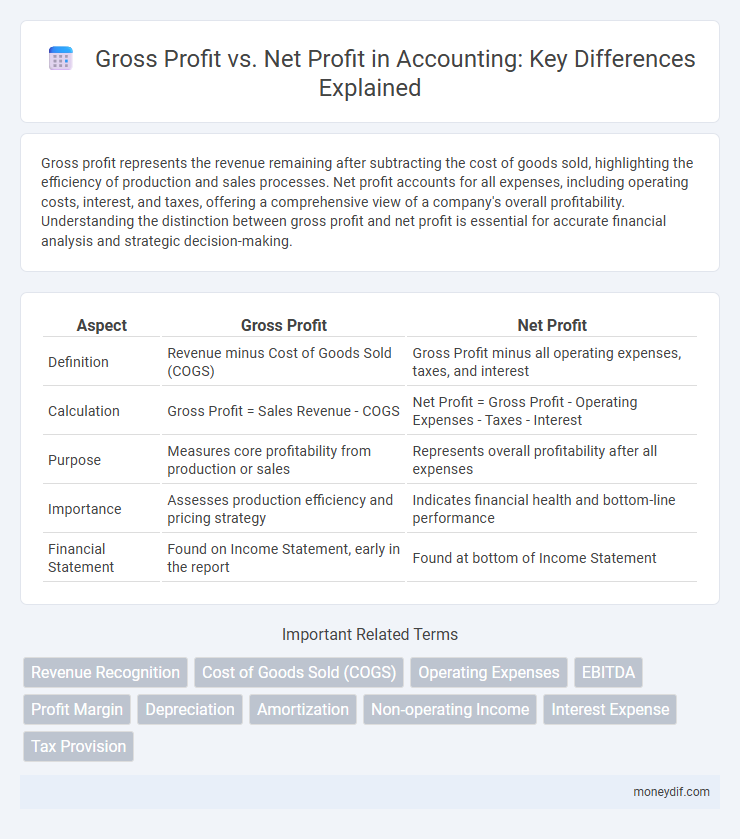

Gross profit represents the revenue remaining after subtracting the cost of goods sold, highlighting the efficiency of production and sales processes. Net profit accounts for all expenses, including operating costs, interest, and taxes, offering a comprehensive view of a company's overall profitability. Understanding the distinction between gross profit and net profit is essential for accurate financial analysis and strategic decision-making.

Table of Comparison

| Aspect | Gross Profit | Net Profit |

|---|---|---|

| Definition | Revenue minus Cost of Goods Sold (COGS) | Gross Profit minus all operating expenses, taxes, and interest |

| Calculation | Gross Profit = Sales Revenue - COGS | Net Profit = Gross Profit - Operating Expenses - Taxes - Interest |

| Purpose | Measures core profitability from production or sales | Represents overall profitability after all expenses |

| Importance | Assesses production efficiency and pricing strategy | Indicates financial health and bottom-line performance |

| Financial Statement | Found on Income Statement, early in the report | Found at bottom of Income Statement |

Understanding Gross Profit: Definition and Components

Gross profit represents the revenue remaining after deducting the cost of goods sold (COGS), highlighting the efficiency of production and sales processes. Key components include total sales revenue and direct costs such as materials, labor, and manufacturing overhead directly tied to the goods sold. Understanding gross profit is essential for analyzing a company's core profitability before operating expenses, taxes, and interest are accounted for.

Defining Net Profit: Key Elements and Importance

Net profit represents the residual earnings after deducting all business expenses, including operating costs, interest, taxes, and depreciation, from total revenue. It is a critical indicator of a company's overall financial health and profitability, reflecting the actual earnings available to shareholders. Understanding net profit enables businesses to assess operational efficiency, make informed strategic decisions, and optimize financial planning.

Formula Breakdown: Calculating Gross Profit vs Net Profit

Gross profit is calculated by subtracting the cost of goods sold (COGS) from total revenue, highlighting the efficiency of production and sales processes. Net profit, on the other hand, is determined by deducting all operating expenses, interest, taxes, and other costs from the gross profit, reflecting the company's overall profitability. Understanding the formula breakdown between gross profit and net profit enables businesses to analyze operational efficiency versus total financial health accurately.

Primary Differences Between Gross Profit and Net Profit

Gross profit represents the revenue remaining after deducting the cost of goods sold (COGS), focusing solely on production efficiency and direct costs. Net profit accounts for all expenses, including operating costs, taxes, and interest, providing a comprehensive view of a company's profitability. The primary difference lies in gross profit measuring core business performance while net profit reflects overall financial health.

Impact of Operating Expenses on Net Profit Calculation

Operating expenses directly reduce gross profit to arrive at net profit, making their management crucial for financial health. High operating expenses such as salaries, rent, and utilities can significantly decrease net profit despite a strong gross profit margin. Efficient control of operating costs enhances profitability by preserving more revenue after covering production costs.

