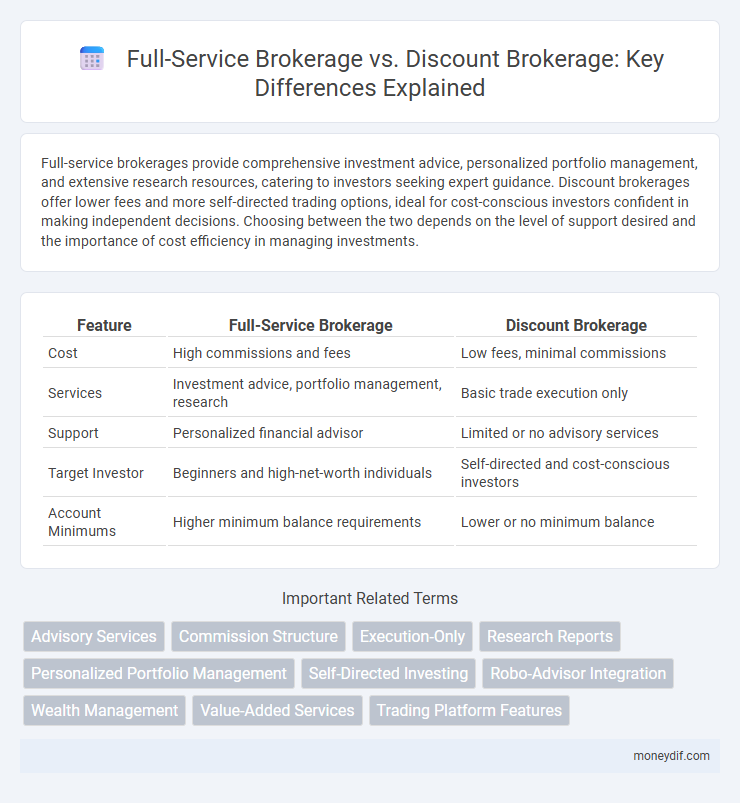

Full-service brokerages provide comprehensive investment advice, personalized portfolio management, and extensive research resources, catering to investors seeking expert guidance. Discount brokerages offer lower fees and more self-directed trading options, ideal for cost-conscious investors confident in making independent decisions. Choosing between the two depends on the level of support desired and the importance of cost efficiency in managing investments.

Table of Comparison

| Feature | Full-Service Brokerage | Discount Brokerage |

|---|---|---|

| Cost | High commissions and fees | Low fees, minimal commissions |

| Services | Investment advice, portfolio management, research | Basic trade execution only |

| Support | Personalized financial advisor | Limited or no advisory services |

| Target Investor | Beginners and high-net-worth individuals | Self-directed and cost-conscious investors |

| Account Minimums | Higher minimum balance requirements | Lower or no minimum balance |

Understanding Full-Service Brokerages: Key Features

Full-service brokerages provide personalized investment advice, portfolio management, and access to a wide range of financial products, including stocks, bonds, mutual funds, and retirement accounts. They offer tailored financial planning, research reports, and expert guidance, making them ideal for investors seeking comprehensive support and customized strategies. These brokerages typically charge higher fees and commissions compared to discount brokerages, reflecting the extensive services and professional expertise they offer.

Discount Brokerages: What They Offer

Discount brokerages provide cost-effective trading options with significantly lower fees compared to full-service brokerages, making them ideal for self-directed investors. They offer essential services such as online trading platforms, real-time market data, and access to a wide range of investment products including stocks, ETFs, and mutual funds. Limited personalized advice and research are common, but increased automation and educational resources support informed decision-making.

Comparing Cost Structures: Fees and Commissions

Full-service brokerages typically charge higher fees and commissions, often including management fees, account maintenance fees, and trading commissions, reflecting the comprehensive services they provide such as personalized advice and portfolio management. Discount brokerages offer significantly lower fees, with reduced or zero commissions on trades and minimal account fees, catering to self-directed investors who prioritize cost efficiency. Evaluating these cost structures involves balancing service benefits against fee savings, where discount brokers enable more cost-effective trading but lack the extensive support offered by full-service firms.

Service Level Differences: Personalized vs. Automated Support

Full-service brokerage firms offer personalized support through dedicated financial advisors who provide tailored investment strategies, portfolio management, and detailed market insights. Discount brokerages primarily utilize automated platforms with limited advisory services, focusing on cost-effective, self-directed trading. The choice between them hinges on the investor's need for expert guidance versus the preference for lower fees and autonomous control.

Investment Options and Research Tools

Full-service brokerages provide extensive investment options, including stocks, bonds, mutual funds, and retirement accounts, paired with comprehensive research tools such as market analysis, expert reports, and personalized portfolio advice. Discount brokerages typically offer a narrower range of investment products, focusing mainly on stocks and ETFs, and provide basic research tools with less detailed market insights. Investors seeking extensive guidance and diverse investment opportunities tend to prefer full-service brokerages, while those prioritizing lower costs and self-directed trading often choose discount brokerages.

