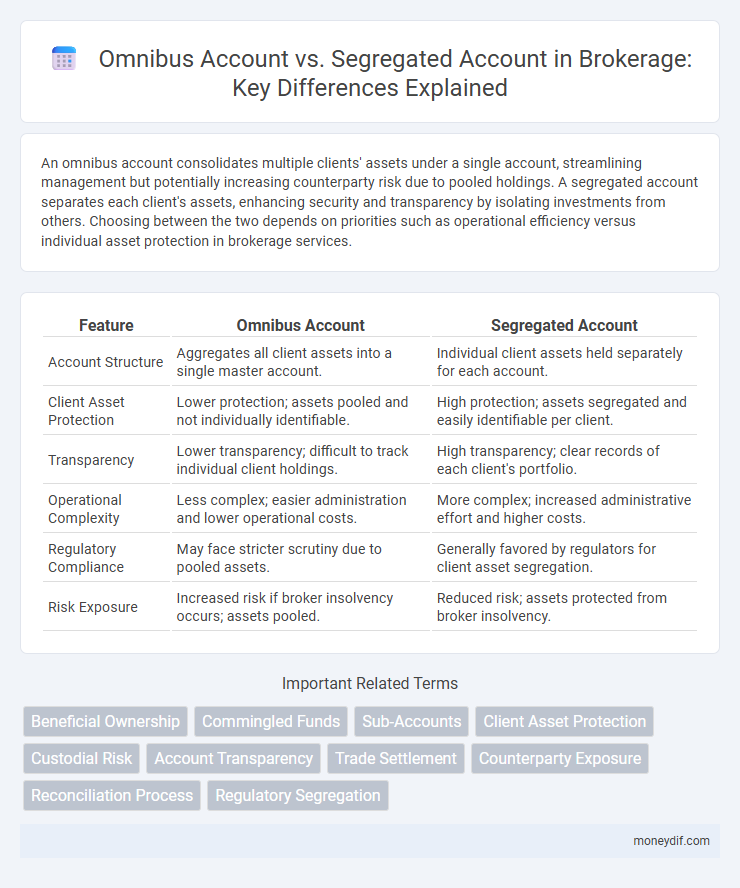

An omnibus account consolidates multiple clients' assets under a single account, streamlining management but potentially increasing counterparty risk due to pooled holdings. A segregated account separates each client's assets, enhancing security and transparency by isolating investments from others. Choosing between the two depends on priorities such as operational efficiency versus individual asset protection in brokerage services.

Table of Comparison

| Feature | Omnibus Account | Segregated Account |

|---|---|---|

| Account Structure | Aggregates all client assets into a single master account. | Individual client assets held separately for each account. |

| Client Asset Protection | Lower protection; assets pooled and not individually identifiable. | High protection; assets segregated and easily identifiable per client. |

| Transparency | Lower transparency; difficult to track individual client holdings. | High transparency; clear records of each client's portfolio. |

| Operational Complexity | Less complex; easier administration and lower operational costs. | More complex; increased administrative effort and higher costs. |

| Regulatory Compliance | May face stricter scrutiny due to pooled assets. | Generally favored by regulators for client asset segregation. |

| Risk Exposure | Increased risk if broker insolvency occurs; assets pooled. | Reduced risk; assets protected from broker insolvency. |

Introduction to Brokerage Account Types

Omnibus accounts pool multiple clients' funds and securities into a single account, simplifying management but potentially reducing transparency for individual investors. Segregated accounts maintain separate records and holdings for each client, offering enhanced security and easier tracking of individual assets. Brokerage firms select account types based on operational efficiency, regulatory requirements, and client asset protection preferences.

What Is an Omnibus Account?

An omnibus account in brokerage is a pooled account that consolidates multiple clients' trades under a single account held by the broker, facilitating streamlined trade execution and settlement. This structure centralizes record-keeping and reduces operational complexity compared to segregated accounts, where each client's assets are maintained individually. Omnibus accounts provide efficiency but may introduce higher counterparty risk since client holdings are not distinctly separated.

What Is a Segregated Account?

A segregated account is a brokerage account where clients' funds and securities are held separately from the broker's own assets, ensuring protection against the broker's insolvency. Regulatory frameworks often mandate segregation to enhance client asset security and facilitate clear reporting and reconciliation. This separation reduces risk and provides clients with greater confidence in the safekeeping of their investments.

Key Differences Between Omnibus and Segregated Accounts

Omnibus accounts consolidate multiple investors' holdings under a single account held by the broker, simplifying administrative processes but reducing individual client transparency. Segregated accounts maintain separate records and custody for each client's assets, enhancing protection and clarity during audits or insolvency events. The choice impacts regulatory compliance, risk allocation, and operational efficiency within brokerage management.

