their current market value, reflecting real-time financial positions but introducing volatility to earnings. Understanding derivatives, hedging relationships, and designation criteria is essential for applying hedge accounting according to IFRS 9 or ASC 815 standards.

Objectives and Purposes of Each Approach

Hedge accounting aims to reduce volatility in financial statements by aligning the timing of gains and losses on hedging instruments with the exposure they offset, providing a clearer picture of risk management effectiveness. Fair value accounting measures assets and liabilities at their current market value, reflecting real-time financial positions and promoting transparency for investors. Each approach serves distinct purposes: hedge accounting focuses on risk mitigation and matching economic outcomes, while fair value accounting prioritizes accurate valuation and market responsiveness.

Measurement and Recognition Techniques

Hedge accounting applies specific measurement and recognition techniques to align the timing of gains and losses on hedging instruments with the hedged item's fluctuations, enhancing financial statement relevance. Fair value accounting requires assets and liabilities to be measured at their current market value, with all changes recognized immediately in profit or loss, reflecting real-time economic conditions. The key distinction lies in hedge accounting's use of designated hedging relationships to mitigate volatility, whereas fair value accounting consistently reports fair value changes without offsetting adjustments.

Types of Hedges and Fair Value Instruments

Hedge accounting includes types such as fair value hedges, cash flow hedges, and net investment hedges, each designed to manage different risk exposures like interest rate risk, foreign currency risk, or commodity price risk. Fair value accounting requires measuring financial instruments, including derivatives, at their current market value, reflecting real-time price fluctuations in assets like bonds, stocks, and foreign exchange contracts. Effective hedge accounting aligns the timing of gain or loss recognition on the hedging instrument with the hedged item, whereas fair value accounting captures changes in market value directly through profit or loss.

Impact on Financial Statements

Hedge accounting stabilizes earnings by matching the timing of gains and losses on hedging instruments with the exposure they offset, reducing volatility in financial statements. Fair value accounting reflects assets and liabilities at current market prices, causing fluctuations in profit or loss due to market movements. The choice between these methods significantly influences reported earnings, asset values, and risk exposure transparency in financial statements.

Compliance with Accounting Standards (IFRS & GAAP)

Hedge accounting aligns with IFRS 9 and ASC 815 by allowing entities to qualify and designate hedging relationships, minimizing profit and loss volatility through specific documentation and effectiveness testing requirements. Fair value accounting, governed by IFRS 13 and ASC 820, mandates measurement of financial instruments at fair value with changes recognized immediately in profit and loss, ensuring transparency but potentially increasing earnings volatility. Compliance with these standards requires careful assessment of eligibility, ongoing validation, and detailed disclosures to meet regulatory expectations and provide accurate financial representation.

Benefits and Challenges of Hedge Accounting

Hedge accounting provides benefits such as better alignment of the timing of gains and losses with the underlying risk management activities, reducing income statement volatility and enhancing financial statement relevance for stakeholders. Challenges include complex documentation requirements, ongoing effectiveness testing, and limitations on hedge designation that can increase administrative burden and affect flexibility. Firms must weigh these factors carefully to optimize risk management strategies and comply with regulatory standards like IFRS 9 or ASC 815.

Limitations and Criticisms of Fair Value Accounting

Fair value accounting faces criticism for its susceptibility to market volatility, resulting in earnings fluctuations that may not reflect an entity's long-term financial health. Its reliance on active market prices can pose significant challenges during illiquid or distressed market conditions, leading to potentially unreliable asset valuations. Moreover, fair value measurements often increase complexity and subjectivity in financial reporting, complicating investor decision-making and reducing comparability across firms.

Practical Examples and Industry Applications

Hedge accounting aligns the timing of gains and losses on hedging instruments with the related exposures, commonly used in industries like energy and manufacturing to manage commodity price risks. Fair value accounting reflects the current market value of assets and liabilities on financial statements, critical for financial institutions managing portfolios of securities and derivatives. Practical examples include airlines using hedge accounting to lock in fuel costs, while investment firms apply fair value accounting to report real-time portfolio performance.

