Crossing networks facilitate anonymous trading by matching buy and sell orders within a brokerage without exposing them to the public market, enhancing price improvement opportunities. In contrast, Alternative Trading Systems (ATS) act as regulated electronic trading venues that offer broader market access and diverse order types while maintaining transparency and compliance standards. Understanding the differences between crossing networks and ATS helps traders optimize execution strategies based on liquidity needs and market impact.

Table of Comparison

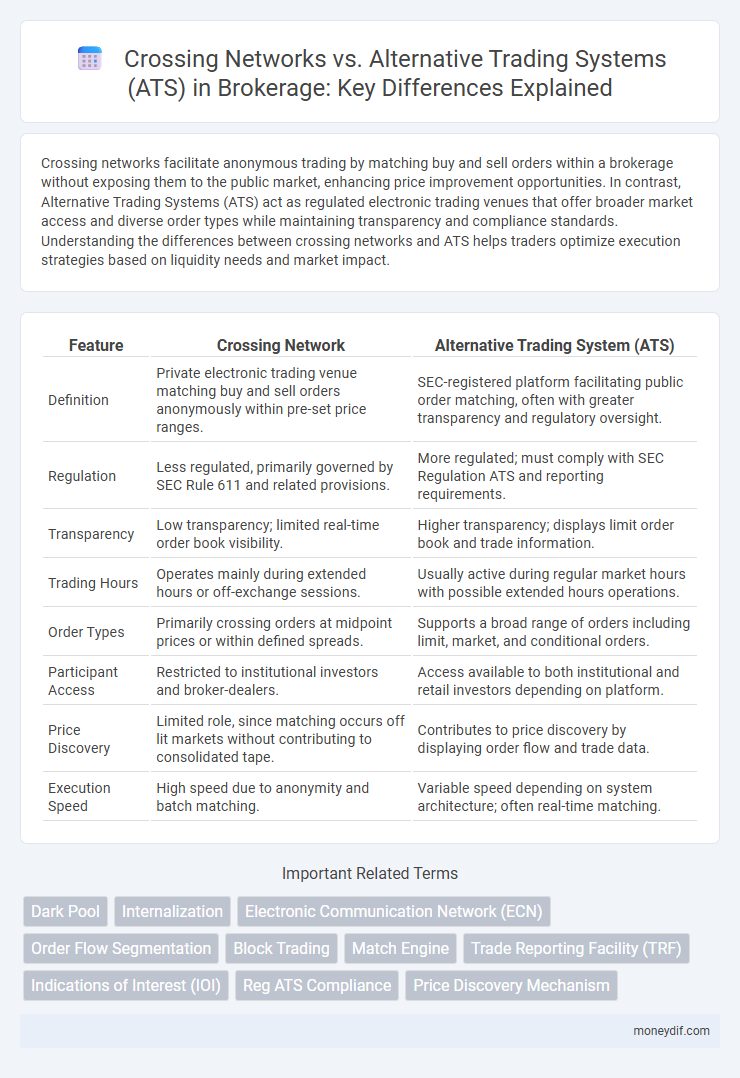

| Feature | Crossing Network | Alternative Trading System (ATS) |

|---|---|---|

| Definition | Private electronic trading venue matching buy and sell orders anonymously within pre-set price ranges. | SEC-registered platform facilitating public order matching, often with greater transparency and regulatory oversight. |

| Regulation | Less regulated, primarily governed by SEC Rule 611 and related provisions. | More regulated; must comply with SEC Regulation ATS and reporting requirements. |

| Transparency | Low transparency; limited real-time order book visibility. | Higher transparency; displays limit order book and trade information. |

| Trading Hours | Operates mainly during extended hours or off-exchange sessions. | Usually active during regular market hours with possible extended hours operations. |

| Order Types | Primarily crossing orders at midpoint prices or within defined spreads. | Supports a broad range of orders including limit, market, and conditional orders. |

| Participant Access | Restricted to institutional investors and broker-dealers. | Access available to both institutional and retail investors depending on platform. |

| Price Discovery | Limited role, since matching occurs off lit markets without contributing to consolidated tape. | Contributes to price discovery by displaying order flow and trade data. |

| Execution Speed | High speed due to anonymity and batch matching. | Variable speed depending on system architecture; often real-time matching. |

Introduction to Crossing Networks and ATS

Crossing Networks are private trading systems that match buy and sell orders internally, minimizing market impact and reducing transaction costs. Alternative Trading Systems (ATS) provide a broader electronic platform for matching orders outside traditional exchanges, offering increased liquidity and extended trading hours. Both Crossing Networks and ATS enhance market efficiency by facilitating off-exchange transactions while maintaining regulatory oversight.

Key Differences Between Crossing Networks and ATS

Crossing Networks execute large block trades off-exchange to minimize market impact and reduce transaction costs, while Alternative Trading Systems (ATS) provide a regulated electronic platform for trading various securities with greater transparency and liquidity. Crossing Networks typically facilitate anonymous matching of buy and sell orders without displaying prices publicly, whereas ATSs display continuous bid and ask prices, allowing broader market participation. The primary distinction lies in Crossing Networks' focus on discreet block trading versus ATSs' role as alternative marketplaces offering diverse trading strategies and price discovery.

How Crossing Networks Operate

Crossing networks operate by matching buy and sell orders within a private system, allowing institutional investors to trade large blocks of securities anonymously without exposing orders to public markets. These networks help minimize market impact and reduce trading costs by executing crossings at predetermined prices or within a specified price range. Unlike traditional exchanges or ATSs, crossing networks do not provide continuous order books but facilitate periodic batch auctions to aggregate and match orders efficiently.

