Prime brokerage offers comprehensive services including securities lending, leveraged trade executions, and risk management tailored for hedge funds and institutional investors. Correspondent brokerage primarily facilitates access to global markets for smaller broker-dealers by providing execution, custody, and clearing services without the extensive portfolio of prime brokerage benefits. Understanding the distinct service scopes and client targets of both models helps firms optimize operational efficiency and client service strategies.

Table of Comparison

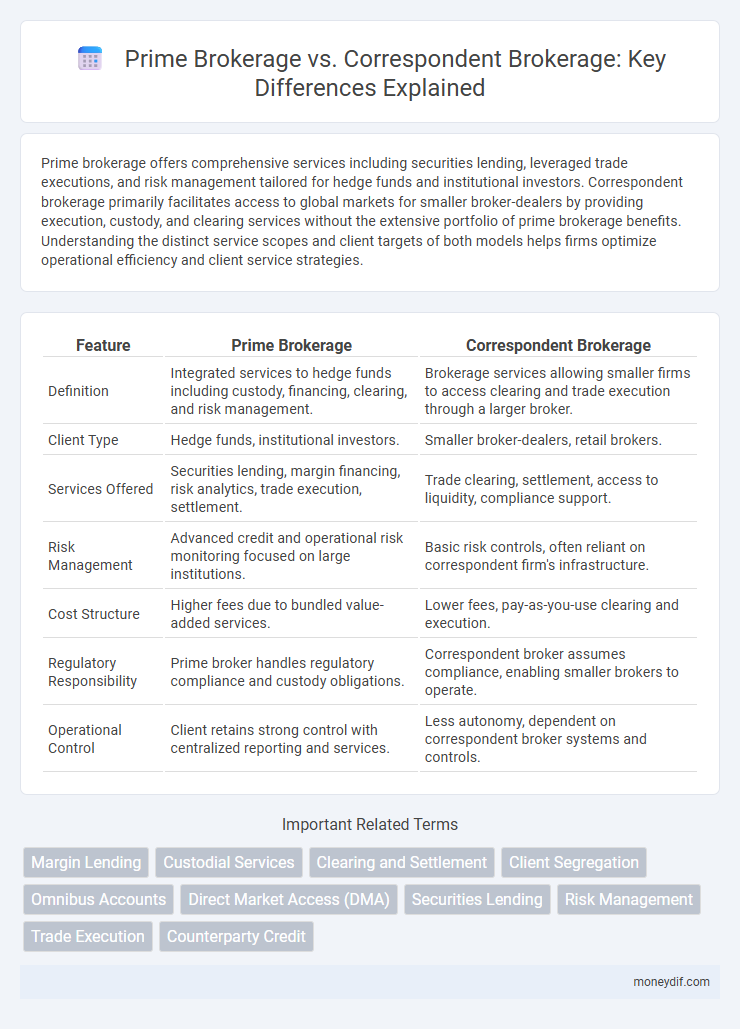

| Feature | Prime Brokerage | Correspondent Brokerage |

|---|---|---|

| Definition | Integrated services to hedge funds including custody, financing, clearing, and risk management. | Brokerage services allowing smaller firms to access clearing and trade execution through a larger broker. |

| Client Type | Hedge funds, institutional investors. | Smaller broker-dealers, retail brokers. |

| Services Offered | Securities lending, margin financing, risk analytics, trade execution, settlement. | Trade clearing, settlement, access to liquidity, compliance support. |

| Risk Management | Advanced credit and operational risk monitoring focused on large institutions. | Basic risk controls, often reliant on correspondent firm's infrastructure. |

| Cost Structure | Higher fees due to bundled value-added services. | Lower fees, pay-as-you-use clearing and execution. |

| Regulatory Responsibility | Prime broker handles regulatory compliance and custody obligations. | Correspondent broker assumes compliance, enabling smaller brokers to operate. |

| Operational Control | Client retains strong control with centralized reporting and services. | Less autonomy, dependent on correspondent broker systems and controls. |

Introduction to Prime Brokerage and Correspondent Brokerage

Prime brokerage offers comprehensive bundled services tailored for hedge funds and institutional investors, including trade execution, custody, financing, and risk management. Correspondent brokerage primarily involves smaller brokerage firms outsourcing trade execution and clearing services to larger brokers to leverage their infrastructure and regulatory compliance. Both models play crucial roles in financial markets by facilitating efficient trade processing and capital access.

Definition and Core Functions of Prime Brokerage

Prime brokerage is a bundled service offered by investment banks and securities firms to hedge funds and institutional clients, providing trade execution, custody, financing, and securities lending. Core functions of prime brokerage include consolidated reporting, margin financing, risk management, and access to global liquidity pools. Correspondent brokerage, in contrast, refers to a relationship where a smaller brokerage uses the infrastructure of a larger firm to process trades and clear transactions without offering the extensive support services found in prime brokerage.

Understanding Correspondent Brokerage Services

Correspondent brokerage services involve a brokerage firm providing access to clearing, custody, and settlement services for smaller broker-dealers that lack these capabilities. These smaller firms rely on the correspondent broker's infrastructure to execute trades and manage back-office operations efficiently. Understanding correspondent brokerage is essential for firms seeking operational support without the overhead of directly managing the entire trade lifecycle.

