Current assets consist of cash, inventory, and receivables expected to be converted into cash within one fiscal year, playing a critical role in maintaining a company's liquidity. Noncurrent assets, such as property, plant, and equipment, provide long-term value and support ongoing operations beyond a single accounting period. Understanding the distinction between these asset types is essential for accurate financial analysis and effective resource management.

Table of Comparison

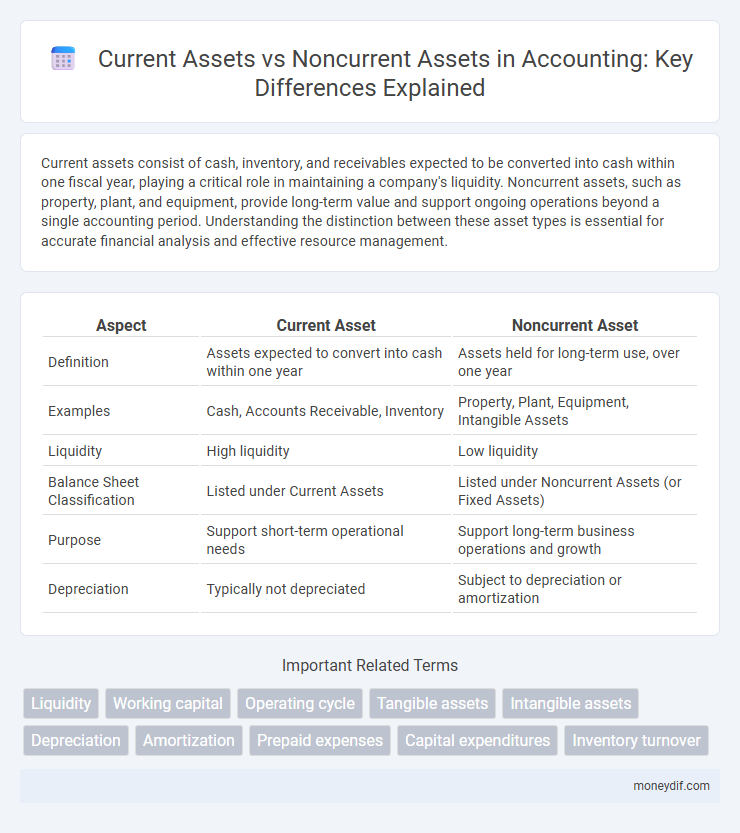

| Aspect | Current Asset | Noncurrent Asset |

|---|---|---|

| Definition | Assets expected to convert into cash within one year | Assets held for long-term use, over one year |

| Examples | Cash, Accounts Receivable, Inventory | Property, Plant, Equipment, Intangible Assets |

| Liquidity | High liquidity | Low liquidity |

| Balance Sheet Classification | Listed under Current Assets | Listed under Noncurrent Assets (or Fixed Assets) |

| Purpose | Support short-term operational needs | Support long-term business operations and growth |

| Depreciation | Typically not depreciated | Subject to depreciation or amortization |

Introduction to Current and Noncurrent Assets

Current assets include cash, accounts receivable, inventory, and other assets expected to be converted into cash or used up within one year. Noncurrent assets consist of property, plant, equipment, and intangible assets held for long-term use beyond one year. Understanding the distinction helps in assessing a company's liquidity and long-term financial stability.

Definition of Current Assets

Current assets are resources expected to be converted into cash, sold, or consumed within one fiscal year or the operating cycle, whichever is longer. Examples include cash and cash equivalents, accounts receivable, inventory, and prepaid expenses. These assets are crucial for managing short-term liquidity and operational efficiency in accounting.

Definition of Noncurrent Assets

Noncurrent assets are long-term tangible or intangible resources that a company holds for more than one fiscal year, such as property, plant, equipment, and patents. Unlike current assets, these assets are not expected to be converted into cash or consumed within the normal operating cycle. Their valuation and depreciation methods significantly impact a company's financial stability and investment decisions.

Key Differences Between Current and Noncurrent Assets

Current assets include cash, accounts receivable, and inventory, which are expected to be converted to cash or used within one year, reflecting a company's short-term liquidity. Noncurrent assets consist of property, plant, equipment, and intangible assets, representing long-term investments that provide value over multiple accounting periods. The primary difference lies in liquidity and usage timeframe, with current assets supporting operational expenses and noncurrent assets facilitating long-term business growth.

