Payment for order flow involves brokers routing client orders to third parties in exchange for compensation, which can create potential conflicts of interest and impact execution quality. Direct market access enables traders to place orders directly on exchanges, offering greater transparency, faster execution, and more control over trade outcomes. Choosing between these models depends on priorities like cost efficiency, execution speed, and order handling transparency.

Table of Comparison

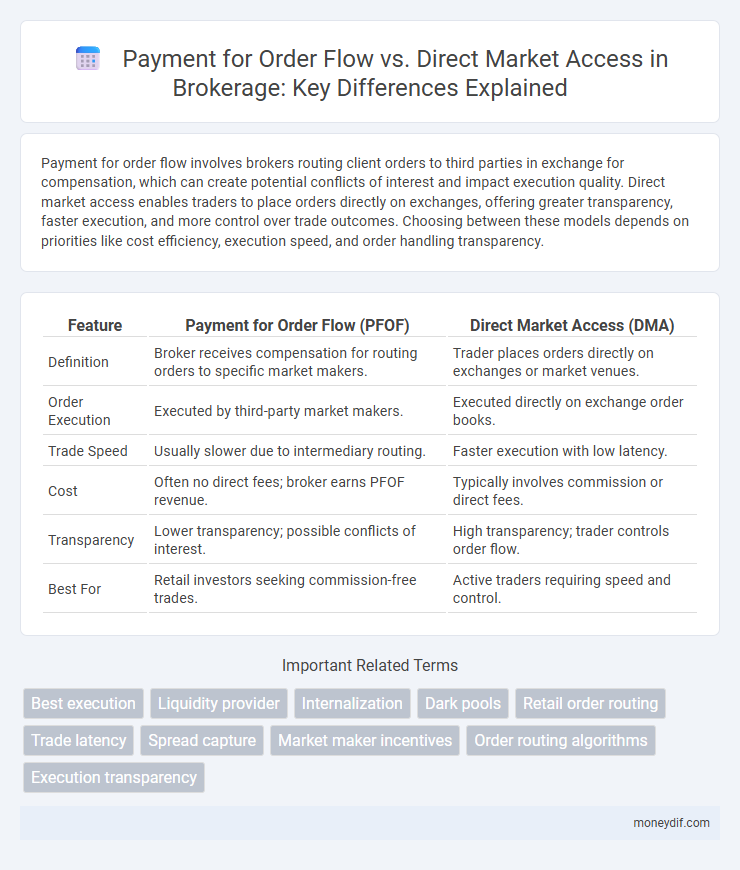

| Feature | Payment for Order Flow (PFOF) | Direct Market Access (DMA) |

|---|---|---|

| Definition | Broker receives compensation for routing orders to specific market makers. | Trader places orders directly on exchanges or market venues. |

| Order Execution | Executed by third-party market makers. | Executed directly on exchange order books. |

| Trade Speed | Usually slower due to intermediary routing. | Faster execution with low latency. |

| Cost | Often no direct fees; broker earns PFOF revenue. | Typically involves commission or direct fees. |

| Transparency | Lower transparency; possible conflicts of interest. | High transparency; trader controls order flow. |

| Best For | Retail investors seeking commission-free trades. | Active traders requiring speed and control. |

Understanding Payment for Order Flow (PFOF)

Payment for Order Flow (PFOF) involves brokers receiving compensation from market makers for routing client orders to them, potentially affecting trade execution quality and transparency. Direct Market Access (DMA) enables investors to send orders straight to the exchange or market venue, often resulting in faster execution and reduced conflicts of interest compared to PFOF arrangements. Evaluating PFOF requires analyzing trade price improvement, execution speed, and the broker's role in order routing to ensure investors' best interests are prioritized.

What Is Direct Market Access (DMA)?

Direct Market Access (DMA) allows traders to place orders directly on the order books of exchanges, bypassing traditional intermediaries like brokers who use payment for order flow (PFOF) models. Unlike PFOF, where brokers route client orders to third parties for execution, DMA offers transparency, faster execution, and potentially lower costs by connecting traders directly to market liquidity. This method is favored by active traders and institutions seeking greater control over trade execution and price improvement.

Key Differences: PFOF vs. DMA

Payment for Order Flow (PFOF) involves brokers receiving compensation from market makers for routing client orders, potentially creating conflicts of interest due to prioritizing profit over best execution. Direct Market Access (DMA) allows traders to place orders directly on exchange order books, offering greater transparency, faster execution speeds, and tighter spreads without intermediary intervention. The key difference lies in PFOF's potential impact on execution quality versus DMA's emphasis on control and market price exposure.

Impact on Trade Execution Quality

Payment for order flow can lead to conflicts of interest as brokers may prioritize orders from market makers offering the highest fees, potentially resulting in suboptimal trade execution prices and increased latency. Direct market access allows traders to send orders directly to exchanges, improving transparency and often achieving better price discovery, tighter spreads, and faster execution speeds. Empirical studies demonstrate that direct market access typically enhances trade execution quality by reducing hidden markups and ensuring orders interact with the best available market liquidity.

Transparency and Cost Implications

Payment for order flow (PFOF) often obscures the true cost of trade execution by routing orders through third-party venues, potentially compromising transparency and leading to hidden fees that impact overall investor returns. Direct market access (DMA) provides traders with real-time order execution on exchanges, enhancing transparency by allowing full visibility of order placement and market conditions, though it may involve higher explicit transaction costs such as exchange and clearing fees. Investors seeking cost efficiency must weigh the opaque rebate structures of PFOF against the upfront, transparent pricing and execution control inherent in DMA models.

