Current assets include cash, accounts receivable, and inventory that are expected to be converted into cash or used within one year, providing liquidity for daily operations. Noncurrent assets, such as property, plant, and equipment, are long-term resources that support business activities beyond the current fiscal year. Proper classification between current and noncurrent assets is essential for accurate financial analysis and effective asset management.

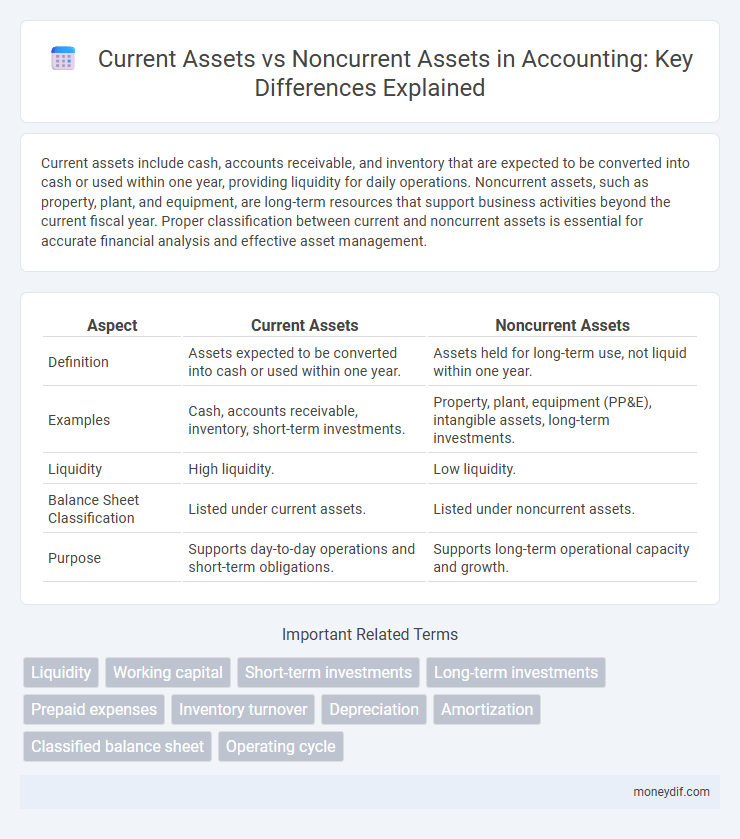

Table of Comparison

| Aspect | Current Assets | Noncurrent Assets |

|---|---|---|

| Definition | Assets expected to be converted into cash or used within one year. | Assets held for long-term use, not liquid within one year. |

| Examples | Cash, accounts receivable, inventory, short-term investments. | Property, plant, equipment (PP&E), intangible assets, long-term investments. |

| Liquidity | High liquidity. | Low liquidity. |

| Balance Sheet Classification | Listed under current assets. | Listed under noncurrent assets. |

| Purpose | Supports day-to-day operations and short-term obligations. | Supports long-term operational capacity and growth. |

Definition of Current Assets

Current assets are assets expected to be converted into cash, sold, or consumed within one fiscal year or the operating cycle, whichever is longer. Examples include cash and cash equivalents, accounts receivable, inventory, and short-term investments. These assets provide liquidity essential for meeting short-term obligations and operational expenses.

Definition of Noncurrent Assets

Noncurrent assets, also known as long-term assets, are resources a company intends to hold for more than one fiscal year, providing long-term financial benefits. These assets include property, plant, equipment, intangible assets, and long-term investments that are not expected to be converted into cash within the normal operating cycle. Proper classification of noncurrent assets is essential for accurate balance sheet presentation and financial analysis.

Key Differences Between Current and Noncurrent Assets

Current assets are short-term resources like cash, accounts receivable, and inventory expected to be converted to cash within one year, enhancing liquidity. Noncurrent assets include long-term investments, property, plant, and equipment, providing sustained operational value beyond a year. The key differences between these assets lie in their liquidity, purpose, and accounting treatment related to financial stability and business growth.

Examples of Current Assets

Examples of current assets include cash, accounts receivable, inventory, and short-term investments, which are expected to be converted into cash within one year or the operating cycle. These assets are crucial for managing a company's liquidity and day-to-day operations. In contrast, noncurrent assets like property, plant, and equipment are held for long-term use and not intended for immediate conversion to cash.

Examples of Noncurrent Assets

Noncurrent assets include tangible and intangible resources such as property, plant, and equipment (PP&E), long-term investments, patents, trademarks, and goodwill. These assets are expected to provide economic benefits over a period longer than one year, distinguishing them from current assets like cash, inventory, and accounts receivable. Understanding noncurrent assets is crucial for assessing a company's long-term financial stability and investment potential.

Importance of Asset Classification in Accounting

Asset classification into current and noncurrent categories is crucial for accurate financial reporting and liquidity assessment. Current assets, such as cash, receivables, and inventory, provide insight into a company's short-term operational efficiency, while noncurrent assets, including property, plant, and equipment, reflect long-term investment and financial stability. Proper differentiation impacts key financial ratios like the current ratio and debt-to-equity ratio, influencing investor decisions and credit evaluations.

