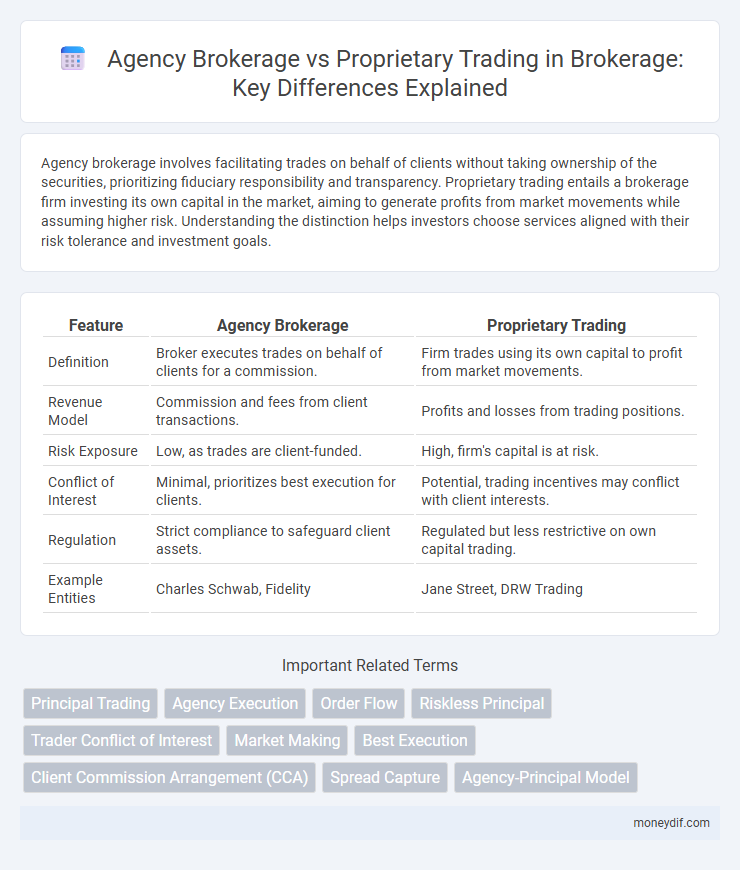

Agency brokerage involves facilitating trades on behalf of clients without taking ownership of the securities, prioritizing fiduciary responsibility and transparency. Proprietary trading entails a brokerage firm investing its own capital in the market, aiming to generate profits from market movements while assuming higher risk. Understanding the distinction helps investors choose services aligned with their risk tolerance and investment goals.

Table of Comparison

| Feature | Agency Brokerage | Proprietary Trading |

|---|---|---|

| Definition | Broker executes trades on behalf of clients for a commission. | Firm trades using its own capital to profit from market movements. |

| Revenue Model | Commission and fees from client transactions. | Profits and losses from trading positions. |

| Risk Exposure | Low, as trades are client-funded. | High, firm's capital is at risk. |

| Conflict of Interest | Minimal, prioritizes best execution for clients. | Potential, trading incentives may conflict with client interests. |

| Regulation | Strict compliance to safeguard client assets. | Regulated but less restrictive on own capital trading. |

| Example Entities | Charles Schwab, Fidelity | Jane Street, DRW Trading |

Understanding Agency Brokerage: Core Functions

Agency brokerage involves acting as an intermediary between buyers and sellers, executing trades on behalf of clients without taking ownership of the securities. Core functions include order execution, providing market access, and offering advisory services to ensure clients receive the best possible prices and terms. Agency brokers earn commissions or fees, maintaining fiduciary responsibility and transparency to optimize client outcomes in financial markets.

What is Proprietary Trading? Key Concepts

Proprietary trading refers to when a brokerage firm trades stocks, bonds, currencies, commodities, derivatives, or other financial instruments using its own capital rather than client funds, aiming to generate direct profits for the firm. Key concepts include risk management strategies, leveraging market insights, and employing advanced algorithms or quantitative models to identify profitable trading opportunities. Unlike agency brokerage, which earns commissions by executing client orders, proprietary trading involves the firm actively taking market positions and bearing the full risk and reward of those trades.

Agency Brokerage vs Proprietary Trading: Fundamental Differences

Agency brokerage acts as an intermediary executing trades on behalf of clients, prioritizing best execution and transparency without taking market risk. Proprietary trading involves firms trading with their own capital to generate profits, assuming direct market risk and leveraging proprietary strategies for competitive advantage. The fundamental differences lie in risk exposure, conflict of interest potential, and the primary sources of revenue: commission fees for agency brokerage versus trading gains for proprietary trading.

Revenue Models: Fees vs Profits

Agency brokerage generates revenue primarily through fees and commissions charged on client transactions, ensuring consistent income regardless of market conditions. Proprietary trading, in contrast, earns profits directly from the firm's own trading activities, exposing the business to higher risk and potential reward volatility. The fee-based model in agency brokerage offers stable cash flow, whereas proprietary trading relies on market performance to drive profitability.

