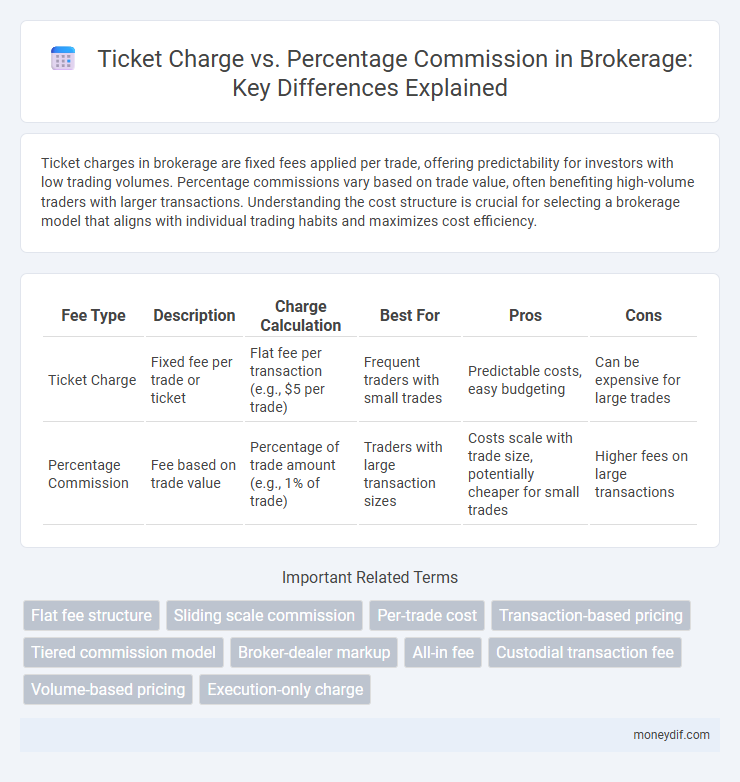

Ticket charges in brokerage are fixed fees applied per trade, offering predictability for investors with low trading volumes. Percentage commissions vary based on trade value, often benefiting high-volume traders with larger transactions. Understanding the cost structure is crucial for selecting a brokerage model that aligns with individual trading habits and maximizes cost efficiency.

Table of Comparison

| Fee Type | Description | Charge Calculation | Best For | Pros | Cons |

|---|---|---|---|---|---|

| Ticket Charge | Fixed fee per trade or ticket | Flat fee per transaction (e.g., $5 per trade) | Frequent traders with small trades | Predictable costs, easy budgeting | Can be expensive for large trades |

| Percentage Commission | Fee based on trade value | Percentage of trade amount (e.g., 1% of trade) | Traders with large transaction sizes | Costs scale with trade size, potentially cheaper for small trades | Higher fees on large transactions |

Understanding Ticket Charges in Brokerage

Ticket charges in brokerage refer to fixed fees applied per transaction, independent of the trade size, offering cost predictability for frequent traders. Percentage commissions vary with the trade value, impacting total costs proportionally and often benefiting low-frequency or high-value investors. Analyzing both structures helps investors optimize expenses based on their trading volume and portfolio size.

What Is Percentage Commission in Brokerage?

Percentage commission in brokerage refers to a fee model where brokers charge a fixed percentage of the transaction value for executing trades on behalf of clients. Unlike flat ticket charges, which are fixed amounts per trade regardless of size, percentage commissions scale with the trade's monetary value, aligning broker costs with transaction volume. This model incentivizes brokers to prioritize higher-value trades and can impact overall trading costs depending on market activity and investment size.

Key Differences Between Ticket Charges and Percentage Commissions

Ticket charges in brokerage are fixed fees applied per transaction regardless of trade size, offering predictable costs for investors. Percentage commissions vary based on the transaction value, calculating fees as a proportion of the investment amount, which can impact profitability on larger trades. Key differences lie in cost predictability and scalability, with ticket charges favoring smaller trades and percentage commissions aligning costs with trade volume.

Pros and Cons of Ticket Charge Models

Ticket charge models in brokerage involve a fixed fee per transaction, providing cost predictability and appealing to high-frequency traders with small trade sizes. However, this model can become expensive for large trades as fees do not scale with trade value, potentially reducing profitability for sizable portfolios. Compared to percentage commissions, ticket charges offer simplicity but may discourage frequent trading of high-value securities due to cumulative costs.

Advantages and Disadvantages of Percentage Commissions

Percentage commissions align broker income with trade volume, incentivizing increased client transactions and potentially boosting revenue. However, this model may encourage excessive trading, leading to higher costs for clients and possible conflicts of interest. Transparency can suffer as clients might prefer fixed ticket charges for predictable expenses over variable commission fees.

