Execution-only brokerage services allow investors to place trades independently without receiving personalized investment advice, offering lower fees and greater control over decisions. Advisory services provide tailored investment guidance based on the client's financial goals, risk tolerance, and market conditions, typically resulting in higher costs but potentially better-aligned portfolios. Choosing between execution-only and advisory depends on the investor's experience, need for professional support, and desire for hands-on management.

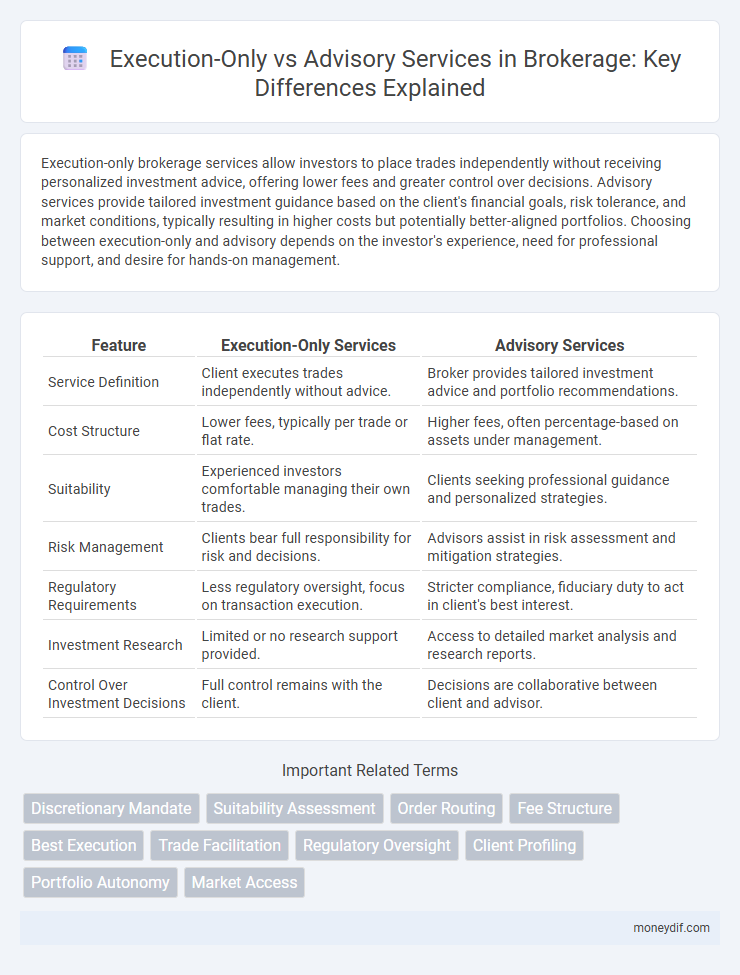

Table of Comparison

| Feature | Execution-Only Services | Advisory Services |

|---|---|---|

| Service Definition | Client executes trades independently without advice. | Broker provides tailored investment advice and portfolio recommendations. |

| Cost Structure | Lower fees, typically per trade or flat rate. | Higher fees, often percentage-based on assets under management. |

| Suitability | Experienced investors comfortable managing their own trades. | Clients seeking professional guidance and personalized strategies. |

| Risk Management | Clients bear full responsibility for risk and decisions. | Advisors assist in risk assessment and mitigation strategies. |

| Regulatory Requirements | Less regulatory oversight, focus on transaction execution. | Stricter compliance, fiduciary duty to act in client's best interest. |

| Investment Research | Limited or no research support provided. | Access to detailed market analysis and research reports. |

| Control Over Investment Decisions | Full control remains with the client. | Decisions are collaborative between client and advisor. |

Understanding Brokerage Service Models

Execution-only brokerage services allow clients to place trades independently without receiving investment advice, offering lower fees and greater control over decisions. Advisory services provide personalized investment recommendations and portfolio management based on clients' financial goals and risk tolerance, typically with higher fees reflecting the added value. Understanding these brokerage service models helps investors choose between cost-efficiency with self-directed trades and expert guidance for tailored investment strategies.

What Is Execution-Only Brokerage?

Execution-only brokerage refers to a trading service where brokers execute buy or sell orders on behalf of clients without providing any investment advice or portfolio management. Clients maintain full control of their decisions and are responsible for research and strategy, benefiting from lower fees and faster order processing. This service suits experienced investors who prefer autonomy over their trading activities without intermediary recommendations.

Defining Advisory Brokerage Services

Advisory brokerage services involve providing personalized investment recommendations based on a client's financial goals, risk tolerance, and market conditions. Unlike execution-only services, advisors conduct in-depth portfolio analysis and ongoing monitoring to optimize client outcomes. These services include tailored asset allocation, continuous guidance, and strategic adjustments aligned with evolving market trends and client objectives.

Key Differences Between Execution-Only and Advisory Services

Execution-only brokerage services allow investors to independently place trades without receiving personalized investment advice, providing lower fees and full control over investment decisions. Advisory services include professional guidance tailored to individual financial goals, involving portfolio management and strategic recommendations, which typically come at higher costs. The key difference lies in the level of support and customization, with execution-only platforms suited for experienced investors and advisory services beneficial for those seeking expert advice.