Examples of Current Assets

Examples of current assets include cash and cash equivalents, accounts receivable, inventory, and short-term investments. These assets are expected to be converted into cash or used up within one year or the operating cycle of the business. Prepaid expenses and marketable securities are also common examples of current assets on a company's balance sheet.

Examples of Noncurrent Assets

Noncurrent assets include property, plant, and equipment (PP&E), intangible assets such as patents and trademarks, long-term investments, and goodwill. These assets are held for more than one fiscal year and are crucial for a company's long-term operations and financial stability. Unlike current assets, noncurrent assets are not expected to be converted into cash within a year.

Importance of Asset Classification in Accounting

Accurate classification of assets into current and noncurrent categories is essential for precise financial statement preparation and analysis. Current assets, such as cash and inventory, provide insights into a company's short-term liquidity and operational efficiency, while noncurrent assets like property, plant, and equipment indicate long-term investment and financial stability. Proper asset classification enhances transparency, supports informed decision-making by stakeholders, and ensures compliance with accounting standards like IFRS and GAAP.

Impact on Financial Statements

Current assets, such as cash, accounts receivable, and inventory, directly influence a company's liquidity and working capital shown on the balance sheet, impacting short-term financial health and operational efficiency. Noncurrent assets, including property, plant, and equipment (PP&E) and intangible assets, affect long-term financial position, capital structure, and depreciation expenses reflected in the income statement. The classification between current and noncurrent assets ensures accurate asset valuation and financial ratios crucial for investment analysis and credit assessments.

Liquidity and Asset Classification

Current assets are highly liquid resources such as cash, accounts receivable, and inventory, expected to be converted into cash within one year, facilitating short-term operational needs. Noncurrent assets, including property, plant, equipment, and intangible assets, are less liquid and provide long-term value, not intended for quick conversion into cash. Proper classification of assets into current and noncurrent categories enhances financial statement clarity and assists stakeholders in assessing liquidity and solvency.

Best Practices for Managing Assets in Business

Effective management of current assets such as cash, inventory, and accounts receivable ensures liquidity and operational efficiency, while strategic oversight of noncurrent assets like property, plant, and equipment supports long-term growth and stability. Regular asset valuation, timely depreciation accounting, and robust asset tracking systems enhance accuracy in financial reporting and informed decision-making. Implementing comprehensive asset management policies minimizes risk, optimizes resource utilization, and improves overall business performance.

Important Terms

Liquidity

Liquidity is determined by the proportion of current assets, which are easily convertible to cash within one year, compared to noncurrent assets that are long-term and less liquid.

Working capital

Working capital is calculated as current assets minus current liabilities, highlighting the difference between short-term assets and obligations rather than noncurrent assets.

Operating cycle

The operating cycle measures the time it takes for current assets like inventory and receivables to convert into cash, distinguishing them from noncurrent assets held for long-term use.

Tangible assets

Tangible assets classified as current assets include inventory and prepaid expenses expected to be used or converted into cash within one year, while those classified as noncurrent assets include property, plant, and equipment held for long-term use.

Intangible assets

Intangible assets are classified as noncurrent assets because they provide long-term value and are not expected to be converted into cash within a year, unlike current assets such as inventory and receivables.

Depreciation

Depreciation applies to noncurrent assets, systematically allocating their cost over useful life, while current assets are not depreciated as they are expected to be converted to cash within one year.

Amortization

Amortization primarily applies to noncurrent intangible assets, systematically allocating their cost over useful life, unlike current assets which are typically expensed or revalued within a short period.

Prepaid expenses

Prepaid expenses classified as current assets represent payments for goods or services to be received within one year, while those extending beyond one year are recorded as noncurrent assets on the balance sheet.

Capital expenditures

Capital expenditures increase noncurrent assets by acquiring or upgrading property, plant, and equipment, whereas current assets involve short-term resources affected mainly by operating expenses rather than capital expenditures.

Inventory turnover

Inventory turnover primarily reflects the efficiency of managing current assets, specifically inventory, by measuring how often inventory is sold and replaced within a period. This ratio does not directly relate to noncurrent assets, which are long-term resources like property and equipment not involved in day-to-day inventory management.

current asset vs noncurrent asset Infographic

moneydif.com

moneydif.com