Conservatism in accounting emphasizes recognizing potential losses promptly while delaying the recognition of gains to avoid overstating financial health. Prudence involves exercising caution in judgment under conditions of uncertainty, ensuring that assets and income are not overstated and liabilities and expenses are not understated. Both principles aim to provide a realistic and reliable representation of a company's financial position by mitigating risks of overly optimistic reporting.

Table of Comparison

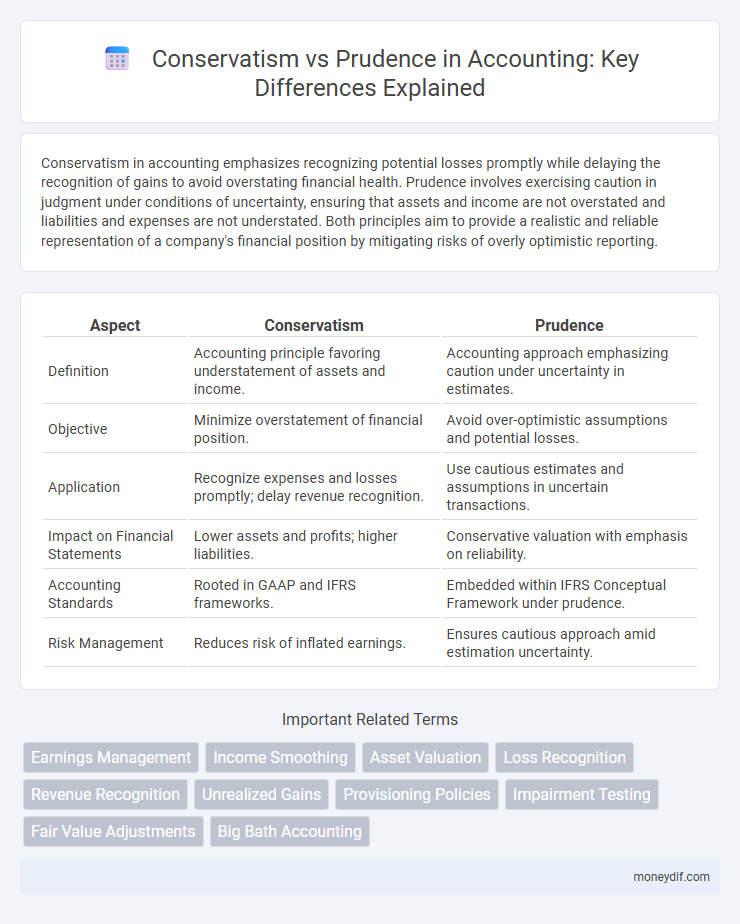

| Aspect | Conservatism | Prudence |

|---|---|---|

| Definition | Accounting principle favoring understatement of assets and income. | Accounting approach emphasizing caution under uncertainty in estimates. |

| Objective | Minimize overstatement of financial position. | Avoid over-optimistic assumptions and potential losses. |

| Application | Recognize expenses and losses promptly; delay revenue recognition. | Use cautious estimates and assumptions in uncertain transactions. |

| Impact on Financial Statements | Lower assets and profits; higher liabilities. | Conservative valuation with emphasis on reliability. |

| Accounting Standards | Rooted in GAAP and IFRS frameworks. | Embedded within IFRS Conceptual Framework under prudence. |

| Risk Management | Reduces risk of inflated earnings. | Ensures cautious approach amid estimation uncertainty. |

Introduction to Accounting Conservatism and Prudence

Accounting conservatism emphasizes recognizing potential losses and liabilities promptly while deferring the recognition of gains, ensuring financial statements present a cautious view of a company's financial position. Prudence, closely related to conservatism, advocates for cautious judgment under uncertainty, promoting the avoidance of overstating assets or income. Both principles aim to provide reliable and credible financial information, minimizing the risk of misrepresentation in accounting records.

Defining Conservatism in Accounting

Conservatism in accounting is a principle that guides accountants to recognize expenses and liabilities as soon as possible when there is uncertainty but to recognize revenues and assets only when they are assured of being received. This approach ensures that financial statements present a cautious view of a company's financial position, minimizing the risk of overstatement. It contrasts with prudence, which emphasizes exercise of caution without the same presumption toward understatement, focusing on unbiased decision-making in accounting estimates.

Understanding Prudence as an Accounting Principle

Prudence in accounting requires recognizing expenses and liabilities as soon as possible when there is uncertainty, avoiding overstatement of assets or income. This principle ensures that financial statements present a realistic and cautious view, reducing the risk of overstating financial health. Unlike conservatism, prudence focuses on careful judgment and the verification of facts before reporting financial outcomes.

Historical Development of Conservatism and Prudence

The historical development of conservatism and prudence in accounting reflects evolving approaches to financial reporting reliability and risk management. Conservatism emerged prominently during the early 20th century as a principle advocating for the understatement of assets and income to protect stakeholders against uncertainties. Prudence developed alongside conservatism, emphasizing cautious judgment in recognizing revenues and expenses to prevent over-optimistic financial statements and ensure faithful representation.

Key Differences Between Conservatism and Prudence

Conservatism in accounting emphasizes recognizing expenses and liabilities promptly while delaying the recognition of revenues to avoid overstating financial health, whereas prudence involves exercising caution and judgment in estimates and judgments to ensure financial statements are free from bias and errors. Conservatism often results in lower asset valuations and net income, prioritizing a cautious approach to financial reporting. Prudence, on the other hand, balances caution with reasonable estimation, ensuring neither overly optimistic nor pessimistic financial outcomes.