Client Relationships in Both Models

Agency brokerage emphasizes transparent client relationships by executing trades on behalf of clients without taking market risk, ensuring fiduciary duty and trust. Proprietary trading involves firms trading for their own accounts, where client interaction centers more on service provision than investment execution. Understanding these distinctions helps clients prioritize either personalized advisory services or potential access to firm-driven market insights.

Risk Exposure: Agency vs Proprietary Activities

Agency brokerage involves executing trades on behalf of clients without assuming ownership of the securities, resulting in minimal risk exposure limited to operational and reputational factors. Proprietary trading entails firms trading their own capital, exposing them to significant market risk, potential losses, and regulatory scrutiny. The risk exposure in proprietary trading is inherently higher due to direct involvement in market fluctuations, unlike agency brokerage that primarily manages client assets.

Regulatory Considerations for Each Approach

Agency brokerage is subject to stringent regulatory oversight prioritizing transparency and client asset protection, requiring firms to act in the best interests of clients without taking proprietary positions. Proprietary trading faces heightened scrutiny due to conflicts of interest and market risk, often governed by regulations like the Volcker Rule that restrict banks' ability to trade for their own profit. Compliance frameworks differ significantly, with agency brokers adhering to fiduciary standards while proprietary traders navigate capital requirements and trading limits imposed by regulatory bodies.

Technology and Infrastructure: Operational Demands

Agency brokerage relies on advanced technology platforms to execute client orders efficiently, prioritizing transparency and regulatory compliance through robust data management systems. Proprietary trading demands high-frequency trading infrastructure with low-latency connections and sophisticated algorithms to capitalize on market opportunities quickly. The operational demands of proprietary trading require continuous investment in cutting-edge hardware and software to sustain competitive advantage and risk management.

Conflict of Interest: Managing Ethical Concerns

Agency brokerage prioritizes client interests by executing trades on their behalf without taking positions, minimizing conflicts of interest and promoting transparency. Proprietary trading involves firms trading using their own capital, which can create conflicts when interests diverge from clients, raising ethical concerns over fairness and market integrity. Effective conflict of interest management in brokerage requires strict Chinese walls, compliance oversight, and transparent disclosure to uphold ethical standards and protect client trust.

Choosing the Right Model: Factors for Institutions

Institutions selecting between agency brokerage and proprietary trading must evaluate factors such as risk tolerance, capital allocation, and regulatory compliance requirements. Agency brokerage offers transparency and client-centric execution, minimizing conflict of interest by acting solely on behalf of clients. Proprietary trading enables institutions to leverage their own capital for profit, demanding robust risk management systems and adherence to stricter regulatory frameworks.

Important Terms

Principal Trading

Principal trading involves firms buying and selling securities for their own accounts, contrasting with agency brokerage where firms execute client orders without taking market risk.

Agency Execution

Agency execution focuses on facilitating client orders by acting solely on behalf of clients, ensuring transparency and best execution without risking the firm's capital. In contrast, agency brokerage involves intermediating trades without assuming market risk, while proprietary trading entails firms trading their own assets to profit from market movements.

Order Flow

Order flow analysis in agency brokerage focuses on executing client trades with best execution standards, while proprietary trading prioritizes leveraging order flow data for firm profit maximization.

Riskless Principal

Riskless principal transactions occur when a broker simultaneously buys and sells securities on behalf of a client without taking a position, contrasting with proprietary trading where the firm trades its own capital for profit. In agency brokerage, the firm acts solely as an intermediary, ensuring transparency and avoiding market risk, while proprietary trading involves higher risk but greater potential returns due to the firm's direct market exposure.

Trader Conflict of Interest

Trader conflicts of interest arise when agency brokerage prioritizes client interests while proprietary trading involves firms trading for their own profit, creating potential ethical dilemmas and risks of biased decision-making.

Market Making

Market making involves providing liquidity by continuously quoting buy and sell prices, significantly benefiting from proprietary trading strategies that capitalize on inventory risk and price movements. In contrast, agency brokerage acts strictly on behalf of clients without taking proprietary positions, focusing on executing trades efficiently while minimizing market impact and maintaining neutrality.

Best Execution

Best Execution requires agency brokers to prioritize client interests by executing trades at optimal prices, contrasting with proprietary trading where firms trade for their own profit, potentially creating conflicts of interest.

Client Commission Arrangement (CCA)

Client Commission Arrangement (CCA) facilitates agencies in using client brokerage commissions to pay for third-party research and services, distinguishing it from proprietary trading where firms trade using their own capital without involving client commission funds.

Spread Capture

Spread capture in agency brokerage involves earning the bid-ask spread by facilitating client trades without taking market risk, whereas proprietary trading captures spreads by executing trades using the firm's own capital to profit from price movements.

Agency-Principal Model

The Agency-Principal Model highlights the conflict of interest between brokers acting as agents earning commissions by trading on behalf of clients and proprietary traders investing the firm's own capital for direct profit.

Agency Brokerage vs Proprietary Trading Infographic

moneydif.com

moneydif.com