Why Gross Profit Matters in Business Analysis

Gross profit reflects a company's core profitability by measuring revenue minus the cost of goods sold, highlighting operational efficiency and product pricing strategies. It serves as a critical indicator for assessing production costs and managing expenses directly tied to sales before accounting for overhead and taxes. Understanding gross profit allows businesses to make informed decisions on inventory management, cost control, and pricing adjustments to enhance overall financial performance.

The Significance of Net Profit for Financial Health

Net profit represents the true profitability of a business after deducting all expenses, including operating costs, taxes, and interest, from total revenue. It provides a comprehensive measure of financial health by revealing how efficiently a company manages its overall operations and obligations. Monitoring net profit is crucial for making informed decisions regarding investments, cost control, and long-term sustainability.

Common Mistakes in Interpreting Profit Figures

Misinterpreting gross profit as net profit frequently leads to overestimating a company's financial health since gross profit excludes operating expenses, taxes, and interest. Confusing these figures can obscure true profitability and impede accurate cash flow assessment. Analyzing both gross and net profit properly is essential for making informed business decisions and evaluating operational efficiency.

Gross Profit vs Net Profit: Use Cases in Decision-Making

Gross profit, calculated as sales revenue minus the cost of goods sold, provides a clear measure of a company's core production efficiency and pricing strategy effectiveness. Net profit accounts for all expenses, including operating costs, taxes, and interest, offering a comprehensive view of overall profitability and financial health. Businesses leverage gross profit to optimize production and pricing decisions, while net profit guides strategic planning, investment choices, and stakeholder reporting.

How to Improve Gross and Net Profit Margins

Improving gross and net profit margins requires a strategic approach to both revenue generation and cost management. Businesses should focus on increasing sales through targeted marketing, upselling, and expanding product lines while controlling direct costs by negotiating better supplier rates and optimizing production efficiency. Enhancing net profit margins involves reducing operating expenses, managing overhead, and implementing effective tax planning to maximize overall profitability.

Important Terms

Revenue Recognition

Revenue recognition directly impacts gross profit by determining the timing and amount of sales recorded, which affects cost of goods sold and overall profitability. Understanding the distinction between gross profit and net profit is critical, as gross profit reflects revenue minus cost of goods sold, while net profit accounts for all expenses including operating costs, taxes, and interest.

Cost of Goods Sold (COGS)

Cost of Goods Sold (COGS) directly impacts gross profit by representing the direct costs attributable to production, thereby reducing gross revenue to gross profit; net profit further deducts operating expenses, taxes, and interest from gross profit to determine the final earnings. Analyzing COGS trends helps businesses optimize margins and improve overall profitability by controlling production costs relative to sales revenue.

Operating Expenses

Operating expenses directly reduce gross profit to determine net profit, reflecting the costs essential for running daily business operations such as salaries, rent, and utilities. Efficient management of operating expenses enhances net profit margin, indicating stronger financial health beyond gross profit alone.

EBITDA

EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) measures a company's operating performance by focusing on earnings before non-operating expenses, positioned between gross profit and net profit on the income statement. Unlike gross profit, which subtracts only cost of goods sold, and net profit, which accounts for all expenses including taxes and interest, EBITDA provides insight into core profitability by excluding non-cash charges and financial costs.

Profit Margin

Profit margin measures a company's profitability by comparing profit levels to revenue, where gross profit margin reflects the percentage of revenue remaining after deducting cost of goods sold, highlighting core production efficiency. Net profit margin accounts for all expenses, taxes, and interest, providing a comprehensive view of overall financial health and operational effectiveness.

Depreciation

Depreciation is a non-cash expense that reduces net profit by allocating the cost of tangible assets over their useful life, while gross profit remains unaffected as it accounts only for direct costs of goods sold. Understanding depreciation's impact is crucial for accurate net profit analysis and financial reporting, reflecting true operational efficiency beyond gross profit metrics.

Amortization

Amortization is a non-cash expense that reduces net profit by spreading the cost of intangible assets over their useful life, without affecting gross profit, which solely reflects revenue minus the cost of goods sold. Understanding amortization's impact on net profit highlights the difference between operational profitability and overall financial performance.

Non-operating Income

Non-operating income, which includes earnings from investments, interest, and rental income, affects net profit but is excluded from gross profit calculations; gross profit strictly measures core business revenue minus cost of goods sold. Understanding the distinction between gross profit and net profit highlights how non-operating income can improve overall profitability without impacting operational efficiency metrics.

Interest Expense

Interest expense directly reduces net profit by increasing total expenses, while gross profit remains unaffected as it only accounts for revenue minus the cost of goods sold. Monitoring interest expense is crucial for assessing overall profitability since it impacts net income beyond the operational earnings reflected in gross profit.

Tax Provision

Tax provision calculations primarily focus on net profit, as it reflects the company's taxable income after deducting expenses, while gross profit represents revenue minus the cost of goods sold and does not account for operating expenses or taxes. Accurate tax provisioning depends on analyzing net profit to ensure compliance with tax regulations and proper financial reporting.

gross profit vs net profit Infographic

moneydif.com

moneydif.com