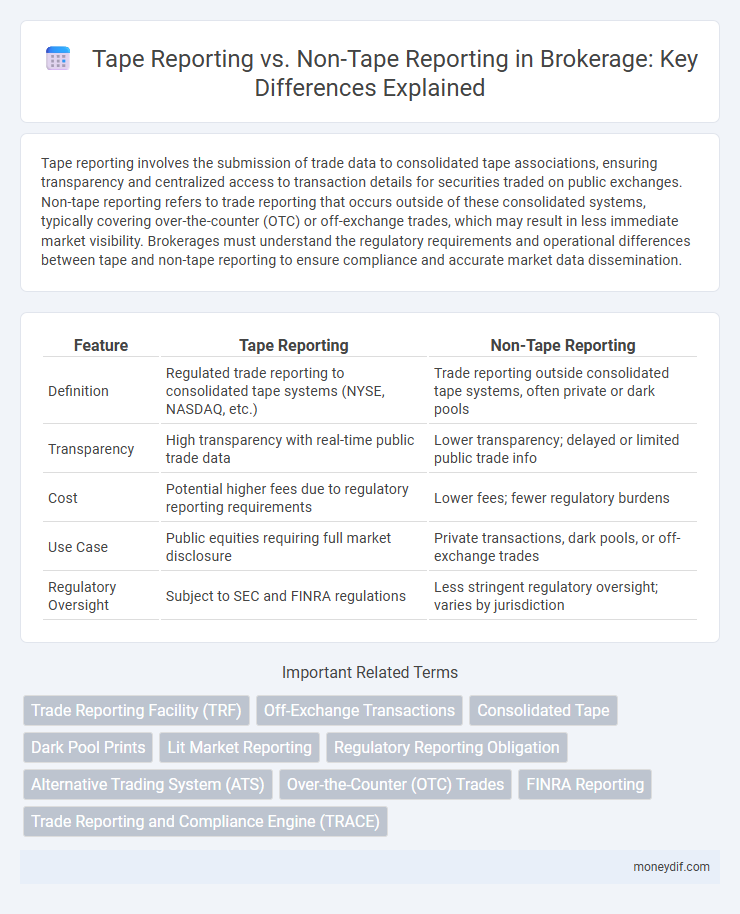

Tape reporting involves the submission of trade data to consolidated tape associations, ensuring transparency and centralized access to transaction details for securities traded on public exchanges. Non-tape reporting refers to trade reporting that occurs outside of these consolidated systems, typically covering over-the-counter (OTC) or off-exchange trades, which may result in less immediate market visibility. Brokerages must understand the regulatory requirements and operational differences between tape and non-tape reporting to ensure compliance and accurate market data dissemination.

Table of Comparison

| Feature | Tape Reporting | Non-Tape Reporting |

|---|---|---|

| Definition | Regulated trade reporting to consolidated tape systems (NYSE, NASDAQ, etc.) | Trade reporting outside consolidated tape systems, often private or dark pools |

| Transparency | High transparency with real-time public trade data | Lower transparency; delayed or limited public trade info |

| Cost | Potential higher fees due to regulatory reporting requirements | Lower fees; fewer regulatory burdens |

| Use Case | Public equities requiring full market disclosure | Private transactions, dark pools, or off-exchange trades |

| Regulatory Oversight | Subject to SEC and FINRA regulations | Less stringent regulatory oversight; varies by jurisdiction |

Understanding Tape Reporting in Brokerage

Tape reporting in brokerage refers to the systematic recording and dissemination of trade data on consolidated tape systems, which aggregate real-time transaction information across multiple exchanges. This reporting mechanism enhances market transparency by providing brokers, traders, and regulators with accurate, time-stamped records of executed trades, facilitating compliance with regulatory requirements such as the SEC's Trade Reporting Rule. Tape-reported trades typically include details like price, volume, and time, ensuring reliable market surveillance and efficient price discovery compared to non-tape reporting methods, which may involve off-exchange or dark pool transactions without immediate public disclosure.

Non-Tape Reporting: An Overview

Non-tape reporting refers to trade reporting mechanisms outside the consolidated tape systems, involving transactions executed on alternative trading systems (ATS) or dark pools not immediately reflected on public market data feeds. This type of reporting often results in delayed or less transparent trade information, impacting market visibility and price discovery. Brokers and regulators monitor non-tape trades closely to ensure compliance with reporting requirements and maintain market integrity despite the reduced transparency.

Key Differences Between Tape and Non-Tape Reporting

Tape reporting involves the automated collection and dissemination of trade data through standardized feeds provided by exchanges, ensuring comprehensive transparency and regulatory compliance. Non-tape reporting relies on manual or disparate sources for trade information, often resulting in delayed or incomplete data visibility. The key differences include data accuracy, timeliness, and regulatory acceptance, with tape reporting offering more reliable and real-time trade reporting essential for brokerage operations.

Regulatory Requirements for Tape Reporting

Tape reporting is a regulatory requirement for broker-dealers that mandates the timely reporting of all equity and options transactions to consolidated tape systems, ensuring market transparency and price discovery. These reports must include detailed transaction data such as time, price, volume, and venue to comply with SEC Rule 605 and FINRA regulations. Non-tape reporting, typically involving off-exchange or private transactions, does not require submission to consolidated tape systems but must adhere to other regulatory reporting standards to maintain market integrity.