Regulatory Perspectives on PFOF and DMA

Regulatory perspectives on payment for order flow (PFOF) often focus on transparency and potential conflicts of interest, with authorities like the SEC scrutinizing its impact on market fairness and investor protection. Direct market access (DMA) is generally viewed more favorably by regulators as it allows clients to execute orders directly on exchanges, minimizing intermediaries and improving price discovery. Regulatory frameworks increasingly emphasize robust disclosure requirements for PFOF and stringent oversight of DMA to ensure competitive and fair trading environments.

User Experience: Retail vs. Institutional Traders

Payment for order flow often benefits retail traders by reducing transaction costs and offering commission-free trades, enhancing accessibility and ease of use. In contrast, direct market access provides institutional traders with greater control, transparency, and speed, enabling sophisticated trade execution strategies. User experience varies significantly as retail clients prioritize cost-efficiency and simplicity while institutional clients demand precision and market immediacy.

Market Liquidity and Price Improvement

Payment for order flow can reduce market liquidity by routing orders to specific market makers, potentially limiting competition and price improvement opportunities for retail traders. Direct market access allows brokers to send orders straight to exchanges, enhancing market liquidity through increased competition and often providing better price improvement. Choosing direct market access supports transparent trade execution, benefiting both price discovery and overall market efficiency.

Choosing the Right Brokerage Model

Payment for order flow (PFOF) allows brokerages to earn revenue by routing client orders to specific market makers, often resulting in lower or zero commissions but potentially less control over execution quality. Direct market access (DMA) offers traders the ability to send orders directly to exchanges, providing greater transparency and faster execution at the cost of higher fees. Selecting the right brokerage model depends on prioritizing trade execution speed, cost efficiency, and the importance of order transparency for strategic trading.

Future Trends in Order Execution Models

Payment for order flow (PFOF) remains a contentious model as regulatory scrutiny intensifies, pushing brokers to explore more transparent alternatives like direct market access (DMA). Future trends indicate a shift towards enhanced execution quality and reduced conflicts of interest, with DMA offering real-time market data and greater control over trade routing. Advancements in technology and regulatory frameworks are expected to accelerate the adoption of DMA, improving price discovery and investor confidence in the order execution process.

Important Terms

Best execution

Best execution mandates brokers to secure the most favorable terms for client orders, balancing factors like price, speed, and order size. Payment for order flow may create conflicts of interest by incentivizing order routing to specific market makers, whereas direct market access allows clients to interact with multiple venues, potentially enhancing price transparency and execution quality.

Liquidity provider

Liquidity providers enhance market efficiency by supplying assets for trade, influencing payment for order flow (PFOF) where brokers receive compensation for routing orders to specific market makers. Direct Market Access (DMA) allows traders to interact directly with order books, bypassing intermediaries and reducing reliance on PFOF, thus affecting how liquidity is sourced and priced in electronic markets.

Internalization

Internalization in trading involves brokers matching client orders internally rather than routing them to public exchanges, often linked to payment for order flow (PFOF) where brokers receive compensation for directing orders to specific market makers. Direct market access (DMA) enables traders to place orders directly on exchange order books, bypassing internalization and potentially reducing conflicts of interest associated with PFOF, promoting greater price transparency and market efficiency.

Dark pools

Dark pools offer anonymous trading venues where institutional investors execute large orders with minimal market impact, contrasting with payment for order flow (PFOF) models that route retail trades through intermediaries for a fee. Direct market access (DMA) provides traders with real-time connectivity to public exchanges, ensuring transparency and eliminating potential conflicts inherent in PFOF arrangements.

Retail order routing

Retail order routing impacts payment for order flow by directing trades through intermediaries offering compensation, whereas direct market access enables investors to send orders straight to exchanges, enhancing transparency and potentially reducing costs.

Trade latency

Trade latency significantly impacts execution speed, with direct market access offering lower latency compared to payment for order flow, which can introduce delays due to order routing through intermediaries.

Spread capture

Spread capture maximizes profit by executing trades within the bid-ask spread, often benefiting from payment for order flow arrangements where market makers compensate brokers for order routing. Direct market access enables traders to bypass intermediaries, potentially reducing latency and improving price execution but may limit spread capture opportunities compared to payment for order flow models.

Market maker incentives

Market maker incentives often favor payment for order flow due to guaranteed order flow volume and rebates, while direct market access prioritizes transparent pricing and low-latency execution without reliance on intermediaries.

Order routing algorithms

Order routing algorithms determine the execution venue for trades by analyzing factors such as price, speed, and liquidity to optimize trade outcomes. Payment for order flow (PFOF) incentivizes brokers to route orders to specific market makers, potentially impacting execution quality, whereas direct market access (DMA) allows traders to send orders directly to exchange order books, enhancing transparency and control over order execution.

Execution transparency

Execution transparency in payment for order flow (PFOF) models often lacks detailed disclosure of order routing practices, affecting investors' ability to assess true trade execution quality. Direct market access (DMA) provides enhanced execution transparency by allowing traders to see and interact directly with market liquidity, optimizing trade execution prices and reducing potential conflicts of interest.

payment for order flow vs direct market access Infographic

moneydif.com

moneydif.com