Account Types and Accessibility

Full-service brokerages offer a range of account types including retirement accounts, managed portfolios, and taxable accounts, providing personalized advisory services with extensive market research tools. Discount brokerages primarily focus on self-directed taxable and retirement accounts, offering lower fees and easy online access but limited advisory support. Accessibility in discount brokerages is enhanced by user-friendly digital platforms, while full-service firms often require more complex account setups and higher minimum balances.

Suitability: Which Brokerage Fits Your Investment Style?

Full-service brokerage firms provide personalized investment advice, portfolio management, and research tailored to individual risk tolerance and financial goals, ideal for investors seeking comprehensive support. Discount brokerages offer lower fees and self-directed trading platforms, suitable for experienced investors comfortable managing their own portfolios. Assessing your investment style, risk appetite, and need for guidance helps determine whether a full-service or discount brokerage aligns best with your financial objectives.

Technological Capabilities and Trading Platforms

Full-service brokerages offer advanced trading platforms with comprehensive research tools, real-time market data, and personalized advisory services, catering to investors seeking in-depth support and sophisticated technology. Discount brokerages provide user-friendly, streamlined platforms emphasizing cost-efficiency, automated trading features, and mobile accessibility suitable for self-directed traders. Technological capabilities in full-service firms often include integrated financial planning software, while discount brokers prioritize low-latency execution and customizable dashboards.

Regulatory Protections and Security Measures

Full-service brokerages offer comprehensive regulatory protections through established compliance frameworks governed by entities like the SEC and FINRA, ensuring rigorous oversight and client asset security. Discount brokerages adhere to similar regulations but typically provide fewer advisory services, relying more on digital platforms with enhanced cybersecurity measures to protect user data and transactions. Both types must implement SIPC insurance and advanced encryption protocols to safeguard investments against fraud and unauthorized access.

Making the Right Choice: Factors to Consider

Choosing between full-service brokerage and discount brokerage depends on factors such as investment goals, level of required guidance, and budget. Full-service brokerages offer personalized advice, comprehensive research, and tailored portfolio management, ideal for investors seeking expert support. Discount brokerages provide lower fees and robust trading platforms suitable for self-directed investors confident in managing their own portfolios.

Important Terms

Advisory Services

Advisory services in full-service brokerage offer personalized investment guidance and portfolio management, while discount brokerage provides limited or no advisory support, focusing primarily on low-cost trade execution.

Commission Structure

Full-service brokerage commissions typically range from 1% to 2% per trade with added advisory fees, while discount brokerage commissions are significantly lower, often between $0 and $10 per trade, reflecting the reduced level of personalized services offered.

Execution-Only

Execution-only services offer trade placement without advice, contrasting with full-service brokerages that provide comprehensive financial guidance, while discount brokerages focus on low-cost trade execution with limited additional services.

Research Reports

Research reports comparing full-service brokerage and discount brokerage highlight that full-service brokers offer comprehensive financial advice, portfolio management, and personalized investment strategies, often accompanied by higher fees. Discount brokerages provide cost-effective trade execution for self-directed investors, emphasizing low commissions and digital platforms, attracting clients focused on minimizing expenses while maintaining trading flexibility.

Personalized Portfolio Management

Personalized Portfolio Management offers tailored investment strategies that typically align better with Full-Service Brokerage firms, which provide comprehensive financial advice and customized asset allocation, unlike Discount Brokerages that focus primarily on low-cost, execution-only trading services.

Self-Directed Investing

Self-directed investing allows individuals to choose between full-service brokerages, which offer personalized advice and comprehensive services, and discount brokerages, providing lower fees and basic trading platforms.

Robo-Advisor Integration

Robo-advisor integration enhances full-service brokerages by combining automated portfolio management with personalized financial advice, offering clients tailored investment strategies alongside traditional services. In discount brokerages, robo-advisors provide cost-effective, algorithm-driven investment solutions that minimize fees while maximizing accessibility for self-directed investors.

Wealth Management

Full-service brokerage firms provide personalized wealth management with comprehensive financial advice, while discount brokerages offer cost-effective trading with limited or no advisory services.

Value-Added Services

Value-Added Services in Full-Service Brokerage include personalized financial advice, portfolio management, and retirement planning, offering comprehensive support beyond basic trade execution. Discount Brokerage focuses on low-cost trades with minimal service, prioritizing cost-efficiency and technology-driven platforms for self-directed investors.

Trading Platform Features

Full-service brokerages offer comprehensive trading platforms with personalized advice, research tools, and advanced order types, while discount brokerages provide streamlined platforms focused on low-cost trades and essential features for self-directed investors.

Full-Service Brokerage vs Discount Brokerage Infographic

moneydif.com

moneydif.com