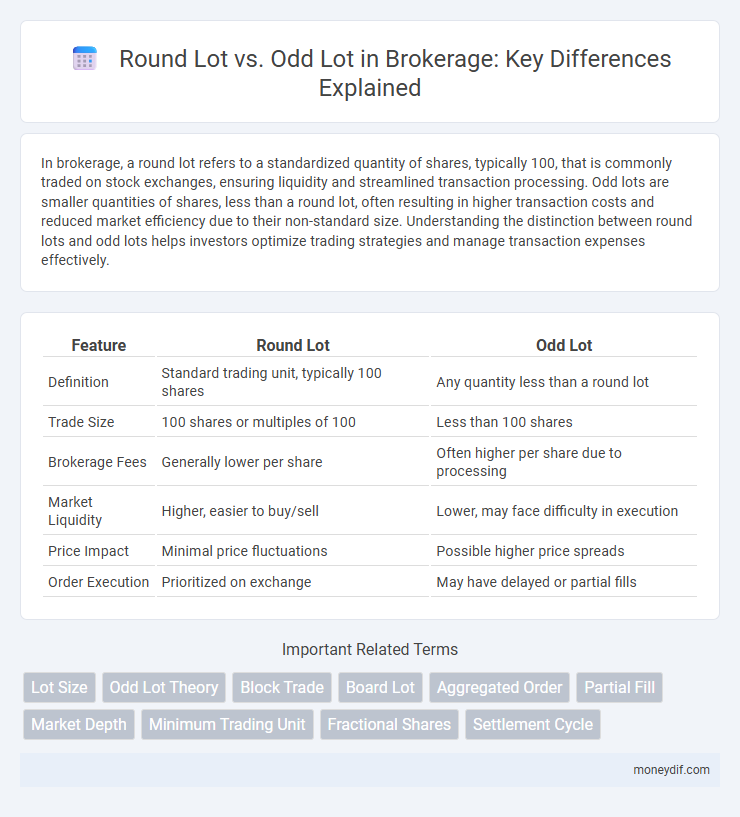

In brokerage, a round lot refers to a standardized quantity of shares, typically 100, that is commonly traded on stock exchanges, ensuring liquidity and streamlined transaction processing. Odd lots are smaller quantities of shares, less than a round lot, often resulting in higher transaction costs and reduced market efficiency due to their non-standard size. Understanding the distinction between round lots and odd lots helps investors optimize trading strategies and manage transaction expenses effectively.

Table of Comparison

| Feature | Round Lot | Odd Lot |

|---|---|---|

| Definition | Standard trading unit, typically 100 shares | Any quantity less than a round lot |

| Trade Size | 100 shares or multiples of 100 | Less than 100 shares |

| Brokerage Fees | Generally lower per share | Often higher per share due to processing |

| Market Liquidity | Higher, easier to buy/sell | Lower, may face difficulty in execution |

| Price Impact | Minimal price fluctuations | Possible higher price spreads |

| Order Execution | Prioritized on exchange | May have delayed or partial fills |

Understanding Round Lot and Odd Lot in Brokerage

In brokerage, a round lot typically refers to a standard trading unit of 100 shares for most stocks, facilitating easier order execution and pricing. Odd lots are any share quantities fewer than 100, often resulting in differing transaction fees or less liquidity. Traders must understand these distinctions to optimize order placement and trading costs effectively.

Key Differences Between Round Lot and Odd Lot

Round lots typically consist of 100 shares or multiples thereof, making transactions more liquid and often subject to lower trading fees compared to odd lots, which are smaller quantities of shares under 100. Institutional investors and professional traders frequently transact in round lots to benefit from better pricing and market execution, while odd lots are common among retail investors or those making partial share purchases. Round lots tend to have more straightforward processing and clearer market signals, whereas odd lots may face wider bid-ask spreads and less favorable trade terms.

Historical Background of Lot Sizes

Round lots historically served as the standard trading unit, typically consisting of 100 shares, simplifying the trading process and market quotation systems. Odd lots emerged as smaller quantities of shares, often less than 100, initially viewed as less desirable due to higher transaction costs and limited liquidity. Over time, the evolution of electronic trading reduced these disadvantages, allowing odd lots to gain acceptance and influence market dynamics alongside round lots.

How Round Lots Affect Trading Liquidity

Round lots, typically consisting of 100 shares, significantly enhance trading liquidity by standardizing trade sizes and facilitating smoother order matching on exchanges. Market participants prefer round lots because these larger, uniform quantities reduce bid-ask spreads and increase the likelihood of executing trades quickly at desired prices. Higher liquidity in round lots improves market efficiency and price stability, benefiting institutional investors and market makers.

