The subsidiary ledger provides detailed information on individual accounts, such as accounts receivable or accounts payable, facilitating precise tracking of transactions. The general ledger consolidates these detailed entries into summary balances, offering an overall view of the company's financial status. Efficient integration between subsidiary ledgers and the general ledger ensures accurate financial reporting and streamlined accounting processes.

Table of Comparison

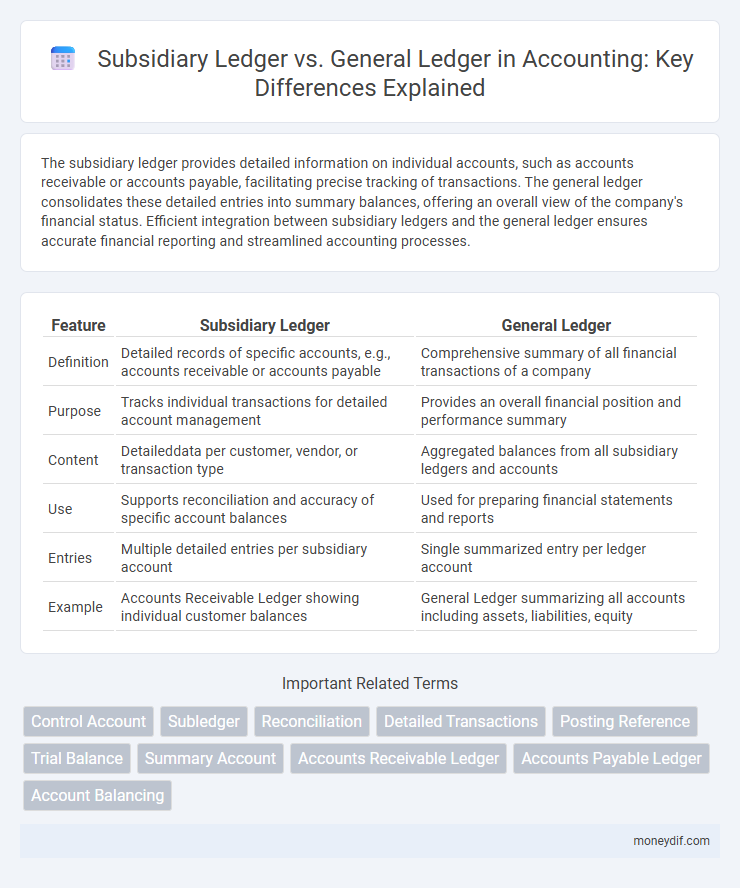

| Feature | Subsidiary Ledger | General Ledger |

|---|---|---|

| Definition | Detailed records of specific accounts, e.g., accounts receivable or accounts payable | Comprehensive summary of all financial transactions of a company |

| Purpose | Tracks individual transactions for detailed account management | Provides an overall financial position and performance summary |

| Content | Detaileddata per customer, vendor, or transaction type | Aggregated balances from all subsidiary ledgers and accounts |

| Use | Supports reconciliation and accuracy of specific account balances | Used for preparing financial statements and reports |

| Entries | Multiple detailed entries per subsidiary account | Single summarized entry per ledger account |

| Example | Accounts Receivable Ledger showing individual customer balances | General Ledger summarizing all accounts including assets, liabilities, equity |

Introduction to Subsidiary and General Ledgers

Subsidiary ledgers provide detailed information for specific accounts, such as accounts receivable or accounts payable, supporting the summarized data in the general ledger. The general ledger consolidates all financial transactions and serves as the primary record for preparing financial statements. Understanding the distinction between subsidiary and general ledgers enhances accuracy in tracking individual transactions and overall account balances.

Definition of General Ledger

The general ledger is a comprehensive accounting record that consolidates all financial transactions from various subsidiary ledgers, providing a complete overview of a company's financial position. It contains detailed accounts such as assets, liabilities, equity, revenues, and expenses, serving as the primary source for preparing financial statements. Unlike subsidiary ledgers, which track individual transactions for specific accounts, the general ledger summarizes these entries to ensure accuracy and consistency in the financial reporting process.

Definition of Subsidiary Ledger

A subsidiary ledger is a detailed set of accounts that breaks down and records individual transactions for specific categories such as accounts receivable or accounts payable. It supports the general ledger by providing granularity and tracking customer or vendor balances separately. This ledger enhances accuracy and simplifies reconciliation by summarizing detailed data into a control account in the general ledger.

Key Differences Between General and Subsidiary Ledgers

General ledgers provide a comprehensive record of all financial transactions and summarize account balances across the entire organization. Subsidiary ledgers break down the general ledger's summary accounts into detailed entries, such as individual customer or vendor transactions. The key difference lies in the level of detail: general ledgers offer a macro view of financial data, while subsidiary ledgers enable granular tracking and reconciliation of specific accounts.

Role of General Ledger in Financial Reporting

The general ledger serves as the primary record for all financial transactions, consolidating data from subsidiary ledgers to provide a comprehensive overview of a company's financial position. It ensures accuracy and completeness in financial reporting by organizing accounts such as assets, liabilities, equity, revenues, and expenses. The general ledger is essential for preparing financial statements, facilitating audits, and supporting regulatory compliance.

