A-Book brokers route client orders directly to the interbank market, ensuring transparency and no conflict of interest, while B-Book brokers internalize trades, profiting from client losses by acting as the counterparty. Traders choosing A-Book brokers benefit from market execution and potentially tighter spreads, whereas B-Book brokers offer fixed spreads but face potential conflicts due to opposing client positions. Understanding these models helps traders make informed decisions based on their trading style and risk tolerance.

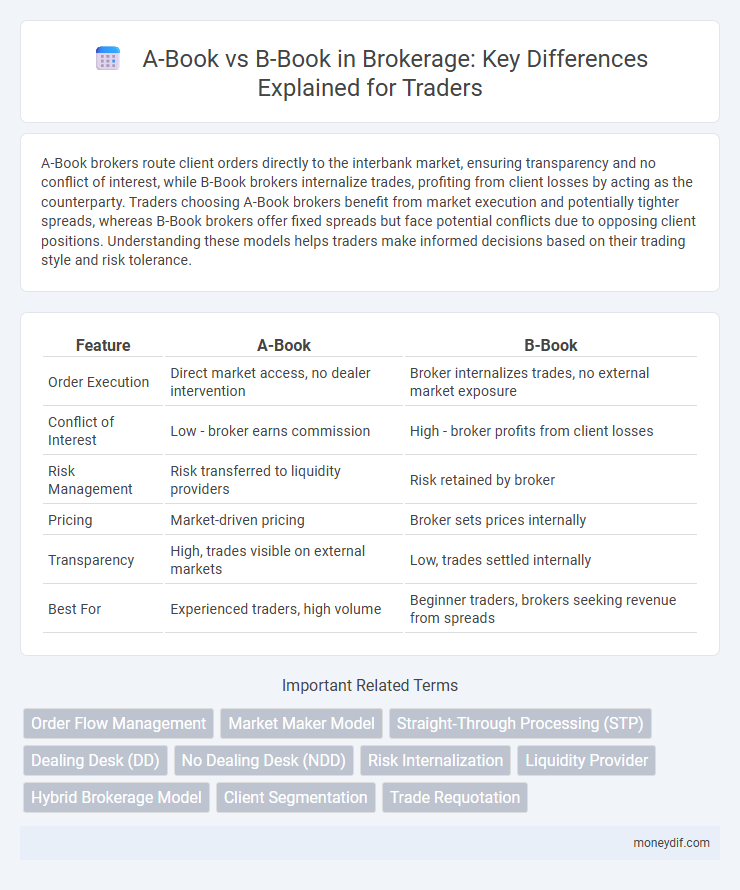

Table of Comparison

| Feature | A-Book | B-Book |

|---|---|---|

| Order Execution | Direct market access, no dealer intervention | Broker internalizes trades, no external market exposure |

| Conflict of Interest | Low - broker earns commission | High - broker profits from client losses |

| Risk Management | Risk transferred to liquidity providers | Risk retained by broker |

| Pricing | Market-driven pricing | Broker sets prices internally |

| Transparency | High, trades visible on external markets | Low, trades settled internally |

| Best For | Experienced traders, high volume | Beginner traders, brokers seeking revenue from spreads |

Understanding A-Book and B-Book Brokerage Models

A-Book brokerage models involve forwarding client orders directly to the interbank liquidity providers, ensuring transparency and eliminating conflicts of interest by matching trades with real market prices. In contrast, B-Book models keep trades in-house, where the broker acts as the counterparty to the client's positions, allowing potential profit from client losses but increasing the risk of conflict and reduced transparency. Selecting between A-Book and B-Book models impacts risk management, pricing, and the overall trustworthiness of the brokerage service.

Key Differences Between A-Book and B-Book Brokers

A-Book brokers pass client orders directly to liquidity providers or the interbank market, ensuring transparent execution and reduced conflict of interest, while B-Book brokers internalize trades, profiting from client losses and exposing potential conflicts. The A-Book model offers better price transparency and lower risk for the broker due to commission-based income, whereas the B-Book model relies on spreads and client losses for profit, often resulting in wider spreads and possible market manipulation. Understanding these key differences is essential for traders seeking transparency, execution quality, and broker reliability.

How A-Book Brokers Operate

A-Book brokers operate by routing client orders directly to the interbank market or liquidity providers without taking the opposite side of trades, ensuring transparent and conflict-free execution. This model allows clients to access real market prices and deeper liquidity pools, often resulting in tighter spreads and better trade execution. By passing trades through to external counterparties, A-Book brokers generate revenue primarily through commissions or small markups rather than profiting from client losses.

The Mechanics of B-Book Order Execution

B-Book order execution involves the broker internalizing client trades by not passing them to the interbank market, effectively acting as the counterparty to client positions. This mechanism allows brokers to profit from client losses but creates a potential conflict of interest, as the broker may benefit from adverse client outcomes. Risk management in B-Book models relies heavily on hedging strategies and exposure limits to balance internal book positions and mitigate financial risk.

