A Turnkey Asset Management Platform (TAMP) provides financial advisors with comprehensive investment management solutions, including portfolio construction, administration, and compliance support, streamlining operational efficiency. Independent Broker-Dealers (IBDs) offer advisors greater autonomy and flexibility in product selection and client relationships but require more internal resources for regulatory compliance and back-office functions. Choosing between TAMP and IBD depends on whether an advisor prioritizes scalable infrastructure and outsourced support or full control over business operations and investment choices.

Table of Comparison

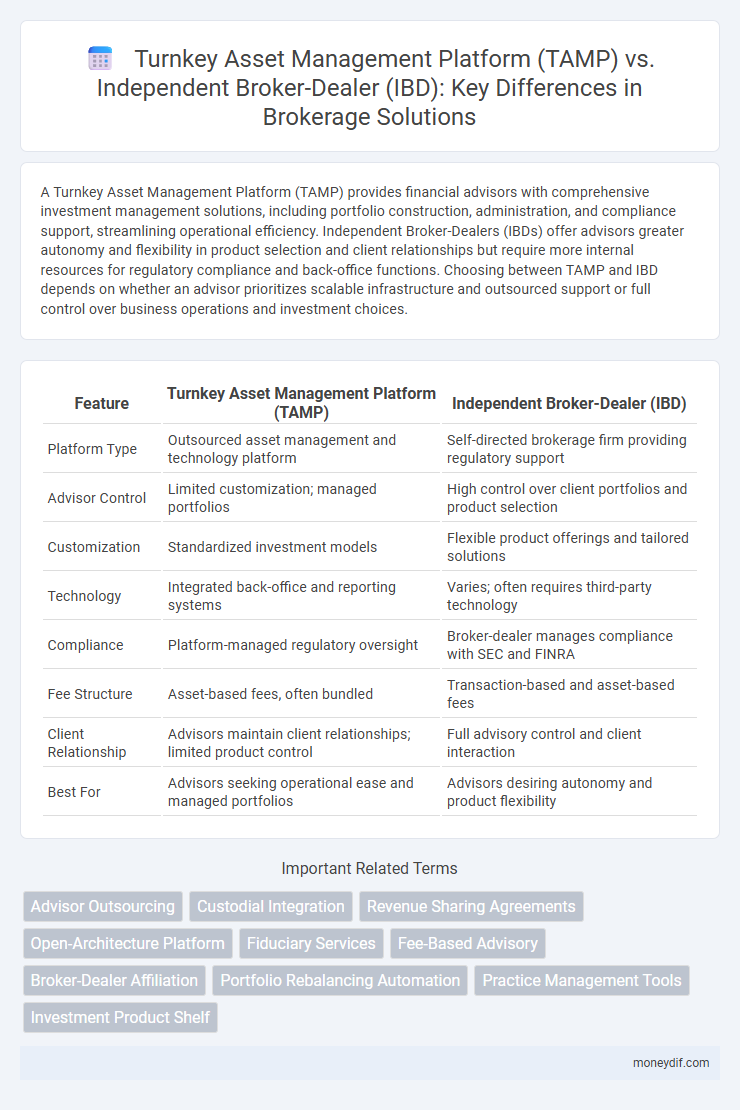

| Feature | Turnkey Asset Management Platform (TAMP) | Independent Broker-Dealer (IBD) |

|---|---|---|

| Platform Type | Outsourced asset management and technology platform | Self-directed brokerage firm providing regulatory support |

| Advisor Control | Limited customization; managed portfolios | High control over client portfolios and product selection |

| Customization | Standardized investment models | Flexible product offerings and tailored solutions |

| Technology | Integrated back-office and reporting systems | Varies; often requires third-party technology |

| Compliance | Platform-managed regulatory oversight | Broker-dealer manages compliance with SEC and FINRA |

| Fee Structure | Asset-based fees, often bundled | Transaction-based and asset-based fees |

| Client Relationship | Advisors maintain client relationships; limited product control | Full advisory control and client interaction |

| Best For | Advisors seeking operational ease and managed portfolios | Advisors desiring autonomy and product flexibility |

Introduction to TAMPs and IBDs

Turnkey Asset Management Platforms (TAMPs) offer financial advisors streamlined access to comprehensive investment management services, including portfolio construction, rebalancing, and reporting through a centralized technology platform. Independent Broker-Dealers (IBDs) provide advisors with regulatory oversight, custodial services, and a wide range of product offerings while maintaining advisor autonomy and client relationships. Understanding the differences in operational models and support structures between TAMPs and IBDs is crucial for advisors seeking tailored solutions for asset management and brokerage compliance.

