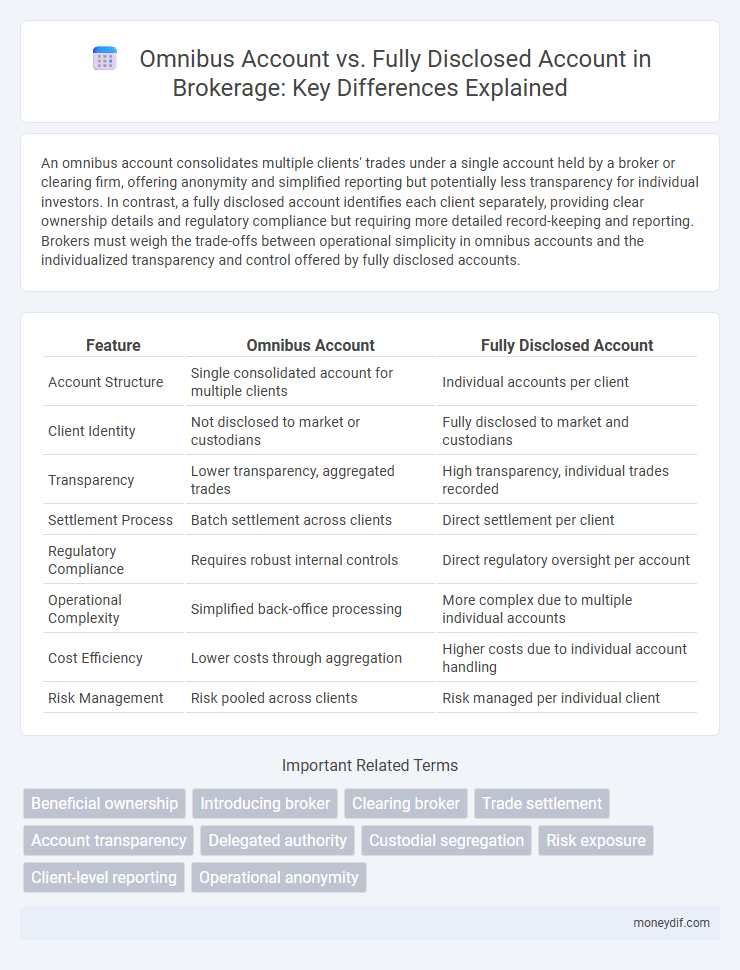

An omnibus account consolidates multiple clients' trades under a single account held by a broker or clearing firm, offering anonymity and simplified reporting but potentially less transparency for individual investors. In contrast, a fully disclosed account identifies each client separately, providing clear ownership details and regulatory compliance but requiring more detailed record-keeping and reporting. Brokers must weigh the trade-offs between operational simplicity in omnibus accounts and the individualized transparency and control offered by fully disclosed accounts.

Table of Comparison

| Feature | Omnibus Account | Fully Disclosed Account |

|---|---|---|

| Account Structure | Single consolidated account for multiple clients | Individual accounts per client |

| Client Identity | Not disclosed to market or custodians | Fully disclosed to market and custodians |

| Transparency | Lower transparency, aggregated trades | High transparency, individual trades recorded |

| Settlement Process | Batch settlement across clients | Direct settlement per client |

| Regulatory Compliance | Requires robust internal controls | Direct regulatory oversight per account |

| Operational Complexity | Simplified back-office processing | More complex due to multiple individual accounts |

| Cost Efficiency | Lower costs through aggregation | Higher costs due to individual account handling |

| Risk Management | Risk pooled across clients | Risk managed per individual client |

Understanding Omnibus and Fully Disclosed Accounts

Omnibus accounts aggregate multiple clients' assets under a single account typically used by brokers to simplify trade execution and custody, enhancing operational efficiency but reducing individual client transparency. Fully disclosed accounts, also known as segregated accounts, provide distinct identification of each client's holdings and transactions, ensuring clear accountability and regulatory compliance. Understanding the key differences involves recognizing omnibus accounts as collective portfolios with limited individual data visibility versus fully disclosed accounts offering granular client-specific reporting and risk management.

Key Differences Between Omnibus and Fully Disclosed Accounts

Omnibus accounts aggregate multiple clients' trades under a single master account, maintaining anonymity and simplifying administration for broker-dealers, whereas fully disclosed accounts record each client's transactions separately, ensuring transparency and individual ownership visibility. Risk management differs as omnibus accounts consolidate risk but complicate compliance, while fully disclosed accounts facilitate precise regulatory reporting and client-specific asset protection. Settlement processing in omnibus accounts is streamlined by batching transactions, contrasted with fully disclosed accounts requiring detailed reconciliations per individual client.

Structure and Function of Omnibus Accounts

Omnibus accounts consolidate multiple individual client orders under a single account held by a broker-dealer, simplifying trade execution and custody by aggregating transactions. This structure enhances operational efficiency, reduces administrative costs, and maintains client confidentiality by not disclosing individual investor details to clearing firms. Functionally, omnibus accounts enable brokers to batch trades for faster settlement while ensuring regulatory compliance through rigorous internal record-keeping and client reconciliation processes.

Structure and Function of Fully Disclosed Accounts

Fully disclosed accounts are structured to directly link each client's trades and holdings to their identity, enhancing transparency and regulatory compliance. This account type facilitates individualized record-keeping, allowing brokers to report transactions and tax documents under the client's name. The clear segregation of assets and positions supports accurate financial reporting and reduces risk of commingling funds.