Impact of Asset Types on Financial Statements

Current assets, including cash, accounts receivable, and inventory, provide liquidity and are essential for covering short-term obligations on the balance sheet. Noncurrent assets, such as property, plant, and equipment, contribute to long-term operational capacity and are depreciated over time, affecting both the balance sheet and income statement. The classification between current and noncurrent assets impacts key financial ratios like working capital and return on assets, crucial for investors and creditors assessing a company's financial health.

Liquidity and Asset Management

Current assets, including cash, accounts receivable, and inventory, provide high liquidity essential for meeting short-term obligations, enabling efficient asset management through quick conversion to cash. Noncurrent assets, such as property, plant, and equipment, offer long-term value but lower liquidity, requiring strategic planning to balance asset utilization and financial stability. Effective management of both asset types ensures optimal liquidity while supporting sustainable growth and operational efficiency.

Role of Asset Classification in Ratio Analysis

Asset classification plays a crucial role in ratio analysis by distinguishing current assets, such as cash, accounts receivable, and inventory, from noncurrent assets like property, plant, and equipment. This distinction affects liquidity ratios, including the current ratio and quick ratio, which measure a company's ability to meet short-term obligations through current assets. Proper classification ensures accurate assessment of financial health, operational efficiency, and long-term solvency in financial analysis.

Best Practices for Managing Current and Noncurrent Assets

Effective management of current and noncurrent assets involves regularly monitoring liquidity ratios such as the current ratio and quick ratio to ensure sufficient short-term financial stability while optimizing long-term asset utilization through depreciation tracking and impairment reviews. Implementing robust asset management systems enhances accuracy in asset classification and valuation, supporting timely decision-making and compliance with accounting standards like IFRS and GAAP. Prioritizing cash flow forecasting for current assets alongside strategic capital expenditure planning for noncurrent assets drives sustainable growth and operational efficiency.

Important Terms

Liquidity

Liquidity measures a company's ability to meet short-term obligations using current assets, such as cash, accounts receivable, and inventory, which are expected to be converted into cash within one year. Noncurrent assets, including property, plant, and equipment, provide long-term value but do not enhance immediate liquidity due to their limited convertibility to cash in the short term.

Working capital

Working capital represents the difference between current assets, such as cash, accounts receivable, and inventory, and current liabilities, reflecting a company's short-term financial health and liquidity. Noncurrent assets, including property, plant, and equipment, do not impact working capital directly as they are long-term investments not used to cover day-to-day operational expenses.

Short-term investments

Short-term investments, classified as current assets, typically include marketable securities or Treasury bills that are expected to be converted into cash within one year or an operating cycle. In contrast, noncurrent assets encompass long-term investments held for periods beyond one year, such as bonds or stocks intended for strategic purposes or capital appreciation.

Long-term investments

Long-term investments, classified as noncurrent assets, represent financial holdings expected to be held for more than one fiscal year, contrasting with current assets which are anticipated to be converted into cash or used up within one year. These investments often include stocks, bonds, real estate, or other securities that provide income or capital gains over an extended period, highlighting their strategic role in a company's financial stability and growth.

Prepaid expenses

Prepaid expenses classified under current assets represent payments made for goods or services to be received within one year or the operating cycle, whichever is longer, while prepaid expenses extending beyond this period are recorded as noncurrent assets. Proper allocation between current and noncurrent prepaid expenses ensures accurate financial reporting and liquidity assessment.

Inventory turnover

Inventory turnover measures how efficiently a company sells its inventory relative to its current assets, showing the liquidity and operational efficiency within the short-term asset category. Unlike noncurrent assets, which are long-term investments such as property and equipment, inventory turnover specifically reflects the management of current assets directly impacting working capital and cash flow.

Depreciation

Depreciation primarily applies to noncurrent assets, such as machinery, buildings, and equipment, reflecting the systematic allocation of their cost over useful life. Current assets, including inventory and cash, are not subject to depreciation as they are expected to be converted into cash within a year and do not lose value through wear and tear over time.

Amortization

Amortization primarily applies to noncurrent assets such as intangible assets, where it systematically allocates the cost over the asset's useful life, unlike current assets which are expected to be converted to cash within a year and are not subject to amortization. Understanding amortization in relation to noncurrent assets ensures accurate financial reporting by matching expenses with revenue generated over multiple periods.

Classified balance sheet

A classified balance sheet organizes assets into current assets, such as cash, accounts receivable, and inventory, which are expected to be converted into cash within one year, and noncurrent assets, including property, plant, equipment, and intangible assets, which provide long-term value beyond one year. This distinction enhances financial analysis by highlighting liquidity and long-term investment, aiding stakeholders in evaluating the company's operational efficiency and financial stability.

Operating cycle

The operating cycle measures the time it takes for a company to convert its current assets, such as inventory and receivables, into cash through sales, highlighting the efficiency of managing short-term assets. Noncurrent assets, including property, plant, and equipment, do not directly impact the operating cycle as they are long-term investments not involved in daily business cash conversion processes.

current assets vs noncurrent assets Infographic

moneydif.com

moneydif.com