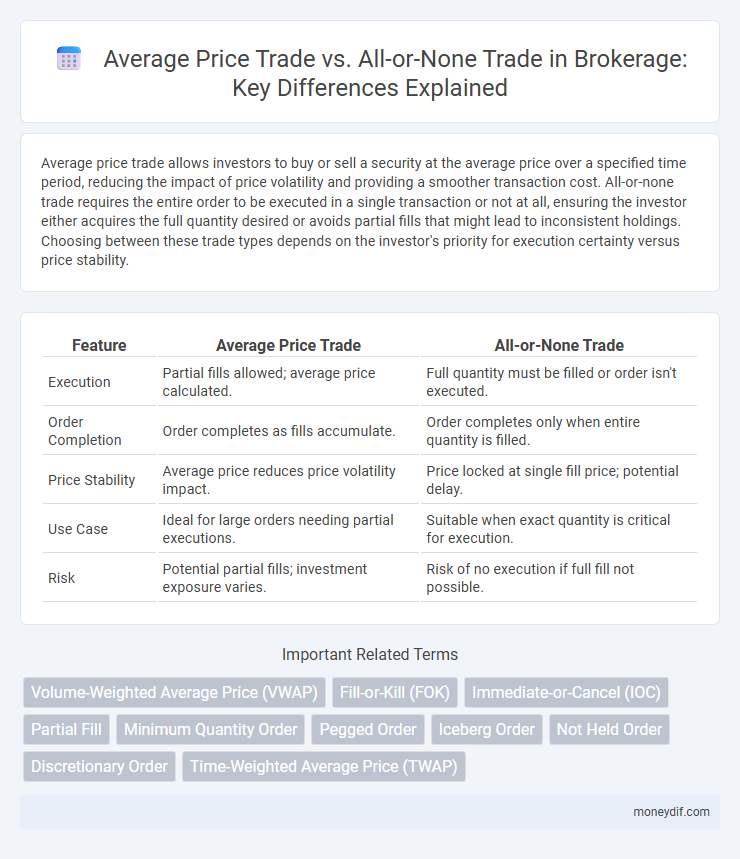

Average price trade allows investors to buy or sell a security at the average price over a specified time period, reducing the impact of price volatility and providing a smoother transaction cost. All-or-none trade requires the entire order to be executed in a single transaction or not at all, ensuring the investor either acquires the full quantity desired or avoids partial fills that might lead to inconsistent holdings. Choosing between these trade types depends on the investor's priority for execution certainty versus price stability.

Table of Comparison

| Feature | Average Price Trade | All-or-None Trade |

|---|---|---|

| Execution | Partial fills allowed; average price calculated. | Full quantity must be filled or order isn't executed. |

| Order Completion | Order completes as fills accumulate. | Order completes only when entire quantity is filled. |

| Price Stability | Average price reduces price volatility impact. | Price locked at single fill price; potential delay. |

| Use Case | Ideal for large orders needing partial executions. | Suitable when exact quantity is critical for execution. |

| Risk | Potential partial fills; investment exposure varies. | Risk of no execution if full fill not possible. |

Understanding Average Price Trade: Definition and Purpose

Average price trade aggregates multiple executed trades of a security into a single transaction reflected at the average execution price, enhancing cost efficiency and execution consistency. This method is primarily used to minimize market impact when executing large orders in brokerage, allowing investors to achieve a balanced price over multiple fills. Understanding average price trade is crucial for traders aiming to optimize trade execution and cost management compared to all-or-none trades that require full order fulfillment at once.

What is an All-or-None (AON) Trade?

An All-or-None (AON) trade is a brokerage order type that requires the entire order quantity to be executed in a single transaction or not at all, ensuring no partial fills occur. This contrasts with Average Price Trades, which allow partial executions at different prices, resulting in an averaged cost basis. AON orders are commonly used by investors seeking precise trade execution without fragmenting their positions.

Key Differences Between Average Price Trade and All-or-None Trade

Average Price Trade executes large orders in multiple smaller trades at different prices, resulting in a weighted average price, which helps minimize market impact and slippage. All-or-None Trade requires the entire order to be filled in a single transaction or not at all, ensuring full execution but potentially increasing trade delay or failure risk. The key difference lies in trade execution certainty versus price averaging, impacting order fulfillment speed and price precision in brokerage strategies.

How Average Price Trades Work in Modern Brokerage

Average Price Trades in modern brokerage aggregate multiple client orders over a set period, executing them at a single average price to achieve equitable filling and minimize market impact. This process enhances transaction efficiency by pooling liquidity and reducing slippage compared to individual order executions. Brokers leverage advanced algorithms and real-time market data to calculate the weighted average price, ensuring fair distribution of trade executions among participating clients.

Execution Mechanics of All-or-None Orders

All-or-None (AON) orders require the entire order quantity to be executed in a single transaction, preventing partial fills and reducing the risk of unfavorable price averages. Execution mechanics of AON orders involve holding the order until sufficient liquidity is available to complete the full trade, often leading to longer execution times compared to Average Price Trades, which allow partial fills and aggregate multiple executions to determine a consolidated average price. Brokers managing AON orders must monitor market depth and timing to ensure order fulfillment aligns with client expectations and trading strategies.

