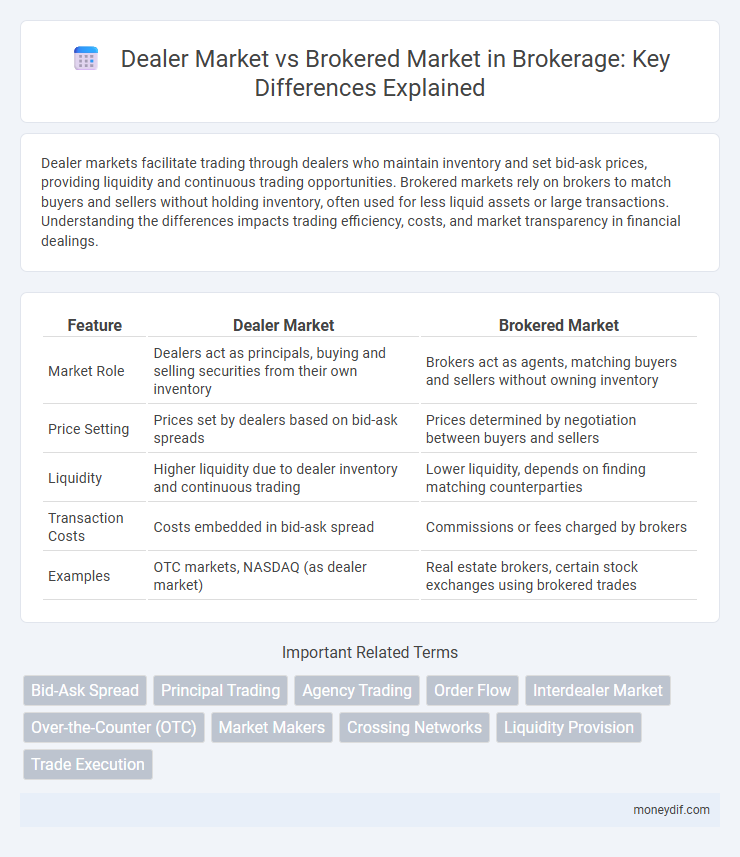

Dealer markets facilitate trading through dealers who maintain inventory and set bid-ask prices, providing liquidity and continuous trading opportunities. Brokered markets rely on brokers to match buyers and sellers without holding inventory, often used for less liquid assets or large transactions. Understanding the differences impacts trading efficiency, costs, and market transparency in financial dealings.

Table of Comparison

| Feature | Dealer Market | Brokered Market |

|---|---|---|

| Market Role | Dealers act as principals, buying and selling securities from their own inventory | Brokers act as agents, matching buyers and sellers without owning inventory |

| Price Setting | Prices set by dealers based on bid-ask spreads | Prices determined by negotiation between buyers and sellers |

| Liquidity | Higher liquidity due to dealer inventory and continuous trading | Lower liquidity, depends on finding matching counterparties |

| Transaction Costs | Costs embedded in bid-ask spread | Commissions or fees charged by brokers |

| Examples | OTC markets, NASDAQ (as dealer market) | Real estate brokers, certain stock exchanges using brokered trades |

Understanding Dealer Markets: An Overview

Dealer markets operate through dealers who hold inventories of securities and facilitate trading by buying and selling from their own accounts, providing liquidity to the market. Unlike brokered markets, where brokers act as intermediaries matching buyers and sellers without holding inventories, dealer markets enable continuous two-sided quotes and faster execution. Prominent examples of dealer markets include the NASDAQ and the over-the-counter (OTC) markets, which rely heavily on market makers to maintain efficient price discovery and trade flow.

What Defines a Brokered Market?

A brokered market is defined by the presence of intermediaries who facilitate trades between buyers and sellers without holding inventory or taking on market risk. Brokers match counterparties and earn commissions or fees for their services, ensuring liquidity and transparency in less liquid or specialized markets. Unlike dealer markets, brokered markets rely on these third-party agents to connect participants, rather than dealers executing trades from their own accounts.

Key Players in Dealer and Brokered Markets

Dealer markets feature key players known as dealers who act as principals, holding inventories of securities and providing liquidity by buying and selling directly with clients. Brokered markets rely on brokers who act as intermediaries, facilitating transactions between buyers and sellers without holding inventory. In dealer markets, firms such as investment banks or market makers dominate, whereas brokered markets often involve specialized brokerage firms or platforms connecting counterparties.

How Transactions Differ: Dealer vs Brokered Systems

In dealer markets, transactions occur directly between buyers and dealers who hold an inventory of securities, allowing for immediate execution and price setting by the dealers themselves. Brokered markets involve brokers who facilitate trades by connecting buyers and sellers but do not hold inventory, relying on finding counterparties to complete transactions. This distinction results in dealer markets offering greater liquidity and faster execution, whereas brokered markets may involve longer search times and depend heavily on the broker's network.

