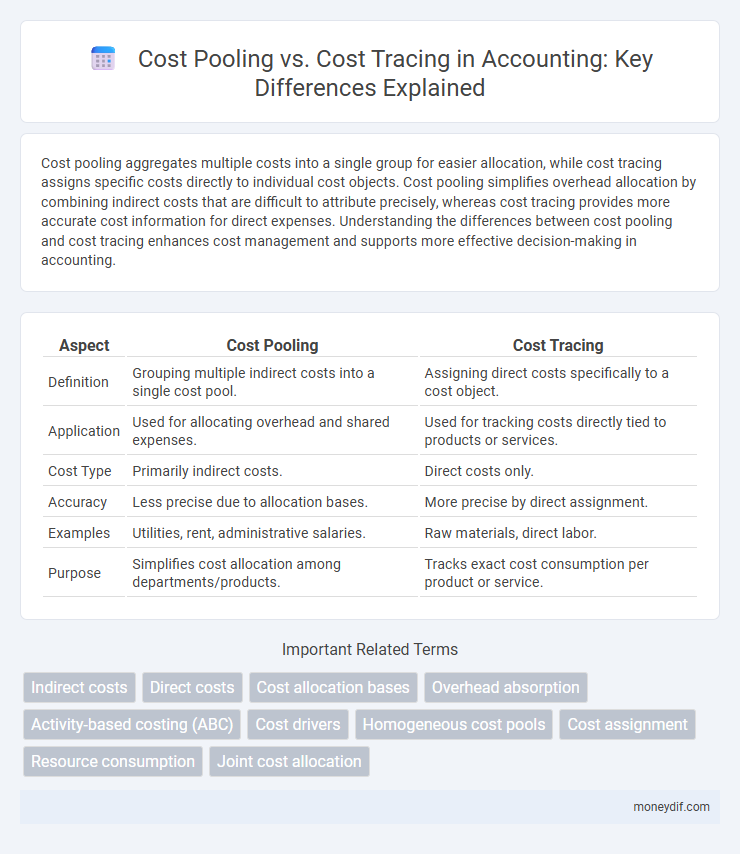

Cost pooling aggregates multiple costs into a single group for easier allocation, while cost tracing assigns specific costs directly to individual cost objects. Cost pooling simplifies overhead allocation by combining indirect costs that are difficult to attribute precisely, whereas cost tracing provides more accurate cost information for direct expenses. Understanding the differences between cost pooling and cost tracing enhances cost management and supports more effective decision-making in accounting.

Table of Comparison

| Aspect | Cost Pooling | Cost Tracing |

|---|---|---|

| Definition | Grouping multiple indirect costs into a single cost pool. | Assigning direct costs specifically to a cost object. |

| Application | Used for allocating overhead and shared expenses. | Used for tracking costs directly tied to products or services. |

| Cost Type | Primarily indirect costs. | Direct costs only. |

| Accuracy | Less precise due to allocation bases. | More precise by direct assignment. |

| Examples | Utilities, rent, administrative salaries. | Raw materials, direct labor. |

| Purpose | Simplifies cost allocation among departments/products. | Tracks exact cost consumption per product or service. |

Introduction to Cost Pooling and Cost Tracing

Cost pooling groups multiple indirect costs into a single cost pool to allocate expenses efficiently across products or departments, simplifying overhead management. Cost tracing identifies and assigns direct costs specifically to individual products, services, or cost objects, providing precise cost measurement. Distinguishing between these methods enhances accurate cost allocation and improves financial decision-making in managerial accounting.

Definitions and Key Concepts

Cost pooling involves aggregating individual costs into a single group for easier allocation, while cost tracing directly assigns costs to specific cost objects based on actual consumption. Cost tracing provides precise cost attribution by identifying direct costs associated with a product or department, whereas cost pooling simplifies overhead allocation by grouping indirect costs. Understanding these approaches is crucial for accurate cost management and financial analysis in managerial accounting.

Purpose of Cost Pooling

Cost pooling aggregates indirect costs into a single group to allocate overhead efficiently across multiple cost objects, improving accuracy in product costing and budgeting. By consolidating expenses such as utilities, rent, and administrative salaries, cost pooling helps streamline cost allocation processes and enhances decision-making for managers. Unlike cost tracing, which assigns costs directly to specific products or services, cost pooling addresses shared costs that cannot be traced easily.