Risk Management: Omnibus vs Segregated Accounts

Omnibus accounts consolidate multiple clients' assets under a single account, increasing the risk of collective exposure if the broker faces insolvency, whereas segregated accounts isolate each client's assets, providing better protection against counterparty risk. Segregated accounts enhance risk management by ensuring individual client funds are not commingled, reducing the likelihood of asset loss due to broker default or operational errors. Omnibus accounts may offer operational efficiencies but compromise on asset protection, making segregated accounts the preferred choice for minimizing systemic and client-specific risks in brokerage services.

Regulatory Compliance and Legal Considerations

Omnibus accounts consolidate multiple clients' assets under a single account, simplifying transaction processing but requiring stringent regulatory compliance to ensure transparency and prevent commingling of funds. Segregated accounts maintain client assets separately, offering enhanced legal protection and clear ownership identification, which aligns with strict regulatory mandates on asset protection and client fund segregation. Regulatory frameworks such as SEC Rule 15c3-3 enforce rigorous standards on recordkeeping and client asset segregation, making segregated accounts preferable for meeting legal obligations and minimizing counterparty risk.

Cost Implications for Brokerages and Clients

Omnibus accounts consolidate multiple clients' assets into a single account, reducing administrative and custody fees for brokerages, which often leads to lower transaction costs for clients. Segregated accounts, while more expensive due to individual client asset separation and enhanced regulatory compliance, provide greater transparency and risk protection for clients. Brokerages must weigh lower operational costs against client preference for security and regulatory requirements when deciding between omnibus and segregated account structures.

Privacy and Transparency: Omnibus vs Segregated

Omnibus accounts aggregate multiple clients' funds under a single account, enhancing privacy by limiting individual transaction visibility, while segregated accounts maintain distinct records for each client, ensuring greater transparency. Privacy in omnibus accounts can protect client identities but may complicate regulatory audits and reconciliations. Segregated accounts provide clear transaction trails, facilitating compliance and investor protection through transparent asset segregation.

Which Account Type Suits Different Investors?

Omnibus accounts are ideal for institutional investors and brokerages that require simplified trade processing and cost efficiency by consolidating multiple client trades into a single account. Segregated accounts suit individual investors seeking greater transparency and asset protection, as client funds are held separately, reducing counterparty risk. Choosing between these accounts depends on the investor's need for operational simplicity versus enhanced security and regulatory compliance.

Conclusion: Choosing the Right Brokerage Account

Choosing the right brokerage account depends on your priorities: an omnibus account offers operational efficiency and lower costs by pooling client assets, while a segregated account provides enhanced security and individualized asset protection. Investors seeking transparency and greater control often prefer segregated accounts, especially in volatile markets or regulatory-sensitive environments. Evaluating your risk tolerance, regulatory requirements, and service preferences will help determine which account type aligns best with your investment strategy.

Important Terms

Beneficial Ownership

Beneficial ownership in an omnibus account obscures individual investor identities by pooling assets, whereas segregated accounts maintain transparent, separate ownership records for each investor, enhancing asset protection and regulatory compliance.

Commingled Funds

Commingled funds pool multiple investors' assets within omnibus accounts for streamlined management, whereas segregated accounts maintain individual investor assets separately to ensure distinct ownership and tailored reporting.

Sub-Accounts

Sub-accounts in omnibus accounts pool multiple clients' assets under a single master account for aggregated trading, while segregated accounts maintain individual client assets separately to enhance transparency and reduce counterparty risk.

Client Asset Protection

Client asset protection is significantly enhanced in segregated accounts compared to omnibus accounts because segregated accounts separate individual client funds, reducing the risk of loss during broker insolvency.

Custodial Risk

Custodial risk is higher in omnibus accounts due to pooled client assets increasing exposure to commingling and insolvency issues, whereas segregated accounts mitigate this risk by keeping individual client assets separate and easily identifiable.

Account Transparency

Omnibus accounts pool multiple clients' assets under a single account increasing operational efficiency but reducing transparency, whereas segregated accounts maintain individual client asset separation providing higher account transparency and enhanced regulatory compliance.

Trade Settlement

Trade settlements in omnibus accounts consolidate multiple client trades for streamlined processing but increase counterparty risk, while segregated accounts separate client assets, enhancing security and regulatory compliance.

Counterparty Exposure

Counterparty exposure in omnibus accounts increases risk due to pooled assets lacking individual segregation, whereas segregated accounts limit exposure by isolating client assets separately.

Reconciliation Process

The reconciliation process for omnibus accounts consolidates multiple client transactions into a single account statement, requiring detailed aggregation and accuracy checks, whereas segregated accounts maintain individual client records, simplifying reconciliation by directly matching each client's transactions and balances.

Regulatory Segregation

Regulatory segregation mandates that client assets held in segregated accounts are physically separated and protected from the firm's own assets, unlike omnibus accounts where multiple clients' assets are pooled, potentially increasing risk exposure.

Omnibus Account vs Segregated Account Infographic

moneydif.com

moneydif.com