Impact on Brokerage Transparency

Tape reporting enhances brokerage transparency by mandating trade data disclosure through consolidated tape systems, enabling investors to access real-time, standardized transaction information across multiple exchanges. Non-tape reporting, conversely, limits transparency as trades executed off-exchange or in dark pools are not immediately or comprehensively reflected in public tape data, reducing visibility into market liquidity and price discovery. The distinction directly impacts the accuracy of trade analysis, regulatory oversight, and investor confidence in brokerage activities.

Cost Implications for Tape vs Non-Tape Reporting

Tape reporting typically incurs higher costs due to extensive data fees and complex reconciliation processes required by exchanges, impacting brokerage operational expenses. Non-tape reporting, often leveraging internal or alternative data sources, reduces reliance on costly market data feeds, providing a cost-effective solution for trade reporting. Brokerages prioritizing cost savings may favor non-tape reporting to minimize ongoing data subscription charges while ensuring compliance.

Compliance Challenges in Trade Reporting

Tape reporting ensures that trades are systematically captured and reported on consolidated tape systems like the FINRA/Nasdaq tapes, providing transparency and regulatory oversight crucial for compliance with SEC regulations. Non-tape reporting, often involving off-exchange or dark pool trades reported through alternative mechanisms, presents compliance challenges such as increased risk of delay, misreporting, and data fragmentation. Brokerages must implement robust monitoring and validation processes to address discrepancies and meet regulatory standards for accurate and timely trade reporting.

Best Practices for Accurate Tape Reporting

Accurate tape reporting requires brokers to systematically capture and submit trade data to consolidated tape authorities, ensuring compliance with regulatory requirements such as those mandated by the SEC and FINRA. Implementing automated data validation tools and maintaining comprehensive audit trails enhance the precision of reported transactions, reducing discrepancies and potential penalties. Prioritizing real-time reporting, standardizing data formats, and continuous staff training are essential best practices to achieve transparency and accuracy in tape reporting processes.

How Non-Tape Reporting Affects Market Data

Non-tape reporting excludes trades not reported on consolidated tape systems, resulting in less transparent and delayed market data. This lack of inclusion affects price discovery by creating data gaps and increasing information asymmetry among market participants. Consequently, non-tape trade reporting can diminish market efficiency and challenge accurate valuation in brokerage operations.

Future Trends in Trade Reporting for Brokerages

Tape reporting involves submitting trade data to consolidated tape publishers for real-time market transparency, while non-tape reporting relies on alternative systems outside these feeds, often used for off-exchange or less regulated trades. Emerging trends show brokerages increasingly adopting blockchain-based reporting to enhance data immutability and transparency, with regulatory bodies pushing for greater integration of real-time analytics and AI-driven surveillance in trade reporting. Future innovations will likely emphasize cross-market data consolidation and advanced compliance automation to reduce operational risks and improve reporting accuracy.

Important Terms

Trade Reporting Facility (TRF)

Trade Reporting Facility (TRF) distinguishes Tape Reporting as trades automatically reported to consolidated tape systems for real-time public dissemination, whereas Non-Tape Reporting involves manual or delayed trade submissions outside consolidated tape feeds.

Off-Exchange Transactions

Off-exchange transactions are classified as non-tape reporting when they are not included in consolidated tape data, while tape reporting involves transactions recorded on the consolidated tape system to ensure transparency and market transparency compliance.

Consolidated Tape

Consolidated Tape aggregates real-time trade and quote data from multiple exchanges, ensuring transparent market pricing through Tape Reporting, which reflects official transactions on national securities exchanges. Non-Tape Reporting involves trades executed off-exchange or via alternative trading systems, often excluded from the Consolidated Tape, potentially causing discrepancies in market data visibility.

Dark Pool Prints

Dark Pool Prints are large block trades executed off-exchange that can be classified as Tape Reporting, which contributes to consolidated market data, or Non-Tape Reporting, which remains hidden from public tape feeds, affecting transparency and price discovery.

Lit Market Reporting

Lit Market Reporting provides detailed trade data including both Tape Reporting, which covers exchange-traded securities through consolidated tape feeds, and Non-Tape Reporting, which encompasses off-exchange and OTC trades not included in the consolidated tapes.

Regulatory Reporting Obligation

Regulatory reporting obligations differentiate Tape Reporting, which involves submitting transaction data through standardized electronic tapes, from Non-Tape Reporting, requiring alternative or manual data submission methods.

Alternative Trading System (ATS)

Alternative Trading Systems (ATS) that engage in tape reporting contribute to consolidated market data feeds, enhancing transparency and regulatory oversight, while non-tape reporting ATS operate off-exchange without mandatory publication of trade data, potentially affecting market liquidity and price discovery.

Over-the-Counter (OTC) Trades

Over-the-Counter (OTC) trades are transactions executed directly between two parties without being recorded on centralized exchanges, often lacking standard tape reporting mechanisms that consolidate trade data like the consolidated tape system used for exchange-listed securities. Non-tape reporting for OTC trades results in less transparency and delayed price discovery compared to tape-reported transactions, which utilize real-time dissemination of trade information essential for market participants and regulatory oversight.

FINRA Reporting

FINRA reporting requires accurate differentiation between Tape Reporting, which covers transaction data submitted to consolidated tape systems like CTA and UTP, and Non-Tape Reporting, which involves off-exchange or proprietary trade data not reported on these tapes.

Trade Reporting and Compliance Engine (TRACE)

TRACE mandates tape reporting for transactions in eligible fixed-income securities to ensure regulatory transparency, while non-tape reporting applies to trades outside TRACE-eligible securities or certain exempt transactions not captured on consolidated tape systems.

Tape Reporting vs Non-Tape Reporting Infographic

moneydif.com

moneydif.com