Best execution in brokerage prioritizes achieving the most favorable terms for a client's trade by considering price, speed, and likelihood of execution across multiple venues. Guaranteed execution ensures a trade is completed at a specified price, providing certainty but potentially sacrificing optimal pricing or speed. Brokers balance these approaches to maximize client outcomes while managing market risks and liquidity constraints.

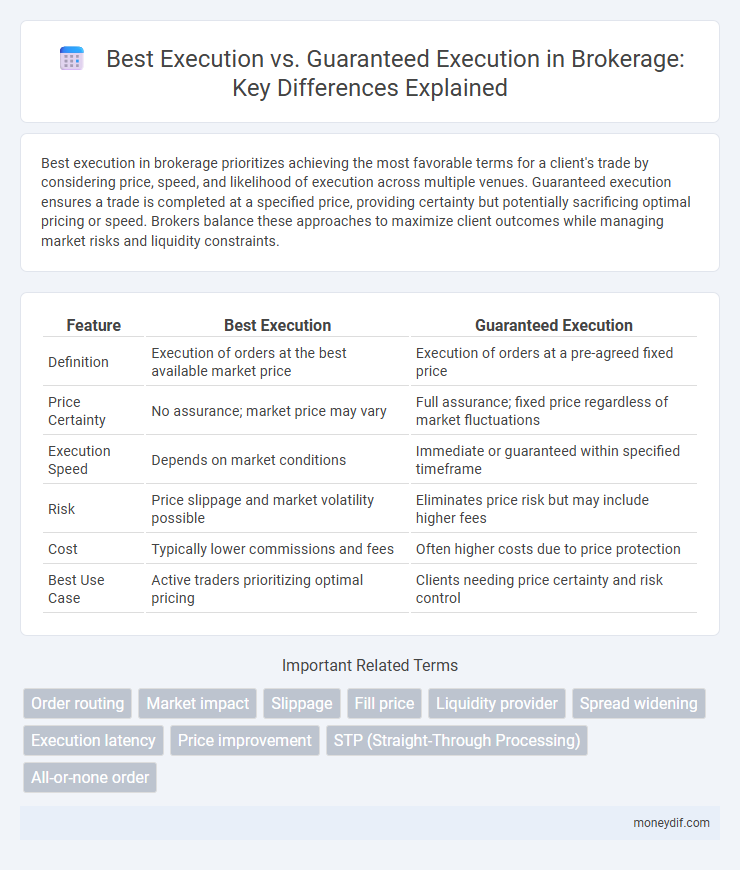

Table of Comparison

| Feature | Best Execution | Guaranteed Execution |

|---|---|---|

| Definition | Execution of orders at the best available market price | Execution of orders at a pre-agreed fixed price |

| Price Certainty | No assurance; market price may vary | Full assurance; fixed price regardless of market fluctuations |

| Execution Speed | Depends on market conditions | Immediate or guaranteed within specified timeframe |

| Risk | Price slippage and market volatility possible | Eliminates price risk but may include higher fees |

| Cost | Typically lower commissions and fees | Often higher costs due to price protection |

| Best Use Case | Active traders prioritizing optimal pricing | Clients needing price certainty and risk control |

Understanding Best Execution in Brokerage

Best execution in brokerage mandates brokers to seek the most favorable terms for client orders by considering price, speed, and order size across multiple trading venues. Unlike guaranteed execution, which assures order fulfillment regardless of market conditions, best execution emphasizes obtaining the optimal trade outcome based on real-time market factors and transparency. Regulatory standards from entities like the SEC and FCA enforce strict best execution policies to protect investors and enhance market fairness.

What Does Guaranteed Execution Mean?

Guaranteed execution in brokerage means that a client's trade order is executed at the exact price requested, regardless of market volatility or liquidity conditions. This assurance protects traders from slippage, ensuring precise entry or exit points during high-impact market events. Brokers offering guaranteed execution often charge higher fees or widen spreads to cover the risk of price fluctuations.

Key Differences Between Best Execution and Guaranteed Execution

Best execution requires brokers to seek the most advantageous terms for clients by considering price, speed, and likelihood of execution, whereas guaranteed execution ensures order fulfillment at a predetermined price regardless of market fluctuations. Best execution prioritizes optimal trade outcomes through market analysis and order routing, while guaranteed execution involves the broker assuming the risk of price changes to provide certainty. The key difference lies in risk allocation: best execution transfers market risk to the client, while guaranteed execution shifts it to the broker for guaranteed order completion.

Regulatory Requirements for Best Execution

Regulatory requirements for best execution mandate brokers to take all sufficient steps to obtain the most favorable terms for client orders, considering price, costs, speed, likelihood of execution, and settlement. In contrast to guaranteed execution, best execution emphasizes a qualitative assessment rather than a fixed assurance, ensuring brokers act in clients' best interests under prevailing market conditions. Compliance with MiFID II and SEC rules enforces rigorous monitoring and transparency to demonstrate adherence to best execution principles.

