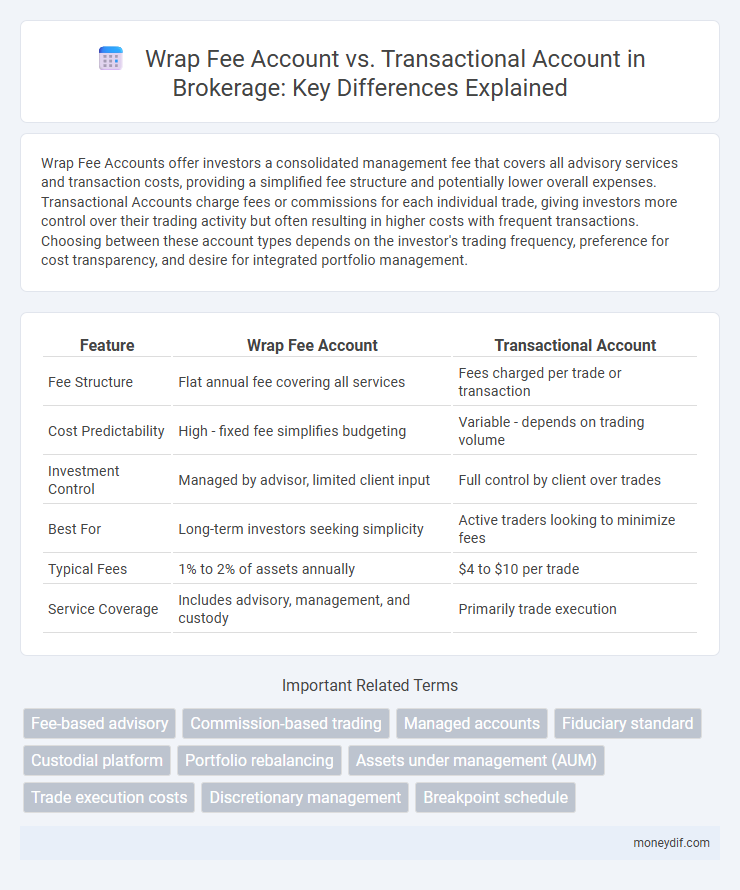

Wrap Fee Accounts offer investors a consolidated management fee that covers all advisory services and transaction costs, providing a simplified fee structure and potentially lower overall expenses. Transactional Accounts charge fees or commissions for each individual trade, giving investors more control over their trading activity but often resulting in higher costs with frequent transactions. Choosing between these account types depends on the investor's trading frequency, preference for cost transparency, and desire for integrated portfolio management.

Table of Comparison

| Feature | Wrap Fee Account | Transactional Account |

|---|---|---|

| Fee Structure | Flat annual fee covering all services | Fees charged per trade or transaction |

| Cost Predictability | High - fixed fee simplifies budgeting | Variable - depends on trading volume |

| Investment Control | Managed by advisor, limited client input | Full control by client over trades |

| Best For | Long-term investors seeking simplicity | Active traders looking to minimize fees |

| Typical Fees | 1% to 2% of assets annually | $4 to $10 per trade |

| Service Coverage | Includes advisory, management, and custody | Primarily trade execution |

Understanding Wrap Fee Accounts

Wrap Fee Accounts offer a comprehensive investment solution by bundling advisory services, transaction costs, and management fees into a single, transparent annual fee, simplifying portfolio management for investors. These accounts provide continuous professional oversight, ensuring asset allocation and rebalancing align with an investor's financial goals and risk tolerance. Compared to Transactional Accounts, Wrap Fee Accounts can reduce cost unpredictability and administrative burden, benefiting investors seeking streamlined, active portfolio management.

What Is a Transactional Account?

A transactional account in brokerage serves as a standard investment account where clients execute and pay fees per trade or transaction without a bundled management fee. Unlike wrap fee accounts, transactional accounts offer flexibility for investors who prefer paying commissions only when buying or selling securities. This structure benefits active traders seeking control over individual trade costs and customized portfolio management.

Key Differences Between Wrap Fee and Transactional Accounts

Wrap fee accounts charge a single, comprehensive annual fee based on assets under management, covering advisory, brokerage, and administrative services, while transactional accounts incur fees per trade or transaction. Wrap fee accounts offer bundled services promoting long-term investment strategies with predictable costs, whereas transactional accounts provide more flexibility and potentially lower costs for infrequent traders. The choice between wrap fee and transactional accounts impacts overall investment expenses, trading frequency, and portfolio management style.

Cost Structure Comparison

Wrap fee accounts charge a single, consolidated fee typically ranging from 1% to 3% of assets under management, covering portfolio management, transactions, and advisory services. Transactional accounts incur separate fees per trade or service, often including commissions, ticket charges, and advisory fees, which can accumulate with frequent trading. Investors with active trading strategies may face higher costs in transactional accounts, while wrap fee accounts offer more predictable expenses ideal for long-term investors.