Odd Lots and Their Impact on Trade Execution

Odd lots, typically defined as stock orders with fewer than 100 shares, often face different execution dynamics compared to round lots, which are standard trading units of 100 shares. Odd lot trades may incur higher transaction costs and receive lower priority in trade execution, potentially leading to less favorable pricing and increased market impact. The prevalence of odd lot orders can influence liquidity and price discovery, as they fragment trading volume and complicate order book transparency.

Broker Handling of Round Lot vs Odd Lot Orders

Brokers typically prioritize round lot orders, which consist of standard share multiples (usually 100 shares), because they align with market conventions and facilitate smoother execution. Odd lot orders, involving fewer shares than a round lot, often receive different handling due to lower liquidity and potential price discrepancies, sometimes resulting in higher transaction costs or partial fills. Modern electronic trading platforms increasingly automate odd lot processing, but brokers still monitor these trades closely to optimize execution quality and minimize market impact.

Fees and Costs: Round Lot vs Odd Lot

Round lot transactions typically incur lower fees and tighter bid-ask spreads compared to odd lot trades, making them more cost-efficient for investors. Odd lot orders often face higher per-share commissions and less favorable pricing due to their smaller size and lower market liquidity. Brokerages may also apply additional fees or less competitive execution terms on odd lots, increasing the overall trading cost relative to round lots.

Implications for Retail and Institutional Investors

Round lots, typically consisting of 100 shares, offer institutional investors advantages such as lower transaction costs, greater liquidity, and more favorable order execution due to standardized trade sizes. Odd lots, comprising fewer than 100 shares, are common among retail investors but may incur higher fees, reduced market liquidity, and potential price inefficiencies during execution. Understanding these differences enables investors to optimize trading costs, enhance liquidity access, and improve portfolio management strategies tailored to their transaction sizes.

Odd Lot Trading Trends in Modern Markets

Odd lot trading in modern brokerage markets has gained significant traction due to increased retail investor participation and fractional share offerings. These trades, involving fewer than 100 shares, enable investors to diversify portfolios with smaller capital and take advantage of market opportunities previously limited to round lot holders. Recent data indicates a surge in odd lot transactions, reflecting changing market dynamics and enhanced accessibility through online trading platforms.

Choosing the Right Lot Size Strategy for Your Portfolio

Selecting the appropriate lot size strategy between round lots and odd lots significantly impacts portfolio efficiency and trading costs. Round lots, typically consisting of 100 shares, offer better liquidity and lower transaction fees, making them ideal for large-scale investors seeking streamlined execution. Investors with smaller portfolios or those pursuing tailored exposure may prefer odd lots, enabling precise allocation without unnecessary capital commitment.

Important Terms

Lot Size

A standard lot size in trading is typically 100 shares, known as a round lot, while any quantity less than 100 shares is considered an odd lot, often affecting transaction costs and liquidity.

Odd Lot Theory

Odd Lot Theory suggests that retail investors who trade in odd lots--quantities less than the standard round lot of 100 shares--often act as contrarian indicators to market trends.

Block Trade

Block trades typically involve large round lots of securities, exceeding standard odd lot sizes, facilitating efficient execution of substantial transactions with minimal market impact.

Board Lot

A Board Lot refers to a standardized trading unit of shares, typically 100 shares, contrasting with a Round Lot which is any whole multiple of the Board Lot, while an Odd Lot consists of fewer shares than a Board Lot, often making it less liquid and subject to different trading rules.

Aggregated Order

Aggregated orders combine multiple round lot and odd lot trades to enhance market liquidity and improve price discovery efficiency.

Partial Fill

Partial fill occurs when an order quantity does not match a round lot size of 100 shares, resulting in a trade execution involving odd lots that may have different pricing or liquidity characteristics.

Market Depth

Market depth displays the available buy and sell orders for round lots and odd lots, highlighting liquidity differences and price impact in trading.

Minimum Trading Unit

Minimum trading unit typically refers to a round lot, which is the standardized quantity of shares in a stock transaction, while odd lots represent smaller, non-standard quantities below the minimum trading unit.

Fractional Shares

Fractional shares represent partial ownership of a stock that does not meet the minimum quantity of 100 shares required for a round lot, making them classified as odd lots in trading.

Settlement Cycle

Settlement cycles for round lots typically follow standard T+2 regulations, while odd lots may experience different processing times due to their non-standard trade sizes.

Round Lot vs Odd Lot Infographic

moneydif.com

moneydif.com