Cost Comparison: Which Model Suits Different Investors?

Ticket charges apply a fixed fee per transaction, benefiting investors who trade large volumes or frequent small trades by minimizing costs. Percentage commissions scale with trade size, favoring investors with smaller portfolios or infrequent trades due to lower upfront fees. Understanding an investor's trading frequency and portfolio size is essential to selecting between ticket charges and percentage commissions for optimal cost efficiency.

Impact on High-Frequency Traders: Ticket Charge vs Percentage Commission

High-frequency traders often face significant impacts from ticket charges due to frequent transaction costs accumulating rapidly, which can erode profit margins more severely than percentage commissions. Percentage commissions scale with trade volume, offering a more flexible cost structure for these traders who execute numerous small trades. Choosing between ticket charges and percentage commissions ultimately influences trading strategies and operational costs for high-frequency trading firms.

Transparency and Client Trust in Fee Structures

Transparent fee structures, including clear distinctions between ticket charges and percentage commissions, enhance client trust by eliminating hidden costs and fostering open communication. Detailed breakdowns of fees empower clients to make informed decisions and compare brokerage services effectively. Brokers who prioritize transparency in ticket charges and commissions build long-term relationships by demonstrating integrity and fairness in their pricing models.

Global Trends in Brokerage Fee Models

Global trends in brokerage fee models indicate a gradual shift from traditional ticket charges to percentage-based commissions, reflecting the rise of digital trading platforms and increased market competition. Percentage commissions, often ranging from 0.1% to 0.5% per transaction, align broker incentives with client portfolio performance, promoting transparency and value-driven services. Emerging markets show hybrid models where flat ticket fees coexist with tiered percentage rates, catering to diverse investor profiles and trading volumes.

Choosing the Right Fee Model for Your Trading Strategy

Selecting the right fee model between ticket charge and percentage commission significantly impacts trading profitability and cost-efficiency. Ticket charges offer fixed fees per trade, ideal for active traders executing high volumes to minimize variable costs. Percentage commissions align expenses with trade size, benefiting investors with larger trades by scaling fees proportionally to investment value.

Important Terms

Flat fee structure

A flat fee structure charges a fixed ticket fee regardless of sale price, offering predictable costs compared to percentage commission models that vary with ticket value and can increase total charges.

Sliding scale commission

Sliding scale commission structures adjust fees based on ticket charge amounts, typically decreasing the percentage commission as ticket prices increase to incentivize higher sales volumes. This method balances fixed costs and revenue generation by charging a higher percentage on lower ticket charges and reducing the commission rate progressively for more expensive tickets.

Per-trade cost

Per-trade costs often include a fixed ticket charge plus a percentage commission that varies by broker and trade volume.

Transaction-based pricing

Transaction-based pricing involves charging a fixed ticket fee per transaction, providing predictable costs regardless of the transaction amount, whereas percentage commission pricing calculates fees as a proportion of the transaction value, aligning charges with revenue size but introducing variability. Businesses select ticket charge models for straightforward budgeting and percentage commissions for scalable fees tied directly to sales volume.

Tiered commission model

A tiered commission model structures earnings by applying varying percentage rates correlated with sales volume, incentivizing higher performance through escalating commission tiers. Ticket charge-based models levy a fixed fee per transaction, ensuring predictable revenue per sale but lacking scalability compared to percentage-based commissions tied directly to sale value.

Broker-dealer markup

Broker-dealer markup typically involves adding a fixed ticket charge or applying a percentage commission on securities transactions, directly impacting the overall cost to investors. Ticket charges provide predictable fees per trade, while percentage commissions vary with trade size, influencing cost-efficiency depending on transaction volume.

All-in fee

All-in fee combines a fixed ticket charge and a percentage commission to provide transparent, consolidated pricing for airline ticket sales.

Custodial transaction fee

Custodial transaction fees typically consist of a flat ticket charge or a percentage commission, with ticket charges providing predictable costs while percentage commissions scale with trade value.

Volume-based pricing

Volume-based pricing adjusts ticket charges by applying lower fees or percentage commissions as transaction quantities increase, incentivizing higher sales volumes. This pricing model balances fixed ticket charges against scalable percentage commissions to optimize revenue based on customer purchase frequency and total ticket count.

Execution-only charge

Execution-only charges typically involve a flat ticket charge for each trade, providing cost transparency regardless of trade size, while percentage commissions scale with the transaction value, potentially increasing costs on larger trades. Ticket charges favor frequent, smaller transactions, whereas percentage commissions may be more cost-effective for high-value trades, influencing investor preference based on trading patterns.

ticket charge vs percentage commission Infographic

moneydif.com

moneydif.com