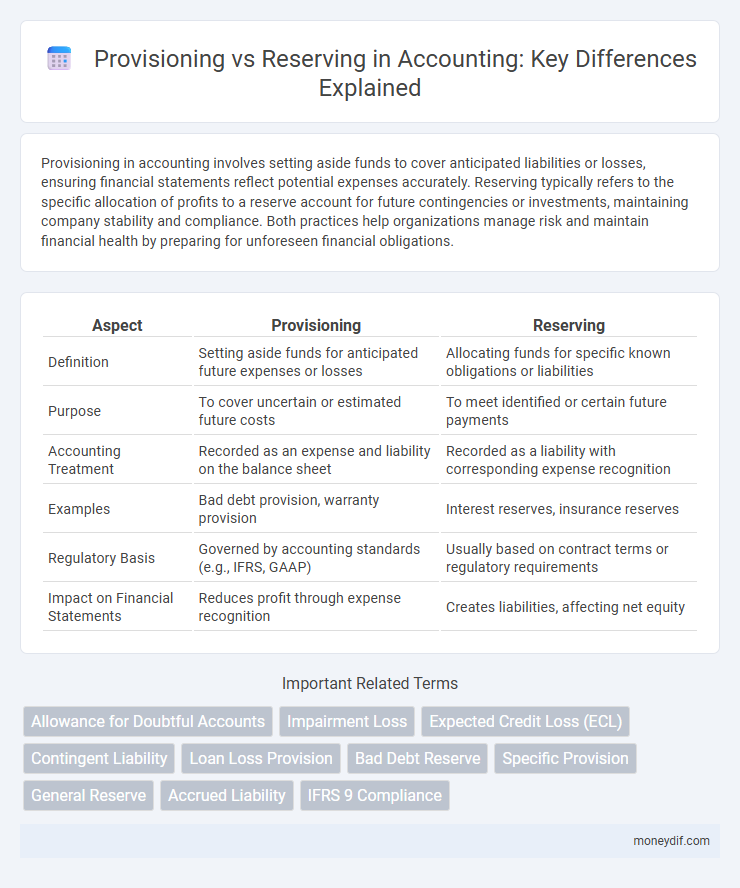

Provisioning in accounting involves setting aside funds to cover anticipated liabilities or losses, ensuring financial statements reflect potential expenses accurately. Reserving typically refers to the specific allocation of profits to a reserve account for future contingencies or investments, maintaining company stability and compliance. Both practices help organizations manage risk and maintain financial health by preparing for unforeseen financial obligations.

Table of Comparison

| Aspect | Provisioning | Reserving |

|---|---|---|

| Definition | Setting aside funds for anticipated future expenses or losses | Allocating funds for specific known obligations or liabilities |

| Purpose | To cover uncertain or estimated future costs | To meet identified or certain future payments |

| Accounting Treatment | Recorded as an expense and liability on the balance sheet | Recorded as a liability with corresponding expense recognition |

| Examples | Bad debt provision, warranty provision | Interest reserves, insurance reserves |

| Regulatory Basis | Governed by accounting standards (e.g., IFRS, GAAP) | Usually based on contract terms or regulatory requirements |

| Impact on Financial Statements | Reduces profit through expense recognition | Creates liabilities, affecting net equity |

Defining Provisioning in Accounting

Provisioning in accounting refers to the practice of setting aside a specific amount of funds to cover anticipated future liabilities or losses, ensuring financial statements reflect potential risks accurately. It involves estimating probable expenses such as bad debts, warranties, or legal claims based on historical data and current conditions. This proactive approach helps maintain compliance with accounting standards like IFRS and GAAP by recognizing expenses in the period they are incurred rather than when they materialize.

Understanding Reserving: Key Concepts

Reserving in accounting refers to the process of setting aside specific amounts of funds to cover future liabilities or expenses that are probable but uncertain in amount or timing. Key concepts include recognizing reserves as liabilities on the balance sheet, adhering to accounting standards such as IFRS or GAAP, and ensuring that reserves are regularly reviewed and adjusted to reflect updated information. This practice helps companies manage financial risk and maintain accurate financial statements by anticipating potential obligations.

Provisioning vs Reserving: Core Differences

Provisioning in accounting refers to setting aside funds to cover anticipated liabilities or losses based on estimated future expenses, while reserving involves earmarking specific amounts within equity for particular purposes or contingencies. Provisioning impacts the income statement by recognizing expenses upfront to reflect expected costs, whereas reserving primarily adjusts the balance sheet without directly affecting profit or loss. Understanding these core differences ensures accurate financial reporting and compliance with accounting standards like IFRS and GAAP.

Purpose and Objectives of Provisions

Provisions in accounting are established to recognize liabilities of uncertain timing or amount, ensuring accurate reflection of potential future expenses and compliance with accounting standards like IFRS and GAAP. The primary purpose is to create financial resilience by anticipating probable losses or obligations, thereby safeguarding the company's financial position. Objectives include matching expenses to the relevant accounting period and providing stakeholders with transparent, reliable financial information.

Purpose and Objectives of Reserves

Reserves in accounting serve the purpose of safeguarding a company's financial stability by allocating funds for anticipated future liabilities or expenses. These provisions ensure that businesses maintain sufficient resources to absorb potential losses or obligations, enhancing financial accountability and transparency. Establishing reserves supports prudent financial management by promoting accurate profit measurement and compliance with regulatory requirements.

