Dark pools offer a private trading environment where buy and sell orders are anonymously matched, reducing market impact and allowing large trades to be executed discreetly. Lit pools operate on public exchanges with transparent order books, providing visible pricing and volume information to all market participants, which enhances price discovery and liquidity. Traders choose between dark and lit pools based on their priorities for transparency, speed, and minimizing price slippage in trade execution.

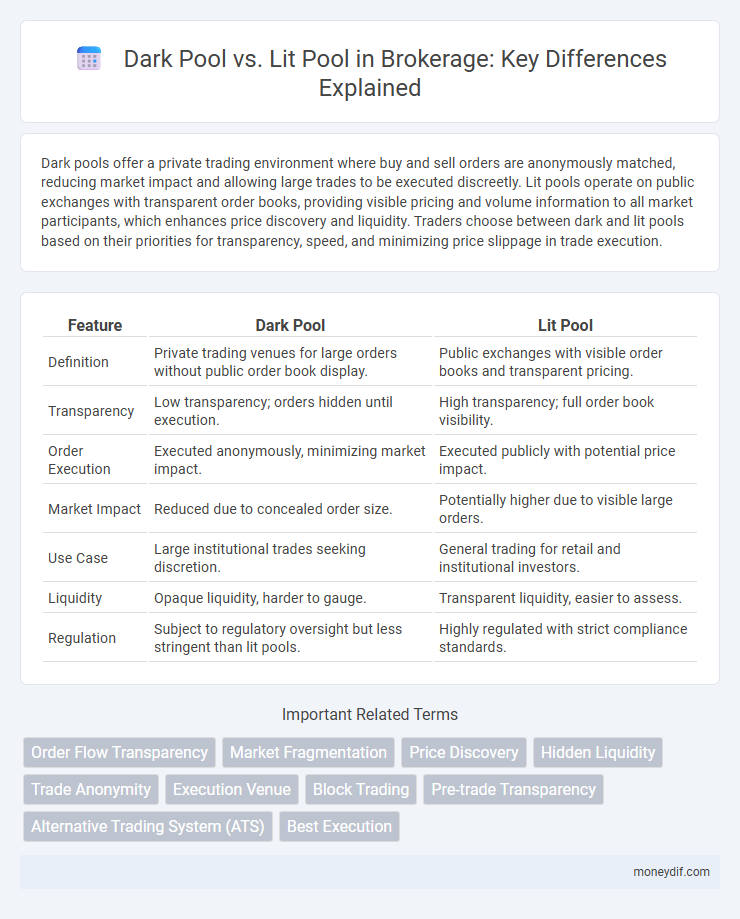

Table of Comparison

| Feature | Dark Pool | Lit Pool |

|---|---|---|

| Definition | Private trading venues for large orders without public order book display. | Public exchanges with visible order books and transparent pricing. |

| Transparency | Low transparency; orders hidden until execution. | High transparency; full order book visibility. |

| Order Execution | Executed anonymously, minimizing market impact. | Executed publicly with potential price impact. |

| Market Impact | Reduced due to concealed order size. | Potentially higher due to visible large orders. |

| Use Case | Large institutional trades seeking discretion. | General trading for retail and institutional investors. |

| Liquidity | Opaque liquidity, harder to gauge. | Transparent liquidity, easier to assess. |

| Regulation | Subject to regulatory oversight but less stringent than lit pools. | Highly regulated with strict compliance standards. |

Understanding Dark Pools and Lit Pools

Dark pools are private trading venues where large institutional investors execute big orders anonymously to minimize market impact and avoid price disruption. Lit pools, or public exchanges, display real-time order books and trade information, promoting transparency and immediate price discovery. Understanding the differences between dark pools and lit pools is essential for traders seeking optimal execution strategies and market insight.

Key Differences Between Dark Pools and Lit Pools

Dark pools are private trading venues where buy and sell orders are not visible to the public, allowing large investors to execute trades with minimal market impact. Lit pools operate on public exchanges with full transparency, displaying order books and prices to all market participants. The key differences lie in transparency, market impact, and order visibility, with dark pools prioritizing anonymity and lit pools emphasizing openness and price discovery.

How Dark Pools Work in Brokerage

Dark pools operate as private, non-transparent trading venues where large institutional investors execute sizable orders away from public exchanges to minimize market impact and price slippage. Orders in dark pools are matched anonymously using algorithms that prioritize discretion, often allowing trades to occur at prices derived from the national best bid and offer (NBBO). This mechanism helps brokers achieve better execution for large trades while maintaining confidentiality and reducing information leakage.

Advantages of Trading in Dark Pools

Trading in dark pools offers enhanced privacy by allowing investors to execute large orders anonymously, reducing market impact and price slippage. These private exchanges provide institutional traders with access to significant liquidity that might not be available on lit pools, helping to secure better pricing. Dark pools also minimize information leakage, which protects trading strategies from being exploited by other market participants.

