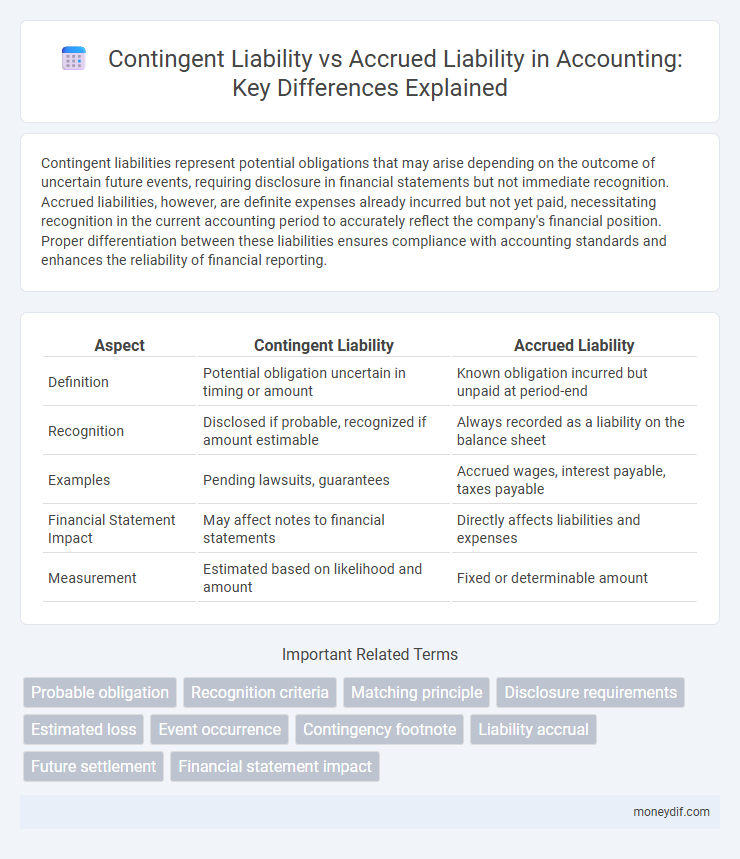

Contingent liabilities represent potential obligations that may arise depending on the outcome of uncertain future events, requiring disclosure in financial statements but not immediate recognition. Accrued liabilities, however, are definite expenses already incurred but not yet paid, necessitating recognition in the current accounting period to accurately reflect the company's financial position. Proper differentiation between these liabilities ensures compliance with accounting standards and enhances the reliability of financial reporting.

Table of Comparison

| Aspect | Contingent Liability | Accrued Liability |

|---|---|---|

| Definition | Potential obligation uncertain in timing or amount | Known obligation incurred but unpaid at period-end |

| Recognition | Disclosed if probable, recognized if amount estimable | Always recorded as a liability on the balance sheet |

| Examples | Pending lawsuits, guarantees | Accrued wages, interest payable, taxes payable |

| Financial Statement Impact | May affect notes to financial statements | Directly affects liabilities and expenses |

| Measurement | Estimated based on likelihood and amount | Fixed or determinable amount |

Introduction to Contingent and Accrued Liabilities

Contingent liabilities represent potential obligations that depend on the outcome of future events and are disclosed in financial statements when the likelihood of occurrence is probable and the amount can be reasonably estimated. Accrued liabilities, on the other hand, are recognized expenses incurred but not yet paid, recorded as liabilities on the balance sheet to accurately match expenses with the related accounting period. Understanding the distinction between contingent and accrued liabilities is essential for accurate financial reporting and risk assessment in accounting.

Definition of Contingent Liability

Contingent liability is a potential obligation that may occur depending on the outcome of a future event, such as pending lawsuits or warranty claims. It is not recorded in the financial statements unless the liability is probable and the amount can be reasonably estimated. This contrasts with accrued liabilities, which are recognized when expenses have been incurred but not yet paid.

Definition of Accrued Liability

Accrued liability refers to expenses that a company has incurred but has not yet paid or recorded through an invoice by the end of an accounting period. This liability is recognized on the balance sheet to reflect obligations such as wages payable, interest payable, and taxes owed. Unlike contingent liabilities, which depend on future events, accrued liabilities are definite amounts owed based on past transactions or services received.

Key Differences Between Contingent and Accrued Liabilities

Contingent liabilities are potential obligations dependent on the outcome of uncertain future events, requiring disclosure unless the loss is remote, whereas accrued liabilities are definite obligations recognized on the balance sheet for expenses already incurred but not yet paid. Contingent liabilities do not appear as liabilities on the financial statements unless the event is probable and the amount can be reasonably estimated, while accrued liabilities are recorded as current liabilities with precise amounts. The key difference lies in certainty and timing: accrued liabilities represent known obligations, whereas contingent liabilities represent possible obligations contingent on future events.