Pros and Cons of Best Execution

Best execution ensures brokers seek the most favorable terms for client orders by evaluating price, speed, and likelihood of execution, enhancing transparency and fiduciary responsibility. However, the approach may lead to execution delays or partial fills due to market volatility and complex order routing, potentially impacting trade efficiency. Unlike guaranteed execution, best execution does not promise order fulfillment at a specific price, introducing variability in outcomes depending on prevailing market conditions.

Pros and Cons of Guaranteed Execution

Guaranteed execution ensures traders receive the exact price they request, eliminating slippage and providing certainty in order fulfillment. However, this assurance often comes with higher trading costs and wider spreads, which can reduce overall profitability. Brokers may also limit availability during volatile markets, potentially causing delays or restricted trading opportunities.

How Brokers Implement Best Execution

Brokers implement best execution by continuously monitoring market conditions, utilizing smart order routing technology, and selecting venues that offer the most favorable prices, speed, and liquidity for client orders. They analyze multiple trading venues, including exchanges and alternative trading systems, to ensure orders are executed at the best available terms rather than simply providing guaranteed execution at a predetermined price. Best execution policies prioritize maximizing client value through price improvement and minimizing trading costs, contrasting with guaranteed execution, which promises order completion without necessarily optimizing market conditions.

Scenarios Suited for Guaranteed Execution

Guaranteed execution is ideal for highly volatile markets where price fluctuations occur rapidly, ensuring traders receive the exact price they requested without slippage. This approach suits traders prioritizing price certainty, such as those executing large orders or employing scalping strategies. It also benefits assets with low liquidity, where market orders might otherwise suffer from significant price deviations.

Impact on Traders: Best vs Guaranteed Execution

Best execution prioritizes achieving the most favorable trade terms based on price, speed, and market conditions, aiming to maximize traders' investment outcomes. Guaranteed execution ensures order fulfillment at a predetermined price, reducing slippage risk but potentially leading to less optimal pricing in volatile markets. Traders face a trade-off between best execution's potential for superior pricing and guaranteed execution's certainty of order completion.

Choosing the Right Execution Method for Your Trading Strategy

Best execution ensures trades are executed at the most favorable terms based on price, speed, and liquidity, aligning with market conditions to maximize trading efficiency. Guaranteed execution provides certainty by locking in a specific price, which is ideal for traders prioritizing predictable outcomes over potential price improvements. Selecting between best execution and guaranteed execution depends on your trading strategy's emphasis on either optimizing price or minimizing execution risk.

Important Terms

Order routing

Order routing systems prioritize best execution by dynamically directing trades to venues offering optimal price, speed, and liquidity, enhancing trade quality and cost efficiency. Unlike guaranteed execution, which ensures trade completion regardless of conditions, best execution focuses on achieving the most favorable trade outcomes based on market data and execution algorithms.

Market impact

Market impact refers to the effect that executing large orders has on the price of a security, often resulting in unfavorable price movements. Best execution aims to minimize market impact by seeking optimal trade conditions through price improvement and liquidity, whereas guaranteed execution ensures order completion but may incur higher costs or increased market impact due to fixed transaction terms.

Slippage

Slippage refers to the difference between the expected price of a trade and the price at which the trade is actually executed, often occurring during volatile market conditions. Best execution aims to achieve the most favorable terms for the client by minimizing slippage, while guaranteed execution ensures a fixed execution price but may result in higher costs or limited flexibility.

Fill price

Fill price accuracy directly impacts best execution quality by reflecting real-time market conditions, whereas guaranteed execution ensures transaction completion at a predetermined price regardless of market fluctuations.

Liquidity provider

Liquidity providers enhance best execution by offering competitive pricing and order flow transparency, whereas guaranteed execution ensures order completion regardless of market conditions, potentially at higher costs.

Spread widening

Spread widening occurs when brokers prioritize guaranteed execution over best execution, leading to less favorable trade prices and increased transaction costs for investors. This phenomenon reflects the trade-off between execution certainty and optimal price discovery in financial markets.

Execution latency

Execution latency significantly impacts best execution by directly influencing the speed at which trades are completed, thereby affecting price improvement opportunities and overall trade quality. Guaranteed execution prioritizes certainty of trade completion over speed, often leading to higher latency but providing assurance against order non-fulfillment, which contrasts with best execution strategies focused on minimizing delay for optimal pricing.

Price improvement

Price improvement occurs when a trade executes at a better price than the prevailing national best bid or offer (NBBO), enhancing best execution by maximizing investor returns. Guaranteed execution ensures a trade will be completed but may not achieve price improvement, potentially resulting in less favorable prices compared to best execution standards.

STP (Straight-Through Processing)

Straight-Through Processing (STP) enhances best execution by automating trade processing for optimal pricing and speed, while guaranteed execution ensures trade completion at a specified price regardless of market fluctuations.

All-or-none order

All-or-none orders ensure that a trade is executed only if the entire order quantity can be fulfilled, optimizing execution quality by preventing partial fills which may affect average price. This contrasts with guaranteed execution, which prioritizes trade completion over price optimization, potentially resulting in partial fills to meet order completion promises.

best execution vs guaranteed execution Infographic

moneydif.com

moneydif.com