Investment Management Approaches

Wrap fee accounts offer a comprehensive investment management approach by bundling advisory, brokerage, and administrative fees into a single recurring charge, facilitating continuous portfolio monitoring and rebalancing. Transactional accounts, in contrast, operate on a per-trade fee basis, allowing investors to execute individual trades without ongoing management but potentially leading to higher costs with frequent transactions. The choice between wrap fee and transactional accounts hinges on investor preferences for active portfolio oversight versus control over trade commissions and flexibility.

Services Included in Each Account Type

Wrap Fee Accounts bundle portfolio management, advisory services, and transaction costs into a single, comprehensive fee, providing clients with continuous monitoring, rebalancing, and personalized financial planning. Transactional Accounts charge fees per trade, allowing clients to pay specifically for each purchase or sale without ongoing advisory services or automatic portfolio adjustments. Investors seeking integrated wealth management often prefer wrap fee accounts, while those valuing flexibility and cost control may opt for transactional accounts.

Suitability for Different Investor Profiles

Wrap Fee Accounts suit investors seeking simplicity and predictable costs, often appealing to those with larger portfolios and a preference for professional management. Transactional Accounts fit active traders who prioritize control over individual trades and prefer paying per transaction, beneficial for smaller or more frequently traded portfolios. The choice depends on investor goals, trading frequency, and comfort with fee structures, ensuring alignment with financial objectives and risk tolerance.

Pros and Cons of Wrap Fee Accounts

Wrap fee accounts offer investors streamlined portfolio management by bundling investment advisory, brokerage services, and administrative fees into a single, predictable annual charge, promoting simplicity and ease of budgeting. These accounts provide professional management with continuous portfolio monitoring and rebalancing, yet they may incur higher overall costs compared to transactional accounts for low-activity investors due to fixed fees regardless of trading frequency. However, wrap fee accounts reduce commission surprises and encourage long-term investment strategies, while transactional accounts suit active traders seeking pay-per-trade cost structures.

Pros and Cons of Transactional Accounts

Transactional accounts offer investors flexibility by charging fees per trade instead of a fixed annual fee, making them cost-effective for infrequent traders or those executing large trades sporadically. These accounts provide greater control over individual transactions and can result in lower costs if trading is minimal, but frequent trading may lead to higher cumulative expenses compared to wrap fee accounts. The absence of bundled advisory services means investors must be more engaged in decision-making and may incur separate charges for research and advice.

How to Choose the Right Brokerage Account

Choosing the right brokerage account depends on your investment style and financial goals. A Wrap Fee Account charges a fixed annual fee covering all trading and advisory services, ideal for investors seeking comprehensive management and cost predictability. Transactional Accounts charge fees per trade, offering more control and flexibility, beneficial for active traders who prefer managing their own transactions.

Important Terms

Fee-based advisory

Fee-based advisory typically involves Wrap Fee Accounts that charge a single comprehensive fee for investment management and transaction costs, whereas Transactional Accounts charge fees separately for each trade or service.

Commission-based trading

Commission-based trading in a Transactional Account charges fees per trade, whereas a Wrap Fee Account aggregates all trading costs into a single, comprehensive annual fee.

Managed accounts

Managed accounts typically use wrap fee structures that bundle advisory, transaction, and custody fees into a single comprehensive fee, whereas transactional accounts charge separately for each trade, resulting in potentially higher costs per transaction.

Fiduciary standard

Fiduciary standard mandates financial advisors to prioritize client interests by recommending Wrap Fee Accounts with bundled fees over Transactional Accounts that charge per trade, enhancing transparency and cost-effectiveness.

Custodial platform

Wrap fee accounts offer a single, consolidated fee covering investment management and custodial services, while transactional accounts charge fees per individual trade or transaction within the custodial platform.

Portfolio rebalancing

Portfolio rebalancing in a Wrap Fee Account is typically included within the annual fee structure, providing seamless adjustments without additional transaction costs, whereas in a Transactional Account, each rebalance incurs separate fees based on individual trades.

Assets under management (AUM)

Assets under management (AUM) in Wrap Fee Accounts typically exhibit higher retention rates and greater growth compared to Transactional Accounts due to bundled fees and integrated management strategies.

Trade execution costs

Trade execution costs in Wrap Fee Accounts are typically bundled into a single management fee, resulting in potentially lower direct transaction expenses compared to Transactional Accounts where each trade incurs separate commissions and fees.

Discretionary management

Discretionary management in a Wrap Fee Account consolidates investment advisory, brokerage, and custodial services under a single fee, contrasting with a Transactional Account where clients pay separate fees per transaction, often resulting in higher costs and less streamlined portfolio management.

Breakpoint schedule

A Breakpoint schedule reduces fees for Wrap Fee Accounts based on asset thresholds while Transactional Accounts incur individual trade commissions without breakpoint discounts.

Wrap Fee Account vs Transactional Account Infographic

moneydif.com

moneydif.com