Crossing networks facilitate direct trades between buyers and sellers without routing orders through public exchanges, resulting in reduced market impact and lower transaction costs. Exchanges provide a centralized platform where buy and sell orders are matched transparently, ensuring price discovery and regulatory oversight. Investors choosing crossing networks benefit from privacy and potentially better execution price, while exchanges offer liquidity and market depth.

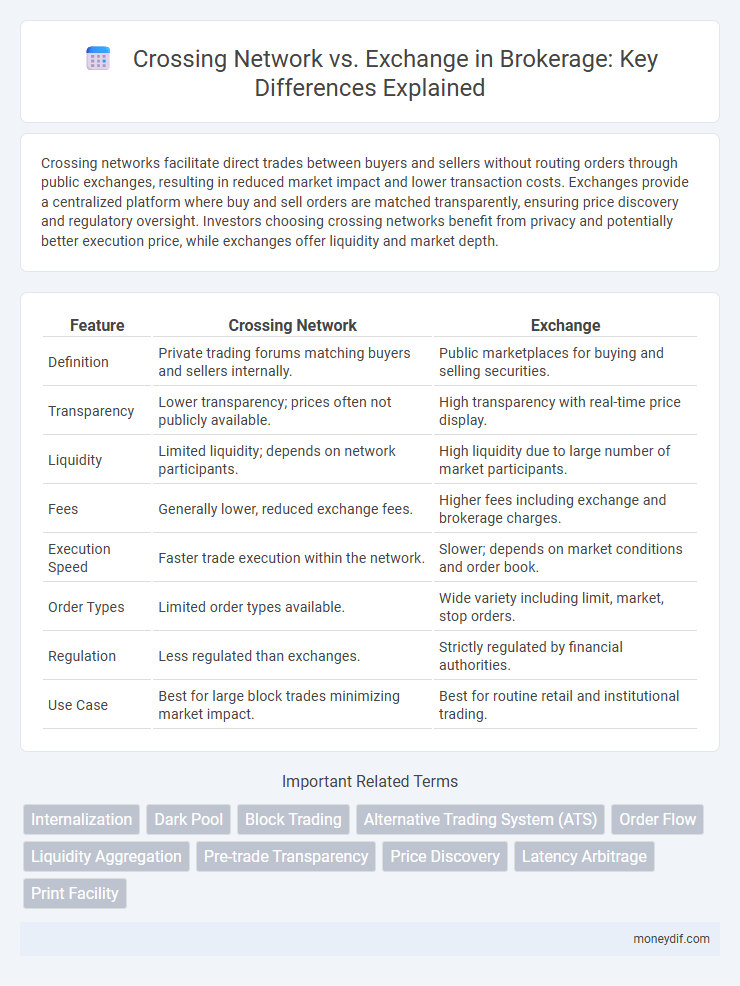

Table of Comparison

| Feature | Crossing Network | Exchange |

|---|---|---|

| Definition | Private trading forums matching buyers and sellers internally. | Public marketplaces for buying and selling securities. |

| Transparency | Lower transparency; prices often not publicly available. | High transparency with real-time price display. |

| Liquidity | Limited liquidity; depends on network participants. | High liquidity due to large number of market participants. |

| Fees | Generally lower, reduced exchange fees. | Higher fees including exchange and brokerage charges. |

| Execution Speed | Faster trade execution within the network. | Slower; depends on market conditions and order book. |

| Order Types | Limited order types available. | Wide variety including limit, market, stop orders. |

| Regulation | Less regulated than exchanges. | Strictly regulated by financial authorities. |

| Use Case | Best for large block trades minimizing market impact. | Best for routine retail and institutional trading. |

Introduction to Crossing Networks and Exchanges

Crossing networks operate by matching buy and sell orders directly between institutional investors, minimizing market impact and reducing transaction costs through off-exchange trading. Exchanges provide centralized platforms where securities are listed and traded openly with real-time price discovery and regulatory oversight to ensure transparency and liquidity. Both systems serve unique roles in brokerage by balancing efficiency, cost, and market access depending on investor needs.

Key Differences Between Crossing Networks and Exchanges

Crossing networks operate as private trading venues that match buy and sell orders internally, often facilitating block trades with reduced market impact and lower transaction costs compared to public exchanges. Exchanges provide centralized, transparent marketplaces where orders are matched on an open order book, ensuring price discovery and regulatory oversight. The primary differences lie in liquidity access, transparency, execution speed, and potential pricing advantages, with crossing networks favoring confidentiality and reduced market impact, while exchanges emphasize transparency and broader market participation.

How Crossing Networks Operate

Crossing networks operate by matching buy and sell orders internally without routing them to public exchanges, minimizing market impact and reducing transaction costs. These private systems utilize algorithms to pair orders within their network, often settling trades at midpoint prices between bid and ask quotes from major exchanges. Crossing networks provide institutional investors with greater anonymity and price improvement opportunities compared to traditional exchange trading.