Importance of Subsidiary Ledgers in Account Detailing

Subsidiary ledgers provide detailed information for individual accounts, enhancing the accuracy and transparency of financial records beyond the summary data in the general ledger. They facilitate efficient tracking of transactions related to specific customers, vendors, or assets, improving account reconciliation and internal control. This detailed account information supports accurate financial reporting and streamlines audit processes, making subsidiary ledgers essential for effective accounting management.

Examples of Common Subsidiary Ledgers

Common subsidiary ledgers include the accounts receivable ledger, which tracks individual customer balances and payments, and the accounts payable ledger, detailing amounts owed to each supplier. Inventory subsidiary ledgers maintain specifics on stock quantities and movements, while fixed assets ledgers record acquisition, depreciation, and disposal of company assets. These ledgers support the general ledger by providing detailed transaction data that aggregate into control accounts for accurate financial reporting.

Integration of Subsidiary Ledgers with the General Ledger

Subsidiary ledgers provide detailed transaction data that supports the summarized account balances recorded in the general ledger, ensuring accuracy and completeness in financial reporting. Integration of subsidiary ledgers with the general ledger enables seamless reconciliation and real-time updates, allowing for efficient tracking of accounts receivable, accounts payable, and fixed assets. This close alignment facilitates error minimization and enhances the reliability of the overall accounting system.

Advantages and Disadvantages of Using Subsidiary Ledgers

Subsidiary ledgers offer the advantage of detailed transaction tracking by breaking down account balances from the general ledger, enhancing accuracy and simplifying error identification. They improve management control and facilitate reconciliation but require additional maintenance effort and can lead to data redundancy if not properly synchronized with the general ledger. The complexity of managing multiple subsidiary ledgers may increase processing time and risk inconsistencies without rigorous internal controls.

Best Practices for Managing Ledgers in Accounting Systems

Effective management of subsidiary ledgers requires regular reconciliation with the general ledger to ensure data accuracy and prevent discrepancies. Implementing automated software solutions can streamline updates and improve real-time financial reporting between ledgers. Maintaining clear documentation and standardized procedures for posting transactions enhances audit trails and supports compliance with accounting standards.

Important Terms

Control Account

A Control Account summarizes the total balances of related subsidiary ledger accounts, providing a concise overview in the general ledger while maintaining detailed transaction records separately. This structure enhances accuracy and efficiency in financial reporting by reconciling individual subsidiary accounts with the aggregate totals in the control account.

Subledger

A subledger, also known as a subsidiary ledger, contains detailed transactional data for specific accounts such as accounts receivable or accounts payable, providing granular insights that support the summary balances recorded in the general ledger. While the general ledger consolidates overall financial information for an organization, subledgers facilitate detailed tracking and reconciliation of individual transactions before they are summarized in the general ledger.

Reconciliation

Reconciliation between subsidiary ledger and general ledger ensures accuracy by matching detailed transactional data in the subsidiary ledger with summarized balances in the general ledger, preventing discrepancies and maintaining financial integrity. This process is crucial for verifying individual accounts such as accounts receivable or payable against the overarching control accounts recorded in the general ledger.

Detailed Transactions

Detailed transactions in a subsidiary ledger provide granular information on individual accounts, such as accounts receivable or accounts payable, enabling precise tracking of each customer or supplier balance. The general ledger consolidates these detailed entries into summary-level accounts, ensuring comprehensive financial reporting and maintaining overall accuracy in the company's financial statements.

Posting Reference

Posting reference links transactions recorded in the subsidiary ledger to the corresponding entries in the general ledger, ensuring accuracy and traceability in financial records. This practice facilitates reconciliation by enabling cross-checking of individual account details against summarized ledger balances.

Trial Balance

Trial balance compiles all debit and credit balances from the general ledger accounts to ensure accounting accuracy, while subsidiary ledgers contain detailed individual account data supporting the summarized figures in the general ledger. Reconciliation between the subsidiary ledger totals and the related general ledger control accounts is essential for verifying completeness and accuracy in financial reporting.

Summary Account

A Summary Account consolidates detailed transactions recorded in subsidiary ledgers, providing a single balance reflected in the corresponding General Ledger account. This structure enhances accuracy and efficiency in financial reporting by linking granular data to overarching financial statements.

Accounts Receivable Ledger

The Accounts Receivable Ledger functions as a detailed subsidiary ledger that records individual customer transactions, providing granular insight beyond the summarized balances maintained in the General Ledger. This segregation enhances accuracy in tracking outstanding customer balances and facilitates efficient reconciliation within the overall financial accounting system.

Accounts Payable Ledger

The Accounts Payable Ledger serves as a subsidiary ledger that details individual creditor transactions, enhancing the accuracy and management of payables by recording specific invoice and payment data. In contrast, the General Ledger consolidates these subsidiary accounts into a single Accounts Payable control account, providing an overall summary for financial reporting and ensuring trial balance integrity.

Account Balancing

Account balancing ensures the consistency and accuracy of financial records by reconciling subsidiary ledger totals with the corresponding general ledger control accounts. This process detects discrepancies between detailed transaction records and summarized financial statements, supporting accurate financial reporting and audit trails.

subsidiary ledger vs general ledger Infographic

moneydif.com

moneydif.com