Risks and Criticisms of Dark Pools

Dark pools pose significant risks such as lack of transparency, which can lead to unfair price discovery and increase market manipulation possibilities. They create an uneven playing field where only select institutional investors access large orders without public scrutiny, raising concerns about market integrity. Critics argue that this opacity undermines investor confidence and regulatory oversight, potentially amplifying systemic risks in the equity markets.

Transparency: Lit Pool Trading Explained

Lit pool trading operates on fully transparent exchanges where buy and sell orders are visible to all market participants, promoting price discovery and fairness. In contrast, dark pools execute large trades privately without displaying order details, reducing market impact but sacrificing transparency. Transparency in lit pools enhances investor confidence by providing real-time information on order flow and market depth.

Regulatory Oversight for Dark and Lit Pools

Regulatory oversight for dark pools involves stringent monitoring by the SEC and FINRA to ensure transparency and fair trading, with mandated reporting of trades to prevent market manipulation and protect investor interests. Lit pools, being fully transparent public exchanges, operate under comprehensive regulatory frameworks requiring real-time disclosure of order books and trade executions, promoting market efficiency and price discovery. Compliance with these regulatory standards is critical to maintaining integrity and investor confidence in both trading venues.

Impact on Market Liquidity and Price Discovery

Dark pools reduce market transparency by allowing large trades to occur away from public exchanges, often leading to lower visible liquidity and potentially wider bid-ask spreads. Lit pools, with their transparent order books and displayed quotes, enhance price discovery by providing real-time market information that facilitates more efficient price formation. The coexistence of dark and lit pools influences market liquidity dynamics, where dark pools absorb large orders without immediate price impact, but lit pools remain crucial for accurate price transparency and market efficiency.

Dark Pool vs Lit Pool: Suitability for Investors

Dark pools offer institutional investors the ability to execute large orders anonymously, minimizing market impact and price fluctuations, making them suitable for those prioritizing discretion and reduced market impact. Lit pools provide transparency and real-time price discovery, benefiting retail investors or traders seeking immediate execution and visible order books. Choosing between dark and lit pools depends on an investor's need for anonymity versus transparency and their trading volume and strategy.

The Future of Brokerage: Dark Pools vs Lit Pools

Dark pools offer greater anonymity and reduced market impact for large trades, attracting institutional investors seeking to minimize price slippage. Lit pools provide transparency and real-time price discovery, benefiting retail investors and promoting market efficiency. The future of brokerage likely involves a hybrid model leveraging dark pool anonymity alongside lit pool transparency to balance liquidity, fairness, and regulatory compliance.

Important Terms

Order Flow Transparency

Order flow transparency is significantly reduced in dark pools compared to lit pools, where trade details and prices are fully disclosed to public markets.

Market Fragmentation

Market fragmentation increases price disparities and reduces liquidity as dark pools trade anonymously away from transparent lit pools.

Price Discovery

Price discovery in financial markets varies significantly between dark pools and lit pools, as lit pools promote transparency through visible order books that reflect real-time bids and offers, enhancing market efficiency. Dark pools, by contrast, conceal trade intentions and transaction details until after execution, limiting immediate price impact but potentially leading to less efficient price discovery.

Hidden Liquidity

Hidden liquidity in dark pools enables large institutional investors to execute sizable trades anonymously without revealing intentions to lit pools, thereby minimizing market impact and price slippage.

Trade Anonymity

Trade anonymity in dark pools enables institutional investors to execute large orders without revealing their identities or intentions, reducing market impact compared to lit pools where trades are publicly visible and can lead to price slippage. Dark pools maintain confidentiality by matching buy and sell orders internally, offering greater discretion than lit pools that display real-time order book data on public exchanges.

Execution Venue

Execution venues differ as dark pools offer private, non-displayed trading environments prioritizing anonymity and minimal market impact, while lit pools provide transparent, publicly visible order books enhancing price discovery and liquidity.

Block Trading

Block trading in dark pools offers institutional investors enhanced anonymity and reduced market impact compared to lit pools, where orders are visible and can influence price volatility.

Pre-trade Transparency

Pre-trade transparency in lit pools enhances market price discovery and liquidity, while dark pools offer anonymity to large traders by withholding pre-trade information to minimize market impact.

Alternative Trading System (ATS)

Alternative Trading Systems (ATS) facilitate trading by providing dark pools, which offer private, non-displayed orders to reduce market impact, contrasting with lit pools that display order books publicly to enhance transparency.

Best Execution

Best Execution requires traders to evaluate Dark Pool liquidity's reduced market impact against Lit Pool transparency for optimal trade outcomes.

Dark Pool vs Lit Pool Infographic

moneydif.com

moneydif.com