Important Terms

Derivative instruments

Derivative instruments under hedge accounting are used to mitigate specific financial risks by matching the timing of gains and losses with the hedged item, thereby reducing income statement volatility. In contrast, fair value accounting requires derivatives to be measured at their current market value, resulting in immediate recognition of gains and losses, which can increase earnings variability.

Cash flow hedges

Cash flow hedges focus on managing the variability of cash flows related to forecasted transactions by deferring gains and losses in other comprehensive income until the hedged item affects profit or loss, aligning with hedge accounting principles. Fair value accounting, by contrast, recognizes changes in the fair value of hedging instruments immediately in earnings, affecting profit volatility without deferral.

Fair value measurement

Fair value measurement in hedge accounting focuses on assessing the changes in the fair value of hedging instruments and hedged items to offset risks, aligning gains and losses to the timing of underlying exposures. In contrast, fair value accounting requires assets and liabilities to be measured at their current market value regardless of hedging relationships, often causing volatility in financial statements.

Hedge effectiveness

Hedge effectiveness measures the extent to which changes in the fair value or cash flows of a hedging instrument offset the changes in the hedged item, playing a critical role in hedge accounting to qualify for special financial reporting treatment. Unlike fair value accounting, which recognizes gains and losses directly in profit or loss, hedge accounting aims to match the timing of these gains and losses to the underlying risk exposures, enhancing financial statement accuracy and reducing volatility.

Risk exposure

Risk exposure in hedge accounting is managed through matching the hedging instrument's gains or losses with the exposure's losses or gains, stabilizing earnings and reducing volatility on the financial statements. Fair value accounting, by contrast, reflects real-time market values of assets and liabilities, which can increase reported earnings volatility due to fluctuating market conditions and unhedged exposures.

OCI (Other Comprehensive Income)

OCI (Other Comprehensive Income) plays a critical role in hedge accounting by allowing gains and losses on hedging instruments to be recorded outside net income, thereby reducing income statement volatility compared to fair value accounting, which recognizes all gains and losses immediately in profit or loss. Hedge accounting aligns the timing of gains and losses on hedging instruments with the hedged item's impact on earnings, whereas fair value accounting reflects current market values directly in net income, potentially causing earnings fluctuations.

Basis adjustment

Basis adjustment modifies the carrying amount of a hedged item in hedge accounting to reflect changes in the hedging instrument's fair value, aligning gain or loss recognition with the hedge relationship and improving profit and loss volatility management. In fair value accounting, assets and liabilities are recorded at their current market values without adjusting for hedging relationships, potentially causing greater earnings fluctuations compared to the smoother results achieved through basis adjustments in hedge accounting.

IAS 39 / IFRS 9 compliance

IAS 39 and IFRS 9 outline distinct frameworks for hedge accounting, focusing on risk management objectives and effectiveness testing to align financial statements with an entity's hedging strategies, whereas fair value accounting mandates measuring financial instruments at market value, reflecting current economic conditions. IFRS 9 significantly improves hedge accounting flexibility by allowing more hedging relationships and removing the strict 80-125% effectiveness threshold present in IAS 39, enhancing the relevance and reliability of financial reporting for entities engaged in risk mitigation.

Reclassification adjustments

Reclassification adjustments in hedge accounting arise when gains or losses recognized in other comprehensive income are reclassified into profit or loss to offset the hedged item's impact, ensuring effective risk management reflection. In contrast, fair value accounting records changes directly in profit or loss, resulting in immediate earnings volatility without deferred recognition through reclassification adjustments.

Hedged item

Hedged items in hedge accounting are designated components of an entity's assets, liabilities, or forecasted transactions that are protected against risks such as interest rate fluctuations or foreign currency exposure, effectively offsetting changes in fair value to stabilize financial results. In contrast, fair value accounting measures these items at their current market value, recognizing gains or losses immediately in profit or loss, which can increase earnings volatility compared to the risk mitigation purpose of hedge accounting.

hedge accounting vs fair value accounting Infographic

moneydif.com

moneydif.com