Core Functions of Turnkey Asset Management Platforms

Turnkey Asset Management Platforms (TAMPs) streamline portfolio management by offering integrated investment research, automated asset allocation, and centralized performance reporting, which enhances operational efficiency for advisors. Core functions of TAMPs include model portfolio construction, rebalancing services, and compliance monitoring, reducing administrative burdens and ensuring regulatory adherence. These platforms provide scalable solutions with robust technology infrastructure, enabling advisors to focus on client relationships rather than back-office complexities typically encountered by Independent Broker-Dealers (IBDs).

Key Features of Independent Broker-Dealers

Independent Broker-Dealers (IBDs) offer personalized advisory services with a broad product inventory, enabling advisors to customize client portfolios effectively. They provide greater autonomy for advisors in decision-making and client management, supported by robust compliance frameworks tailored to diverse client needs. IBDs also emphasize strong regulatory support and advanced technology platforms that streamline operations and enhance client engagement across various investment strategies.

Cost Structure Comparison: TAMP vs IBD

Turnkey Asset Management Platforms (TAMPs) typically offer a bundled fee structure that includes investment management, technology, and back-office services, often charged as a percentage of assets under management (AUM), ranging from 0.25% to 1.0%. Independent Broker-Dealers (IBDs) usually have a more complex cost structure with separate fees for brokerage transactions, platform access, and compliance, potentially resulting in higher overall expenses for advisors depending on trading volume and service usage. TAMPs provide cost predictability through consolidated billing, while IBDs may offer greater customization but require careful analysis of combined fees to assess total costs accurately.

Technology and Integration Capabilities

Turnkey Asset Management Platforms (TAMPs) offer advanced technology solutions with seamless integration capabilities, enabling advisors to efficiently manage client portfolios through automated processes and centralized dashboards. Independent Broker-Dealers (IBDs) provide customizable technology stacks, allowing advisors to select best-of-breed tools tailored to their business needs but may require more complex integration efforts. TAMPs excel in streamlined, plug-and-play technology environments, while IBDs prioritize flexibility and control over individual software components and CRM systems.

Regulatory and Compliance Considerations

Turnkey Asset Management Platforms (TAMPs) streamline regulatory adherence by offering centralized compliance oversight and standardized reporting, reducing the burden on financial advisors. Independent Broker-Dealers (IBDs) face complex regulatory environments requiring robust internal compliance infrastructure to meet FINRA and SEC standards independently. Both models demand continuous updates to regulatory policies, but TAMPs typically provide more integrated compliance support, enhancing risk management efficiency.

Customization and Flexibility for Advisors

Turnkey Asset Management Platforms (TAMPs) offer advisors streamlined investment solutions with pre-built portfolios and automated management, limiting customization options. Independent Broker-Dealers (IBDs) provide greater flexibility, allowing advisors to tailor investment strategies, select diverse products, and personalize client services. Advisors prioritizing autonomy and bespoke portfolio construction typically prefer IBDs, while those valuing efficiency and operational ease lean towards TAMPs.

Client Experience and Service Models

Turnkey Asset Management Platforms (TAMPs) offer a streamlined client experience with centralized portfolio management, automated reporting, and scalable investment solutions, which appeal to advisors seeking efficiency and consistency. Independent Broker-Dealers (IBDs) provide personalized service models, empowering advisors with greater autonomy to tailor financial strategies and client interactions. The choice between TAMPs and IBDs significantly impacts service customization, advisor control, and client engagement levels.