Recognition Criteria: Provisions and Reserves

Provisions are liabilities recognized when there is a present obligation resulting from past events, a probable outflow of resources, and a reliable estimate can be made. Reserves, on the other hand, are portions of equity set aside by management for future expenses or losses without meeting liability recognition criteria. The recognition criteria for provisions follow IAS 37 guidelines, requiring a detailed assessment of legal or constructive obligations, whereas reserves lack formal recognition on the balance sheet as liabilities.

Accounting Standards: Provisions vs Reserves

Accounting standards differentiate provisions and reserves by their purpose and recognition criteria; provisions are liabilities with uncertain timing or amount, recognized under IAS 37 when a present obligation exists, while reserves represent retained earnings allocations without specific liabilities. Provisions require reliable measurement and probable outflow of resources, reflecting expected future expenses or losses, contrasting with reserves, which function as equity buffers or retained profit appropriations. Understanding these distinctions ensures compliance with IFRS and GAAP, enhancing financial statement accuracy and stakeholder transparency.

Financial Statement Impact of Provisions and Reserves

Provisions directly reduce a company's profit and increase liabilities on the balance sheet as they represent probable future obligations estimated with reasonable certainty. Reserves, shown within equity, do not impact profit or liabilities immediately but act as internal funds set aside from retained earnings to strengthen financial stability. The distinction significantly influences financial statements by affecting net income and the presentation of liabilities versus equity.

Examples of Provisions and Reserves in Practice

Provisions in accounting include allowances for doubtful debts, warranties, and legal claims, representing estimated liabilities based on probable future expenses. Reserves, such as general reserves and capital reserves, are appropriations of profits retained to strengthen financial stability or fund future investments. For instance, a company may create a warranty provision to cover expected repair costs, while maintaining a general reserve to cushion against unforeseen financial downturns.

Best Practices for Managing Provisions and Reserves

Best practices for managing provisions and reserves include ensuring accurate estimation based on historical data, current financial conditions, and risk assessments to maintain compliance with accounting standards such as IFRS and GAAP. Regularly reviewing and adjusting the amounts to reflect changes in liabilities or obligations ensures transparency and prevents financial misstatements. Implementing robust documentation and approval processes enhances audit readiness and supports effective financial decision-making.

Important Terms

Allowance for Doubtful Accounts

Allowance for Doubtful Accounts represents a contra-asset account that estimates uncollectible receivables, serving as a provisioning technique to match bad debt expenses with related revenue. Reserving involves setting aside specific funds based on historical data and risk assessment, ensuring financial statements reflect a realistic value of accounts receivable.

Impairment Loss

Impairment loss reflects a significant decline in the recoverable value of an asset, necessitating provisioning to recognize estimated future losses on financial statements, whereas reserving involves setting aside funds for anticipated liabilities without an immediate recognition of asset value reduction. Provisions adjust the carrying amount of impaired assets directly, impacting profit and loss, while reserves serve as general financial buffers for uncertain risks not specifically tied to asset impairment.

Expected Credit Loss (ECL)

Expected Credit Loss (ECL) represents the estimated loss from credit exposures over the life of a financial asset, serving as the basis for timely provisioning under accounting standards like IFRS 9. Provisions reflect the recognition of ECL in financial statements, whereas reserves are internal allocations maintained by financial institutions as a buffer beyond regulatory or accounting requirements.

Contingent Liability

Contingent liability refers to a potential obligation that may arise depending on the outcome of a future event, necessitating the creation of provisions when the liability is probable and the amount can be reasonably estimated. In contrast, reserving involves setting aside resources for known liabilities or expenses already incurred, reflecting a more certain financial commitment compared to the conditional nature of contingent liabilities.

Loan Loss Provision

Loan Loss Provision represents the expense set aside to cover potential loan defaults, directly impacting a bank's income statement and reflecting anticipated credit losses. In contrast, Loan Loss Reserves constitute the accumulated balance of these provisions on the balance sheet, serving as a financial buffer to absorb actual loan losses and maintain asset quality.

Bad Debt Reserve

Bad Debt Reserve represents funds set aside to cover potential uncollectible accounts, reflecting estimated credit losses based on historical data and risk assessment. Provisioning involves recognizing an expense in financial statements to create or adjust the bad debt reserve, ensuring accurate reflection of anticipated credit risks.

Specific Provision

Specific provision refers to the allocation of funds to cover known, identifiable liabilities or potential losses, ensuring accurate financial reporting. Unlike general reserves, specific provisions are directly tied to particular risks or doubtful assets, enhancing transparency in accounting practices.

General Reserve

General Reserve represents accumulated retained earnings set aside by a company to strengthen its financial stability, distinct from specific provisions that are created to cover known liabilities or potential losses. Unlike provisioning, which requires compliance with accounting standards and regulatory guidelines for anticipated expenses, general reserves provide flexible financial cushioning without earmarked liabilities, supporting long-term business sustainability and unforeseen contingencies.

Accrued Liability

Accrued liability represents expenses recognized on the balance sheet before payment is made, differing from provisioning which involves estimating future liabilities with uncertain timing or amount, while reserving refers to setting aside funds for known future obligations. Accurate management of accrued liabilities ensures compliance with accounting standards such as GAAP and IFRS and enhances financial reporting transparency.

IFRS 9 Compliance

IFRS 9 compliance mandates entities to apply an expected credit loss (ECL) model for provisioning financial assets, which requires forward-looking estimations of credit risk rather than historical loss events. Provisioning under IFRS 9 focuses on accurately measuring impairment through three stages of credit deterioration, while reserving refers more broadly to setting aside funds for potential future losses, often influenced by regulatory or policy requirements beyond IFRS mandates.

provisioning vs reserving Infographic

moneydif.com

moneydif.com