Variable costs fluctuate directly with production volume, increasing as output rises and decreasing when it falls, making them essential for cost control in budgeting. Fixed costs remain constant regardless of production levels, covering expenses such as rent and salaries, which must be managed to maintain profitability during periods of low sales. Understanding the distinction between variable and fixed costs is crucial for accurate financial forecasting and strategic decision-making in accounting.

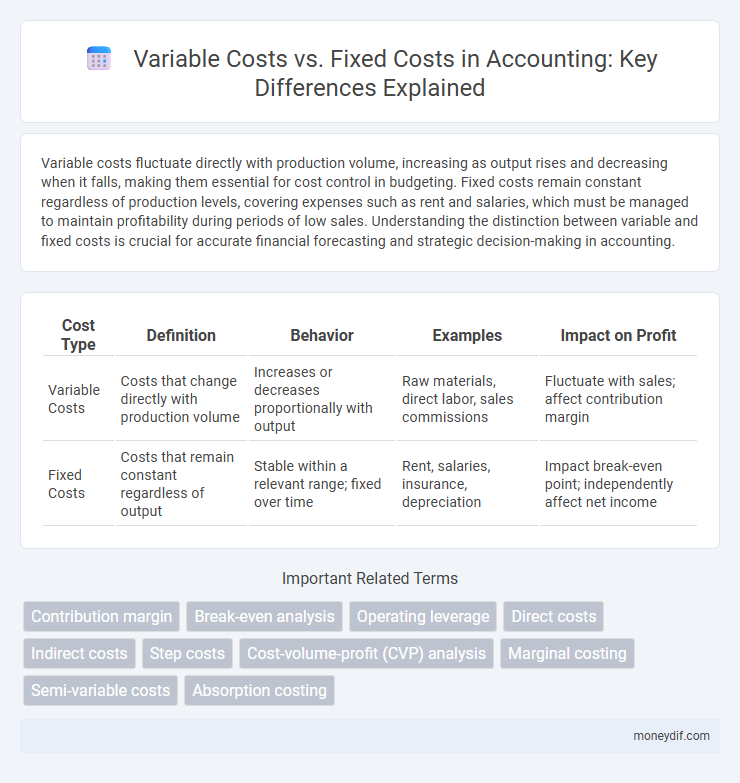

Table of Comparison

| Cost Type | Definition | Behavior | Examples | Impact on Profit |

|---|---|---|---|---|

| Variable Costs | Costs that change directly with production volume | Increases or decreases proportionally with output | Raw materials, direct labor, sales commissions | Fluctuate with sales; affect contribution margin |

| Fixed Costs | Costs that remain constant regardless of output | Stable within a relevant range; fixed over time | Rent, salaries, insurance, depreciation | Impact break-even point; independently affect net income |

Introduction to Variable and Fixed Costs

Variable costs fluctuate directly with production volume, increasing as output rises and decreasing when output falls. Fixed costs remain constant regardless of production levels, including expenses like rent, salaries, and insurance. Understanding the distinction between variable and fixed costs is essential for effective budgeting, cost control, and decision-making in managerial accounting.

Defining Variable Costs in Accounting

Variable costs in accounting refer to expenses that fluctuate directly with production volume or sales activity, such as raw materials, direct labor, and utility costs linked to manufacturing. These costs increase as output rises and decrease when production slows, making them crucial for cost behavior analysis and budgeting. Understanding variable costs helps businesses predict profit margins and manage operational efficiency effectively.

Understanding Fixed Costs in Business

Fixed costs in business are expenses that remain constant regardless of production volume, such as rent, salaries, and insurance premiums. These costs do not fluctuate with sales or output levels, ensuring predictable budgeting and financial planning. Understanding fixed costs is crucial for break-even analysis and determining the minimum revenue required to cover operational expenses.

Key Differences Between Variable and Fixed Costs

Variable costs fluctuate directly with production volume, such as raw materials and direct labor expenses, while fixed costs remain constant regardless of output, including rent and salaried employee wages. Variable costs impact contribution margin and are crucial for break-even analysis, whereas fixed costs affect operating leverage and long-term financial planning. Understanding these key differences helps managers optimize budgeting, cost control, and profitability strategies.

Examples of Variable Costs

Variable costs in accounting fluctuate directly with production volume or sales activity, examples include raw materials, direct labor, and sales commissions. Costs such as packaging, shipping expenses, and utility costs tied to manufacturing usage also vary based on output levels. Understanding these examples helps businesses accurately forecast expenses and manage operational efficiency.

Common Fixed Costs in Organizations

Common fixed costs in organizations are expenses that remain constant regardless of production levels and cannot be directly traced to a specific product or department. These costs include rent, salaries of administrative staff, and insurance premiums, which support multiple departments or products simultaneously. Proper allocation of common fixed costs is crucial for accurate product costing and profitability analysis in managerial accounting.