Recognition Criteria for Contingent Liabilities

Contingent liabilities require recognition in accounting only when it is probable that an outflow of resources embodying economic benefits will be required to settle the obligation and a reliable estimate of the amount can be made. If the likelihood of the outflow is possible but not probable, or the amount cannot be reasonably estimated, disclosure in the notes to the financial statements is necessary instead of recognition. This contrasts with accrued liabilities, which are recognized when the obligation is probable and can be measured with reasonable certainty at the end of the reporting period.

Recognition Criteria for Accrued Liabilities

Accrued liabilities are recognized when a company incurs expenses that are both probable and can be reasonably estimated, reflecting obligations for goods or services received but not yet paid. The recognition criteria require that the liability must be present due to past transactions or events, and the amount owed must be reliably measurable. Unlike contingent liabilities, which depend on uncertain future events, accrued liabilities are recorded in the financial statements to ensure accuracy in matching expenses with related revenues.

Examples of Contingent Liabilities in Accounting

Examples of contingent liabilities in accounting include pending lawsuits where the outcome and financial impact are uncertain, product warranties that may require future repairs or replacements, and guarantees on loans made by third parties that could result in repayment obligations. These liabilities are recorded only when the likelihood of the event is probable and the amount can be reasonably estimated. Unlike accrued liabilities, which represent known obligations with fixed amounts, contingent liabilities depend on future events and remain off the balance sheet until recognition criteria are met.

Examples of Accrued Liabilities in Financial Statements

Accrued liabilities in financial statements commonly include wages payable, interest expenses, and taxes owed that have been incurred but not yet paid by the reporting date. These obligations are recorded as current liabilities to accurately reflect expenses matching the period in which they were incurred. Unlike contingent liabilities, which depend on uncertain future events, accrued liabilities represent definite amounts owed based on past transactions.

Impact on Financial Statements and Reporting

Contingent liabilities are potential obligations depending on future events and are disclosed in financial statement footnotes unless the likelihood of occurrence is remote. Accrued liabilities represent expenses incurred but not yet paid, directly impacting the balance sheet as current liabilities and reducing net income on the income statement. Accurate classification affects financial ratios, risk assessment, and compliance with accounting standards like GAAP and IFRS.

Importance of Proper Disclosure and Compliance

Proper disclosure and compliance in accounting require clearly distinguishing between contingent liabilities and accrued liabilities to ensure accurate financial reporting. Contingent liabilities, recognized only when their occurrence is probable and estimable, must be disclosed in financial statement notes to provide transparency about potential risks. Accrued liabilities, representing obligations already incurred but not yet paid, demand precise recognition on the balance sheet to maintain compliance with accounting standards like GAAP or IFRS and facilitate reliable financial analysis.

Important Terms

Probable obligation

Probable obligations related to contingent liabilities require disclosure or recognition in financial statements if the obligation is likely and the amount can be reasonably estimated, whereas accrued liabilities represent obligations that are certain and recognized as expenses incurred but not yet paid.

Recognition criteria

Recognition criteria for contingent liabilities require a probable outflow of resources and reliable estimation, whereas accrued liabilities are recognized when an obligation is both probable and can be measured reliably.

Matching principle

The matching principle requires recognizing contingent liabilities only when they are probable and measurable, whereas accrued liabilities are recorded when expenses are incurred regardless of uncertainty.

Disclosure requirements

Disclosure requirements mandate recognizing contingent liabilities only when probable and estimable, whereas accrued liabilities must be recognized on the balance sheet as obligations with measurable amounts.

Estimated loss

Estimated loss from a contingent liability is recorded only when the loss is probable and can be reasonably estimated, whereas an accrued liability reflects an obligation that is both probable and has a definite amount recognized in the financial statements.

Event occurrence

Event occurrence triggers recognition of accrued liabilities when the obligation is certain and measurable, whereas contingent liabilities require disclosure only if the event's outcome is probable but not yet confirmed.

Contingency footnote

Contingency footnotes disclose potential losses from contingent liabilities that depend on future events, unlike accrued liabilities which represent definite obligations already recorded in financial statements.

Liability accrual

Liability accrual involves recognizing accrued liabilities for known obligations with fixed amounts, while contingent liabilities require disclosure or accrual only when the obligation is probable and the amount can be reasonably estimated.

Future settlement

Future settlement of contingent liabilities hinges on uncertain events while accrued liabilities represent definite obligations recognized based on incurred expenses.

Financial statement impact

Contingent liabilities impact financial statements only if the obligation is probable and estimable, whereas accrued liabilities are recognized as present obligations with measurable amounts, directly affecting the balance sheet and income statement.

contingent liability vs accrued liability Infographic

moneydif.com

moneydif.com