Key Differences Between Prime and Correspondent Brokerage

Prime brokerage offers comprehensive services such as clearing, custody, financing, and securities lending tailored for hedge funds and institutional clients, while correspondent brokerage primarily facilitates trade execution and clearing services for smaller broker-dealers lacking direct market access. Prime brokers provide advanced risk management tools and access to capital, whereas correspondent brokers focus on backend operational support and maintaining regulatory compliance. The key differences lie in service scope, client base sophistication, and level of financial intermediation.

Client Profiles: Who Uses Prime vs. Correspondent Brokerage?

Prime brokerage primarily serves institutional investors such as hedge funds, mutual funds, and asset managers seeking comprehensive services like securities lending, leverage, and risk management. Correspondent brokerage caters to smaller broker-dealers and regional firms requiring trade execution and clearing services without direct market access. Understanding client profiles helps tailor financial solutions, with prime clients demanding integrated platforms and correspondent clients focusing on cost-efficient operational support.

Advantages of Prime Brokerage for Institutional Clients

Prime brokerage offers institutional clients comprehensive services including consolidated trade execution, custody, and financing, enhancing operational efficiency and risk management. Access to advanced technology platforms and tailored capital introduction opportunities optimizes institutional investment strategies and liquidity management. This integrated approach supports scalability and seamless global market access, distinguishing prime brokerage from correspondent brokerage models.

Benefits and Limitations of Correspondent Brokerage

Correspondent brokerage offers smaller or regional brokerages access to a wider range of products, global markets, and trading capabilities by partnering with larger prime brokers, enabling them to serve clients more efficiently. However, limitations include higher operational risks due to reliance on the prime broker's infrastructure, potential delays in trade execution, and reduced control over client relationships and compliance processes. Despite these drawbacks, correspondent brokerage remains cost-effective for firms lacking the resources to build extensive in-house trading and custody systems.

Risk Management in Prime and Correspondent Brokerage

Prime brokerage offers advanced risk management tools enabling hedge funds and institutional clients to monitor and mitigate counterparty and market risks through centralized reporting and real-time analytics. Correspondent brokerage involves handling risk by partnering with multiple clearing brokers, which can diversify exposure but may introduce operational complexity and potential gaps in consolidated risk oversight. Effective risk management in prime brokerage relies on integrated platforms and direct credit relationships, whereas correspondent brokerage demands robust coordination and communication among multiple intermediaries to manage risk efficiently.

Cost and Fee Structures Compared

Prime brokerage typically involves higher fees due to comprehensive services like securities lending, margin financing, and risk management, which cater to hedge funds and institutional investors. Correspondent brokerage generally offers lower costs by providing more limited services, focusing on trade execution and settlement support for smaller or regional brokers. Firms must evaluate the trade-off between cost efficiency and service depth when choosing between prime and correspondent brokerage models.

Choosing Between Prime Brokerage and Correspondent Brokerage

Choosing between prime brokerage and correspondent brokerage depends on the scale and complexity of trading activities; prime brokerage offers comprehensive services such as custody, clearing, and financing typically suited for hedge funds and institutional investors. Correspondent brokerage focuses on executing trades through partnerships with other brokers, ideal for smaller firms seeking access to wider markets without extensive infrastructure. Evaluating operational needs, cost structures, and service scope is essential for selecting the most efficient brokerage model to optimize trading efficiency and risk management.

Important Terms

Margin Lending

Prime brokerage offers integrated margin lending solutions with consolidated risk management and reporting, while correspondent brokerage provides margin loans through third-party partnerships, often resulting in less streamlined service and higher costs.

Custodial Services

Prime brokerage offers integrated custodial services with enhanced portfolio management and financing solutions, whereas correspondent brokerage provides basic custodial functions primarily supporting trade execution and settlement.

Clearing and Settlement

Clearing and settlement processes differ between prime brokerage, which offers centralized trade execution and risk management for hedge funds, and correspondent brokerage, which provides access to multiple clearing firms for executing client orders through third-party intermediaries.

Client Segregation

Client segregation in prime brokerage ensures separate custody and risk isolation of client assets, unlike correspondent brokerage where client assets may be commingled with broker-dealer holdings.

Omnibus Accounts

Omnibus accounts consolidate multiple client trades under a single account in prime brokerage for streamlined execution and custody, whereas correspondent brokerage uses separate accounts for each client, emphasizing individualized settlement and reporting.

Direct Market Access (DMA)

Direct Market Access (DMA) enables hedge funds to execute trades directly on exchanges with lower latency and greater control, contrasting with Prime Brokerage which offers bundled services including clearing and financing, while Correspondent Brokerage primarily facilitates order routing without direct market execution.

Securities Lending

Prime brokerage offers integrated securities lending services with enhanced risk management and financing options, whereas correspondent brokerage primarily facilitates transaction execution without comprehensive lending solutions.

Risk Management

Prime brokerage offers comprehensive risk management solutions including centralized collateral, margin optimization, and real-time exposure monitoring, whereas correspondent brokerage primarily focuses on transactional services with limited integrated risk controls.

Trade Execution

Prime brokerage offers comprehensive trade execution services including direct market access and advanced order routing, while correspondent brokerage primarily facilitates trade settlement and clearing through intermediary relationships.

Counterparty Credit

Counterparty credit risk in prime brokerage involves direct exposure to the broker-dealer's creditworthiness, while in correspondent brokerage it primarily depends on the correspondent bank's credit standing and interbank agreements.

Prime Brokerage vs Correspondent Brokerage Infographic

moneydif.com

moneydif.com