Impact on Profitability and Break-Even Analysis

Variable costs fluctuate directly with production volume, impacting profitability by increasing total expenses as output rises, thereby affecting the break-even point. Fixed costs remain constant regardless of production levels, requiring sufficient sales to cover these expenses before generating profit, which stabilizes break-even analysis but demands higher sales to avoid losses. Understanding the balance between variable and fixed costs is essential for accurate profit forecasting and strategic pricing decisions.

Role in Cost-Volume-Profit Analysis

Variable costs fluctuate in direct proportion to production volume, significantly impacting the calculation of contribution margin in Cost-Volume-Profit (CVP) analysis. Fixed costs remain constant regardless of output level, providing a baseline against which profitability thresholds and break-even points are determined. Understanding the interplay between variable and fixed costs enables accurate prediction of profit changes as sales volume varies, optimizing managerial decision-making.

Strategies for Managing Variable and Fixed Costs

Effective strategies for managing variable costs include closely monitoring production volumes and negotiating supplier contracts to maintain flexibility and cost control. Fixed costs require long-term planning and periodic reviews to optimize resource allocation and minimize overhead without compromising operational efficiency. Leveraging activity-based costing helps in accurately assigning costs, enhancing decision-making for both variable and fixed expenses.

Importance in Budgeting and Financial Planning

Variable costs fluctuate directly with production levels, making them crucial for accurate budgeting and forecasting in dynamic business environments. Fixed costs, remaining constant regardless of output, provide a baseline for financial planning and help ensure stability in long-term budgeting. Understanding the interplay between variable and fixed costs enables more precise allocation of resources and effective cost control strategies.

Important Terms

Contribution margin

Contribution margin represents the difference between sales revenue and variable costs, highlighting the amount available to cover fixed costs and generate profit. Variable costs fluctuate with production volume, while fixed costs remain constant regardless of output, making contribution margin a critical metric to analyze cost behavior and profitability.

Break-even analysis

Break-even analysis identifies the sales volume at which total revenues equal total costs, separating fixed costs like rent and salaries from variable costs such as materials and direct labor. Understanding the proportion of variable costs versus fixed costs is crucial for calculating the break-even point, as higher fixed costs increase the required sales volume, while higher variable costs impact the profit margin per unit.

Operating leverage

Operating leverage measures how a company's operating income changes with sales volume, influenced by the proportion of fixed costs to variable costs in the cost structure. Higher fixed costs and lower variable costs result in greater operating leverage, amplifying profit fluctuations relative to sales changes.

Direct costs

Direct costs primarily consist of variable costs that fluctuate with production levels, such as raw materials and labor directly involved in manufacturing. Fixed costs, like rent and salaried wages, remain constant regardless of output and are typically not classified as direct costs since they do not vary with product volume.

Indirect costs

Indirect costs, encompassing both variable and fixed costs, refer to expenses not directly attributable to a specific product but necessary for overall operations, such as rent (fixed) and utilities (variable). Variable indirect costs fluctuate with production levels, whereas fixed indirect costs remain constant regardless of output.

Step costs

Step costs are expenses that remain fixed over a specific range of activity but increase in discrete increments once that range is exceeded, differing from variable costs which change proportionally with activity levels and fixed costs that remain constant regardless of production volume. These costs create challenges in budgeting and forecasting as they exhibit characteristics of both fixed and variable costs, requiring careful analysis to optimize operational efficiency.

Cost-volume-profit (CVP) analysis

Cost-volume-profit (CVP) analysis evaluates how changes in sales volume affect net income by examining the interplay between variable costs, which fluctuate directly with production levels, and fixed costs, which remain constant regardless of output. Understanding the contribution margin per unit, derived from subtracting variable costs from sales price, is essential for determining break-even points and profit targets in CVP analysis.

Marginal costing

Marginal costing focuses on variable costs, considering only those costs that change with production volume while treating fixed costs as period expenses unrelated to output levels. This method enhances decision-making by isolating the impact of variable costs on profitability and contribution margin analysis.

Semi-variable costs

Semi-variable costs, also known as mixed costs, combine elements of fixed costs and variable costs by maintaining a fixed base expense while varying with production volume or activity levels. These costs typically include utilities and maintenance expenses that remain constant up to a certain level of output but increase proportionally beyond that threshold.

Absorption costing

Absorption costing allocates both fixed manufacturing overhead and variable production costs to the cost of products, ensuring that inventory values reflect total production expenses. This method contrasts with variable costing, which includes only variable manufacturing costs in product valuation, treating fixed overhead as a period expense.

variable costs vs fixed costs Infographic

moneydif.com

moneydif.com