Practical Applications in Financial Reporting

Conservatism in financial reporting ensures that potential losses are recognized promptly while gains are recorded only when assured, guiding accountants to avoid overstating assets or income. Prudence emphasizes exercising caution by making reasonable estimates and judgments under uncertainty, leading to more reliable and realistic financial statements. Applying these principles helps maintain the integrity of financial reports by preventing optimistic bias and enhancing the credibility of reported financial positions.

Advantages and Limitations of Conservatism

Conservatism in accounting ensures that assets and income are not overstated, promoting reliability and caution in financial reporting by recognizing potential losses early. This approach enhances stakeholder confidence by presenting a more cautious view of a company's financial position, helping to mitigate risks associated with over-optimistic valuations. However, conservatism may lead to undervaluation of assets and profits, potentially distorting decision-making and reducing the usefulness of financial statements for predicting future performance.

Advantages and Limitations of Prudence

Prudence in accounting ensures expenses and liabilities are recorded promptly, preventing overstatement of assets and income, which enhances financial statement reliability and safeguards stakeholders' interests. It supports cautious decision-making by acknowledging uncertainties and potential losses, fostering long-term financial stability. However, excessive prudence may lead to undervaluation of assets and delayed income recognition, potentially distorting true financial performance and hindering investment decisions.

Impact on Financial Statements and Decision-Making

Conservatism in accounting leads to recognizing expenses and liabilities sooner, resulting in lower reported profits and asset values, which enhances reliability but may understate financial health. Prudence emphasizes exercising caution in uncertain situations by avoiding over-optimistic estimates, thereby reducing the risk of overstated income and assets on financial statements. Both principles influence decision-making by promoting more cautious assessments of financial performance, helping stakeholders avoid overly optimistic judgments that could lead to suboptimal investment or management choices.

Current Trends and Future Perspectives

Conservatism and prudence in accounting are evolving as companies integrate more real-time data analytics to enhance financial decision-making accuracy. Emerging standards emphasize prudence to prevent overstated profits while conservatism is being recalibrated to balance transparency with risk management. Future perspectives indicate a shift towards dynamic accounting frameworks that respond proactively to economic uncertainties and regulatory changes.

Important Terms

Earnings Management

Earnings management involves the strategic manipulation of financial reports to influence stakeholders' perceptions, often contrasting with the principles of conservatism and prudence that emphasize cautious recognition of revenues and expenses to avoid overstating financial performance. Conservatism requires recognizing potential losses earlier than gains, serving as a safeguard against earnings management by promoting realistic and reliable financial statements.

Income Smoothing

Income smoothing involves managing financial reports to present stable earnings, often relying on conservative accounting principles to avoid overstating profits, while prudence emphasizes cautious recognition of expenses and liabilities to ensure realistic asset valuations. This balance between conservatism and prudence helps companies mitigate income volatility without compromising financial statement reliability or investor trust.

Asset Valuation

Asset valuation under the conservatism principle emphasizes recording assets at the lower of cost or market value to avoid overstatement, ensuring financial statements reflect potential losses promptly. Prudence complements this by advocating for cautious estimation of asset values and liabilities, preventing over-optimistic financial reporting and promoting reliability.

Loss Recognition

Loss recognition under conservatism principles mandates immediate recording of foreseeable losses to prevent overstatement of assets and income, enhancing financial statement reliability. Prudence, while similar, emphasizes cautious estimation and avoids understatement of liabilities, ensuring that financial risks are neither concealed nor exaggerated.

Revenue Recognition

Revenue recognition under conservatism emphasizes recording revenues only when they are reasonably certain to avoid overstating financial performance, aligning closely with prudence which advocates for cautious estimation to prevent potential overstating of assets or income. This approach ensures financial statements reflect conservative profitability, minimizing risks of future reversals and enhancing reliability for stakeholders.

Unrealized Gains

Unrealized gains represent potential profit on investments not yet sold, highlighting the prudence principle which advocates for recognizing losses promptly while deferring gains to avoid overstating asset values. Conservatism in accounting emphasizes cautious reporting, ensuring that unrealized gains are excluded from financial statements until they are realized, thus preventing optimistic biases.

Provisioning Policies

Provisioning policies in accounting emphasize prudence by ensuring potential losses are recognized promptly while avoiding overstatement of liabilities, reflecting a cautious approach aligned with conservative principles. These policies balance the need to protect stakeholders' interests through realistic financial reporting without unduly diminishing profitability or inflating reserves.

Impairment Testing

Impairment testing involves assessing whether an asset's carrying amount exceeds its recoverable amount to prevent overstating assets, reflecting the principle of prudence by recognizing potential losses promptly. Conservatism in impairment testing ensures that financial statements do not overestimate asset values, safeguarding stakeholders from inflated financial positions.

Fair Value Adjustments

Fair value adjustments reflect the current market value of assets or liabilities, incorporating timely and relevant information to provide a realistic financial position. Conservatism emphasizes recognizing potential losses promptly while prudence ensures neither excessive optimism nor unwarranted pessimism, balancing fair value measurements to avoid overstatement or understatement of financial results.

Big Bath Accounting

Big Bath Accounting involves intentionally manipulating financial statements to recognize larger losses in a single period, aligning more with aggressive accounting than prudence, which emphasizes caution in reporting. Conservatism in accounting generally encourages anticipating potential losses, but Big Bath strategies can distort this principle by front-loading negative adjustments to improve future profitability appearances.

conservatism vs prudence Infographic

moneydif.com

moneydif.com