How Traditional Exchanges Function

Traditional exchanges operate as centralized marketplaces where buyers and sellers submit orders that are matched through an order book system, ensuring transparency and price discovery. They facilitate liquidity by aggregating multiple participants and providing regulated environments that enforce trading rules and protect market integrity. Unlike crossing networks, exchanges typically involve public order books, continuous trading sessions, and standardized contract specifications.

Advantages of Crossing Networks in Brokerage

Crossing networks offer significant advantages in brokerage by providing reduced transaction costs and enhanced trade execution speed through direct matching of buy and sell orders outside public exchanges. They minimize market impact and price slippage by allowing large block trades to be executed anonymously, preserving confidentiality for institutional investors. Lower fees and improved liquidity access in crossing networks contribute to overall trading efficiency compared to traditional exchanges.

Challenges and Risks of Crossing Networks

Crossing networks face significant challenges such as limited transparency and lower regulatory oversight compared to traditional exchanges, increasing counterparty risk and potential price manipulation. These networks often struggle with liquidity fragmentation, leading to wider bid-ask spreads and execution uncertainty. The lack of centralized order books also raises concerns about fair access and the potential for conflicts of interest within broker-dealer operations.

Benefits of Using Exchanges for Traders

Exchanges provide traders with enhanced transparency by displaying real-time bid and ask prices, which enables informed decision-making and fair price discovery. The centralized nature of exchanges ensures higher liquidity and tighter bid-ask spreads, resulting in more efficient trade execution and reduced transaction costs. Regulatory oversight on exchanges offers traders increased security and protection against fraud, fostering trust in the trading environment.

Impact on Market Transparency and Price Discovery

Crossing networks execute trades privately, reducing market transparency by limiting public order book visibility and delaying trade reporting, which can impair price discovery by obscuring true supply and demand dynamics. In contrast, exchanges promote transparency through public order books and real-time trade reporting, enhancing accurate price discovery by reflecting comprehensive market information. The reduced transparency in crossing networks may benefit institutional traders seeking minimal market impact but can weaken overall market efficiency compared to exchange trading venues.

Liquidity Considerations: Crossing Networks vs Exchanges

Crossing networks aggregate liquidity by matching large block orders internally, minimizing market impact and reducing transaction costs for institutional investors. Exchanges provide centralized liquidity pools with continuous order books, enabling real-time price discovery but often facing higher volatility and transaction fees. Liquidity in crossing networks tends to be more discreet and stable, while exchanges offer greater transparency and depth, benefiting different trading strategies based on order size and urgency.

Choosing the Right Venue: Factors for Brokers and Investors

Choosing the right venue between crossing networks and exchanges depends on factors such as liquidity, transparency, and transaction costs. Crossing networks offer reduced market impact and anonymity, making them attractive for large block trades, while exchanges provide higher liquidity and price discovery through public order books. Brokers and investors must evaluate trade size, urgency, and the importance of price transparency to optimize execution outcomes.

Important Terms

Internalization

Internalization enables broker-dealers to execute client orders internally within crossing networks, offering reduced transaction costs and increased price improvement compared to traditional exchange executions.

Dark Pool

Dark pools are private crossing networks that enable institutional investors to execute large trades anonymously without impacting public exchange prices.

Block Trading

Block trading in crossing networks offers reduced market impact and lower transaction costs compared to traditional exchanges by matching large orders directly off-exchange.

Alternative Trading System (ATS)

An Alternative Trading System (ATS) facilitates non-exchange trading platforms such as Crossing Networks which match buy and sell orders internally, contrasting with traditional Exchanges that provide centralized, open order books for market participants.

Order Flow

Order flow in crossing networks offers reduced market impact and anonymity by matching large blocks of trades internally, whereas exchanges provide transparent, real-time price discovery through publicly displayed order books.

Liquidity Aggregation

Liquidity aggregation enhances trade execution by combining liquidity from crossing networks and exchanges, reducing price slippage and improving market depth.

Pre-trade Transparency

Crossing networks enhance pre-trade transparency by matching buy and sell orders internally, reducing market impact compared to traditional exchanges that publicly display order books and real-time trade data.

Price Discovery

Crossing networks enhance price discovery by reducing market impact and transaction costs compared to exchanges, which provide greater transparency and continuous order flow for price formation.

Latency Arbitrage

Latency arbitrage exploits speed differences between crossing networks and exchanges by rapidly executing trades on slower venues to capitalize on price discrepancies.

Print Facility

Crossing networks facilitate off-exchange trading by matching buy and sell orders internally, whereas exchanges provide centralized marketplaces with transparent order books and price discovery for print facilities to execute trades efficiently.

Crossing Network vs Exchange Infographic

moneydif.com

moneydif.com