Regulatory Implications for Each Account Type

Omnibus accounts consolidate multiple client orders under a single account number, complicating regulatory compliance due to the lack of individual investor identification, which may increase risks related to anti-money laundering (AML) and know-your-customer (KYC) requirements. Fully disclosed accounts provide clear client identification to regulatory bodies, enhancing transparency and facilitating adherence to SEC, FINRA, and other regulatory mandates. Regulatory frameworks often mandate stringent reporting and record-keeping for fully disclosed accounts, while omnibus accounts require robust internal controls to mitigate compliance risks associated with aggregated client information.

Risk Management: Omnibus vs. Fully Disclosed Accounts

Omnibus accounts consolidate multiple client orders under a single account number, amplifying operational risk due to limited transparency and potential regulatory scrutiny. Fully disclosed accounts provide clear, individual client identification, enhancing risk management by enabling precise tracking and compliance. Effective risk management relies on balancing the efficiency of omnibus accounts with the detailed oversight afforded by fully disclosed accounts to mitigate liquidity and counterparty risks.

Transparency and Reporting Requirements

Omnibus accounts consolidate multiple client orders under a single account number, reducing transparency by limiting individual trade visibility to brokers and regulatory bodies, which can complicate audit trails and compliance checks. Fully disclosed accounts provide granular reporting on each client's trade activity, ensuring transparency by allowing brokers and regulators to monitor specific transactions and holdings directly. Enhanced transparency in fully disclosed accounts supports stringent reporting requirements, facilitating adherence to regulatory standards and improving client accountability.

Client Benefits and Drawbacks of Each Account

Omnibus accounts consolidate multiple clients' trades under a single account, enhancing trading speed and reducing administrative costs but limiting individual trade transparency and regulatory oversight for clients. Fully disclosed accounts provide complete transparency and individualized reporting, improving regulatory compliance and client trust but often involve higher fees and slower transaction processing. Clients choosing omnibus accounts benefit from cost-efficiency and streamlined executions, while those opting for fully disclosed accounts prioritize detailed asset tracking and personalized control over investments.

Operational Challenges in Managing Brokerage Accounts

Omnibus accounts consolidate multiple client transactions under a single account, complicating trade allocation and increasing the risk of compliance errors, while fully disclosed accounts provide transparency through direct client identification, simplifying regulatory reporting but increasing administrative workload. Operational challenges include maintaining accurate record-keeping and managing margin requirements, as omnibus accounts require detailed internal tracking whereas fully disclosed accounts necessitate frequent client communication and reconciliation. Brokerages must balance efficiency and compliance by implementing robust technology solutions to mitigate risks associated with each account type.

Choosing the Right Account Type for Your Brokerage Needs

Choosing the right account type for your brokerage needs hinges on your transparency and control preferences. An omnibus account consolidates multiple clients under one master account, simplifying administration but limiting individual reporting and customization. Fully disclosed accounts provide detailed client-specific data and regulatory transparency, essential for personalized management and compliance with strict fiduciary standards.

Important Terms

Beneficial ownership

Beneficial ownership in fully disclosed accounts provides transparent attribution of securities to individual clients, unlike omnibus accounts which consolidate holdings under a single account, obscuring direct owner identification.

Introducing broker

Introducing brokers managing omnibus accounts consolidate multiple client orders under one account, enhancing trade execution efficiency, while fully disclosed accounts provide detailed individual client information to clearing firms for increased transparency and regulatory compliance.

Clearing broker

A clearing broker facilitates trade settlement by holding securities and cash in omnibus accounts that aggregate multiple clients' trades without disclosing individual identities to the clearinghouse, enhancing operational efficiency and lower costs. Fully disclosed accounts, in contrast, provide the clearing broker with detailed client information for each transaction, enabling tailored reporting and compliance with regulatory requirements on a per-customer basis.

Trade settlement

Trade settlement for omnibus accounts involves consolidating multiple client trades under a single account number, streamlining processing but requiring meticulous record-keeping to ensure accurate allocation. Fully disclosed accounts settle trades directly under individual client names, enhancing transparency and compliance while potentially increasing administrative complexity.

Account transparency

Omnibus accounts aggregate multiple client orders under a single account number, limiting transparency by concealing individual investor identities, whereas fully disclosed accounts provide detailed information on each individual investor, enhancing regulatory compliance and risk management. The choice between omnibus and fully disclosed accounts significantly impacts trade reporting accuracy, anti-money laundering measures, and overall market transparency.

Delegated authority

Delegated authority in omnibus accounts allows a single custodian to manage multiple clients' assets collectively without individual disclosure, whereas fully disclosed accounts grant direct authority to manage assets with explicit ownership and transparency for each client.

Custodial segregation

Custodial segregation in omnibus accounts consolidates multiple clients' assets under one umbrella, lacking individual identification unlike fully disclosed accounts that maintain separate, detailed client records for regulatory transparency and asset protection.

Risk exposure

Risk exposure in omnibus accounts arises from aggregated client positions, increasing counterparty and operational risks due to lack of individual client identification, whereas fully disclosed accounts mitigate these risks by maintaining distinct client information, enhancing transparency and regulatory compliance. Omnibus accounts can lead to amplified market risk during volatility due to pooled assets, while fully disclosed accounts allow for precise risk assessment and tailored risk management strategies.

Client-level reporting

Client-level reporting provides detailed transaction and position data for individual investors within omnibus accounts, enabling precise tax, compliance, and performance analysis. Fully disclosed accounts simplify reporting by directly linking client information to trades, but omnibus accounts require sophisticated reconciliation processes to maintain accurate client-level data across pooled assets.

Operational anonymity

Operational anonymity in omnibus accounts aggregates multiple client transactions under a single account, obscuring individual identities compared to fully disclosed accounts that reveal each client's specific ownership and activity.

omnibus account vs fully disclosed account Infographic

moneydif.com

moneydif.com