Purpose of Cost Tracing

The purpose of cost tracing is to directly assign costs to specific cost objects, ensuring accurate measurement of expenses associated with products, services, or departments. This method improves the precision of cost allocation by linking costs to their exact source, facilitating better budgeting and financial analysis. Cost tracing supports managerial decision-making by providing detailed insights into resource consumption and cost behavior.

Methods of Cost Allocation

Cost pooling aggregates multiple individual costs into a single group to facilitate simpler allocation across products or departments based on a common cost driver, whereas cost tracing assigns costs directly to a specific cost object by identifying a direct cause-and-effect relationship. Cost tracing is highly accurate for direct costs such as raw materials and labor, while cost pooling is primarily used for indirect costs like utilities and administrative expenses. Effective cost allocation methods rely on balancing accuracy with practicality, using tracing for easily attributable expenses and pooling for those that are more diffuse.

Advantages of Cost Pooling

Cost pooling simplifies expense allocation by aggregating similar costs into a single group, reducing complexity and administrative effort in managerial accounting. It enhances cost control by providing a clearer overview of overhead expenses, facilitating more accurate budgeting and decision-making. Cost pooling supports scalability by easily accommodating new cost elements without disrupting existing allocation structures.

Advantages of Cost Tracing

Cost tracing enhances accuracy by directly assigning expenses to specific cost objects, enabling precise product or service costing. It improves managerial decision-making through detailed expense visibility and accountability. This method reduces allocation errors commonly found in cost pooling, leading to more reliable financial analysis.

Limitations and Challenges

Cost pooling can obscure individual product costs due to the aggregation of expenses, making it difficult for managers to identify specific cost drivers and allocate overhead accurately. Tracing costs directly to products presents challenges with indirect costs, as not all expenses can be linked clearly or efficiently, leading to incomplete cost information. Both methods face limitations in complex environments where distinguishing between direct and indirect costs is ambiguous, impacting precise cost control and decision-making.

Impact on Financial Reporting

Cost pooling aggregates indirect costs into common groups, simplifying allocation but potentially reducing the precision of expense reporting in financial statements. Cost tracing assigns direct costs to specific products or services, enhancing accuracy and transparency in financial reporting by clearly linking expenses to their sources. This distinction influences financial statement reliability, with tracing providing more detailed cost insights versus pooling's broader expense distribution.

Choosing the Right Approach

Choosing the right approach between cost pooling and cost tracing depends on the nature of the costs and the level of accuracy needed in cost allocation. Cost tracing is preferable when costs can be directly linked to specific products or departments, ensuring precise cost allocation and enhancing decision-making accuracy. Cost pooling is suitable for indirect costs that are difficult to assign directly, aggregating expenses for a more practical and efficient distribution across cost objects.

Important Terms

Indirect costs

Indirect costs are allocated through cost pooling methods rather than cost tracing, as they cannot be directly traced to a specific cost object.

Direct costs

Direct costs are expenses that can be directly traced to a specific cost object or activity, enabling accurate cost tracing for precise allocation. In contrast, cost pooling aggregates multiple indirect costs into a single group, requiring allocation bases to distribute costs since these expenses cannot be directly linked to a specific product or service.

Cost allocation bases

Cost allocation bases determine how costs are assigned to cost pools for indirect expenses or directly traced to specific cost objects for accurate cost tracing.

Overhead absorption

Overhead absorption allocates indirect costs using cost pooling to aggregate expenses and cost tracing to assign specific costs directly to products or services for accurate cost management.

Activity-based costing (ABC)

Activity-based costing (ABC) improves accuracy in cost allocation by prioritizing cost tracing to specific activities over traditional cost pooling methods that aggregate indirect costs.

Cost drivers

Cost drivers influence cost allocation efficiency by enabling precise cost tracing to specific activities, while cost pooling aggregates expenses for broader, less detailed distribution.

Homogeneous cost pools

Homogeneous cost pools group similar costs for accurate allocation, enhancing cost pooling efficiency compared to direct cost tracing that assigns expenses to specific cost objects.

Cost assignment

Cost assignment involves allocating expenses either through cost tracing, which directly links costs to specific products or services, or cost pooling, which groups indirect costs for later distribution based on allocation bases.

Resource consumption

Cost pooling aggregates indirect costs for allocation, while cost tracing directly assigns expenses to specific resources, optimizing resource consumption by enhancing cost accuracy and managerial decision-making.

Joint cost allocation

Joint cost allocation involves distributing combined costs between products, relying on cost pooling to aggregate expenses and cost tracing to assign costs directly to individual products based on measurable criteria.

cost pooling vs cost tracing Infographic

moneydif.com

moneydif.com