How Alternative Trading Systems Function

Alternative Trading Systems (ATS) operate as regulated electronic trading venues that match buyers and sellers of securities outside traditional stock exchanges, providing increased liquidity and often lower transaction costs. ATS platforms utilize sophisticated algorithms and smart order routing to facilitate anonymous, efficient trade execution, minimizing market impact while adhering to regulatory requirements such as Regulation ATS. By aggregating orders from multiple broker-dealers, ATS enhances price discovery and supports large block trades that might be challenging to execute on public exchanges.

Regulatory Framework: Crossing Network vs ATS

Crossing networks operate under less stringent regulatory oversight compared to Alternative Trading Systems (ATS), often benefiting from exemptions such as Rule 611 under Reg NMS, which governs order protection and fair access. ATS platforms are subject to comprehensive SEC and FINRA regulations, requiring regular disclosures, transparency in trade execution, and stringent record-keeping obligations to ensure market integrity. The regulatory framework for ATS aims to mitigate potential conflicts of interest and market manipulation more rigorously than crossing networks, reflecting their broader market impact and operational scope.

Liquidity Provision in Crossing Networks and ATS

Crossing networks and Alternative Trading Systems (ATS) both enhance liquidity provision by enabling block trades outside traditional exchanges, reducing market impact and signaling risk. Crossing networks facilitate anonymous matching of large institutional orders at midpoint prices, improving price execution and reducing transaction costs for participants. ATS platforms, regulated under SEC Rule ATS, offer broader liquidity access through multiple trading protocols, including dark pools and lit orders, attracting diverse liquidity providers to optimize trade execution.

Order Matching Mechanisms: Comparing Approaches

Crossing networks match buy and sell orders internally at predetermined prices without displaying them on public exchanges, minimizing market impact and reducing transaction costs. Alternative Trading Systems (ATS) utilize electronic order books that aggregate liquidity and match orders based on price-time priority, offering greater transparency and increased price discovery. The fundamental difference lies in crossing networks prioritizing anonymity and reduced market footprint, whereas ATS platforms focus on dynamic order matching and competitive pricing.

Transparency and Market Impact

Crossing Networks operate with limited transparency by matching buy and sell orders internally without exposing them to public markets, reducing market impact but potentially obscuring price discovery. Alternative Trading Systems (ATS) offer greater transparency through regulatory oversight and public reporting requirements, enhancing price visibility while still aiming to minimize market impact compared to traditional exchanges. Both platforms balance transparency and market impact differently, catering to specific trading strategies and regulatory environments within brokerage operations.

Benefits and Limitations of Each Platform

Crossing Networks offer benefits such as reduced market impact and lower transaction costs by matching buy and sell orders internally without routing to public exchanges, but they may suffer from limited liquidity and transparency compared to Alternative Trading Systems (ATS). ATS platforms provide greater trading flexibility, increased access to diverse liquidity pools, and enhanced regulatory oversight, yet they often involve higher operational complexity and potential latency issues. Both platforms serve as vital alternatives to traditional exchanges, with crossing networks excelling in cost efficiency and ATS delivering broader market access and regulatory compliance.

Choosing Between Crossing Networks and ATS

Choosing between Crossing Networks and Alternative Trading Systems (ATS) hinges on trade size, liquidity needs, and transparency preferences. Crossing Networks facilitate anonymous trade matching off-exchange, ideal for large block trades seeking minimal market impact, while ATS offer centralized order books with varying degrees of transparency and regulatory oversight. Evaluating factors like execution speed, fee structures, and compliance requirements ensures alignment with trading strategy and regulatory frameworks.

Important Terms

Dark Pool

Dark pools are private trading venues where Crossing Networks execute large block trades with minimal market impact, differing from Alternative Trading Systems (ATS) by typically offering pre-negotiated order matching and reduced transparency.

Internalization

Internalization involves brokers executing client orders within their own networks, contrasting with Crossing Networks and ATSs that match orders from multiple participants externally to enhance liquidity and reduce market impact.

Electronic Communication Network (ECN)

Electronic Communication Networks (ECNs) are a type of Alternative Trading System (ATS) that matches buy and sell orders electronically, while Crossing Networks are a subset of ATSs that facilitate block trades by matching large orders anonymously without displaying pre-trade prices.

Order Flow Segmentation

Order Flow Segmentation in Crossing Networks isolates retail and institutional trades to optimize price discovery and reduce adverse selection, whereas Alternative Trading Systems aggregate diverse order flows to enhance liquidity and execution efficiency.

Block Trading

Block trading in crossing networks facilitates large-volume trades internally to minimize market impact, while Alternative Trading Systems (ATS) offer a broader range of trading functionalities and access to multiple liquidity pools.

Match Engine

Match Engines in Crossing Networks prioritize anonymous order matching without price discovery, whereas ATS platforms integrate centralized order books to facilitate transparent price formation and liquidity aggregation.

Trade Reporting Facility (TRF)

Trade Reporting Facility (TRF) enables post-trade reporting for transactions executed off-exchange, including those from Crossing Networks and Alternative Trading Systems (ATS), facilitating transparent trade data dissemination and regulatory compliance.

Indications of Interest (IOI)

Indications of Interest (IOIs) in Crossing Networks are used to anonymously communicate potential large block trades, whereas ATS platforms facilitate actual trade execution by matching buyers and sellers within regulated alternative trading venues.

Reg ATS Compliance

Reg ATS compliance mandates that crossing networks adhere to specific disclosure, transparency, and regulatory requirements distinguishing them from other Alternative Trading Systems to ensure fair and orderly markets.

Price Discovery Mechanism

Price discovery in Crossing Networks often relies on pooled order matching off-exchange, whereas ATS platforms facilitate continuous order flow and centralized price formation enhancing market transparency.

Crossing Network vs ATS (Alternative Trading System) Infographic

moneydif.com

moneydif.com