Risks and Benefits of Average Price Trading

Average Price Trading mitigates market impact risk by executing multiple trades at varying prices to achieve a weighted average cost, enhancing order execution flexibility compared to All-or-None (AON) trades that require full execution or none. This strategy reduces the risk of high volatility affecting large single trades and allows partial fills, improving liquidity management and cost efficiency. However, it may expose traders to market risk during the execution window and could result in less favorable average prices if the market moves sharply.

Pros and Cons of All-or-None Trades

All-or-None (AON) trades guarantee that an order is executed in its entirety or not at all, which prevents partial fills and helps maintain price integrity, but can lead to delayed execution or missed opportunities if the full quantity is unavailable. This order type is beneficial for large institutional investors seeking to avoid market impact and price slippage, though it may reduce liquidity and execution speed compared to Average Price trades that prioritize speed and partial fills at the average price point. Traders must weigh the certainty of full execution against potential delays and reduced market participation when choosing AON orders in brokerage strategies.

When to Use Average Price vs All-or-None Trades

Average Price trades are ideal for large orders that require execution at a price reflecting the overall market movement, minimizing price impact and providing a weighted average price. All-or-None trades are preferred when full order execution is critical, ensuring the entire quantity is filled or none at all, which is vital for illiquid securities or specific trading strategies. Choosing between these depends on trade size, liquidity, and the priority of partial fills versus complete execution.

Impact on Trading Strategies: A Comparative Analysis

Average Price Trade impacts trading strategies by enabling partial executions at multiple price points, optimizing order fulfillment and reducing market impact during high liquidity periods. All-or-None Trade influences strategies by requiring complete order execution, which minimizes partial fills but may delay transactions or increase exposure to price volatility. Comparing both, traders must balance execution certainty against price improvement opportunities to align with specific risk tolerance and market conditions.

Choosing the Right Order Type for Your Investment Goals

Selecting the appropriate order type hinges on your investment goals and trade strategy; average price trades allow execution at the weighted average price for large orders, optimizing cost efficiency. All-or-none trades ensure the entire order is filled simultaneously or not at all, which is crucial when partial fills could disrupt strategy or position size. Assessing market liquidity, urgency, and the importance of trade completion will guide investors to the optimal order type for achieving their financial objectives.

Important Terms

Volume-Weighted Average Price (VWAP)

Volume-Weighted Average Price (VWAP) provides a more accurate market benchmark by incorporating trade volume, contrasting with Average Price Trade which averages prices without volume weighting, and All-or-None Trade that executes entire orders at a single price to avoid partial fills.

Fill-or-Kill (FOK)

Fill-or-Kill (FOK) orders require immediate and complete execution at a specified price, often impacting the average price trade by avoiding partial fills common in All-or-None trades, which mandate full execution but allow delayed completion affecting price averaging.

Immediate-or-Cancel (IOC)

Immediate-or-Cancel (IOC) orders execute all or part of a trade instantly, canceling any unfilled portion, optimizing average price trades by allowing partial fills at desired prices. In contrast, All-or-None (AON) orders require the entire order quantity to be executed together, preventing partial fills but potentially delaying execution, affecting the timing and average price realization.

Partial Fill

Partial fill orders impact average price trades by executing at multiple prices resulting in a weighted average, whereas all-or-none trades execute only when the entire order quantity is filled at a single price.

Minimum Quantity Order

Minimum Quantity Order impacts trading strategies by setting a threshold that often results in average price trade executions rather than all-or-none trade executions, optimizing order fulfillment efficiency.

Pegged Order

Pegged Orders dynamically adjust based on market prices, allowing traders to achieve an average price trade strategy, whereas All-or-None Trades prioritize transaction completeness, potentially limiting price optimization.

Iceberg Order

Iceberg Orders allow large traders to execute substantial volumes by revealing only a portion of the order size, optimizing the average price trade by minimizing market impact. In contrast, All-or-None Trades require the entire order to be filled at once, potentially leading to less favorable average pricing due to execution delays or partial fills.

Not Held Order

A Not Held Order allows traders flexibility in execution timing and price during Average Price Trades, unlike All-or-None Trades which require complete fill at a specified price, impacting trade completion certainty and average execution costs.

Discretionary Order

A discretionary order allows traders to set price flexibility within a specified range, optimizing execution compared to the rigid conditions of an all-or-none trade and enhancing average price trade outcomes through selective order completion.

Time-Weighted Average Price (TWAP)

Time-Weighted Average Price (TWAP) calculates the average price of a security over a specified time period, optimizing execution by breaking large orders into smaller, time-distributed trades. Unlike All-or-None trades that require the entire order to be filled at once, TWAP focuses on minimizing market impact and achieving an average execution price close to the market trend.

Average Price Trade vs All-or-None Trade Infographic

moneydif.com

moneydif.com