Liquidity and Pricing Mechanisms Compared

In dealer markets, liquidity is typically higher due to dealers actively quoting bid and ask prices, facilitating immediate transactions. Brokered markets rely on intermediaries to match buyers and sellers, which may result in lower liquidity and wider price spreads. Pricing mechanisms in dealer markets are driven by dealer inventory and competition, whereas brokered markets depend on broker negotiation and the aggregation of buyers and sellers.

Regulatory Environment for Dealer and Brokered Markets

Dealer markets operate under stringent regulatory frameworks designed to ensure transparency, fair pricing, and capital adequacy, with entities required to register with regulatory bodies such as the SEC and comply with the Dodd-Frank Act's risk management standards. Brokered markets face regulatory oversight focusing on fiduciary duties, trade execution best practices, and conflict of interest mitigation, governed by regulations like FINRA rules and MiFID II in the EU. Both markets emphasize investor protection, but dealer markets are subject to stricter capital requirements, while brokered markets prioritize transparent order handling and client asset segregation.

Risks and Transparency: Dealer vs Brokered Markets

Dealer markets present higher risks due to potential conflicts of interest from dealers acting as principals, often leading to reduced transparency in price formation and liquidity. Brokered markets offer enhanced transparency by matching buyers and sellers without holding inventory, minimizing conflicts and providing clearer price discovery. Investors benefit from brokered markets' open exchanges but may face slower executions compared to the immediacy and inventory risk absorption found in dealer markets.

Cost Structures and Fee Models Explained

Dealer markets typically involve brokers acting as principals, buying and selling securities from their own inventory which results in markup costs included in bid-ask spreads, generating profits through these spreads rather than explicit fees. Brokered markets operate by connecting buyers and sellers, charging explicit transaction fees or commissions based on trade volume or value, often providing more transparent cost structures. Understanding these fee models is essential for investors to assess overall trading costs and optimize their brokerage selections in various market environments.

Examples of Assets Traded in Each Market Type

Dealer markets primarily trade assets like stocks on the NASDAQ and corporate bonds where dealers hold inventories and provide liquidity. Brokered markets involve assets such as real estate, where brokers facilitate transactions between buyers and sellers without holding inventory. Other examples include collectibles and art for brokered markets, highlighting their reliance on intermediary expertise.

Choosing Between Dealer and Brokered Markets: Factors to Consider

Choosing between dealer and brokered markets depends on factors such as liquidity, transaction costs, and market transparency. Dealer markets offer greater immediacy and price certainty due to dealers' inventory holdings, while brokered markets provide access to a wider range of counterparties with potentially lower spreads but less immediacy. Market participants should evaluate trade size, urgency, and price impact to determine the optimal venue for execution.

Important Terms

Bid-Ask Spread

Bid-ask spreads in dealer markets tend to be narrower due to continuous inventory-based pricing by dealers, whereas brokered markets often exhibit wider spreads resulting from transaction-based matching between buyers and sellers.

Principal Trading

Principal trading involves dealers buying and selling securities for their own accounts, creating liquidity in dealer markets, whereas brokered markets rely on brokers who facilitate transactions between buyers and sellers without taking ownership of the securities.

Agency Trading

Agency trading involves brokers acting on behalf of clients to execute trades without taking ownership of securities, differing fundamentally from dealer markets where dealers buy and sell securities for their own accounts. In a dealer market, liquidity is provided by dealers who quote prices, whereas in brokered markets, brokers facilitate transactions between buyers and sellers, emphasizing agency roles and client interests.

Order Flow

Order flow in a dealer market is managed internally by dealers who buy and sell securities from their own inventory, whereas brokered markets facilitate trades by connecting buyers and sellers without holding inventory.

Interdealer Market

The interdealer market facilitates direct trading between dealers, contrasting with the brokered market where intermediaries match buyers and sellers without holding inventory.

Over-the-Counter (OTC)

The Over-the-Counter (OTC) market operates primarily through dealer markets where participants trade securities directly via dealers acting as principals, contrasting with brokered markets where brokers facilitate transactions between buyers and sellers without holding inventory.

Market Makers

Market makers provide liquidity by continuously quoting bid and ask prices in dealer markets, whereas brokered markets rely on brokers to match buyers and sellers without holding inventory.

Crossing Networks

Crossing networks facilitate anonymous trading by matching buy and sell orders internally, reducing market impact compared to traditional dealer markets where dealers set prices, and brokered markets where brokers execute trades between buyers and sellers.

Liquidity Provision

Liquidity provision in dealer markets relies on dealers holding inventory and quoting bid-ask spreads, whereas brokered markets facilitate liquidity by matching buyers and sellers without holding inventory.

Trade Execution

Trade execution in dealer markets occurs through dealers who hold inventories and set prices, whereas in brokered markets, brokers facilitate trades by matching buyers and sellers without holding inventory.

Dealer Market vs Brokered Market Infographic

moneydif.com

moneydif.com