Advantages of A-Book Trading for Clients

A-Book trading offers clients transparent market execution by sending orders directly to external liquidity providers, reducing conflicts of interest commonly seen in B-Book models. Clients benefit from tighter spreads, faster order processing, and genuine price discovery, which contribute to more favorable trading outcomes. The A-Book model also ensures higher fairness and reduced risk of price manipulation, enhancing overall trust and confidence in the brokerage service.

Benefits and Risks of B-Book Brokerage

B-Book brokerage allows brokers to internalize client trades, generating profit from client losses and reducing reliance on external liquidity providers, which can increase cost efficiency and speed of order execution. This model carries risks including potential conflicts of interest since brokers may benefit from clients' losses, leading to ethical concerns and regulatory scrutiny. Effective risk management and transparent practices are essential to mitigate possible reputational damage and ensure compliance in B-Book operations.

Conflict of Interest: A-Book vs B-Book

A-Book brokers route client orders directly to the interbank market or liquidity providers, minimizing conflict of interest by earning only through transparent commissions or spreads. B-Book brokers internalize trades, often profiting when clients lose, creating an inherent conflict of interest between the broker and the trader. This divergence impacts trade execution transparency and incentivizes brokers to manage risk differently depending on the chosen model.

Which Traders Prefer A-Book or B-Book Brokers?

Traders who prioritize transparency and market pricing often prefer A-Book brokers because their orders are routed directly to the interbank market, minimizing conflicts of interest. Conversely, retail or high-frequency traders may lean towards B-Book brokers, where trades are internalized, potentially offering faster execution and fixed spreads. Understanding the trader's strategy, risk tolerance, and trade volume is crucial when choosing between A-Book and B-Book brokerage models.

Regulation and Transparency in A-Book vs B-Book

A-Book brokers operate by routing client orders directly to the interbank market or liquidity providers, ensuring a high level of transparency and adherence to regulatory standards such as those imposed by FCA or CySEC. In contrast, B-Book brokers act as counterparty to their clients' trades, often leading to potential conflicts of interest and reduced transparency, which can raise regulatory concerns or scrutiny. Regulatory authorities typically favor the A-Book model for its clear audit trails and minimized risk of client-principal conflicts, promoting trust and compliance in financial markets.

How to Choose Between A-Book and B-Book Brokerages

Choosing between A-Book and B-Book brokerages depends on your trading strategy and risk tolerance; A-Book brokers route orders directly to the interbank market, offering transparent pricing and no conflict of interest, ideal for traders seeking market-based execution. B-Book brokers internalize trades and profit from client losses, often providing fixed spreads and faster execution but potentially creating a conflict of interest. Evaluating factors like spread costs, execution speed, transparency, and your trading volume ensures selection of the best brokerage model aligning with your goals.

Important Terms

Order Flow Management

Order flow management differentiates between A-Book execution, where client orders are routed directly to the interbank market ensuring transparency and reduced conflict of interest, and B-Book execution, where brokers internalize trades, potentially increasing profit but introducing higher counterparty risk.

Market Maker Model

The Market Maker Model contrasts A-Book, where trades are routed to external liquidity providers, with B-Book, where the broker internalizes client orders and takes the opposite side of trades.

Straight-Through Processing (STP)

Straight-Through Processing (STP) enhances trade execution efficiency by automating order flow, while A-Book brokers directly route client orders to external liquidity providers and B-Book brokers internalize trades, potentially creating conflicts of interest.

Dealing Desk (DD)

Dealing Desk (DD) brokers often operate using a B-Book model by internalizing client trades and taking the opposite side, whereas A-Book brokers pass orders directly to liquidity providers without intervention.

No Dealing Desk (NDD)

No Dealing Desk (NDD) brokers use the A-Book model to directly route client orders to liquidity providers, contrasting with B-Book brokers who internalize trades and assume counterparty risk.

Risk Internalization

Risk internalization in trading involves firms using A-Book strategies to pass client orders to external liquidity providers, minimizing proprietary risk, whereas B-Book models internalize risk by taking the opposite side of client trades, exposing the firm to potential losses.

Liquidity Provider

Liquidity providers play a crucial role in A-Book forex broker models by routing client orders directly to the interbank market, while in B-Book models, brokers often internalize trades, reducing reliance on external liquidity providers.

Hybrid Brokerage Model

The Hybrid Brokerage Model combines A-Book and B-Book execution, allowing brokers to route some client trades directly to the market (A-Book) while internalizing others (B-Book) to optimize risk management and profitability.

Client Segmentation

Client segmentation based on trading behavior and risk profiles enables brokers to allocate clients to A-Book models for direct market access or B-Book models for internal order processing, optimizing profitability and risk management.

Trade Requotation

Trade requotation occurs when brokers using a B-Book model adjust prices internally to manage risk, while A-Book brokers pass client orders directly to liquidity providers, minimizing requotes.

A-Book vs B-Book Infographic

moneydif.com

moneydif.com