Pros and Cons of Execution-Only Brokerage

Execution-only brokerage offers investors full control over their trades with lower fees and faster transaction times, making it ideal for experienced traders confident in their decision-making. However, this approach lacks personalized investment advice and risk management, increasing the potential for uninformed choices and suboptimal portfolio performance. Limited oversight can expose investors to higher market risks without the guidance that advisory services provide.

Advantages and Limitations of Advisory Services

Advisory services in brokerage offer personalized investment guidance, leveraging expert analysis to tailor portfolios that align with clients' financial goals and risk tolerance, enhancing the potential for optimized returns. These services provide continuous monitoring and proactive adjustments, ensuring portfolios adapt to market changes and regulatory shifts. Limitations include higher fees compared to execution-only services and potential conflicts of interest if advisors receive commissions, which may impact the objectivity of recommendations.

Cost Comparison: Execution-Only vs Advisory Brokerage

Execution-only brokerage services typically offer lower fees since clients manage their own trades without receiving personalized investment advice, resulting in reduced commission and platform charges. Advisory brokerage services, while more expensive due to fees for professional portfolio management and tailored recommendations, provide added value through expert guidance and strategic planning. Investors must weigh the cost savings of execution-only models against the potential benefits of advisory services when selecting a brokerage option.

Suitable Investor Profiles for Each Service

Execution-only services cater to experienced investors with a high risk tolerance who prefer autonomy in decision-making and lower service fees. Advisory services suit investors seeking personalized guidance, tailored investment strategies, and risk management support, often beneficial for those with moderate to low financial literacy or complex portfolios. Understanding individual financial goals, risk appetite, and investment knowledge is essential to selecting the appropriate brokerage service.

Regulatory Considerations for Execution-Only and Advisory Models

Execution-only brokerage services operate under fewer regulatory obligations since clients make all investment decisions independently, reducing the firm's liability for advice accuracy. Advisory services require compliance with comprehensive fiduciary duties and suitability assessments under regulations such as MiFID II, ensuring recommendations align with clients' financial goals and risk profiles. Regulators mandate transparent disclosure of fees and conflicts of interest in advisory models, while execution-only platforms emphasize safeguarding order execution integrity and timely trade confirmations.

How to Choose Between Execution-Only and Advisory Services

Choosing between execution-only and advisory brokerage services depends on your investment knowledge, risk tolerance, and desired level of control. Execution-only services suit experienced investors who prefer making independent decisions and lower fees, while advisory services provide personalized guidance, portfolio management, and risk assessment for those seeking expert support. Assessing your financial goals, investment experience, and willingness to pay for professional advice will help determine the optimal service model for your brokerage needs.

Important Terms

Discretionary Mandate

Discretionary mandates empower portfolio managers to make autonomous investment decisions, contrasting with execution-only services where clients independently select trades, and advisory services that offer tailored investment recommendations without direct decision-making authority.

Suitability Assessment

Suitability Assessment ensures clients receive personalized financial recommendations by evaluating risk tolerance and investment objectives, distinguishing Execution-Only services, which lack tailored advice, from Advisory Services that provide customized guidance.

Order Routing

Order routing in execution-only services involves directing client trades directly to exchanges or liquidity providers without personalized financial advice, optimizing speed and cost efficiency. In advisory services, order routing incorporates tailored recommendations where advisors guide order placement based on client goals, balancing execution quality with strategic investment decisions.

Fee Structure

Execution-only services typically charge lower fees, often structured as flat rates or per-transaction fees, reflecting the absence of personalized advice. Advisory services impose higher fees, generally calculated as a percentage of assets under management (AUM), accounting for tailored investment guidance and ongoing portfolio management.

Best Execution

Best Execution mandates brokers to seek optimal trade outcomes for clients, with Execution-Only services prioritizing direct transaction speed and cost efficiency, whereas Advisory Services emphasize personalized investment guidance and strategy alongside execution quality.

Trade Facilitation

Trade facilitation in execution-only services emphasizes streamlined transaction processing without personalized guidance, enabling faster trade execution and reduced operational costs. Advisory services offer tailored market insights and strategic recommendations, enhancing decision-making accuracy and risk management in complex trade environments.

Regulatory Oversight

Regulatory oversight ensures compliance by differentiating execution-only services, which exclude personalized advice, from advisory services that require tailored financial recommendations and fiduciary responsibility.

Client Profiling

Client profiling differentiates between execution-only and advisory services by assessing investors' risk tolerance, financial goals, and knowledge to tailor suitable investment strategies and ensure regulatory compliance.

Portfolio Autonomy

Portfolio Autonomy maximizes investor control by enabling Execution-Only services, while Advisory Services provide personalized guidance that balances autonomy with expert recommendations.

Market Access

Market access strategies differ significantly between execution-only platforms, which offer direct trade execution without advice, and advisory services that provide personalized investment guidance tailored to client goals.

Execution-Only vs Advisory Services Infographic

moneydif.com

moneydif.com