Scalability and Growth Opportunities

Turnkey Asset Management Platforms (TAMPs) offer streamlined scalability by providing advisors with ready-made technology, compliance support, and investment solutions, enabling rapid client acquisition and efficient portfolio management. Independent Broker-Dealers (IBDs) present broader growth opportunities through greater customization and control over business models but require significant investment in back-office infrastructure and regulatory compliance. Firms prioritizing accelerated expansion with minimal operational overhead often favor TAMPs, while those seeking long-term brand development and bespoke services lean towards IBDs.

Which Solution Fits Your Brokerage Needs?

A Turnkey Asset Management Platform (TAMP) offers streamlined operational support, investment management, and back-office services ideal for advisors seeking scalability and efficiency within their brokerage. Independent Broker-Dealers (IBDs) provide greater autonomy, customizable compliance frameworks, and wider product access suited for brokers desiring control over their business model. Evaluating your brokerage needs involves assessing factors like technology integration, compliance burden, product flexibility, and growth objectives to determine the best solution fit.

Important Terms

Advisor Outsourcing

Advisor outsourcing through Turnkey Asset Management Platforms (TAMPs) offers streamlined portfolio management and scalable technology solutions compared to Independent Broker-Dealers (IBDs), which provide greater autonomy and personalized client service flexibility.

Custodial Integration

Custodial integration in Turnkey Asset Management Platforms (TAMPs) streamlines asset custody and trading, enhancing operational efficiency compared to Independent Broker-Dealers (IBDs) which often require separate custody arrangements and manual reconciliations.

Revenue Sharing Agreements

Revenue sharing agreements in Turnkey Asset Management Platforms (TAMPs) typically provide advisors with scalable compensation through platform fees and asset-based revenue, whereas Independent Broker-Dealers (IBDs) often offer more flexible, commission-based revenue models aligned with advisor autonomy and client service customization.

Open-Architecture Platform

Open-Architecture Platforms enable Turnkey Asset Management Platforms (TAMPs) to offer diverse investment products and strategies with seamless integration, providing Independent Broker-Dealers (IBDs) enhanced operational efficiency and expanded client customization options.

Fiduciary Services

Turnkey Asset Management Platforms (TAMPs) offer fiduciary services with streamlined portfolio management and lower operational complexity compared to Independent Broker-Dealers (IBDs), which provide greater advisor autonomy but require more extensive compliance management.

Fee-Based Advisory

Fee-based advisory through a Turnkey Asset Management Platform (TAMP) offers scalable, integrated investment solutions with lower operational burdens compared to Independent Broker-Dealers (IBDs), which provide greater autonomy but higher compliance responsibilities.

Broker-Dealer Affiliation

Broker-Dealer affiliation significantly impacts client service models and regulatory compliance, with Turnkey Asset Management Platforms (TAMPs) offering integrated investment solutions under a broker-dealer umbrella, whereas Independent Broker-Dealers (IBDs) provide advisors greater autonomy and customizable product access.

Portfolio Rebalancing Automation

Portfolio rebalancing automation in a Turnkey Asset Management Platform (TAMP) leverages integrated technology to streamline asset allocation adjustments, enhancing efficiency and consistency for advisors managing multiple client accounts. Independent Broker-Dealers (IBDs) typically rely on third-party rebalancing tools or manual processes, which may result in less scalability and slower response times compared to the comprehensive automation features embedded within TAMP solutions.

Practice Management Tools

Turnkey Asset Management Platforms (TAMPs) offer integrated Practice Management Tools that streamline portfolio management, compliance, and reporting for advisors, whereas Independent Broker-Dealers (IBDs) provide more customizable Practice Management solutions with greater autonomy but require advisors to manage multiple systems independently.

Investment Product Shelf

The Investment Product Shelf on a Turnkey Asset Management Platform (TAMP) offers a curated selection of mutual funds, ETFs, and alternative investments designed for streamlined asset management and compliance efficiency. Independent Broker-Dealers (IBDs) provide advisors with a broader, customizable product shelf, enabling tailored client solutions through direct access to a wide range of investment products and proprietary offerings.

Turnkey Asset Management Platform (TAMP) vs Independent Broker-Dealer (IBD) Infographic

moneydif.com

moneydif.com